Blank Illinois Quitclaim Deed Form

Documents used along the form

The Illinois Quitclaim Deed is an important document used to transfer property ownership. However, several other forms and documents are often needed during this process. Here is a list of commonly used forms that may accompany the Quitclaim Deed.

- Property Transfer Tax Declaration: This form is required to report the sale price of the property and calculate any applicable transfer taxes.

- Affidavit of Title: This document confirms the seller's ownership and states that there are no outstanding claims against the property.

- Bill of Sale: This form is crucial in documenting the transfer of ownership of personal property, ensuring proof of purchase. For a template, visit pdftemplates.info/washington-bill-of-sale-form.

- Title Insurance Policy: This insurance protects the buyer against any future claims or disputes regarding the property title.

- Real Estate Purchase Agreement: This contract outlines the terms of the sale between the buyer and seller, including price and contingencies.

- General Warranty Deed: Unlike a Quitclaim Deed, this document provides a guarantee that the seller holds clear title to the property.

- Notice of Transfer: This form notifies local authorities of the change in property ownership, which may be necessary for tax purposes.

- Power of Attorney: If the seller cannot be present to sign the deed, this document allows another person to act on their behalf.

- Settlement Statement: This document details all costs and fees associated with the property transfer, ensuring transparency for both parties.

These documents play a crucial role in ensuring a smooth property transfer process. Having them prepared and ready can help avoid delays and complications during the transaction.

Other Popular State-specific Quitclaim Deed Templates

How Do I File a Quit Claim Deed - A Quitclaim Deed is often preferred for simple property transfers among familiar parties.

Understanding the California General Power of Attorney form is crucial for ensuring that responsibilities are effectively managed, as it provides one individual the power to make decisions for another in various legal and financial scenarios. To explore more about this essential document and its implications, you can refer to the following resource: https://californiapdf.com/.

Pennsylvania Quit Claim Deed Pdf - Although simple, it is essential to ensure clear intentions are documented.

Similar forms

The Warranty Deed is a legal document used to transfer property ownership, similar to a Quitclaim Deed. However, the Warranty Deed provides a guarantee that the grantor holds clear title to the property and has the right to sell it. This assurance protects the grantee from future claims against the property. In contrast, a Quitclaim Deed makes no such guarantees, leaving the grantee vulnerable to potential title issues.

When it comes to the transfer of ownership, understanding the different types of deeds is crucial for both sellers and buyers. For instance, while the Warranty Deed provides a secure guarantee of ownership, others like the Bargain and Sale Deed may present heightened risks without such warranties. To ensure proper documentation during transactions, those dealing with vehicles can also benefit from utilizing resources like Vehicle Bill of Sale Forms, which help safeguard the details of vehicle exchanges just as various deeds protect property transfers.

The Bargain and Sale Deed is another document that shares similarities with the Quitclaim Deed. This type of deed transfers property without any warranties regarding the title. While it implies that the grantor has ownership of the property, it does not guarantee that the title is free from encumbrances. This contrasts with the Quitclaim Deed, which explicitly relinquishes any claim the grantor may have without asserting ownership rights.

The Grant Deed is also akin to the Quitclaim Deed, but it includes certain implied warranties. In a Grant Deed, the grantor assures that they have not transferred the property to anyone else and that it is free from undisclosed encumbrances. This level of assurance is absent in a Quitclaim Deed, where the grantor simply conveys their interest without any promises regarding the title's condition.

The Special Warranty Deed is another related document. This deed provides a limited warranty, where the grantor guarantees that they have not caused any title issues during their ownership. Unlike a Quitclaim Deed, which offers no warranties, the Special Warranty Deed protects the grantee from claims arising from the grantor's actions, but not from prior issues.

The Deed of Trust is similar in that it involves the transfer of property rights, but it serves a different purpose. A Deed of Trust secures a loan by transferring property to a trustee until the borrower repays the loan. In contrast, a Quitclaim Deed simply transfers ownership without any financial obligations attached. The Quitclaim Deed does not involve the complexities of loan agreements or security interests.

The Life Estate Deed is another document that shares some characteristics with the Quitclaim Deed. This deed allows the grantor to retain ownership of the property during their lifetime while transferring future ownership to another party. Although it involves a transfer of interest, it differs from a Quitclaim Deed in that it establishes a life estate, limiting the grantee's rights until the grantor passes away.

The Revocable Living Trust is somewhat similar in that it involves the management and transfer of property. However, a Revocable Living Trust allows individuals to retain control over their assets while designating beneficiaries for after their death. Unlike a Quitclaim Deed, which transfers ownership immediately, a Revocable Living Trust maintains ownership until the grantor passes, providing flexibility and avoiding probate.

Finally, the Affidavit of Title is a document that provides information about the ownership of a property but does not transfer any rights. It is often used in real estate transactions to confirm the seller's ownership and the absence of liens. While a Quitclaim Deed facilitates the transfer of property rights, the Affidavit of Title serves as a declaration of the current state of ownership without any transfer taking place.

