Blank Illinois Deed in Lieu of Foreclosure Form

Documents used along the form

A Deed in Lieu of Foreclosure is a useful tool for homeowners facing foreclosure. However, several other documents often accompany this form to ensure a smooth process. Here are some key documents that may be used alongside the Illinois Deed in Lieu of Foreclosure:

- Loan Modification Agreement: This document outlines the new terms of the mortgage after a modification, which may include changes to the interest rate or repayment schedule.

- Employee Handbook Form: This form is essential for outlining company policies and expectations, ensuring employees are informed of their rights and responsibilities. For more information, visit https://arizonaformspdf.com.

- Release of Liability: This form releases the borrower from personal liability for the mortgage debt, ensuring they are no longer responsible after the deed is transferred.

- Property Inspection Report: A report that assesses the condition of the property, which can help both parties understand its value and any necessary repairs.

- Affidavit of Title: This document confirms that the borrower holds clear title to the property and that there are no liens or claims against it.

- Closing Statement: A detailed account of all financial transactions related to the deed transfer, including any fees or payments made during the process.

- Notice of Default: A formal notice sent to the borrower indicating that they have failed to meet the terms of their mortgage agreement.

- Deed Transfer Form: This document officially transfers ownership of the property from the borrower to the lender.

- Tax Clearance Certificate: A certificate that confirms all property taxes have been paid, which is often required to finalize the deed transfer.

These documents work together to facilitate the deed transfer and protect the interests of both the borrower and the lender. It’s essential to understand each document's role in the process to navigate it effectively.

Other Popular State-specific Deed in Lieu of Foreclosure Templates

Deed in Lieu Vs Foreclosure - A Deed in Lieu of Foreclosure helps homeowners avoid the public stigma associated with foreclosure proceedings.

When engaging in the sale of an ATV, it is crucial to have proper documentation to facilitate the transaction. The North Carolina ATV Bill of Sale form serves this purpose effectively, providing a formal record that protects both the seller and buyer. For anyone looking to make a purchase or sale, using the Bill of Sale for a Quad can ensure all necessary details are captured accurately.

A Deed in Lieu of Foreclosure - Lastly, understanding the timeline and responsibilities in a Deed in Lieu may help manage expectations.

California Pre-foreclosure Property Transfer - This legal document may involve several steps, including due diligence from both parties.

Similar forms

The first document similar to the Illinois Deed in Lieu of Foreclosure is the mortgage modification agreement. This agreement allows a borrower to change the terms of their existing mortgage, such as the interest rate or payment schedule, to make it more manageable. Like a deed in lieu, it aims to prevent foreclosure by providing a solution that keeps the borrower in their home while addressing financial difficulties. Both documents require cooperation between the borrower and lender to reach a mutually beneficial outcome.

Another related document is the short sale agreement. In a short sale, the lender agrees to accept less than the full amount owed on the mortgage when the property is sold. This option is often pursued when the homeowner cannot continue making payments but wants to avoid foreclosure. Similar to a deed in lieu, a short sale can help protect the homeowner's credit score and provide a way out of a financially burdensome situation. Both processes involve negotiation with the lender and can lead to a more favorable resolution for the borrower.

In order to ensure compliance with tenant regulations, landlords may also consider utilizing the Texas Notice to Quit form, which communicates the intent for tenants to vacate or rectify lease violations. This form is essential in initiating the eviction process and clarifying the responsibilities of both parties involved. To facilitate the completion of this document, landlords can get the pdf here and ensure proper protocol is followed.

The third document is the forbearance agreement. This agreement allows a borrower to temporarily pause or reduce their mortgage payments for a specified period. In times of financial hardship, this can provide relief and prevent foreclosure. While a deed in lieu transfers ownership of the property to the lender, a forbearance agreement keeps the borrower in their home, giving them time to recover financially. Both documents require communication with the lender and a willingness to work together toward a solution.

Lastly, the bankruptcy filing serves as another document that shares similarities with the deed in lieu of foreclosure. When a borrower files for bankruptcy, it can halt foreclosure proceedings and provide a fresh start. While a deed in lieu involves the voluntary transfer of property to the lender, bankruptcy can restructure debts and provide a way to keep the home. Both options aim to alleviate financial stress and offer a path toward recovery, but they differ in their legal implications and outcomes.

