Blank Illinois Durable Power of Attorney Form

Documents used along the form

When setting up a Durable Power of Attorney in Illinois, it's often beneficial to consider additional documents that can complement this important legal tool. These forms can help clarify your wishes and ensure that your affairs are managed according to your preferences. Below is a list of commonly used documents that may accompany the Durable Power of Attorney.

- Health Care Power of Attorney: This document allows you to appoint someone to make medical decisions on your behalf if you become unable to do so. It ensures that your health care preferences are respected.

- Living Will: A Living Will outlines your wishes regarding medical treatment in situations where you are terminally ill or permanently unconscious. It provides guidance to your family and healthcare providers about your end-of-life care preferences.

- Will: A Will specifies how your assets should be distributed after your death. It names beneficiaries and can appoint guardians for minor children, ensuring your wishes are followed.

- Revocable Living Trust: This document allows you to place your assets in a trust during your lifetime. It helps manage your assets and can simplify the transfer of property upon your death, avoiding probate.

- HIPAA Authorization: This form grants permission for healthcare providers to share your medical information with designated individuals. It ensures that your loved ones can access necessary health information when needed.

- Financial Power of Attorney: Similar to the Durable Power of Attorney, this document specifically grants someone the authority to manage your financial affairs. It can be useful if you want to designate a different person for financial matters.

By considering these additional documents, you can create a comprehensive plan that addresses both your health care and financial needs. It’s always a good idea to consult with a legal professional to ensure that everything is set up correctly and aligns with your wishes.

Other Popular State-specific Durable Power of Attorney Templates

Nys Durable Power of Attorney Form 2023 - A Durable Power of Attorney can help prevent family disputes regarding your finances.

Free Durable Power of Attorney Form Ohio - This form helps ensure your wishes are followed even if you can't communicate them.

Printable Financial Power of Attorney - This legal document can be revoked at any time, as long as you are mentally competent.

Similar forms

The Illinois Durable Power of Attorney form shares similarities with a Medical Power of Attorney. Both documents grant authority to an individual, known as an agent, to make decisions on behalf of another person. However, while the Durable Power of Attorney can encompass a broad range of financial and legal matters, the Medical Power of Attorney is specifically focused on health care decisions. This means that if someone becomes incapacitated, the designated agent can make medical choices, such as treatment options or end-of-life care, ensuring that the individual's health care preferences are honored.

Another document akin to the Illinois Durable Power of Attorney is the Living Will. A Living Will outlines an individual's preferences regarding medical treatment in situations where they cannot communicate their wishes. While the Durable Power of Attorney allows an agent to make decisions, the Living Will serves as a guide for those decisions, specifying what types of medical interventions the individual desires or refuses. Together, these documents provide a comprehensive approach to health care planning, ensuring that both personal preferences and designated authority are clearly articulated.

The Financial Power of Attorney is yet another document that parallels the Illinois Durable Power of Attorney. Like its durable counterpart, the Financial Power of Attorney empowers an agent to manage financial affairs, such as banking, investments, and property transactions. The key distinction lies in the durability aspect; the Durable Power of Attorney remains effective even if the principal becomes incapacitated, whereas a standard Financial Power of Attorney may not retain its validity under such circumstances. This durability ensures continuity in financial management during critical times.

A Trust is another legal instrument that shares some features with the Durable Power of Attorney. Trusts allow individuals to designate a trustee to manage their assets for the benefit of designated beneficiaries. Both documents involve the delegation of authority and aim to ensure that the individual's wishes are carried out. However, while a Durable Power of Attorney primarily focuses on decision-making during a person's lifetime, a Trust can manage and distribute assets after death, providing a mechanism for estate planning and minimizing probate complications.

Finally, the Advance Directive is a document that complements the Durable Power of Attorney, particularly in the realm of health care. An Advance Directive encompasses both a Living Will and a Medical Power of Attorney, allowing individuals to express their wishes about medical treatment and appoint an agent to make decisions on their behalf. This comprehensive approach ensures that an individual's health care preferences are documented and that someone is available to advocate for those choices, especially during times of incapacity.