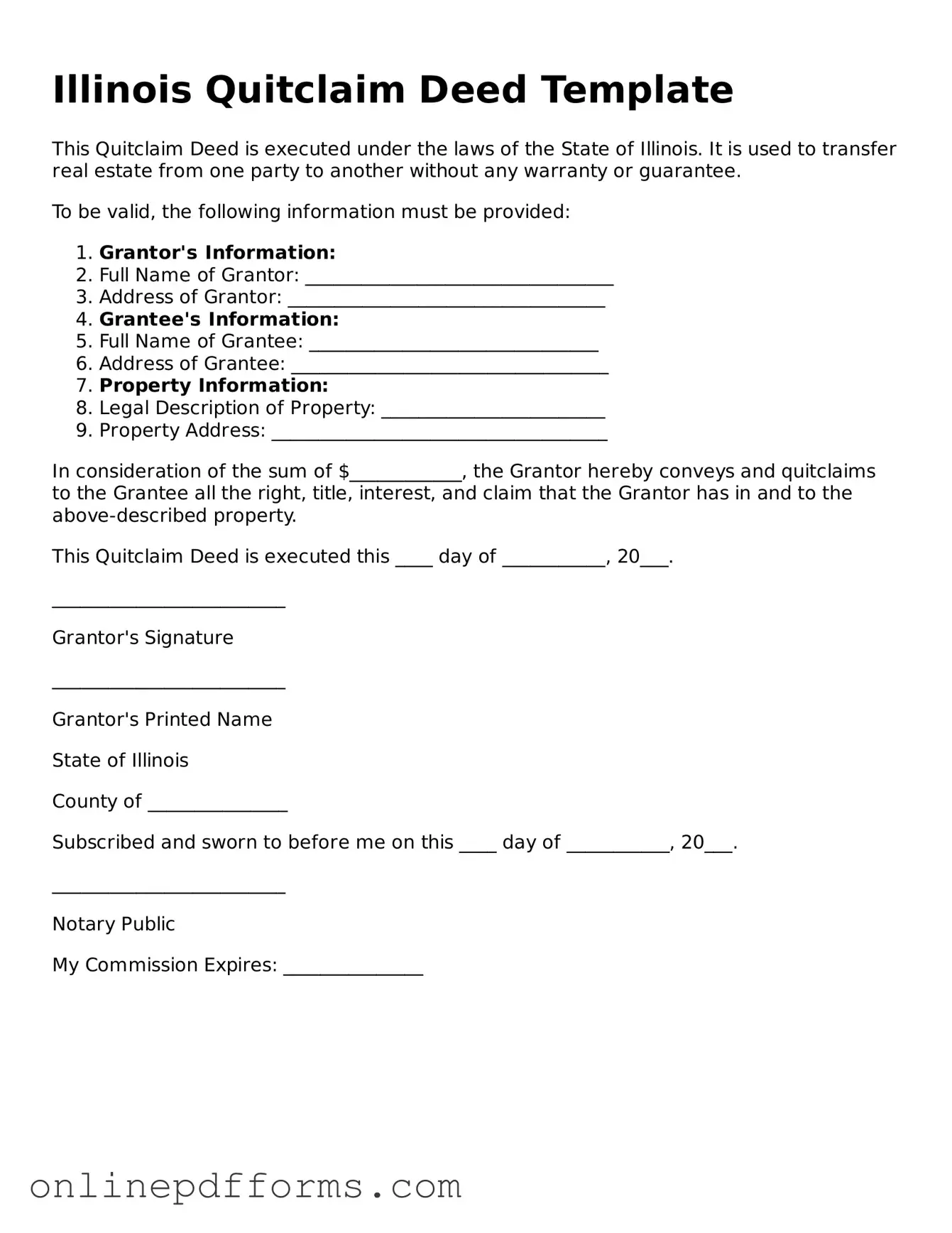

Steps to Filling Out Illinois Quitclaim Deed

Once you have obtained the Illinois Quitclaim Deed form, it’s important to fill it out accurately to ensure a smooth transfer of property. After completing the form, you will need to have it signed and notarized before filing it with the appropriate county recorder's office.

- Obtain the Form: Download the Illinois Quitclaim Deed form from a reliable source or visit your local county recorder's office to get a physical copy.

- Identify the Grantor: Fill in the name of the person transferring the property (the grantor). Include their address and any other required identifying information.

- Identify the Grantee: Enter the name of the person receiving the property (the grantee). Again, include their address and any other necessary details.

- Describe the Property: Provide a complete legal description of the property being transferred. This usually includes the address and any parcel identification numbers.

- Consideration: State the amount of money or other consideration being exchanged for the property. If it is a gift, you may indicate that as well.

- Sign the Document: The grantor must sign the form in the presence of a notary public. Ensure that the signature matches the name listed as the grantor.

- Notarization: Have the notary public complete their section, which includes their signature and seal, verifying the identity of the grantor.

- File the Deed: Take the completed and notarized Quitclaim Deed to the county recorder's office where the property is located. Pay any applicable filing fees.