Fill in Your IRS 1120 Template

Documents used along the form

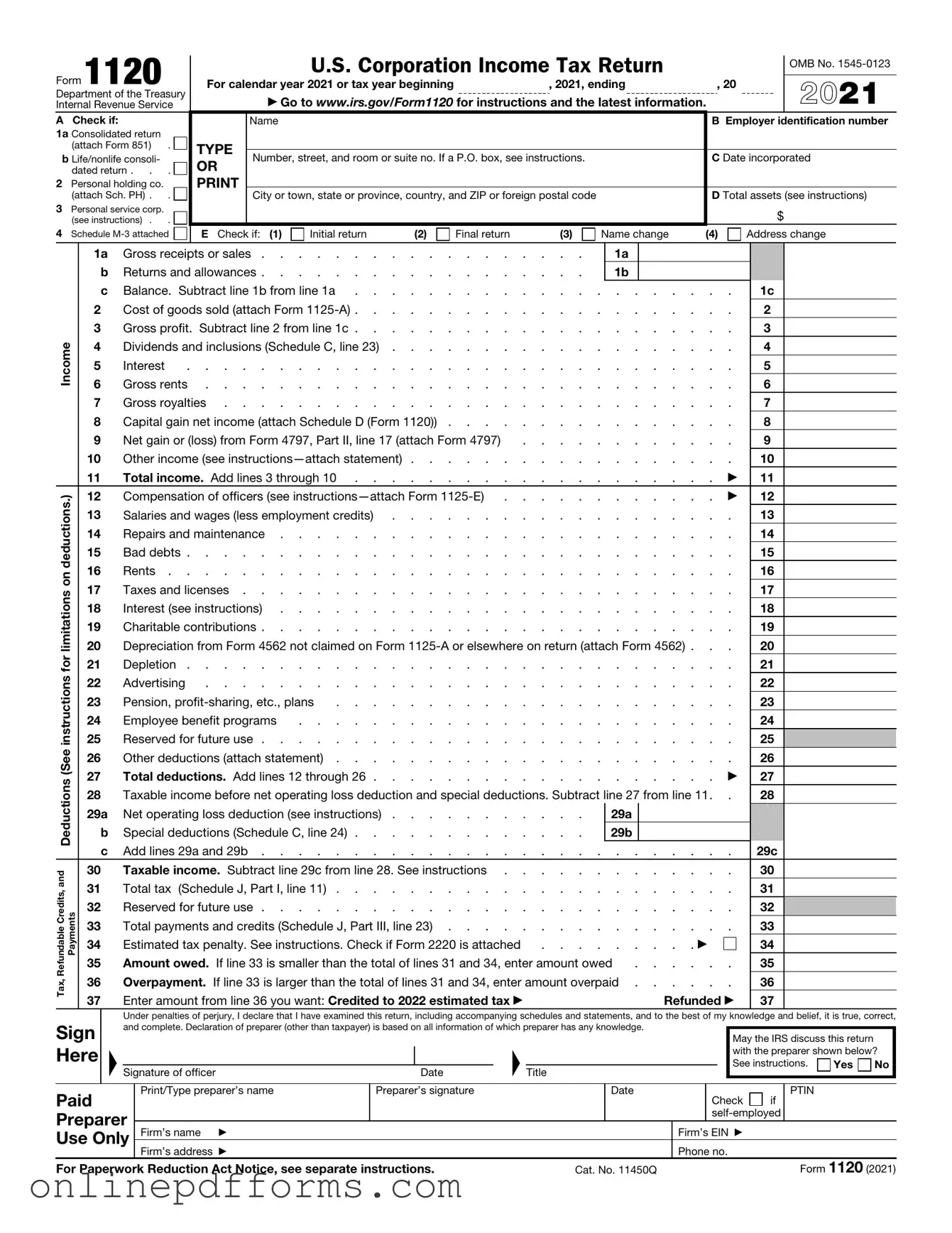

The IRS Form 1120 is essential for corporations in the United States to report their income, gains, losses, deductions, and credits. However, several other forms and documents are often required to provide a complete picture of a corporation's financial standing and compliance with tax obligations. Below is a list of these forms, each playing a critical role in the tax filing process.

- Form 1125-A: This form is used to report the cost of goods sold. It helps determine the gross profit of a corporation by detailing the expenses associated with producing or purchasing goods that were sold during the tax year.

- Marital Separation Agreement: To navigate the complexities of separation, refer to the important Marital Separation Agreement considerations that clarify your rights and responsibilities.

- Form 1125-E: This document is utilized to report compensation of officers. Corporations must disclose the salaries and other compensation paid to their officers to ensure transparency and compliance with tax regulations.

- Schedule C: This schedule is part of Form 1120 and is used to report income, deductions, and credits related to specific activities of the corporation. It provides a detailed breakdown of financial activities that may not be covered in the main form.

- Form 4562: This form is necessary for claiming depreciation and amortization. Corporations use it to report the depreciation of their assets, which can significantly impact taxable income.

- Form 941: This quarterly form is used to report income taxes, Social Security tax, and Medicare tax withheld from employee paychecks. It is crucial for corporations with employees to ensure compliance with payroll tax obligations.

- Form 1099: This series of forms is used to report various types of income other than wages, salaries, and tips. Corporations must issue these forms to independent contractors and other non-employee service providers to report payments made throughout the year.

