Blank Illinois Loan Agreement Form

Documents used along the form

When entering into a loan agreement in Illinois, several other documents may be necessary to ensure a clear understanding between the parties involved. Each of these documents serves a specific purpose in the loan process, providing additional details and protections for both the lender and the borrower.

- Promissory Note: This document outlines the borrower's promise to repay the loan. It specifies the loan amount, interest rate, repayment schedule, and any penalties for late payments.

- Loan Disclosure Statement: This statement provides detailed information about the terms of the loan, including the total cost of the loan, interest rates, and fees. It ensures transparency and helps the borrower understand their financial obligations.

- Security Agreement: If the loan is secured by collateral, this agreement details the assets pledged by the borrower. It protects the lender's interests in case of default.

- Personal Guarantee: In some cases, a personal guarantee may be required from the borrower or a third party. This document holds the individual personally responsible for the loan if the borrowing entity defaults.

- Marital Separation Agreement: To navigate the complexities of separation, consider utilizing the detailed Marital Separation Agreement resources that outline key legal aspects and responsibilities.

- Credit Application: This form collects information about the borrower's financial history and creditworthiness. It helps the lender assess the risk of lending to the borrower.

- Amortization Schedule: This schedule outlines each payment over the life of the loan, breaking down principal and interest components. It aids borrowers in understanding their repayment obligations over time.

- Loan Modification Agreement: If the terms of the original loan need to be changed, this document formalizes those changes. It may adjust interest rates, repayment terms, or other conditions to better suit the borrower's current situation.

Having these documents in place can facilitate a smoother loan process and provide clarity to both parties. It is advisable to review each document carefully and seek guidance if needed to ensure all terms are understood and agreed upon.

Other Popular State-specific Loan Agreement Templates

Texas Promissory Note Requirements - A Loan Agreement outlines the terms and conditions under which a borrower receives funds from a lender.

To facilitate the process of transferring ownership, it is advisable for sellers and buyers to utilize Auto Bill of Sale Forms, which streamline the creation of the necessary documentation, ensuring that all legal requirements are met effectively.

Free Promissory Note Template California - The Loan Agreement defines the duration of the loan and its maturity date.

Similar forms

The Illinois Loan Agreement form shares similarities with a Promissory Note. Both documents serve to outline the terms of a loan, including the amount borrowed, interest rates, and repayment schedule. A Promissory Note is typically a simpler document that focuses on the borrower's promise to repay the loan, while the Loan Agreement may include more detailed terms and conditions, such as collateral and default provisions. Both documents legally bind the borrower to repay the debt, but the Loan Agreement often provides a broader framework for the relationship between the lender and borrower.

Another document that resembles the Illinois Loan Agreement is the Security Agreement. This document is used when a borrower offers collateral to secure a loan. Similar to the Loan Agreement, a Security Agreement outlines the obligations of the borrower and the rights of the lender regarding the collateral. It details what happens if the borrower defaults, including the lender's right to seize the collateral. While the Loan Agreement focuses on the terms of the loan itself, the Security Agreement specifically addresses the collateral aspect, making them complementary documents in secured lending situations.

When considering a transaction involving motorcycles, it is essential to be aware of the necessary documentation to facilitate a smooth transfer of ownership. One key form that every seller and buyer should utilize is the Vehicle Bill of Sale Forms, which ensures that all pertinent details are clearly documented and both parties are protected throughout the process.

The Illinois Loan Agreement also has parallels with a Lease Agreement, particularly in situations where financing is involved in leasing property or equipment. Both agreements establish the terms under which one party borrows or uses property owned by another party. A Lease Agreement typically includes terms related to rental payments and the duration of the lease, while a Loan Agreement focuses on the repayment of borrowed funds. However, both documents create a legal obligation for the borrower to adhere to the agreed-upon terms, ensuring that both parties understand their rights and responsibilities.

Finally, the Illinois Loan Agreement is similar to a Business Loan Application. This document is often the first step in securing a loan, as it provides the lender with essential information about the borrower's financial situation and purpose for the loan. While the Loan Agreement formalizes the terms once the loan is approved, the Business Loan Application serves to initiate the process. Both documents are crucial in the lending process, as they help establish the borrower's intent and ability to repay the loan, ensuring that the lender can make informed decisions.

