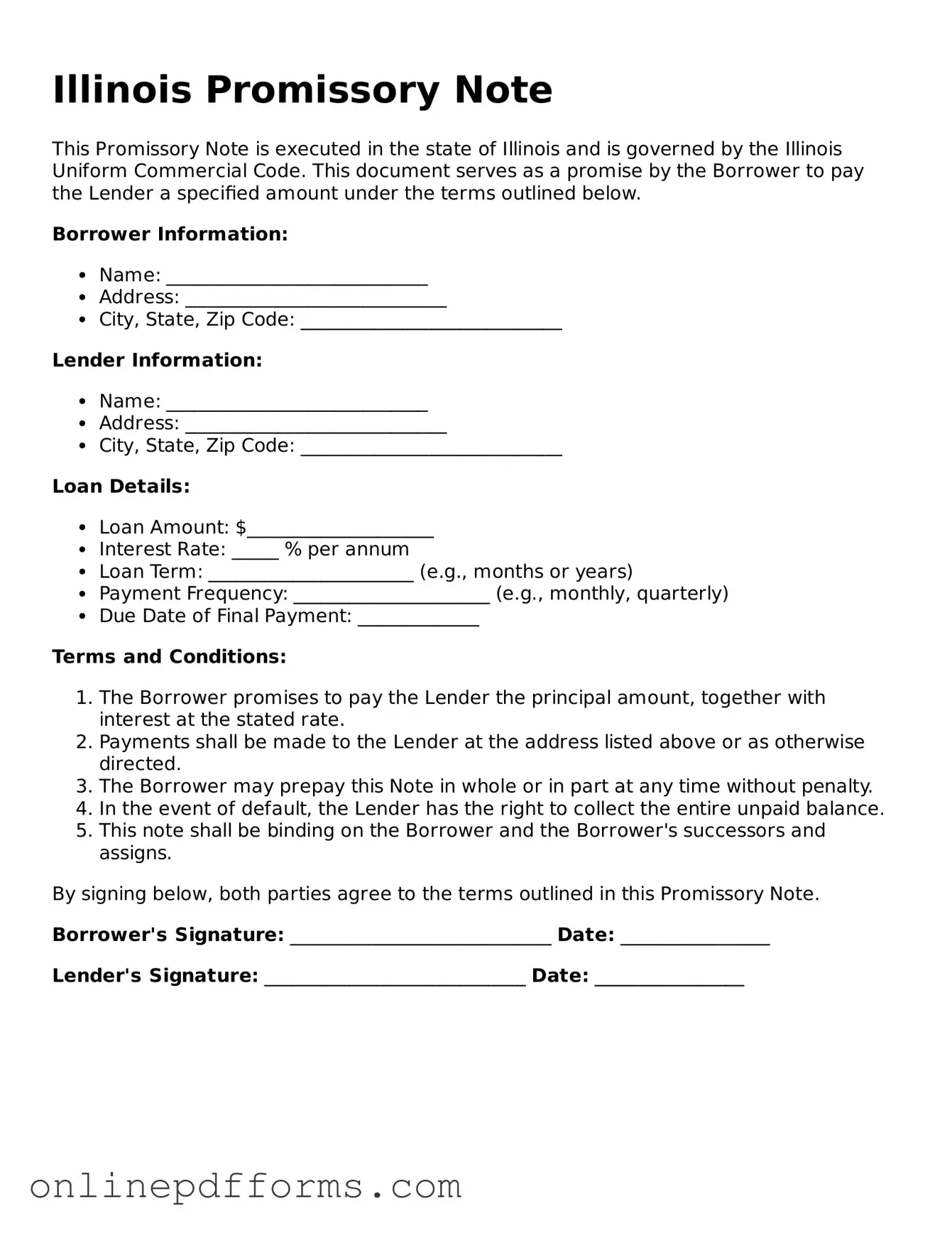

Blank Illinois Promissory Note Form

Documents used along the form

When dealing with financial agreements in Illinois, the Promissory Note is a crucial document. However, it often works in conjunction with other forms and documents to ensure clarity and legality in transactions. Below are some commonly used documents that complement the Illinois Promissory Note.

- Loan Agreement: This document outlines the terms and conditions of the loan, including the amount borrowed, interest rates, repayment schedule, and any collateral involved. It serves as a comprehensive contract between the lender and borrower.

- Security Agreement: If the loan is secured by collateral, this agreement details the assets pledged by the borrower. It defines the lender's rights in case of default and clarifies how the collateral can be seized.

