Legal Lady Bird Deed Form

Documents used along the form

A Lady Bird Deed is a unique estate planning tool that allows property owners to transfer their real estate to beneficiaries while retaining control during their lifetime. When using this deed, several other forms and documents may be necessary to ensure a smooth transfer and to address various legal and financial considerations. Below is a list of common documents that are often used in conjunction with a Lady Bird Deed.

- Durable Power of Attorney: This document designates someone to make financial or legal decisions on behalf of the property owner if they become incapacitated. It ensures that someone trusted can manage affairs without court intervention.

- Prenuptial Agreement: This legal document can establish financial arrangements between spouses before marriage, ensuring clarity regarding assets and obligations, much like the arizonaformspdf.com provides.

- Will: A will outlines how a person's assets, including real estate, should be distributed after their death. It can work alongside a Lady Bird Deed to clarify intentions regarding other assets not covered by the deed.

- Transfer on Death Deed: Similar to a Lady Bird Deed, this document allows property to be transferred directly to a beneficiary upon the owner's death, avoiding probate. However, it does not provide the same level of control during the owner's lifetime.

- Revocable Living Trust: This trust holds assets during the owner's lifetime and specifies how they should be managed and distributed after death. A Lady Bird Deed can be part of a broader estate plan that includes a living trust.

- Affidavit of Heirship: This document is used to establish the heirs of a deceased person without going through probate. It may be necessary if the property owner passes away and the Lady Bird Deed is not sufficient to clarify ownership.

- Property Tax Exemption Application: If the property is eligible for certain tax exemptions, such as a homestead exemption, this application may be needed to ensure that the property remains exempt after the transfer.

- Notice of Transfer: Depending on state laws, a notice may need to be filed with local authorities to inform them of the transfer of property ownership. This document helps maintain accurate public records.

Using a Lady Bird Deed effectively often involves understanding how these related documents function together. Each serves a unique purpose in the estate planning process, helping to ensure that the property owner's wishes are honored and that their assets are managed according to their preferences.

Consider More Types of Lady Bird Deed Forms

What Is Deed in Lieu - This form can sometimes be used as part of a broader loan modification negotiation.

How to Get a Quit Claim Deed - Encourages transparency among family members in property dealings.

To facilitate the sale of a trailer, it is advisable for both parties to utilize the appropriate documentation, such as the Illinois Trailer Bill of Sale form, which can be crucial in establishing ownership transfer. For additional guidance on the required paperwork, consider referring to Auto Bill of Sale Forms, which offer insights and templates for effective transactions.

California Corrective Deed - It allows for an efficient resolution without the need for extensive legal proceedings.

Similar forms

The Lady Bird Deed is often compared to a traditional life estate deed. Both documents allow a property owner to retain certain rights to the property during their lifetime. With a life estate deed, the owner can live in the property and use it as they wish. However, upon their death, the property automatically transfers to the designated beneficiaries. The Lady Bird Deed offers a bit more flexibility, allowing the owner to sell or mortgage the property without needing consent from the beneficiaries, which can be a significant advantage.

Another similar document is the Transfer on Death Deed (TOD). Like the Lady Bird Deed, a TOD allows property to pass directly to beneficiaries upon the owner's death, avoiding probate. The key difference lies in the rights retained during the owner's lifetime. With a TOD, the owner has no control over the property once the deed is executed. In contrast, the Lady Bird Deed allows the owner to maintain full control, making it a more versatile option for many.

A revocable living trust also shares similarities with the Lady Bird Deed. Both are designed to facilitate the transfer of property without going through probate. In a revocable living trust, the property is transferred into the trust while the owner is alive, allowing them to manage it as they wish. However, the Lady Bird Deed allows the owner to keep the title in their name, which can simplify management and provide more direct control until death.

The joint tenancy deed is another document that resembles the Lady Bird Deed. In a joint tenancy, two or more people own the property together, and when one owner passes away, their share automatically transfers to the surviving owner(s). While both documents allow for a seamless transfer of property, the Lady Bird Deed provides more flexibility in terms of control and management during the owner’s lifetime.

A quitclaim deed is also similar in that it transfers ownership of property. However, it does not provide the same level of protection or retained rights as a Lady Bird Deed. With a quitclaim deed, the grantor relinquishes any claim to the property without guarantees about the title. In contrast, a Lady Bird Deed allows the original owner to retain control and benefits of the property while ensuring a smooth transfer to beneficiaries after death.

If you're looking to join the Trader Joe's team, filling out the Trader Joe's application form is an excellent step. This key document gathers vital details regarding your background, skills, and availability. To find more information about the application process, visit pdftemplates.info/trader-joe-s-application-form, where you can also access the form needed to kickstart your journey with the popular grocery store chain.

The warranty deed can be compared to the Lady Bird Deed as well. Both documents transfer ownership of property, but a warranty deed guarantees that the title is clear of any claims or liens. This provides a level of security for the buyer. In contrast, the Lady Bird Deed focuses more on the rights retained by the owner during their lifetime and the automatic transfer of property upon death, rather than guaranteeing the title.

An irrevocable trust is another document that has similarities with the Lady Bird Deed. Both can be used for estate planning and transferring property. However, once assets are placed in an irrevocable trust, the owner loses control over them. The Lady Bird Deed allows for continued control over the property, making it a more flexible option for those who want to retain their rights while planning for the future.

