Fill in Your IRS 941 Template

Documents used along the form

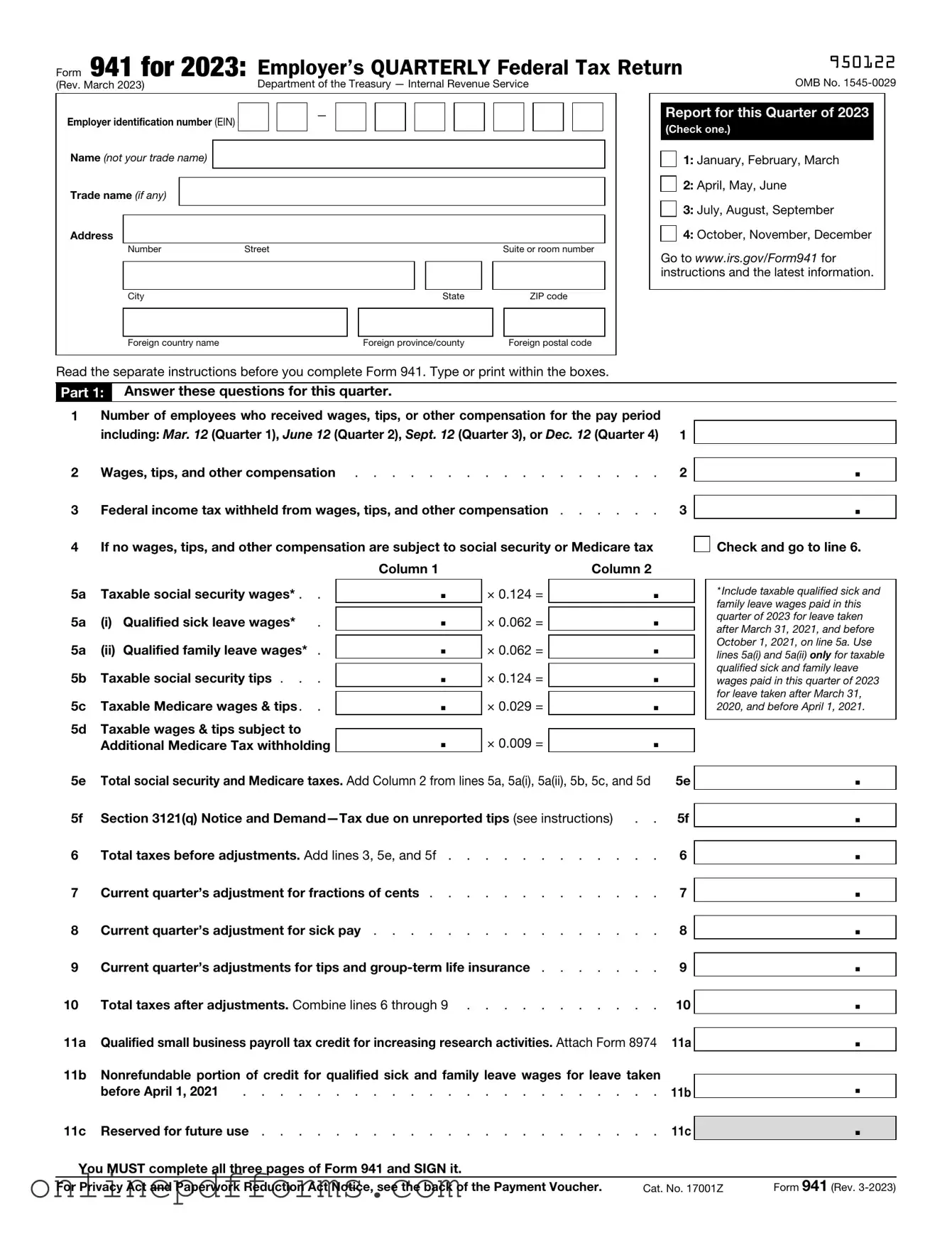

The IRS Form 941 is a crucial document for employers, as it reports the amount of federal income tax withheld from employee wages, along with Social Security and Medicare taxes. However, it is often accompanied by other forms and documents that help ensure compliance with tax obligations. Below is a list of forms and documents commonly used alongside Form 941, each serving a specific purpose in the payroll and tax reporting process.

- IRS Form 940: This form is used to report and pay federal unemployment taxes (FUTA). Employers must file it annually, detailing their total payroll and calculating the amount owed for unemployment insurance.

- IRS Form W-2: The W-2 form is provided to employees at the end of the year. It summarizes their total earnings and the taxes withheld, including federal income tax, Social Security, and Medicare contributions.

- IRS Form W-3: This is a summary form that accompanies the W-2s when submitted to the IRS. It provides a total of all W-2 forms issued by an employer, ensuring accurate reporting of wages and taxes.

- IRS Form 1099-MISC: For independent contractors or freelancers, this form is used to report payments made outside of regular employment. It is essential for reporting non-employee compensation and other payments made throughout the year.

- Arizona Motor Vehicle Bill of Sale: This form is essential for documenting the transfer of ownership for motor vehicles. Completing the form accurately helps facilitate a smooth transaction and establishes proof of ownership, which can be found at https://mypdfform.com/blank-arizona-motor-vehicle-bill-of-sale/.

