Fill in Your IRS Schedule C 1040 Template

Documents used along the form

When filing taxes as a sole proprietor, the IRS Schedule C (Form 1040) is essential for reporting income and expenses from a business. However, several other forms and documents often accompany this form to ensure accurate reporting and compliance with tax laws. Below is a list of these documents, each serving a specific purpose in the tax filing process.

- Form 1040: This is the standard individual income tax return form. It serves as the foundation for reporting personal income, including wages, dividends, and business income from Schedule C.

- Schedule SE: This form is used to calculate self-employment tax. If you earn more than a certain amount from self-employment, you need to file this form to determine how much you owe in Social Security and Medicare taxes.

- Nevada Motor Vehicle Bill of Sale: The Nevada Motor Vehicle Bill of Sale form is essential for documenting vehicle ownership transfer, providing critical details such as sale date and price. For more information, refer to Auto Bill of Sale Forms.

- Form 4562: This form is used to claim depreciation on business assets. If you purchase equipment or property for your business, you can deduct the cost over time using this form.

- Form 8829: If you use part of your home for business, this form allows you to calculate and deduct home office expenses, such as utilities and mortgage interest.

- Form 1099-MISC: If you received payments from clients or other businesses, they might issue this form to report the income. You should keep these forms for your records, as they help verify your reported income.

- Form W-9: This form is often requested by clients to obtain your taxpayer identification number. It is essential for ensuring that any payments made to you are reported accurately to the IRS.

- Form 1040-ES: This is used for estimating quarterly tax payments if you expect to owe tax. It helps you plan and pay your taxes throughout the year instead of waiting until you file your return.

- Business Licenses and Permits: Depending on your business type and location, you may need various licenses and permits. These documents are crucial for operating legally and can be required for tax deductions.

Each of these forms and documents plays a vital role in the tax filing process for sole proprietors. Understanding their purpose can help streamline your tax preparation and ensure compliance with IRS regulations. By keeping organized records and filing the necessary forms, you can simplify your tax season and focus more on your business.

More PDF Templates

What Is Asurion - This form aids in men’s clothing replacement requests.

Salary Advance Format - The form plays a vital role in employee cash flow management.

For those navigating complex separation issues, understanding the significance of a Florida Marital Separation Agreement is crucial. This document serves as a framework for agreements regarding asset division and day-to-day responsibilities during a period of separation. To explore more about this essential form, visit our guide on the Marital Separation Agreement requirements at your comprehensive resource for the Marital Separation Agreement.

Trader Joes Apply - Dedicated to maintaining excellent communication among team members for smooth operations.

Similar forms

The IRS Schedule C (Form 1040) is similar to the IRS Form 1065, which is used by partnerships to report income, deductions, and profits. Both forms serve the purpose of detailing business income and expenses, but while Schedule C is for sole proprietors, Form 1065 is designed for multiple owners. Each document allows for the deduction of business-related expenses, ensuring that the net income reflects the true profitability of the business. Understanding the nuances between the two forms is essential for anyone involved in a partnership versus operating as a sole proprietor.

Another document comparable to Schedule C is the IRS Form 1120, which is used by corporations to report their income and expenses. Like Schedule C, Form 1120 provides a framework for outlining revenue, costs, and deductions. However, the key difference lies in the type of business entity being reported. Corporations have different tax obligations and structures compared to sole proprietorships. Both forms require accurate reporting to ensure compliance with tax laws and to determine the correct tax liability.

IRS Schedule C also shares similarities with the IRS Form 1040, specifically the main individual income tax return form. Schedule C is an attachment to Form 1040 and is used by individuals who earn income from self-employment. While Form 1040 captures all sources of income, Schedule C specifically focuses on business income and expenses. This relationship illustrates how self-employment income fits into an individual's overall tax picture, allowing for a comprehensive view of one’s financial situation.

For those delving into the nuances of vehicle transactions, understanding the intricacies of forms like the Washington Motor Vehicle Bill of Sale form is essential, especially when ensuring that all necessary documentation is in order. Similar to how various IRS forms serve distinct reporting purposes, having access to reliable resources can greatly facilitate compliance. For detailed guidance and an editable version of this essential form, visit https://billofsaleforvehicles.com.

Lastly, the IRS Form 990 is relevant for non-profit organizations and can be compared to Schedule C in terms of financial reporting. Both forms require detailed accounting of income and expenditures. However, while Schedule C is aimed at profit-generating entities, Form 990 is designed for tax-exempt organizations. Each form plays a critical role in transparency and accountability, ensuring that stakeholders have access to important financial information, albeit for different types of organizations.

