Blank Illinois Real Estate Purchase Agreement Form

Documents used along the form

When engaging in a real estate transaction in Illinois, several important documents often accompany the Real Estate Purchase Agreement. Each of these documents serves a specific purpose and helps ensure that both parties understand their rights and obligations. Below is a list of common forms and documents that are typically used alongside the purchase agreement.

- Property Disclosure Statement: This document provides details about the condition of the property. Sellers are required to disclose any known defects or issues, which helps buyers make informed decisions.

- Lead-Based Paint Disclosure: For homes built before 1978, this form informs buyers about potential lead paint hazards. It is a federal requirement to ensure safety for families, especially those with young children.

- Tractor Bill of Sale: This document is pivotal for the sale and transfer of a tractor, legally documenting the transaction in Arizona, and can be found at arizonaformspdf.com/.

- Title Commitment: This document outlines the legal ownership of the property and any liens or encumbrances that may affect it. Buyers should review this carefully to ensure they are receiving clear title.

- Closing Statement: Also known as a HUD-1 or settlement statement, this document itemizes all the costs associated with the transaction. It provides a detailed breakdown of what each party owes and receives at closing.

- Earnest Money Agreement: This agreement outlines the amount of earnest money the buyer will deposit to show their commitment to the purchase. It specifies conditions under which the deposit may be forfeited or returned.

- Home Inspection Report: After a buyer has an inspection conducted, this report details the findings. It can influence negotiations and decisions regarding repairs or price adjustments.

- Loan Commitment Letter: If the buyer is financing the purchase, this letter from the lender confirms the buyer's eligibility for a mortgage. It outlines the terms and conditions of the loan, assuring the seller of the buyer's financial capability.

Understanding these documents is crucial for anyone involved in a real estate transaction. Each form plays a vital role in protecting the interests of both buyers and sellers, ensuring that the process runs smoothly and transparently.

Other Popular State-specific Real Estate Purchase Agreement Templates

Pa Real Estate Contract - It can specify if the buyer shall have access to the property before closing.

Trec Texas - It may include options for buyers to extend the closing date.

Completing the sale of your RV requires careful attention to detail, and one of the most important steps in this process is ensuring you have the correct documentation. By utilizing the Texas RV Bill of Sale form, you can effectively safeguard your interests as a buyer or seller. For those who need to obtain this essential form, you can download the pdf here and begin the documentation process without delay.

Real-estate Sale Contract - Provides a timeline for each step of the purchase process.

Similar forms

The Illinois Real Estate Purchase Agreement form shares similarities with the Residential Purchase Agreement, which is commonly used in many states across the country. Both documents outline the terms and conditions of a real estate transaction, including the purchase price, financing details, and contingencies. They serve as a legally binding contract between the buyer and seller, ensuring that both parties understand their rights and obligations throughout the sale process.

Another document that resembles the Illinois Real Estate Purchase Agreement is the Commercial Purchase Agreement. While the Illinois version is tailored for residential transactions, the commercial counterpart addresses the complexities of buying and selling commercial properties. Both agreements detail essential elements such as the purchase price, closing date, and any contingencies that may apply, but the commercial version may also include clauses specific to business operations, zoning, and property use.

The Lease Purchase Agreement is yet another document that bears a resemblance to the Illinois Real Estate Purchase Agreement. This type of agreement allows a tenant to rent a property with the option to purchase it at a later date. Like the purchase agreement, it outlines the terms of the transaction, including the rental period, purchase price, and conditions under which the tenant can exercise their option to buy. Both documents aim to protect the interests of both parties while facilitating a smooth transition from renting to ownership.

The Option to Purchase Agreement is similar in that it grants a buyer the right, but not the obligation, to purchase a property within a specified timeframe. This document sets forth the purchase price and the duration of the option. While the Illinois Real Estate Purchase Agreement is a definitive contract for sale, the Option to Purchase Agreement provides flexibility for buyers who may need time to secure financing or assess the property further before committing to a purchase.

The Seller Financing Agreement also shares characteristics with the Illinois Real Estate Purchase Agreement. In situations where a buyer cannot secure traditional financing, the seller may agree to finance the purchase directly. This document outlines the terms of the loan, including interest rates, payment schedules, and consequences for default. Both agreements establish the framework for the transaction, but the Seller Financing Agreement introduces additional financial terms that must be carefully considered by both parties.

The Addendum to Purchase Agreement is another relevant document that complements the Illinois Real Estate Purchase Agreement. This addendum is used to modify or add specific terms to the original agreement, such as repairs, seller concessions, or other contingencies. While the main purchase agreement outlines the overall transaction, the addendum allows for flexibility and adjustments based on negotiations between the buyer and seller, ensuring that all parties are on the same page.

When engaging in the sale of a trailer, it is crucial to utilize a Trailer Bill of Sale, as this legal document accurately records the ownership transfer and delineates key details such as the sale price and trailer specifications. For more information and to access a template for this essential form, visit https://pdftemplates.info/trailer-bill-of-sale-form/.

Lastly, the Real Estate Disclosure Statement is a critical document that aligns with the Illinois Real Estate Purchase Agreement. This statement provides essential information about the property's condition, including any known defects or issues that may affect its value. While the purchase agreement focuses on the transaction itself, the disclosure statement ensures transparency and protects buyers from unforeseen problems after the sale. Both documents work together to create a fair and informed buying process.