Finally, the power of attorney can be seen as related to the Lady Bird Deed. A power of attorney allows someone to act on behalf of another person regarding property decisions. While this document can help manage property during the owner’s lifetime, it does not provide for automatic transfer upon death like the Lady Bird Deed does. The Lady Bird Deed ensures that the property goes directly to the chosen beneficiaries without needing any further legal action after the owner passes away.

Steps to Filling Out Lady Bird Deed

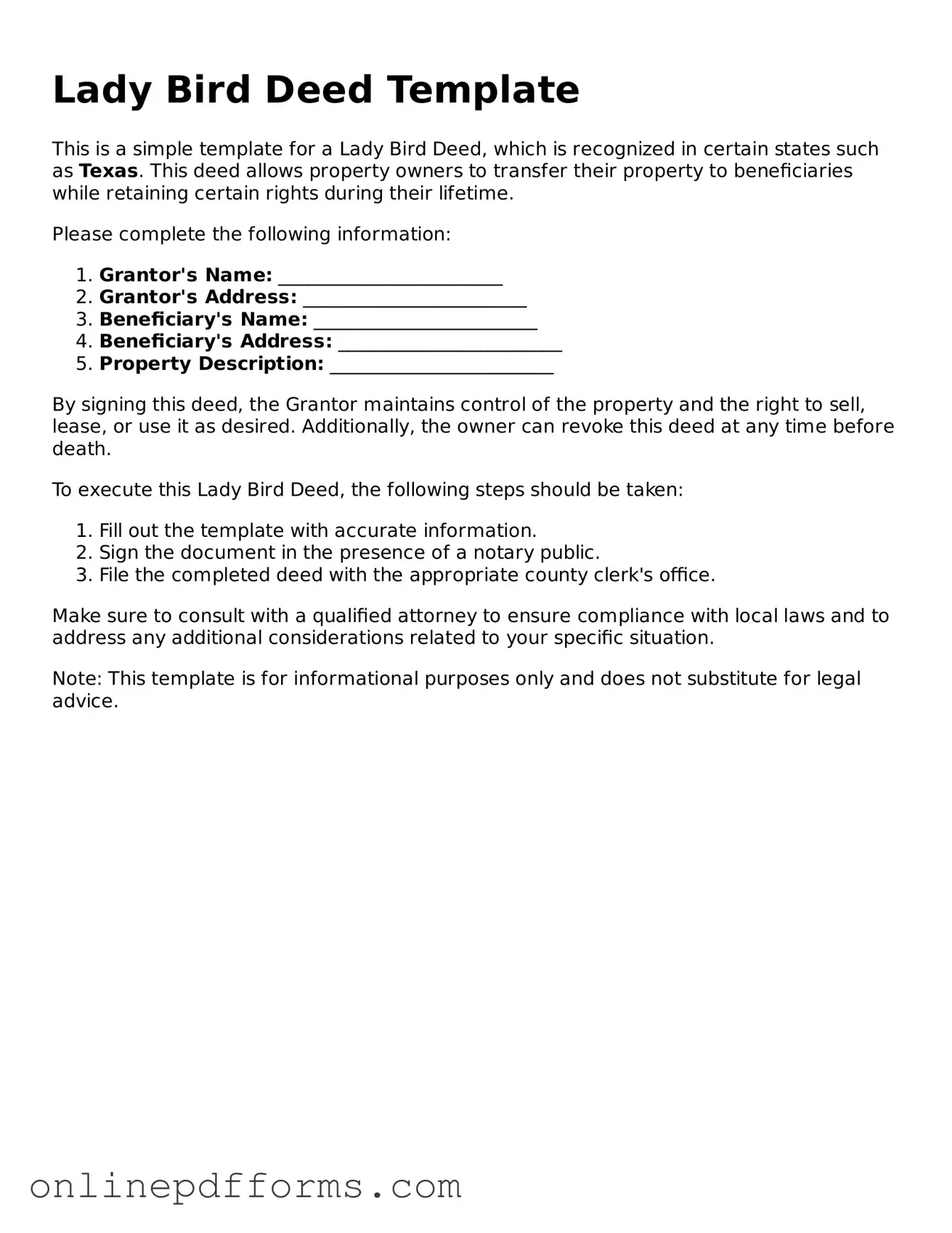

Completing a Lady Bird Deed form is an important step in managing property ownership and ensuring a smooth transfer of assets. After gathering the necessary information and understanding the requirements, you can proceed to fill out the form accurately. Follow these steps to ensure you complete the form correctly.

- Begin by downloading the Lady Bird Deed form from a reliable source or obtain a physical copy from a legal office.

- In the top section, fill in the names of the current property owners. This includes the full legal names as they appear on the property title.

- Next, provide the address of the property being transferred. Ensure that the address is complete and accurate to avoid any issues.

- Indicate the names of the beneficiaries who will receive the property upon the owner’s passing. These should also be the full legal names.

- Specify the relationship of the beneficiaries to the current property owners. This could include terms like “child,” “spouse,” or “friend.”

- Include any additional terms or conditions you wish to impose on the transfer of the property. Be clear and concise in your wording.

- Review the form for accuracy. Double-check all names, addresses, and any other information you have provided.

- Sign and date the form in the designated areas. Ensure that all property owners sign the document.

- Consider having the form notarized. This step may not be required in all states, but it can add an extra layer of validity to the document.

- Once completed, file the Lady Bird Deed with your local county clerk or recorder’s office, following any specific submission guidelines they may have.

After completing the form, it’s essential to keep a copy for your records. You may also want to inform the beneficiaries about the deed and its implications. This transparency can help prevent confusion or disputes in the future.