- Personal Guarantee: In cases where a business borrows money, a personal guarantee may be required. This document holds an individual personally responsible for the debt if the business fails to repay.

- Disclosure Statement: This document provides essential information about the loan, including fees, terms, and conditions. It ensures that borrowers understand their obligations before signing the Promissory Note.

- RV Bill of Sale: An essential document for the transaction of a Recreational Vehicle, it signifies a change of ownership and can be obtained through Auto Bill of Sale Forms.

- Amendment Agreement: If any terms of the original Promissory Note need to be changed after it has been signed, an amendment agreement formalizes those changes. It requires signatures from both parties to be valid.

Using these documents alongside the Illinois Promissory Note can help protect both parties involved in a loan agreement. Each document serves a specific purpose, ensuring that all aspects of the transaction are clearly defined and legally binding.

Other Popular State-specific Promissory Note Templates

Promissory Note Form California - A promissory note can include specific dates for payments to keep the borrower accountable.

When engaging in a motorcycle transaction in Alabama, it's essential to utilize a properly completed Alabama Motorcycle Bill of Sale form to ensure that both parties are protected and that the sale is documented legally. For further assistance in creating this important document, you can find helpful resources including Vehicle Bill of Sale Forms.

Promissory Note Florida Pdf - Some promissory notes include a co-signer, adding an extra layer of security for the lender.

Similar forms

The Illinois Promissory Note is similar to a Loan Agreement. Both documents outline the terms of a loan, including the amount borrowed, interest rate, and repayment schedule. A Loan Agreement typically includes additional details such as collateral and conditions for default, making it more comprehensive than a simple promissory note. However, the core purpose remains the same: to formalize the borrowing arrangement between a lender and a borrower.

Another document that resembles the Illinois Promissory Note is the IOU. An IOU is a more informal acknowledgment of a debt, often lacking the detailed terms found in a promissory note. While an IOU simply states that one party owes money to another, a promissory note includes specific repayment terms, making it a more legally binding document. Both serve as evidence of a debt, but the promissory note provides clearer guidelines for repayment.

The Texas Real Estate Purchase Agreement form is a vital legal document that delineates the specific terms and conditions governing real estate transactions in Texas. It ensures that all parties involved have a clear understanding of their rights and responsibilities. To gain further clarity and initiate your real estate dealings, you can access the form by visiting https://pdftemplates.info/texas-real-estate-purchase-agreement-form/.

The Illinois Promissory Note also shares similarities with a Mortgage. While a mortgage specifically pertains to real estate transactions and involves securing the loan with the property itself, both documents involve borrowing money with a promise to repay. In a mortgage, the property serves as collateral, while in a promissory note, the borrower’s signature serves as the guarantee. Both documents aim to protect the lender’s interests in the event of default.

Lastly, a Business Loan Agreement is comparable to the Illinois Promissory Note. This document is used when a business borrows money and outlines the terms of the loan, similar to a promissory note. A Business Loan Agreement may include specific clauses regarding business operations, financial reporting, and covenants that the borrower must adhere to. While both documents secure a loan, the Business Loan Agreement often addresses the complexities of business finances, whereas the promissory note is more straightforward.

Steps to Filling Out Illinois Promissory Note

After obtaining the Illinois Promissory Note form, you are ready to fill it out. Ensure that you have all necessary information at hand, such as the names of the parties involved, the loan amount, and the repayment terms. Accurate completion of this form is crucial for establishing a clear agreement.

- Begin by entering the date at the top of the form. This is the date when the note is created.

- Next, fill in the name of the borrower. This is the individual or entity receiving the loan.

- Then, provide the address of the borrower. This should be the current residential or business address.

- Identify the lender by writing their name in the designated space. This is the individual or entity providing the loan.

- Include the lender's address. Ensure that it is accurate and up-to-date.

- State the principal amount of the loan. This is the total amount being borrowed.

- Specify the interest rate. If applicable, clearly indicate whether it is fixed or variable.

- Outline the repayment terms. Include the payment schedule, such as monthly or quarterly payments.

- Indicate the due date for the final payment. This is when the loan must be fully repaid.

- Provide space for signatures. Both the borrower and lender should sign and date the document to validate it.

Once the form is completed and signed, make copies for both parties. Retain these copies for your records. The signed Promissory Note serves as a formal agreement, ensuring clarity and accountability for both the borrower and the lender.