- IRS Form 941-X: This form is used to amend a previously filed Form 941. If an error was made in reporting taxes, employers can correct it using this form to ensure accurate records and compliance.

- IRS Form SS-4: This application is used to apply for an Employer Identification Number (EIN), which is necessary for reporting taxes and opening a business bank account. Every employer must obtain an EIN before filing Form 941.

- State Payroll Tax Forms: Depending on the state, employers may need to file additional payroll tax forms. These can include state income tax withholding forms and unemployment tax reports, which vary by jurisdiction.

- Employee Time Sheets: While not an official IRS form, these documents track hours worked by employees. They are essential for accurate payroll calculations and ensuring compliance with wage and hour laws.

Understanding these forms and documents can help streamline the payroll process and ensure compliance with tax regulations. By keeping accurate records and submitting the necessary paperwork, employers can avoid penalties and maintain good standing with tax authorities.

More PDF Templates

Bdsm List - Encourages feedback about experiences.

The Nevada Motor Vehicle Bill of Sale form is an essential document that ensures clarity in the transfer of ownership, detailing important information such as the date of sale, price, and vehicle specifics. It serves as a protective measure for both parties involved, affirming the transaction's authenticity. For those looking to navigate this process effectively, utilizing Auto Bill of Sale Forms can be incredibly beneficial.

W-9 Example - While not mandatory, submitting a W-9 can help expedite payment processing.

Similar forms

The IRS Form 940 is similar to Form 941 in that both are used by employers to report taxes related to employee wages. While Form 941 is filed quarterly and focuses on federal income tax withholding, Social Security, and Medicare taxes, Form 940 is an annual report specifically for the Federal Unemployment Tax Act (FUTA). Employers use Form 940 to calculate their unemployment tax liability based on the wages paid to employees. Both forms require accurate record-keeping and timely submission to avoid penalties.

Form W-2 is another document that shares similarities with Form 941. Employers must complete Form W-2 for each employee to report annual wages and the taxes withheld. While Form 941 provides a quarterly summary of these withholdings, Form W-2 details the total amounts for the entire year. Both forms are essential for ensuring compliance with federal tax regulations and for providing employees with the necessary information for their personal tax filings.

Form 1099-MISC serves a different purpose but is still comparable to Form 941 in that it involves reporting payments made to non-employees. Businesses use Form 1099-MISC to report payments to independent contractors and other non-employee service providers. While Form 941 focuses on employee wages and associated tax withholdings, both forms are crucial for accurate reporting of income to the IRS and for ensuring that all tax obligations are met.

The Texas Motorcycle Bill of Sale form is a crucial document used to transfer ownership of a motorcycle from one party to another in Texas. This form protects both the buyer and seller by providing a clear record of the transaction. To ensure a smooth transfer, fill out the form by clicking the button below. For more information, you can visit https://pdftemplates.info/texas-motorcycle-bill-of-sale-form/.

Form 944 is designed for small employers and is similar to Form 941 in that it also reports federal income tax withheld, Social Security, and Medicare taxes. However, Form 944 is filed annually rather than quarterly. This distinction allows qualifying small businesses to streamline their reporting process. Both forms require accurate calculations and timely submission to remain compliant with federal tax laws.

Form 943 is specifically tailored for agricultural employers and is akin to Form 941 in that it reports taxes related to employee wages. Form 943 is used to report income tax withholding and Social Security and Medicare taxes for farmworkers. While both forms serve the same fundamental purpose of tax reporting, Form 943 caters to the unique needs of the agricultural sector, reflecting the specific tax obligations that arise in this industry.

Form 945 is another document that parallels Form 941 in its reporting function. Employers use Form 945 to report federal income tax withheld from non-payroll payments, such as pensions and annuities. While Form 941 addresses payroll taxes for employees, Form 945 focuses on other types of payments. Both forms require attention to detail and adherence to submission deadlines to ensure compliance with IRS regulations.

Steps to Filling Out IRS 941

Filling out the IRS Form 941 is an important step for employers to report their payroll taxes. Completing this form accurately ensures compliance with federal tax regulations. Below are the steps to guide you through the process.

- Gather necessary information. Collect your business details, including the Employer Identification Number (EIN), business name, and address.

- Determine the reporting period. Identify the quarter for which you are filing the form, as Form 941 is filed quarterly.

- Complete Part 1. Fill in the number of employees, total wages paid, and the amount of federal income tax withheld.

- Calculate the taxes owed. Use the information from Part 1 to determine the amount of Social Security and Medicare taxes due.

- Fill out Part 2. Report any adjustments for tips, group-term life insurance, or other credits that may apply.

- Complete Part 3. Sign and date the form. This section certifies that the information provided is true and correct.

- Review the form for accuracy. Double-check all entries to ensure there are no mistakes.

- Submit the form. Send the completed Form 941 to the appropriate IRS address based on your location.

After submission, keep a copy of the completed form for your records. It’s essential to stay organized and maintain accurate records for future reference and compliance.