Legal Investment Letter of Intent Form

Documents used along the form

When engaging in investment opportunities, various documents complement the Investment Letter of Intent (LOI). Each of these forms serves a unique purpose in the investment process, helping to clarify intentions and protect the interests of all parties involved. Below are five commonly used documents that often accompany the LOI.

- Confidentiality Agreement: This document ensures that sensitive information shared between parties remains private. It outlines the terms under which confidential information can be disclosed and the obligations of the receiving party to protect that information.

- Term Sheet: A term sheet summarizes the key terms and conditions of an investment. It serves as a preliminary agreement that outlines the main points, such as investment amount, valuation, and governance rights, before a more detailed contract is drafted.

- Due Diligence Checklist: This checklist is used to guide the investigation of a potential investment. It includes items that need to be reviewed, such as financial statements, legal documents, and operational metrics, to ensure that the investment is sound.

- Subscription Agreement: This agreement is executed when an investor agrees to purchase shares or interests in a company. It details the terms of the investment, including the amount being invested and the rights associated with the investment.

- Shareholders' Agreement: This document outlines the rights and responsibilities of shareholders in a company. It addresses issues such as voting rights, dividend distribution, and procedures for transferring shares, ensuring clarity among investors.

Understanding these accompanying documents can facilitate a smoother investment process. Each form plays a crucial role in establishing clear expectations and protecting the interests of all parties involved in the investment transaction.

Consider More Types of Investment Letter of Intent Forms

Rental Letter of Intent - The LOI is not a legally binding contract but shows commitment to negotiate.

Loi Meaning in Job - The document is generally straightforward and can be easily customized for various job positions.

Letter of Intent to Sue - Expression of dissatisfaction potentially leading to court action.

Similar forms

The Investment Letter of Intent form shares similarities with a Memorandum of Understanding (MOU). An MOU outlines the intentions of two or more parties to collaborate on a project or business venture. Like the Investment Letter of Intent, it serves as a preliminary agreement that establishes the framework for future negotiations. Both documents express a mutual understanding of the goals and expectations of the involved parties, although an MOU may not be legally binding, while the intent letter often leads to more formal commitments.

Another document that resembles the Investment Letter of Intent is the Term Sheet. A Term Sheet summarizes the key terms and conditions of an investment or partnership agreement. It provides a clear overview of the major points that need to be addressed in a formal contract. Much like the Investment Letter of Intent, a Term Sheet helps facilitate discussions and negotiations by laying out the essential terms before drafting a more detailed agreement.

The Non-Binding Agreement is also similar to the Investment Letter of Intent. This type of agreement outlines the intentions of the parties involved without creating enforceable obligations. Both documents are often used in the early stages of negotiations to clarify expectations and intentions. While the Investment Letter of Intent may lead to binding agreements, the Non-Binding Agreement explicitly states that it does not create legal obligations, making it useful for exploratory discussions.

Lastly, the Confidentiality Agreement, or Non-Disclosure Agreement (NDA), bears some resemblance to the Investment Letter of Intent. While the primary purpose of an NDA is to protect sensitive information shared between parties, it is often used in conjunction with investment discussions. Both documents aim to create a safe environment for open dialogue. The Investment Letter of Intent may include confidentiality clauses to ensure that the details of the investment discussions remain private, similar to the protections offered by an NDA.

