Fill in Your IRS W-9 Template

Documents used along the form

The IRS W-9 form is essential for providing taxpayer information to individuals or businesses that need to report income paid to you. However, there are several other forms and documents that are commonly used alongside the W-9. Below is a list of these forms, each serving a specific purpose in financial and tax-related matters.

- IRS 1099-MISC: This form reports payments made to independent contractors or freelancers. It details the amount paid and is sent to both the IRS and the recipient.

- IRS 1099-NEC: Similar to the 1099-MISC, this form is specifically used for reporting non-employee compensation. It became a separate form starting in the 2020 tax year.

- IRS 1040: This is the standard individual income tax return form used by U.S. taxpayers to report their annual income and calculate their tax liability.

- IRS 1040-Schedule C: Self-employed individuals use this form to report income or loss from their business. It is filed along with the 1040.

- IRS 4506-T: This form allows taxpayers to request a transcript of their tax return from the IRS. It can be useful for verifying income.

- Form SS-4: This application for an Employer Identification Number (EIN) is used by businesses to obtain a unique identifier for tax purposes.

- Form W-4: Employees use this form to inform their employer about their tax withholding preferences. It affects the amount of tax withheld from their paychecks.

- Form 1098: This form reports mortgage interest paid by a borrower. Lenders send it to the IRS and the borrower for tax deduction purposes.

- Form 941: Employers use this quarterly form to report income taxes, Social Security tax, and Medicare tax withheld from employee wages.

These forms and documents are integral to ensuring accurate reporting and compliance with tax obligations. Familiarity with them can help streamline financial processes and avoid potential issues with the IRS.

More PDF Templates

Dd 214 - Protecting the DD 214 is important as it is not meant for identification.

How to Estimate Roof Replacement Cost - List your preferred method of communication for follow-up.

Fedex Frt - Shippers can specify the weight and dimensions of their packages, critical for determining transport costs.

Similar forms

The IRS W-4 form is often compared to the W-9 because both documents are used for tax purposes. The W-4 form is filled out by employees to indicate their tax withholding preferences. This means that employees can choose how much tax should be taken out of their paychecks. In contrast, the W-9 is used by independent contractors and freelancers to provide their taxpayer identification information to clients. While the W-4 focuses on withholding, the W-9 is about reporting income accurately.

The 1099 form is another document similar to the W-9. While the W-9 collects taxpayer information, the 1099 form reports income earned by independent contractors and freelancers. Clients use the information from the W-9 to complete the 1099 form at the end of the tax year. Therefore, both forms are crucial in ensuring that the IRS receives accurate income reporting for self-employed individuals.

The IRS Form 1040 is also related to the W-9, as both are part of the tax filing process. The W-9 provides necessary information for clients to report payments made to contractors, while the 1040 is the individual income tax return that taxpayers use to report their total income. Essentially, the W-9 helps gather information that will later be summarized in the 1040 form.

The Form 1096 serves as a cover sheet for submitting paper 1099 forms to the IRS. While the W-9 is about collecting taxpayer information, the 1096 is about reporting that information to the IRS. Both forms work together to ensure that the IRS has a complete picture of income paid to independent contractors throughout the year.

The IRS Form SS-4 is another document that has similarities with the W-9. The SS-4 is used to apply for an Employer Identification Number (EIN), which is often required for businesses. When a business completes a W-9, it may provide its EIN instead of a Social Security Number. Both forms are used to identify taxpayers, but they serve different purposes in the tax system.

The Form 4506-T is related to the W-9 in that it allows taxpayers to request a transcript of their tax return. While the W-9 provides information for reporting income, the 4506-T can help verify that information if needed. Both forms can be essential for individuals who need to confirm their income for loans or other financial matters.

The IRS Form 941 is another document that can be compared to the W-9. The 941 form is used by employers to report payroll taxes. While the W-9 is focused on independent contractors, the 941 is for employees. However, both forms are part of the broader tax system and help ensure compliance with IRS regulations.

Finally, the Form 1065 is similar in that it is used for partnerships to report income, deductions, and other tax-related information. While the W-9 is used by individuals to report their taxpayer identification, the 1065 is a collective reporting form for partnerships. Both forms are important for ensuring that the IRS receives accurate information about income and taxes owed.

