Blank Illinois Power of Attorney Form

Documents used along the form

The Illinois Power of Attorney form is a crucial legal document that allows an individual to designate someone else to make decisions on their behalf. However, several other forms and documents often accompany it to ensure comprehensive legal coverage and clarity in various situations. Below is a list of these related documents, each serving a specific purpose.

- Advance Directive: This document outlines an individual's preferences for medical treatment in case they become unable to communicate their wishes. It often includes instructions about life-sustaining treatments and end-of-life care.

- Living Will: A type of advance directive, a living will specifically details what medical interventions an individual does or does not want in critical situations, such as terminal illness or irreversible coma.

- Health Care Proxy: This document allows an individual to appoint someone to make medical decisions on their behalf if they are incapacitated. It complements the Power of Attorney by focusing specifically on health care choices.

- Durable Power of Attorney: Similar to the general Power of Attorney, this document remains effective even if the principal becomes incapacitated. It is essential for long-term planning.

- Financial Power of Attorney: This specialized form grants authority to a designated person to manage financial matters, such as paying bills, managing investments, and handling real estate transactions.

- Will: A legal document that outlines how a person's assets should be distributed upon their death. It can also name guardians for minor children, making it a critical component of estate planning.

- Trust Agreement: This document establishes a trust, allowing a trustee to manage assets on behalf of beneficiaries. It can help avoid probate and provide more control over asset distribution.

- HIPAA Release Form: This form allows an individual to authorize the sharing of their medical information with designated persons. It is vital for ensuring that health care proxies can access necessary information to make informed decisions.

Understanding these documents is essential for effective estate planning and ensuring that one's wishes are honored in various circumstances. Each document plays a distinct role, and together they create a comprehensive framework for managing health care, financial matters, and asset distribution.

Other Popular State-specific Power of Attorney Templates

Do You Need a Lawyer to Get a Power of Attorney in Texas - It removes the burden of decision-making from families in times of crisis.

Georgia Power of Attorney Form - Often includes instructions on how to handle finances.

Ohio Power of Attorney Form Pdf - A Power of Attorney can be limited to specific tasks or broad in scope.

Simple Power of Attorney Form Florida - Allows for flexibility in choosing whom to trust with decision-making power.

Similar forms

The Illinois Power of Attorney form shares similarities with the Medical Power of Attorney, which allows individuals to designate someone to make healthcare decisions on their behalf. Like the Illinois Power of Attorney, the Medical Power of Attorney empowers an agent to act in the best interest of the principal, especially when they are unable to communicate their wishes due to illness or incapacity. Both documents require clear communication of the principal's preferences and values, ensuring that their choices are respected even when they cannot voice them directly.

Another related document is the Durable Power of Attorney. This form provides a broader scope of authority, enabling an agent to manage financial and legal matters for the principal. Similar to the Illinois Power of Attorney, the Durable Power of Attorney remains effective even if the principal becomes incapacitated. This ensures continuity in managing the principal’s affairs, allowing the appointed agent to step in seamlessly during challenging times.

The Living Will is another document that aligns closely with the Illinois Power of Attorney. While the Power of Attorney designates someone to make decisions, the Living Will outlines specific preferences regarding medical treatment and end-of-life care. Both documents work together to provide clarity and guidance, ensuring that the principal’s wishes are honored in situations where they cannot express their desires. This combination offers a comprehensive approach to healthcare planning.

Additionally, the Guardianship Agreement bears resemblance to the Illinois Power of Attorney. This document is used when an individual is unable to make decisions due to incapacity, and it designates a guardian to make those choices. While the Power of Attorney allows for a more flexible and often less formal arrangement, the Guardianship Agreement typically requires court approval. Both documents aim to protect the interests of individuals who may not be able to advocate for themselves.

Lastly, the Trust Agreement also shares similarities with the Illinois Power of Attorney. A Trust allows individuals to manage their assets during their lifetime and specify how those assets should be distributed after their passing. Like the Power of Attorney, a Trust provides a mechanism for someone to act on behalf of the principal, ensuring that their financial and personal wishes are honored. Both documents emphasize the importance of planning for the future and securing one’s legacy.

