Fill in Your Independent Contractor Pay Stub Template

Documents used along the form

When working with independent contractors, several key forms and documents often accompany the Independent Contractor Pay Stub. Each of these documents serves a specific purpose, ensuring that both the contractor and the hiring entity maintain clear records and comply with applicable regulations.

- Independent Contractor Agreement: This document outlines the terms of the relationship between the contractor and the hiring entity. It typically includes details about the scope of work, payment terms, deadlines, and any confidentiality agreements.

- W-9 Form: This form is used to collect the contractor's taxpayer identification number. It is essential for the hiring entity to report payments made to the contractor to the IRS, ensuring compliance with tax regulations.

- Articles of Incorporation Form: To establish a corporation in Wisconsin, it's essential to complete the Articles of Incorporation form. For more information, visit https://pdftemplates.info/wisconsin-articles-of-incorporation-form.

- Invoice: Contractors often submit invoices to request payment for their services. An invoice details the work completed, the amount owed, and payment terms, providing a clear record for both parties.

- 1099 Form: At the end of the tax year, hiring entities must issue a 1099 form to report payments made to independent contractors. This form is crucial for the contractor’s tax filing and ensures that income is accurately reported to the IRS.

- Time Tracking Sheet: This document helps contractors log hours worked on specific projects. It can support invoicing and provide transparency regarding the time spent on tasks, which is beneficial for both the contractor and the hiring entity.

Understanding these forms and documents is vital for maintaining a smooth working relationship with independent contractors. Proper documentation not only helps in managing payments but also ensures compliance with legal and tax obligations.

More PDF Templates

Ncoer Order of Signatures - The DA 2166-9-1 is an NCO evaluation report designed for Sergeants.

For those navigating employment contracts, understanding the "key aspects of a Non-compete Agreement" can be vital. This document helps safeguard businesses while clarifying the future prospects of employees. For further insights, explore the key aspects of a Non-compete Agreement.

Printable Mar - The sheet promotes the safety of patients by minimizing medication errors.

Similar forms

The Independent Contractor Agreement is a document that outlines the terms and conditions between a contractor and a client. Similar to a pay stub, it provides essential information regarding payment, including rates and payment schedules. This agreement ensures both parties understand their responsibilities, including deliverables and timelines, mirroring the clarity found in a pay stub regarding earnings and deductions.

The Invoice is a document that independent contractors often use to request payment for services rendered. Like a pay stub, an invoice details the amount owed, the services provided, and payment terms. Both documents serve as a record of financial transactions, helping contractors track their income and clients to manage their expenses.

The W-9 form is used by independent contractors to provide their taxpayer identification information to clients. This form is similar to a pay stub in that it facilitates the financial relationship between the contractor and the client. Both documents ensure compliance with tax regulations, allowing for accurate reporting of income earned by the contractor.

The 1099 form is issued by clients to report payments made to independent contractors. Like a pay stub, it summarizes earnings for a specific tax year, ensuring that contractors have the necessary information for tax filing. Both documents help maintain transparency in financial dealings and assist in accurate income reporting.

In addition to the various forms discussed, those engaging in vehicle transactions should also be aware of the importance of having the proper documentation. For example, when buying or selling a vehicle, it is essential to utilize the correct forms to ensure a smooth transfer of ownership. The process can be simplified by using templates available online, such as the Vehicle Bill of Sale Forms, which provide a structured way to record the necessary details and protect the rights of both parties involved.

The Employment Contract is a formal agreement between an employer and an employee. While it primarily applies to employees, it shares similarities with the Independent Contractor Pay Stub in that it outlines payment terms, job responsibilities, and conditions of employment. Both documents aim to clarify financial arrangements and expectations between the parties involved.

The Payment Receipt serves as proof of payment for services rendered. Similar to a pay stub, it confirms that a transaction has occurred and outlines the amount paid. Both documents are important for record-keeping, providing contractors with evidence of income and clients with documentation for their financial records.

The Statement of Work (SOW) is a document that defines specific project deliverables and timelines. While it focuses on the scope of work, it often includes payment terms, akin to a pay stub. Both documents ensure that all parties have a clear understanding of what is expected, including financial obligations associated with the work performed.

The Profit and Loss Statement is a financial report that summarizes revenues and expenses over a specific period. Similar to a pay stub, it provides a snapshot of financial health, helping independent contractors understand their earnings and expenditures. Both documents are vital for budgeting and financial planning, enabling contractors to assess their profitability.

The Business License is a document that authorizes a contractor to operate legally within a specific jurisdiction. While it does not directly relate to payments, it shares the purpose of establishing legitimacy in business practices. Both the business license and pay stub contribute to a contractor's professional standing, ensuring compliance with local regulations.