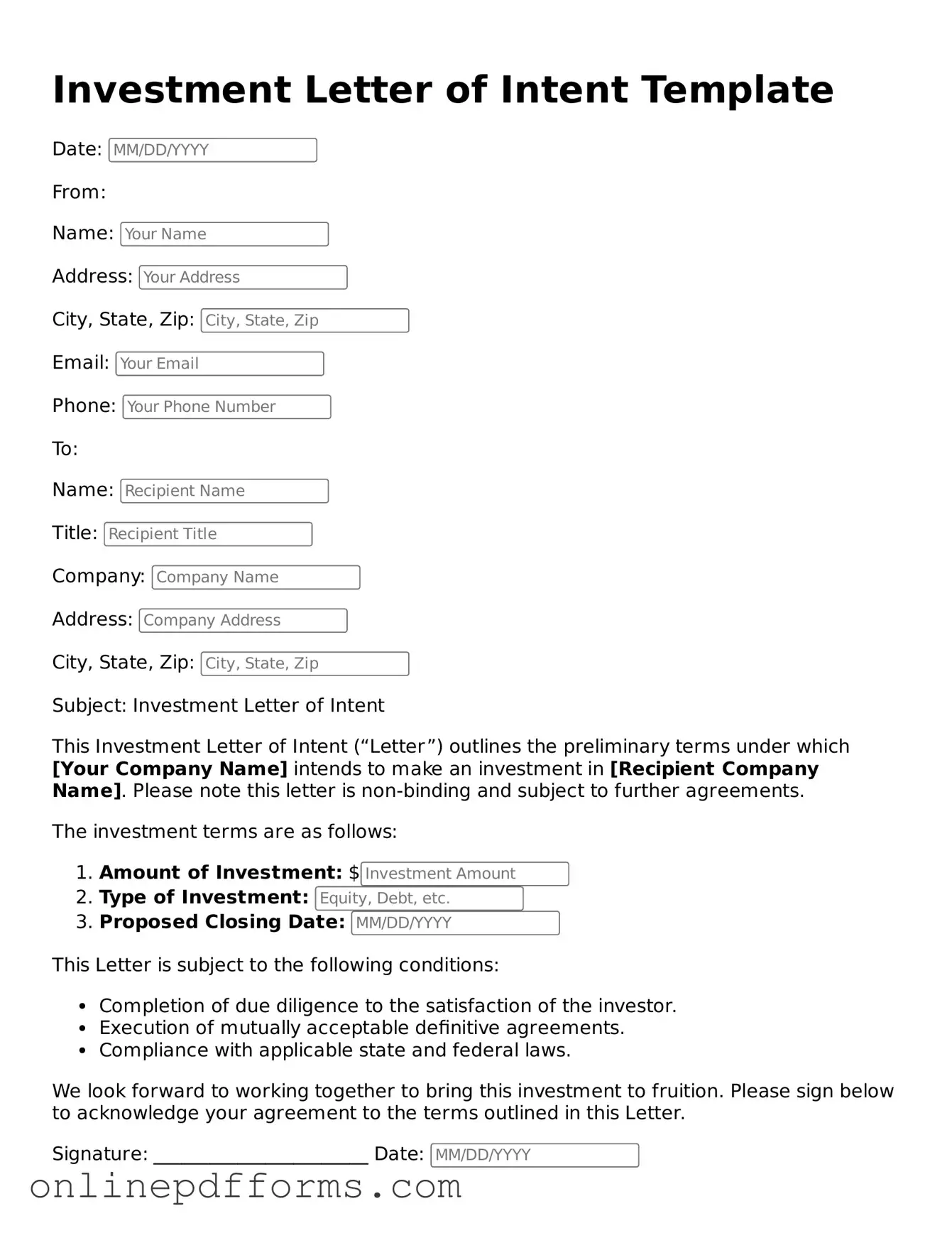

Steps to Filling Out Investment Letter of Intent

Filling out the Investment Letter of Intent form is a straightforward process that requires attention to detail. After completing the form, you will be ready to submit it to the relevant parties, which will initiate the next steps in your investment journey.

- Begin by entering your full name in the designated field at the top of the form.

- Provide your current address, including city, state, and ZIP code.

- Fill in your contact information, including your phone number and email address.

- Specify the name of the company or investment opportunity you are interested in.

- Indicate the amount you intend to invest in the provided section.

- Read through any terms and conditions outlined in the form carefully.

- Sign and date the form at the bottom to confirm your intent.

- Review the completed form for any errors or missing information.

- Make a copy of the filled-out form for your records before submission.