- Form 1120-W: This is the estimated tax for corporations. It helps corporations calculate and pay estimated tax payments throughout the year, ensuring they meet their tax obligations without incurring penalties.

- Form 8832: This form is used to elect how a corporation will be classified for federal tax purposes. It can affect the tax treatment of the corporation, making it an important document for strategic financial planning.

- Form 5471: This form is required for certain U.S. citizens and residents who are officers, directors, or shareholders in certain foreign corporations. It ensures that U.S. taxpayers report their foreign investments and comply with international tax regulations.

Understanding these additional forms and documents is crucial for corporations to maintain compliance with IRS regulations and to accurately report their financial activities. Each document serves a unique purpose and contributes to a comprehensive tax filing process, ensuring that corporations fulfill their obligations while taking advantage of available deductions and credits.

More PDF Templates

Which of These Items Is Checked in a Pre-trip Inspection? - Verify that all seat belts are functioning correctly and are free from damage.

The Texas Motor Vehicle Power of Attorney form is crucial for individuals requiring assistance in managing their vehicle affairs; for more information and to download the form, visit pdftemplates.info/texas-motor-vehicle-power-of-attorney-form.

I983 Form Instructions - The form fosters transparency in the training relationship.

Similar forms

The IRS Form 1065 is similar to Form 1120 in that it is used by partnerships to report income, deductions, gains, and losses. While Form 1120 is for corporations, Form 1065 allows partnerships to pass their income through to partners, who then report it on their personal tax returns. Both forms require detailed financial information and must be filed annually, ensuring compliance with tax regulations.

Form 1120-S is another related document, specifically for S corporations. Like Form 1120, it reports income, deductions, and credits, but it allows income to pass through to shareholders to avoid double taxation. Both forms require information on the corporation's financial performance, but the tax implications differ significantly due to the S corporation status.

The IRS Form 990 is applicable to tax-exempt organizations, similar to how Form 1120 serves for taxable corporations. Both forms require organizations to disclose financial information, including revenue and expenses. However, Form 990 focuses on the public benefit aspect, whereas Form 1120 emphasizes profit generation for shareholders.

Form 941 is used by employers to report payroll taxes, making it similar to Form 1120 in that both deal with business operations and financial reporting. While Form 1120 captures the overall financial performance of a corporation, Form 941 specifically addresses employment taxes withheld from employee paychecks and the employer's contributions.

In the realm of vehicle transactions, having proper documentation is essential for both parties involved. Similar to various tax forms that ensure compliance and transparency, the Nevada Motor Vehicle Bill of Sale form acts as a key document facilitating the transfer of ownership of a vehicle. This crucial form captures vital details needed to validate the transaction, akin to the importance of Auto Bill of Sale Forms that protect both the buyer's and seller's interests throughout the purchasing process.

Form 1120-POL is for political organizations and shares similarities with Form 1120 in that both report income and expenses. Political organizations must file Form 1120-POL if they have taxable income, while Form 1120 is for standard corporations. Each form ensures compliance with tax obligations in their respective sectors.

Form 1065-B is designed for electing large partnerships, akin to how Form 1120 functions for corporations. Both forms require detailed financial reporting and allow for the distribution of income to partners or shareholders. The primary difference lies in the structure of the entity and the tax treatment of income.

Form 1120-F is for foreign corporations doing business in the United States. Similar to Form 1120, it reports income and expenses but caters specifically to non-resident entities. Both forms aim to ensure that corporations meet their tax obligations, but they address different types of corporate structures and residency statuses.

The IRS Form 2553 is used by corporations to elect S corporation status, making it similar to Form 1120 in that it pertains to corporate taxation. While Form 1120 is the annual tax return for corporations, Form 2553 allows corporations to choose a tax status that can lead to different tax treatment and benefits.

Form 1120-L is for life insurance companies and shares similarities with Form 1120 in that both report income, deductions, and taxes owed. However, Form 1120-L has specific provisions and calculations unique to the life insurance industry, while Form 1120 applies to a broader range of corporations.

Lastly, Form 1120-C is for cooperatives, paralleling Form 1120 in that both report financial information for tax purposes. Cooperatives have unique tax considerations, and Form 1120-C allows them to report income and expenses specific to their cooperative operations, while still adhering to the general corporate tax structure.

Steps to Filling Out IRS 1120

Completing the IRS Form 1120 is an important step for corporations to report their income, gains, losses, and deductions. This process requires careful attention to detail to ensure all information is accurate. Below are the steps to help you fill out the form correctly.

- Gather necessary documents, including financial statements, income records, and expense reports.

- Obtain the IRS Form 1120 from the IRS website or your tax professional.

- Fill in the corporation's name, address, and Employer Identification Number (EIN) at the top of the form.

- Report the total income in the appropriate section. Include gross receipts or sales, and any other income sources.

- List the cost of goods sold (if applicable) to calculate the gross profit.

- Detail deductions in the designated section. Include business expenses such as salaries, rent, and utilities.

- Calculate the taxable income by subtracting total deductions from gross profit.

- Determine the tax liability based on the taxable income and applicable tax rates.

- Complete any additional schedules or forms required for specific deductions or credits.

- Review the completed form for accuracy and completeness.

- Sign and date the form. Ensure it is filed by the due date to avoid penalties.