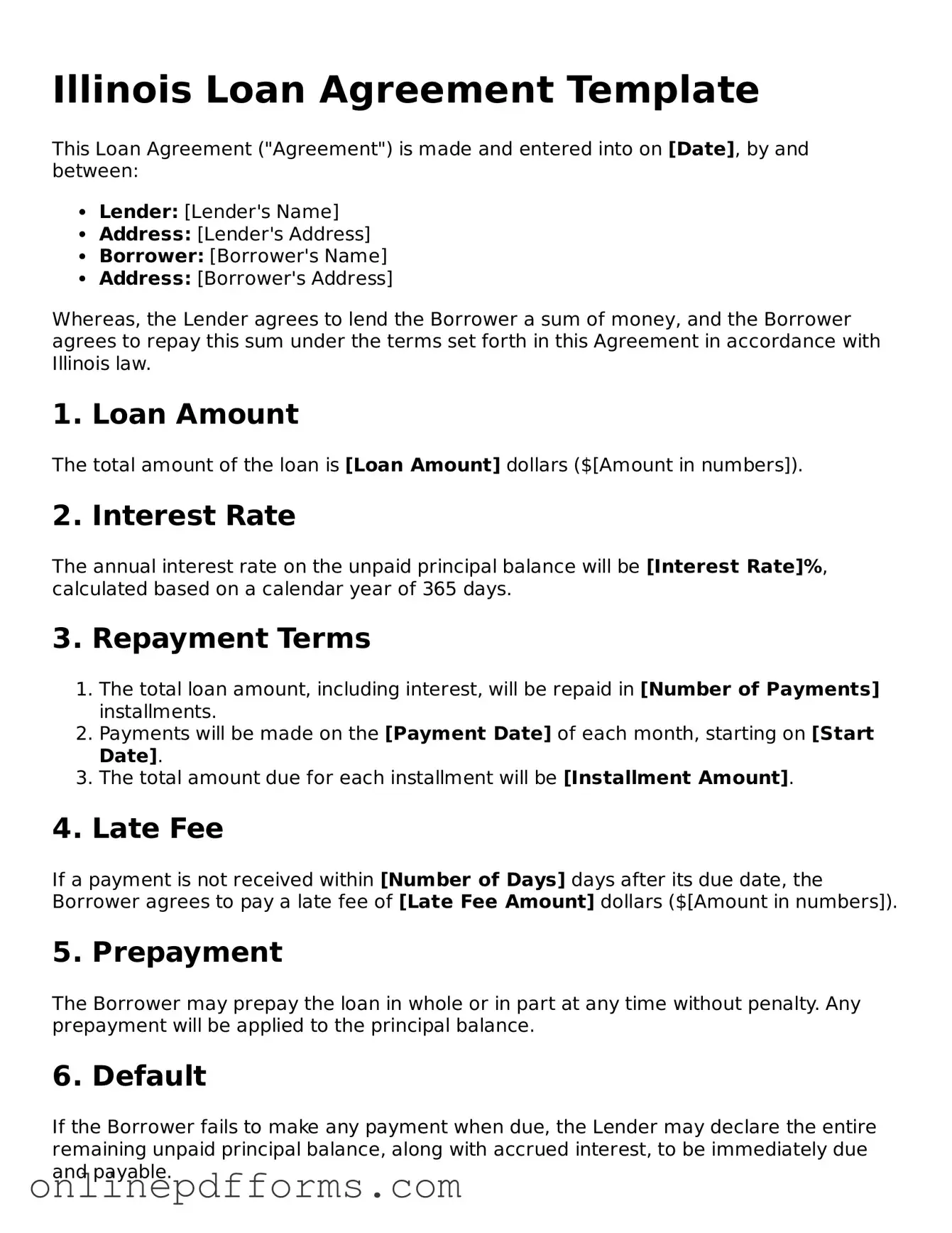

Steps to Filling Out Illinois Loan Agreement

Completing the Illinois Loan Agreement form is an important step in establishing a clear understanding between the lender and the borrower. After filling out the form, both parties should review the information for accuracy before signing. Here are the steps to guide you through the process.

- Begin by entering the date at the top of the form.

- Fill in the name and address of the lender in the designated section.

- Provide the name and address of the borrower, ensuring all details are correct.

- Specify the loan amount in the appropriate field.

- Indicate the interest rate being charged on the loan.

- Outline the repayment terms, including the payment schedule and due dates.

- Include any late fees or penalties for missed payments.

- Detail any collateral being offered for the loan, if applicable.

- Both parties should read the entire agreement carefully.

- Sign and date the form where indicated, ensuring both parties have copies for their records.