Blank Illinois Prenuptial Agreement Form

Documents used along the form

When preparing a prenuptial agreement in Illinois, several other documents and forms may also be necessary to ensure a comprehensive understanding of each party's financial situation and intentions. Here’s a list of key documents that often accompany a prenuptial agreement:

- Financial Disclosure Statement: This document outlines each party's assets, liabilities, income, and expenses. It provides transparency and helps both individuals make informed decisions.

- Property Inventory: A detailed list of all property owned by each party before the marriage. This includes real estate, vehicles, and personal belongings, helping to clarify ownership issues later on.

- Debt Disclosure Form: This form lists all debts incurred by each party prior to the marriage. Understanding these obligations is crucial for addressing financial responsibilities in the prenup.

- Income Statements: Recent pay stubs or tax returns that demonstrate each party's income level. This information is vital for determining spousal support and other financial considerations.

- Estate Planning Documents: Wills, trusts, or powers of attorney may be included to ensure that both parties’ wishes regarding their estates are clear and legally binding.

- Trailer Bill of Sale Form: In states like Louisiana, the Auto Bill of Sale Forms are essential for documenting the sale of trailers, ensuring both the buyer and seller have a clear understanding of the transaction and legal ownership transfer.

- Marital Settlement Agreement: If the couple later decides to separate, this document outlines the terms of the separation, including asset division and support obligations.

- Postnuptial Agreement: In cases where circumstances change after marriage, a postnuptial agreement can be created to modify the terms of the original prenup.

- Legal Consultation Records: Documentation of discussions with legal counsel regarding the prenup. This can demonstrate that both parties understood their rights and obligations.

Having these documents prepared alongside the prenuptial agreement can help both parties navigate their financial futures with clarity and confidence. It's always advisable to consult with a legal professional to ensure that all necessary forms are completed correctly and that both parties' interests are protected.

Other Popular State-specific Prenuptial Agreement Templates

Florida Prenup Agreement - A prenuptial agreement promotes mutual understanding of financial goals.

For those looking to empower someone else in a variety of legal and financial matters, utilizing a critical General Power of Attorney document is an important step. This formal agreement enables the chosen party to manage decisions effectively on your behalf, ensuring that your interests are prioritized.

California Prenup Agreement - It provides an opportunity to protect personal assets gained before marriage.

Georgia Prenup Agreement - This agreement can help in planning for future expenses.

Texas Prenup Agreement - A prenuptial agreement is an essential financial tool for many couples.

Similar forms

A Cohabitation Agreement is similar to a Prenuptial Agreement in that both documents outline the rights and responsibilities of partners. While a prenuptial agreement is created before marriage, a cohabitation agreement is designed for couples living together without the legal bond of marriage. This agreement can address issues like property ownership, financial responsibilities, and what happens if the relationship ends. It helps provide clarity and protection for both parties, similar to how a prenuptial agreement functions for married couples.

A Postnuptial Agreement shares similarities with a Prenuptial Agreement, as both are intended to manage the financial and property rights of spouses. However, a postnuptial agreement is executed after the marriage has taken place. This document can address changes in circumstances, such as a significant increase in income or the acquisition of new assets. Like a prenuptial agreement, it aims to prevent disputes and provide a clear plan for asset division in the event of divorce.

A Separation Agreement is another document that resembles a Prenuptial Agreement. It is typically created when a couple decides to live apart but is not yet divorced. This agreement outlines the terms of the separation, including asset division, child custody, and support obligations. Like a prenuptial agreement, it serves to clarify each party's rights and responsibilities, aiming to reduce conflict during a difficult time.

A Marital Settlement Agreement is closely related to a Prenuptial Agreement. This document is used during divorce proceedings to outline how assets and debts will be divided. It can also cover issues like alimony and child support. Both agreements focus on financial matters and aim to prevent disputes, though the marital settlement agreement is executed at the end of a marriage rather than at the beginning.

An Estate Plan can be compared to a Prenuptial Agreement in that both documents deal with the distribution of assets. While a prenuptial agreement focuses on asset division during a divorce, an estate plan outlines how a person's assets will be managed and distributed after their death. Both documents require careful consideration of individual and shared assets, ensuring that intentions are clear and legally binding.

A Trust Agreement is similar to a Prenuptial Agreement in its function of managing assets. A trust can specify how assets are to be handled during a person's lifetime and after their death, much like how a prenuptial agreement dictates asset division in the event of divorce. Both documents require clear definitions of ownership and distribution, providing a framework for asset management and protection.

Understanding how to create a valid agreement is essential, which is why resources like a comprehensive guide to the Promissory Note are invaluable for borrowers and lenders alike. This legal documentation clarifies obligations and expectations, ensuring both parties are protected throughout the lending process. For further information, visit this link to learn more about Promissory Note forms.

A Financial Power of Attorney can also be likened to a Prenuptial Agreement, as both documents address financial matters. A financial power of attorney grants someone the authority to make financial decisions on behalf of another person. While a prenuptial agreement deals with asset division in the context of marriage, a financial power of attorney ensures that financial interests are managed effectively, especially in situations where one partner may be unable to make decisions for themselves.

