Blank Illinois Last Will and Testament Form

Documents used along the form

When preparing a Last Will and Testament in Illinois, several other forms and documents may be useful to ensure comprehensive estate planning. Each document serves a unique purpose and can help clarify intentions, protect assets, or provide guidance for loved ones.

- Durable Power of Attorney: This document allows an individual to designate someone else to make financial or medical decisions on their behalf if they become incapacitated. It is an essential tool for ensuring that personal wishes are respected during difficult times.

- Healthcare Power of Attorney: Similar to the Durable Power of Attorney, this document specifically allows an individual to appoint someone to make healthcare decisions. It ensures that medical preferences are followed when the individual is unable to communicate them.

- Living Will: A Living Will outlines an individual’s preferences regarding medical treatment and end-of-life care. It provides guidance to healthcare providers and loved ones about the individual’s wishes in situations where they cannot express them.

- Wisconsin Articles of Incorporation: This document is essential for anyone planning to establish a corporation in Wisconsin. It officially records the creation of the business entity, detailing its name and purpose. To initiate your entrepreneurial journey, visit https://pdftemplates.info/wisconsin-articles-of-incorporation-form/.

- Revocable Living Trust: This legal entity holds an individual’s assets during their lifetime and can help avoid probate after death. It allows for the management of assets and can simplify the transfer of property to beneficiaries.

- Beneficiary Designations: Certain assets, such as life insurance policies and retirement accounts, allow individuals to name beneficiaries directly. These designations override the will and ensure that assets are distributed according to the individual’s wishes.

- Letter of Intent: While not a legally binding document, a Letter of Intent can accompany a will to provide additional instructions or personal messages to beneficiaries. It can clarify intentions and express sentiments that a will may not fully capture.

- Affidavit of Heirship: This document can be used to establish the heirs of a deceased person when no will exists. It is often used in probate proceedings to simplify the distribution of assets among heirs.

Incorporating these documents into estate planning can provide clarity and peace of mind. Each serves a distinct purpose and can work in tandem with a Last Will and Testament to ensure that an individual’s wishes are honored and that their loved ones are supported during challenging times.

Other Popular State-specific Last Will and Testament Templates

Ohio Will Template - A structured approach to facilitate a smoother transition of assets after death.

Last Will and Testament Georgia - Documents the individual's instructions about handling digital assets after death.

Last Will and Testament Template New York - Offers a comprehensive view of your financial landscape to your executor.

In addition to the Connecticut Mobile Home Bill of Sale, it is essential for buyers and sellers to consider utilizing various resources to ensure a smooth transaction. For instance, those interested in motor vehicles should explore the Vehicle Bill of Sale Forms, as they provide valuable templates and guidance for different types of sales agreements.

Simple Will Template Texas - Conveys considerations for alternate beneficiaries in case of predeceasing heirs.

Similar forms

The Illinois Last Will and Testament is similar to a Living Will, which outlines an individual's preferences regarding medical treatment in case they become unable to communicate their wishes. While a Last Will deals primarily with the distribution of assets after death, a Living Will focuses on healthcare decisions, ensuring that one's medical preferences are respected during life. Both documents serve to express personal wishes and protect individual rights, but they operate in different contexts—one in life and the other after death.

Another document akin to the Last Will is a Trust. A Trust allows for the management of assets during a person's lifetime and can continue after their death. Unlike a Last Will, which typically goes through probate, a Trust can help bypass this process, allowing for a more private and potentially quicker distribution of assets. Both documents aim to ensure that a person's wishes regarding their property are honored, but they differ significantly in terms of administration and timing.

A Power of Attorney (POA) is also similar, as it grants someone the authority to make decisions on behalf of another person. While a Last Will takes effect after death, a POA is active during a person’s lifetime, especially if they become incapacitated. This document is crucial for managing financial and legal matters, whereas a Last Will focuses solely on asset distribution. Both empower individuals to designate who will make decisions in their best interests.

A Living Trust shares similarities with the Last Will in terms of asset management and distribution. However, a Living Trust is established during a person's lifetime and allows for the transfer of assets without going through probate. This can lead to a smoother transition for heirs. While both documents aim to ensure that a person's wishes are honored, a Living Trust provides more flexibility and control during the grantor's life.

A Codicil is another related document. It serves as an amendment to an existing Last Will and Testament, allowing individuals to make changes without creating an entirely new will. This can include updates to beneficiaries or asset distributions. Both documents must be executed with the same formalities as a Last Will, ensuring that the individual's intentions are clear and legally binding.

A Declaration of Trust is similar in that it outlines how assets should be managed and distributed, but it is often used in conjunction with a Trust. This document specifies the terms and conditions under which the Trust operates. While a Last Will focuses on post-death asset distribution, a Declaration of Trust addresses the management of assets during the grantor's lifetime, providing clarity and guidance for trustees.

In California, when engaging in the sale of a horse, it's essential for both the buyer and seller to be aware of the legalities involved, including the necessity of a Horse Bill of Sale. This document ensures that all relevant information about the transaction, such as the horse's identification and the sale terms, is recorded clearly to protect both parties. To learn more about how to appropriately document this transaction, interested individuals can visit https://californiapdf.com.

A DNR (Do Not Resuscitate) order, while primarily a medical directive, shares the intent of ensuring personal wishes are honored. It specifies that a person does not wish to receive life-saving treatment in certain situations. Like a Last Will, a DNR reflects an individual's values and preferences, but it is focused on healthcare decisions rather than asset distribution. Both documents empower individuals to control their circumstances in critical situations.