Steps to Filling Out Illinois Real Estate Purchase Agreement

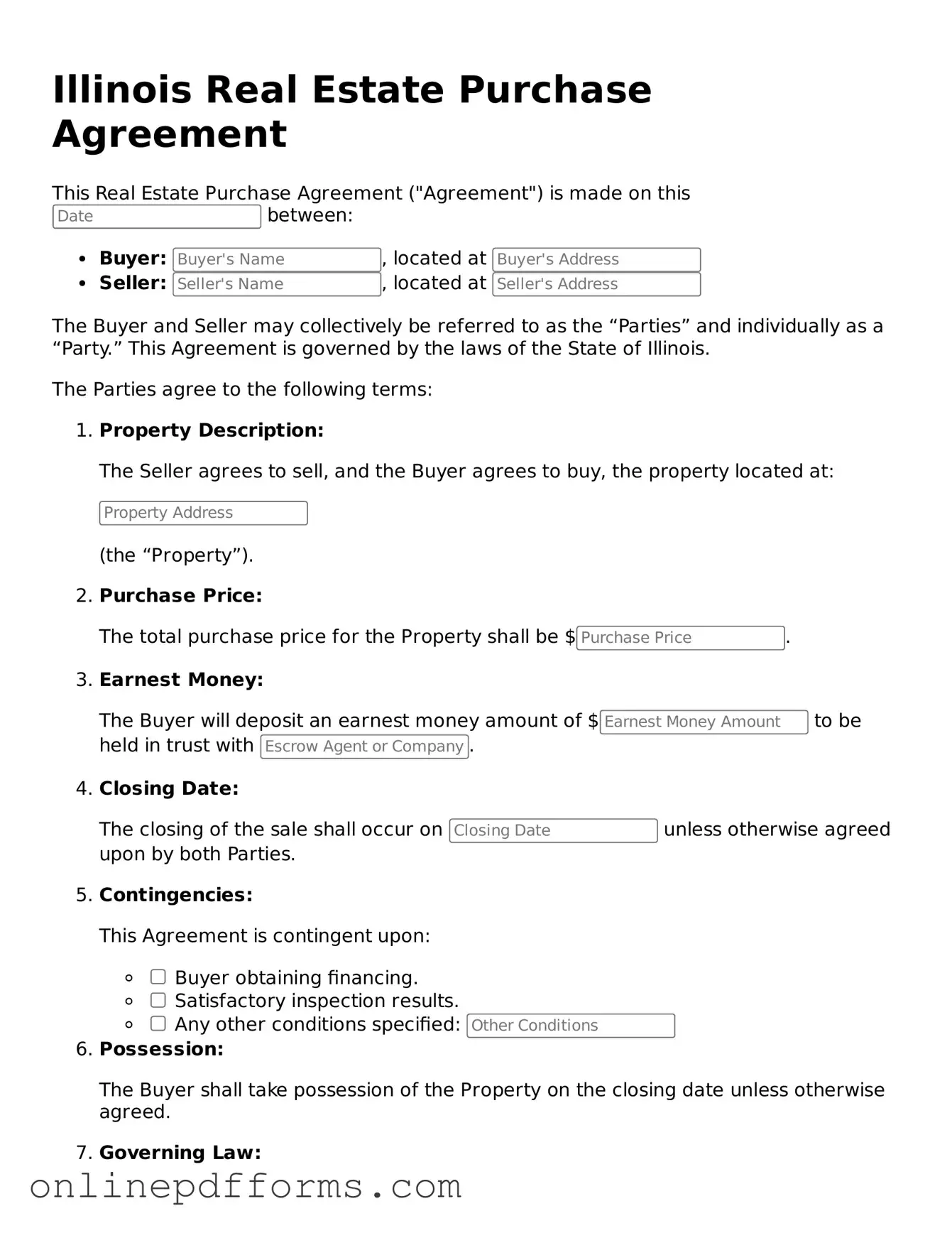

After obtaining the Illinois Real Estate Purchase Agreement form, you will need to fill it out carefully. This form outlines the terms of the sale between the buyer and seller. Make sure to have all necessary information at hand before you begin.

- Identify the Parties: Fill in the names and contact information for both the buyer and the seller. Include any relevant addresses.

- Property Description: Provide a detailed description of the property being sold. This should include the address and any legal descriptions if available.

- Purchase Price: Enter the agreed-upon purchase price for the property. Be clear and precise.

- Earnest Money: Specify the amount of earnest money the buyer will provide. This shows commitment to the purchase.

- Financing Terms: Indicate how the buyer plans to finance the purchase. This could include mortgage details or cash purchase.

- Contingencies: List any conditions that must be met for the sale to proceed. This might include inspections or financing approval.

- Closing Date: Agree on a closing date for the transaction. Make sure this date works for both parties.

- Signatures: Both the buyer and seller must sign and date the agreement. Ensure all signatures are in place.

Once you have completed the form, review it for accuracy. Both parties should keep a copy for their records. This document will guide the next steps in the real estate transaction.