Steps to Filling Out IRS W-9

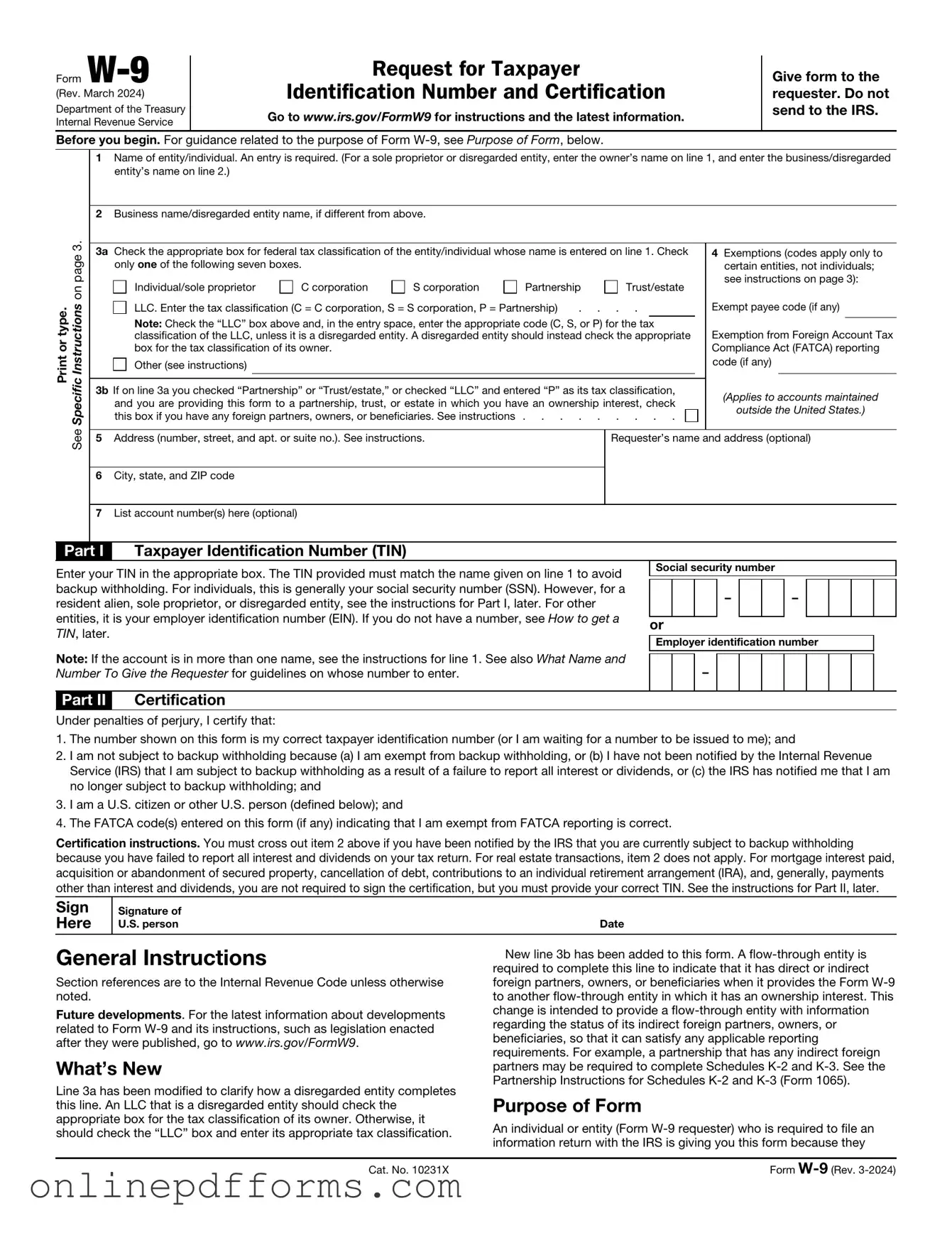

Once you have your IRS W-9 form ready, it’s important to fill it out accurately. This form will help ensure that your information is properly recorded for tax purposes. Follow these steps to complete the form correctly.

- Download the W-9 form: Obtain the latest version of the W-9 form from the IRS website or a reliable source.

- Provide your name: In the first line, enter your full name as it appears on your tax return.

- Business name (if applicable): If you operate under a different name, enter it in the second line. If not, you can leave this blank.

- Select your tax classification: Check the appropriate box that describes your tax status. This could be Individual/Sole proprietor, Corporation, Partnership, etc.

- Address: Fill in your street address, city, state, and ZIP code in the designated fields.

- Taxpayer Identification Number (TIN): Enter your Social Security Number (SSN) or Employer Identification Number (EIN) in the appropriate section.

- Certification: Read the certification statement carefully. By signing, you confirm that the information provided is accurate.

- Sign and date: Sign the form and provide the date. Ensure your signature matches the name you provided at the top.

After completing the form, it’s ready to be submitted to the requester. Keep a copy for your records. If you have any questions about the process, consider reaching out to a tax professional for assistance.