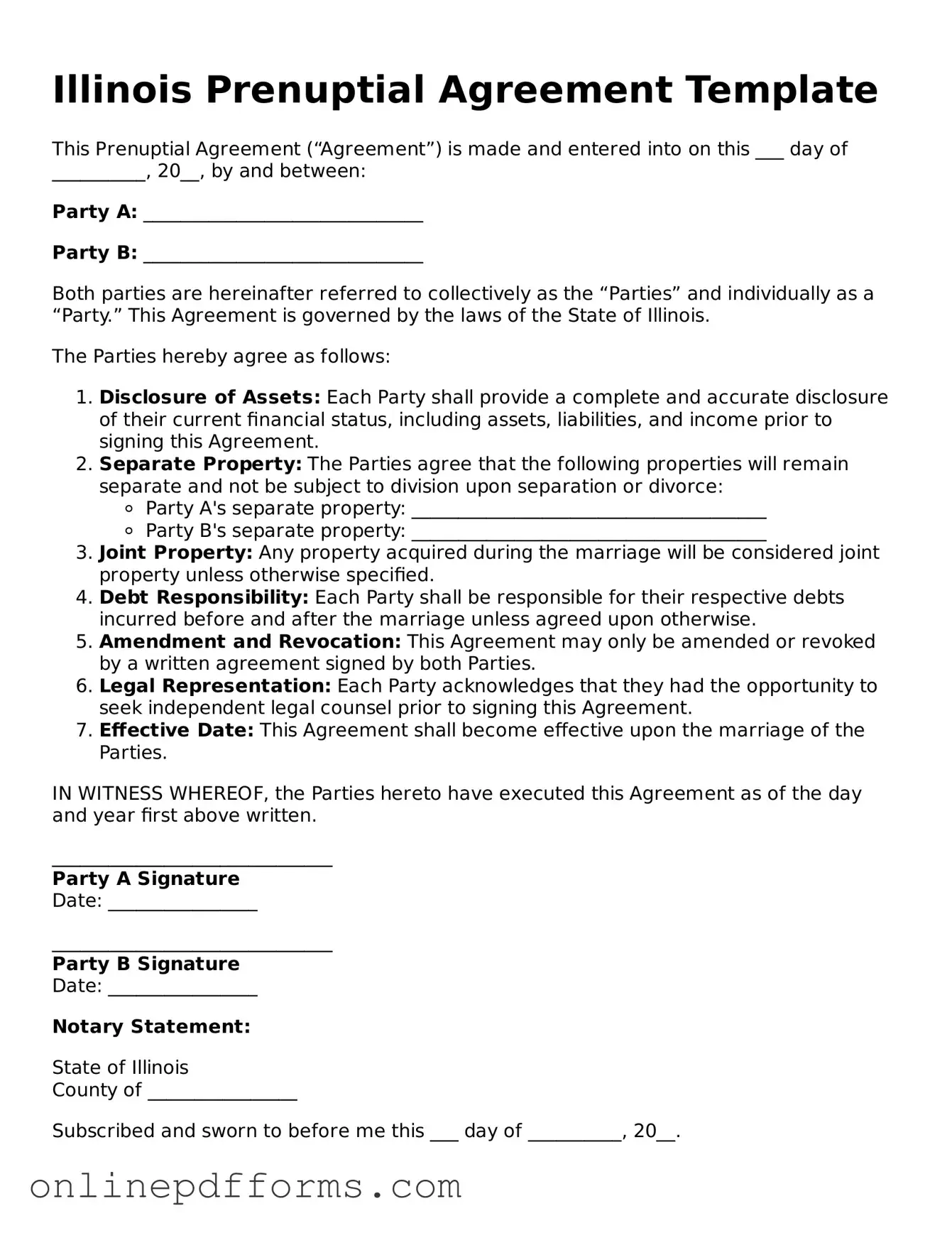

Steps to Filling Out Illinois Prenuptial Agreement

Filling out the Illinois Prenuptial Agreement form is an important step for couples considering marriage. This agreement helps clarify financial matters and property rights before tying the knot. Here’s how to complete the form step-by-step.

- Obtain the Form: Start by downloading the Illinois Prenuptial Agreement form from a reliable legal resource or your attorney.

- Title the Document: At the top of the form, clearly label it as "Prenuptial Agreement." This sets the tone for the document.

- Identify the Parties: Fill in the full names and addresses of both individuals entering the agreement. Make sure the names match those on legal documents.

- State the Purpose: Briefly explain the intent of the agreement. This might include clarifying property rights or outlining financial responsibilities.

- List Assets and Debts: Create a comprehensive list of each party’s assets and debts. Be as detailed as possible, including account numbers and property descriptions.

- Outline Terms: Specify how you wish to handle property division, spousal support, and any other financial matters in case of divorce or separation.

- Include Signatures: Both parties must sign and date the document. It’s advisable to have witnesses present during the signing.

- Consider Notarization: While not always required, having the agreement notarized can add an extra layer of validity and may be beneficial in the future.

Once you’ve completed the form, review it carefully to ensure all information is accurate. It’s often wise to consult with a legal professional to confirm that the agreement meets your needs and complies with Illinois law.