Steps to Filling Out Illinois Durable Power of Attorney

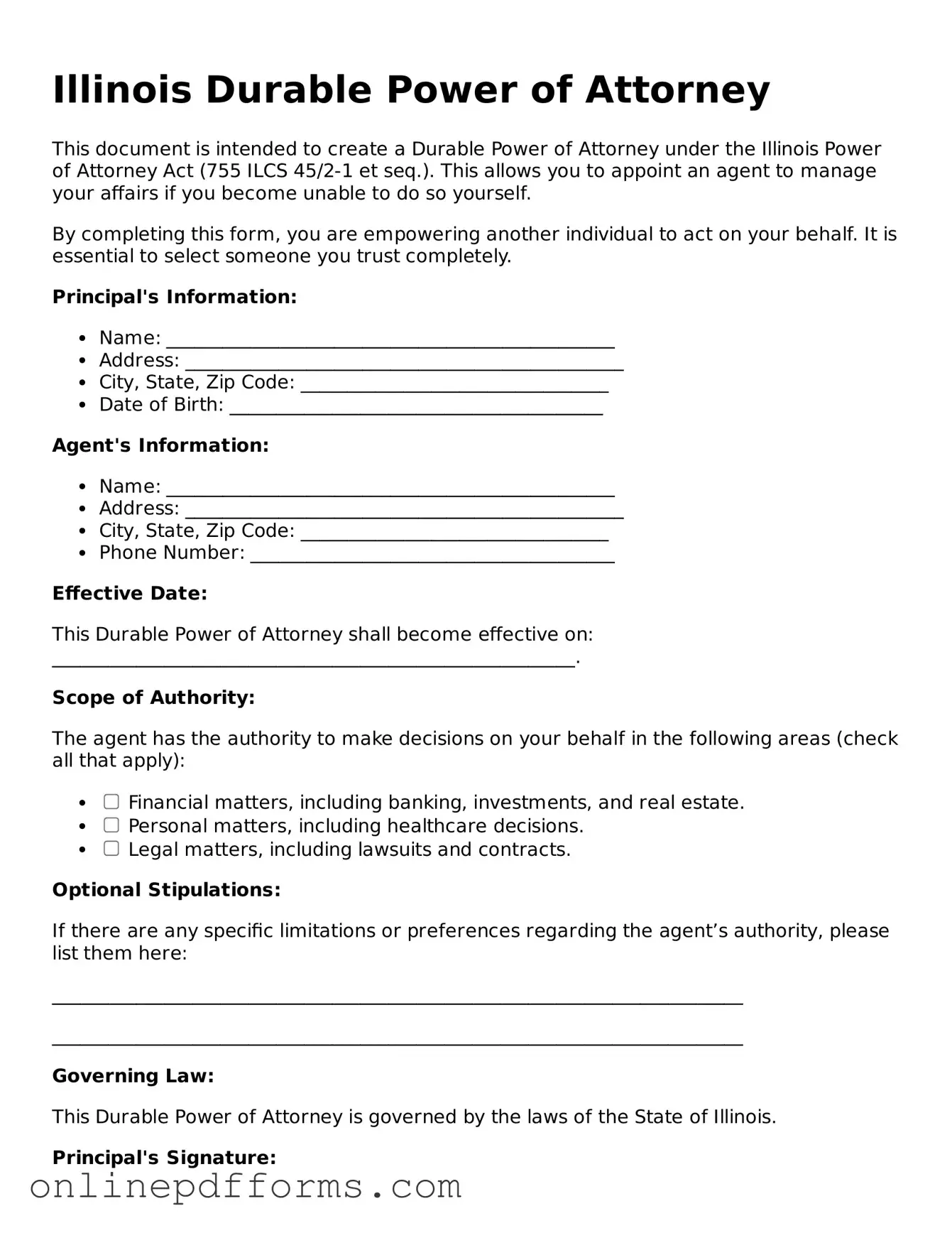

Filling out the Illinois Durable Power of Attorney form is an important step in ensuring that your financial and medical decisions can be managed by someone you trust if you become unable to make those decisions yourself. The following steps will guide you through the process of completing this form accurately.

- Begin by downloading the Illinois Durable Power of Attorney form from a reliable source or obtain a hard copy from a legal office.

- Read through the form carefully to understand each section before filling it out.

- In the first section, enter your full name and address. This identifies you as the principal.

- Next, select the individual you wish to designate as your agent. Include their full name and address.

- Decide whether you want to grant your agent general powers or specific powers. If you choose specific powers, clearly list those powers in the designated area.

- Indicate any limitations or conditions you wish to place on the agent's authority, if applicable.

- Provide the date on which the powers will begin. This can be immediate or contingent upon your incapacity.

- Sign and date the form in the presence of a notary public. This step is crucial for the form's validity.

- Ensure that your agent and any alternate agents also sign the form, acknowledging their roles.

- Make copies of the completed form for your records and to provide to your agent and any relevant institutions.

Once the form is completed and signed, it is advisable to discuss your decisions with your designated agent. This ensures they are aware of your wishes and are prepared to act on your behalf when necessary.