The Expense Report is a document that details costs incurred during the course of business. Similar to a pay stub, it helps contractors track their finances, providing insight into earnings versus expenses. Both documents are essential for financial management, enabling contractors to evaluate their overall financial situation and make informed decisions.

Steps to Filling Out Independent Contractor Pay Stub

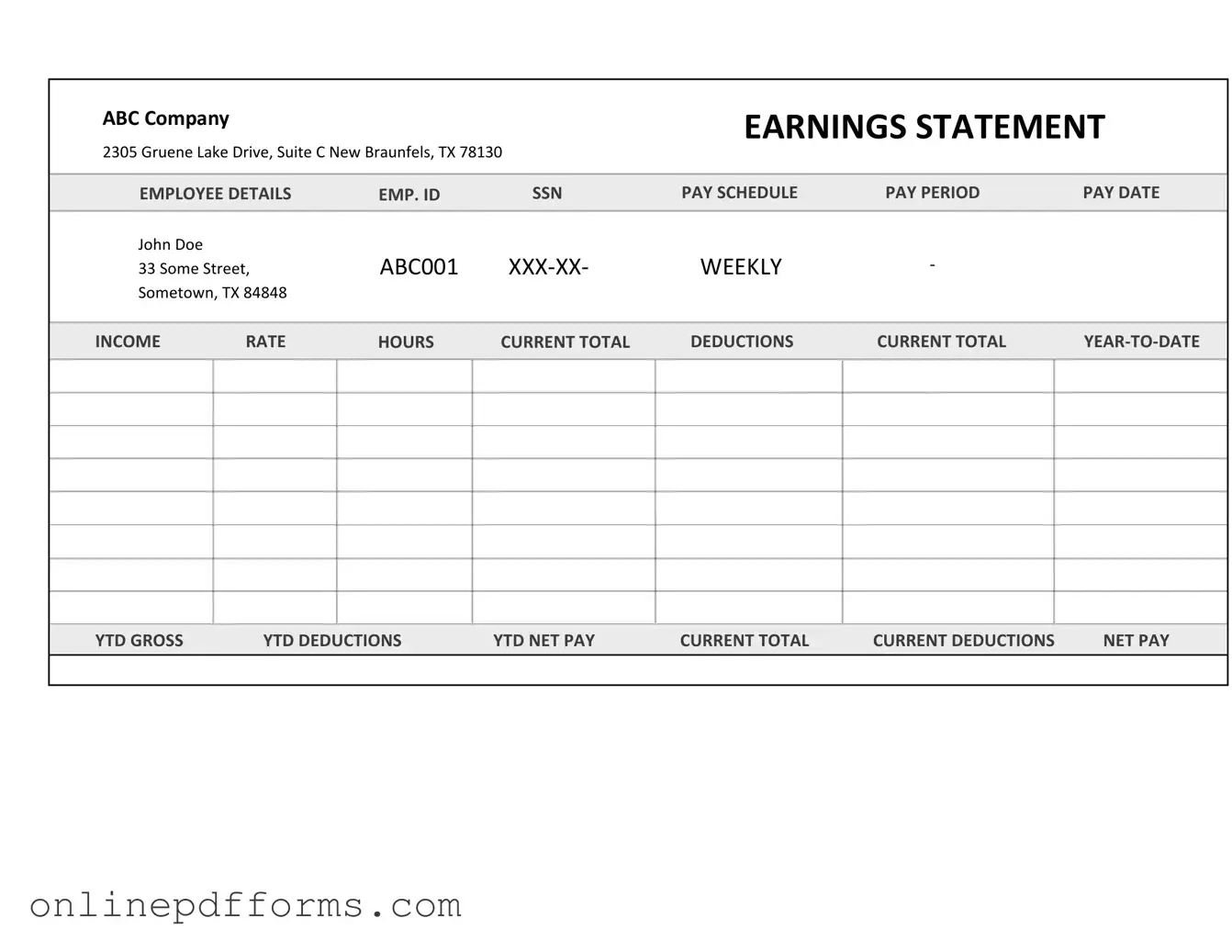

Filling out the Independent Contractor Pay Stub form is an important step in documenting payments for services rendered. Accurate information ensures both parties have a clear record of earnings and deductions. Follow the steps below to complete the form correctly.

- Start with your personal information. Enter your name, address, and contact details in the designated fields.

- Provide the name and address of the business or individual who hired you. This is crucial for proper record-keeping.

- Fill in the pay period dates. Indicate the start and end dates for the period you are being paid for.

- Enter the total amount earned during the pay period. Be sure this matches any agreements made.

- List any deductions, if applicable. This may include taxes, fees, or other withholdings.

- Calculate the net pay by subtracting deductions from the total amount earned. Write this amount clearly.

- Sign and date the form. This confirms that the information provided is accurate.

After completing the form, keep a copy for your records. Submit the pay stub to the appropriate party to ensure timely processing of your payment.