Blank Illinois Transfer-on-Death Deed Form

Documents used along the form

The Illinois Transfer-on-Death Deed (TOD) allows property owners to transfer real estate to beneficiaries upon their death without the need for probate. While the TOD deed itself is crucial, several other documents often accompany it to ensure a smooth transfer of ownership. Here are some key forms and documents that may be used alongside the Illinois Transfer-on-Death Deed:

- Affidavit of Identity: This document verifies the identity of the property owner and may be required to confirm that the individual executing the TOD deed is indeed the rightful owner of the property.

- Beneficiary Designation Form: This form outlines the specific beneficiaries who will receive the property. It can help clarify intentions and avoid disputes among heirs.

- Revocation of Transfer-on-Death Deed: If the property owner decides to change their mind after executing the TOD deed, this document serves to revoke the previous deed and nullify the transfer to the designated beneficiaries.

- Mobile Home Bill of Sale: When acquiring mobile properties, ensure you have the comprehensive Mobile Home Bill of Sale form to facilitate a smooth ownership transfer.

- Property Deed: The original property deed may need to be referenced or attached to the TOD deed to establish clear ownership and details about the property being transferred.

Using these documents in conjunction with the Illinois Transfer-on-Death Deed can help ensure that the property transfer is executed according to the owner's wishes. Proper documentation is essential for a seamless transition and to prevent potential legal complications in the future.

Other Popular State-specific Transfer-on-Death Deed Templates

Ladybird Deed Texas Form - Choosing a beneficiary for a Transfer-on-Death Deed can provide peace of mind knowing who will inherit the property.

To facilitate the purchase and transfer of ownership for recreational vehicles, it is advisable to utilize the Georgia RV Bill of Sale form, which can be accessed through various resources, including Auto Bill of Sale Forms. This document is essential for ensuring that all parties have a clear record of the transaction, including the identities of the buyer and seller, along with the specific details of the RV involved.

Transfer on Death Deed Georgia - Retain a copy of the deed and any amendments for personal records and reference.

Similar forms

The Illinois Transfer-on-Death Deed (TODD) is similar to a will in that both documents allow individuals to dictate the distribution of their assets after death. A will outlines how a person's property should be distributed, names beneficiaries, and can appoint guardians for minor children. However, unlike a will, which must go through probate, a TODD allows for the direct transfer of real estate to the named beneficiaries without the need for probate court. This can simplify the process and reduce costs for the heirs.

The Texas Operating Agreement form is essential for members of a Limited Liability Company (LLC) to clarify their operational procedures and define ownership structures within the business. This important legal document not only ensures that all member interests are protected but also formalizes the agreements needed for a smooth operation. To ensure your operating procedures are well laid out, it’s crucial to read the form and complete it accurately.

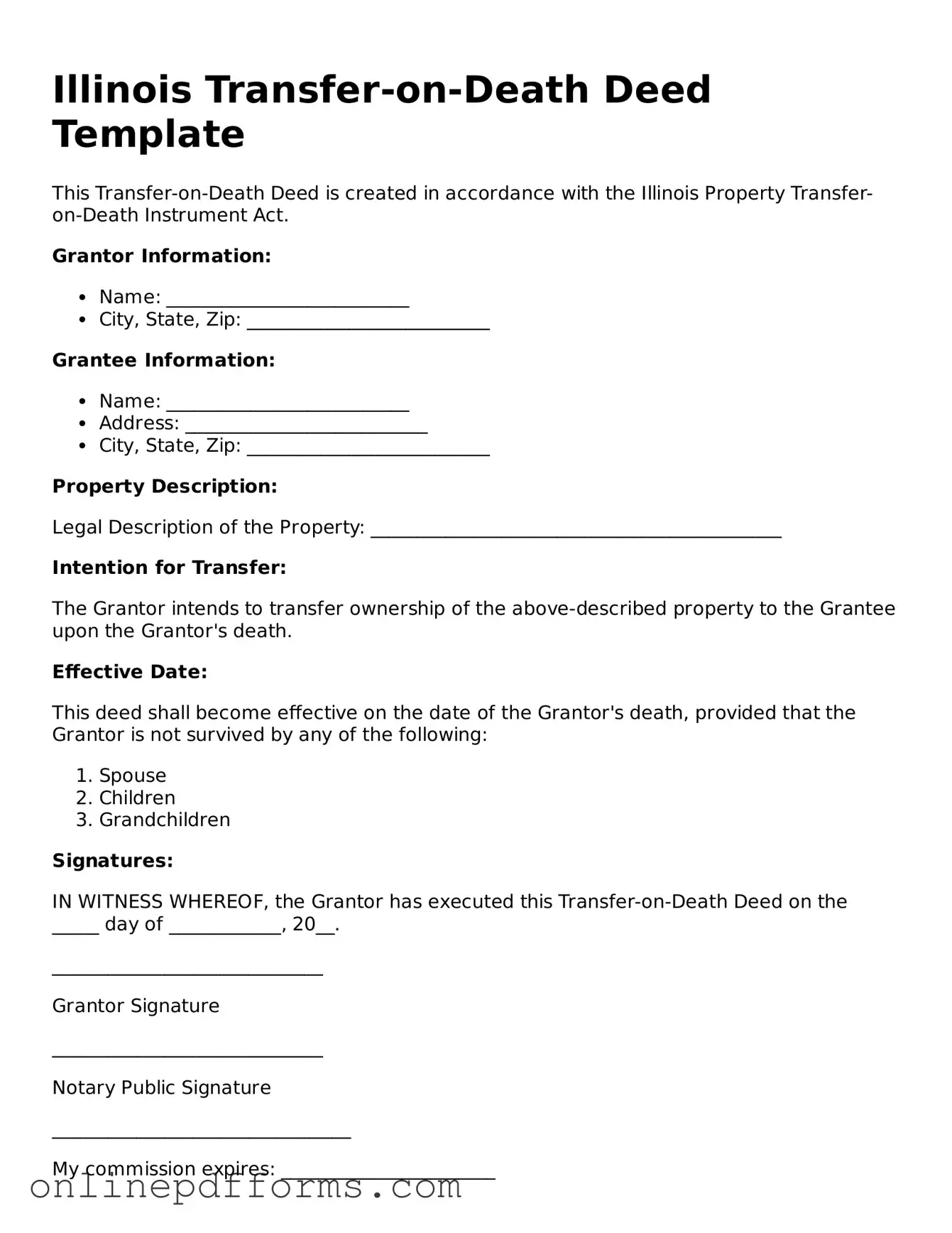

Steps to Filling Out Illinois Transfer-on-Death Deed

After obtaining the Illinois Transfer-on-Death Deed form, you will need to fill it out accurately to ensure that your property transfers as intended. Follow these steps carefully to complete the form correctly.

- Begin by entering your name as the grantor. Make sure to include your full legal name.

- Provide your address. This should be your current residential address.

- Identify the property you wish to transfer. Include the complete legal description of the property, which can typically be found on your property tax bill or deed.

- List the name of the beneficiary or beneficiaries. Include their full names and addresses. If there are multiple beneficiaries, ensure that they are clearly identified.

- Specify how you want the beneficiaries to hold the property. You can choose to have it transferred equally or in specific shares.

- Sign the form in the presence of a notary public. Your signature must be notarized for the deed to be valid.

- File the completed deed with the appropriate county recorder's office. This step is crucial for the deed to take effect.

Once the form is filled out and submitted, it will be recorded. Keep a copy for your records, and ensure your beneficiaries are aware of the deed and its contents.