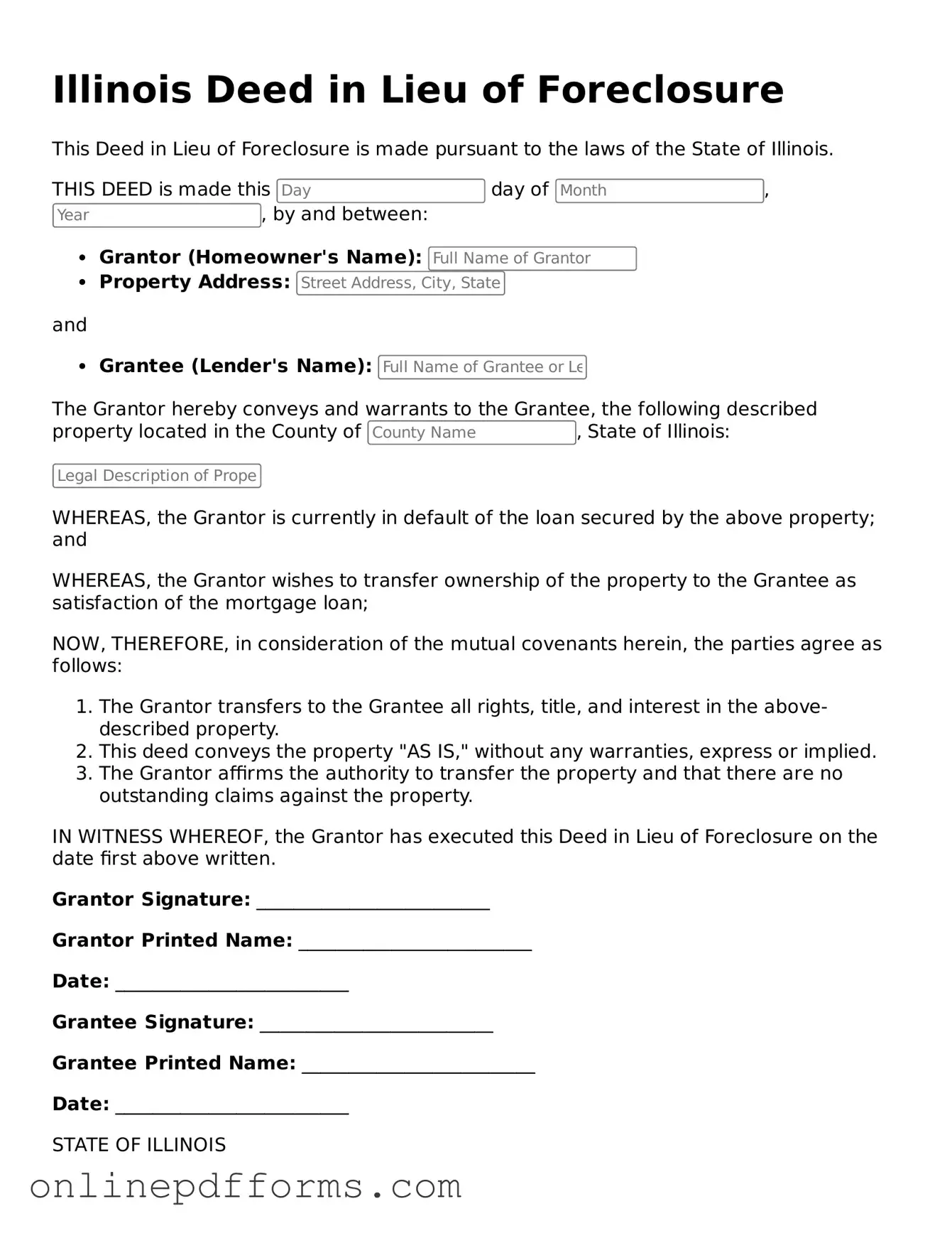

Steps to Filling Out Illinois Deed in Lieu of Foreclosure

After completing the Illinois Deed in Lieu of Foreclosure form, the next steps involve submitting the document to the appropriate parties and ensuring that it is recorded with the local county recorder's office. This process can help facilitate the transition of property ownership and may provide a clearer path forward for both the borrower and the lender.

- Obtain the Illinois Deed in Lieu of Foreclosure form from a reliable source, such as a legal website or your lender.

- Fill in the names of the grantor (the borrower) and the grantee (the lender) at the top of the form.

- Provide the property address and legal description of the property being conveyed.

- Specify the date of the deed's execution.

- Indicate whether the grantor is conveying the property with or without covenants.

- Sign the form in the presence of a notary public. Ensure that the notary public also signs and stamps the document.

- Make copies of the signed and notarized deed for your records.

- Submit the original deed to the lender and request confirmation of receipt.

- Record the deed with the county recorder's office where the property is located. Pay any required recording fees.