Steps to Filling Out IRS Schedule C 1040

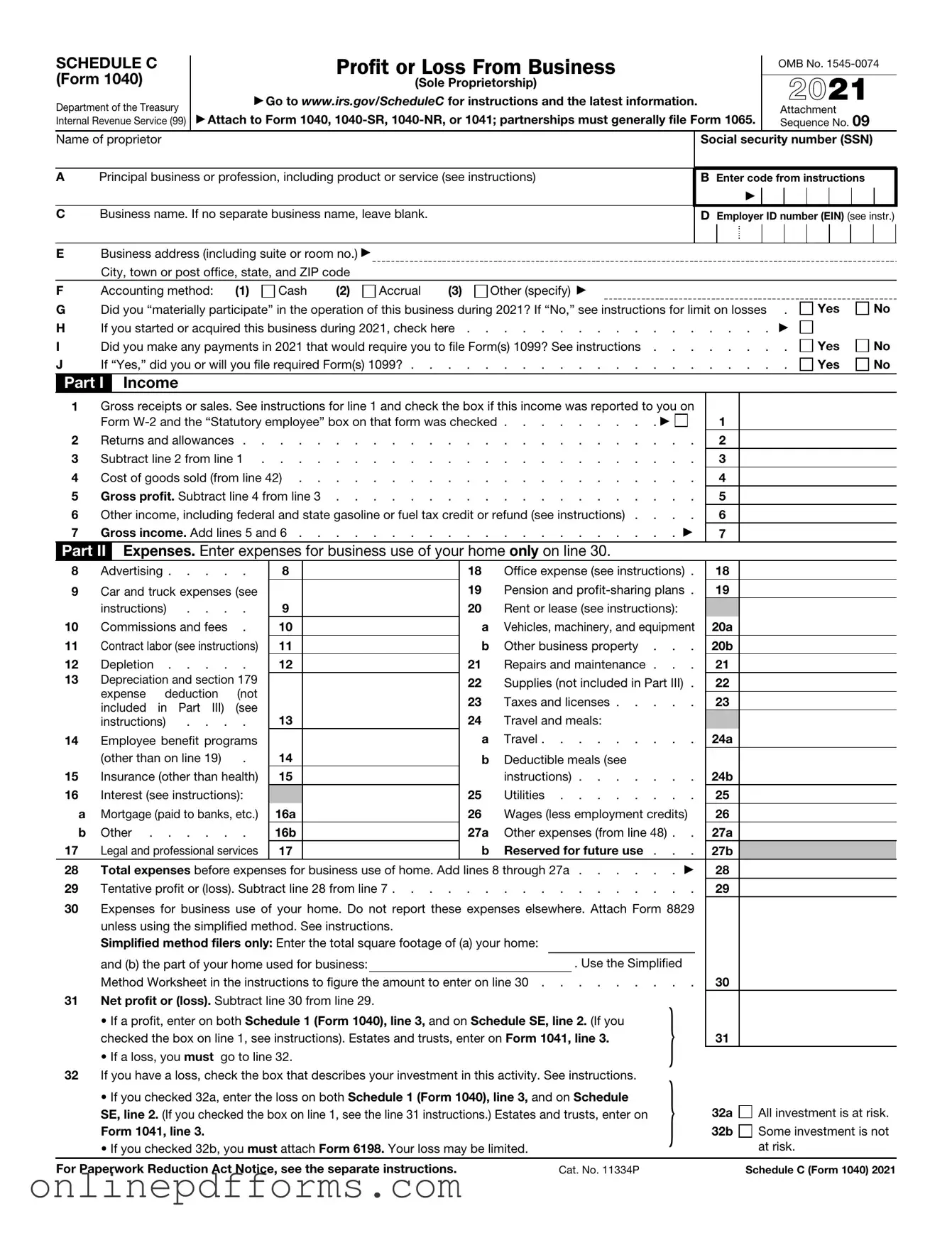

Filling out the IRS Schedule C (Form 1040) is an important step for self-employed individuals. This form allows you to report income and expenses from your business. Make sure to gather all necessary documents before you begin, such as your income records and receipts for business expenses.

- Download the IRS Schedule C form from the IRS website or obtain a physical copy.

- At the top of the form, fill in your name and Social Security number as they appear on your Form 1040.

- Provide the name of your business, its address, and the type of business you operate.

- Indicate your accounting method (cash or accrual) in Part I.

- Report your gross receipts or sales in line 1.

- If applicable, enter any returns or allowances in line 2, and calculate your gross income by subtracting line 2 from line 1 in line 3.

- List your business expenses in Part II. Categorize them by type, such as advertising, car and truck expenses, or supplies.

- Calculate the total expenses in line 28 and subtract this amount from your gross income to determine your net profit or loss in line 31.

- Sign and date the form at the bottom of page 2.

- Attach Schedule C to your Form 1040 when filing your taxes.

Once you have completed the form, review it for accuracy. Ensure all numbers are correct and that you have included all necessary information. This will help avoid delays in processing your tax return.