Steps to Filling Out Illinois Power of Attorney

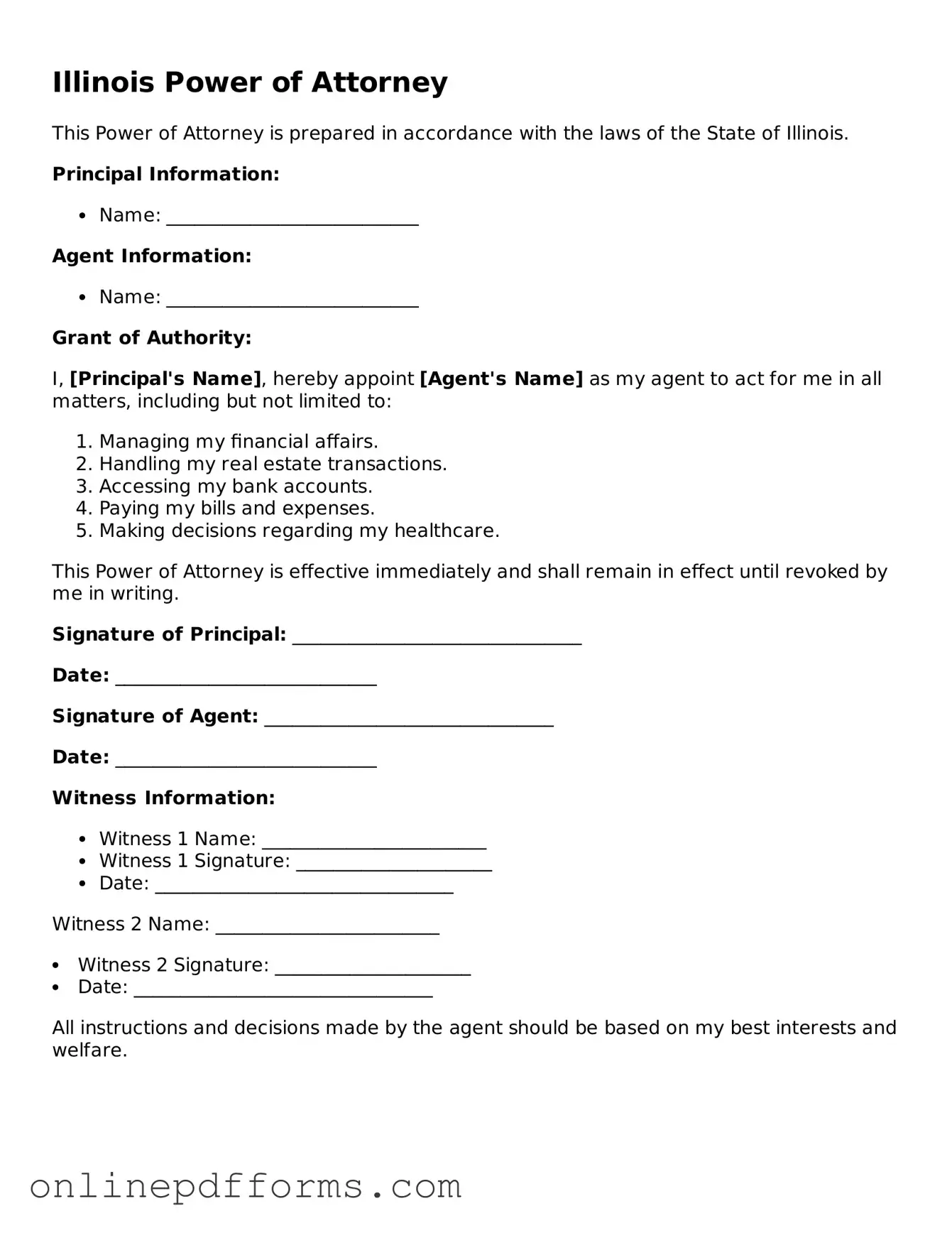

Filling out the Illinois Power of Attorney form is an important task that requires attention to detail. This document allows you to designate someone to make decisions on your behalf regarding financial or medical matters. To ensure that the form is completed accurately and effectively, follow the steps outlined below.

- Obtain the Form: Access the Illinois Power of Attorney form from a reliable source, such as the Illinois Secretary of State's website or a legal document provider.

- Choose the Type: Decide whether you need a Power of Attorney for healthcare or financial matters. There are specific forms for each type.

- Fill in Your Information: At the top of the form, provide your full name, address, and date of birth. This identifies you as the principal.

- Designate Your Agent: Clearly write the name, address, and phone number of the person you are appointing as your agent. This person will act on your behalf.

- Specify Powers Granted: Indicate the specific powers you wish to grant your agent. Be clear about what decisions they can make for you.

- Set Conditions (if any): If there are conditions or limitations to the powers granted, state them clearly in the designated section.

- Sign and Date: Once you have completed the form, sign and date it in the presence of a witness. Ensure that the witness is not your agent or related to you.

- Notarization: Although not always required, having the form notarized can add an extra layer of validity. If you choose to do this, find a notary public to witness your signature.

- Distribute Copies: After completing the form, make copies for yourself, your agent, and any relevant institutions, such as banks or healthcare providers.

Once the form is filled out and properly executed, it is essential to keep it in a safe but accessible location. Ensure that your agent knows where to find the document when needed. Regularly review and update the Power of Attorney as your circumstances change.