Lastly, a Healthcare Proxy is similar as it designates someone to make medical decisions on behalf of an individual if they are unable to do so. While a Last Will addresses asset distribution after death, a Healthcare Proxy is active during a person's life, ensuring that their healthcare preferences are respected. Both documents highlight the importance of personal choice in critical matters, whether in health or estate planning.

Steps to Filling Out Illinois Last Will and Testament

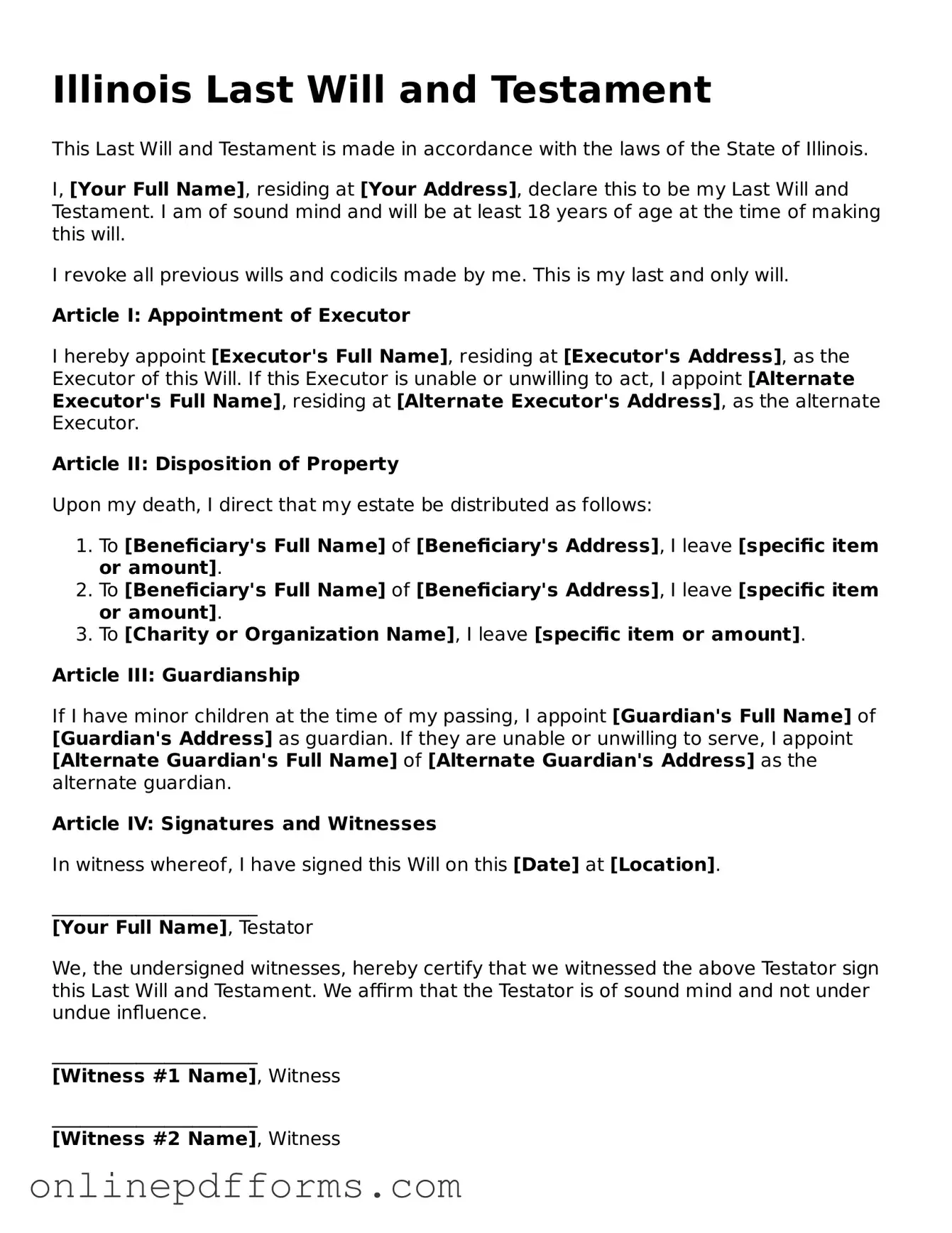

Once you have your Illinois Last Will and Testament form ready, it’s time to fill it out carefully. This document will allow you to outline your wishes regarding the distribution of your assets after your passing. Follow these steps to ensure that your will is completed accurately and reflects your intentions.

- Start with your personal information. Write your full name, address, and date of birth at the top of the form. This identifies you as the testator.

- Declare your intentions. Clearly state that this document is your Last Will and Testament. You can include a statement like, "I revoke all previous wills and codicils."

- Identify your beneficiaries. List the names and addresses of the individuals or organizations you wish to inherit your assets. Be specific about what each beneficiary will receive.

- Choose an executor. Appoint someone you trust to carry out your wishes as outlined in the will. Include their name and contact information.

- Consider guardianship. If you have minor children, designate a guardian for them. Provide the name and address of the chosen guardian.

- Sign the document. At the end of the form, sign your name in the presence of witnesses. This is crucial for the will to be valid.

- Have witnesses sign. In Illinois, at least two witnesses must sign the will. They should also include their names and addresses. Make sure they are not beneficiaries.

- Store the will safely. Keep the signed will in a secure place, such as a safe or with an attorney, and inform your executor where it can be found.