Legal Letter of Intent to Lease Commercial Property Form

Documents used along the form

When entering into a lease agreement for commercial property, several documents often accompany the Letter of Intent to Lease. Each of these documents plays a crucial role in outlining the terms and ensuring clarity between the parties involved. Below is a list of common forms and documents you may encounter.

- Lease Agreement: This is the formal contract that outlines the terms and conditions of the lease, including rent, duration, and responsibilities of both the landlord and tenant.

- Disclosure Statement: This document provides important information about the property, such as zoning laws, any existing liens, or potential environmental issues.

- Tenant Application: A form that potential tenants fill out to provide personal and financial information, allowing landlords to assess their suitability.

- California Homeschool Letter of Intent: This document is crucial for notifying local authorities about a family's intent to homeschool, ensuring compliance with state laws. For more details, you can refer to Documents PDF Online.

- Personal Guarantee: This document may be required by landlords to ensure that an individual agrees to take personal responsibility for the lease obligations if the business fails.

- Security Deposit Receipt: A receipt acknowledging the payment of a security deposit, which protects the landlord against damages or unpaid rent.

- Estoppel Certificate: This document confirms the terms of the lease and the status of the tenant's obligations, often used in financing or sale transactions.

- Sublease Agreement: If a tenant wishes to rent out part or all of the leased space to another party, this document outlines the terms of that sublease.

- Maintenance Agreement: This document specifies who is responsible for repairs and maintenance of the property, clarifying obligations for both parties.

- Insurance Certificate: Proof of insurance coverage, which may be required by the landlord to protect against potential liabilities or damages.

Having these documents prepared and reviewed can help ensure a smoother leasing process. Each one serves to protect the interests of both the landlord and the tenant, promoting a clear understanding of expectations and responsibilities.

Consider More Types of Letter of Intent to Lease Commercial Property Forms

Letter of Intent Homeschool Ny - Can ease potential concerns from local authorities about homeschooling.

A Letter of Intent can significantly streamline the negotiation process, ensuring that both parties have a clear understanding of their intentions and obligations. For those looking to create a professional and effective Letter of Intent, resources like smarttemplates.net can provide valuable templates and guidelines to aid in this crucial phase of agreement formation.

Similar forms

The Letter of Intent (LOI) to Lease Commercial Property serves as a preliminary agreement outlining the basic terms and conditions of a lease. It resembles a Memorandum of Understanding (MOU), which also lays out the intentions of two parties. Like the LOI, an MOU is often non-binding and serves to clarify the main points of agreement before a formal contract is drafted. Both documents facilitate communication and ensure that all parties are on the same page regarding essential terms.

Another document similar to the LOI is the Term Sheet. A Term Sheet provides an outline of the main points of a deal, including the proposed lease terms, rental rates, and duration. While a Term Sheet is often used in various types of agreements, its purpose aligns closely with the LOI in that it serves as a summary of the key components that will be detailed in a formal lease agreement later on.

The Letter of Intent can also be compared to a Purchase Agreement, particularly in commercial real estate transactions. While a Purchase Agreement is a binding contract for the sale of property, it often includes similar preliminary discussions about price, terms, and conditions. The LOI sets the stage for these discussions, helping both parties understand their expectations before entering into a binding contract.

A Confidentiality Agreement, or Non-Disclosure Agreement (NDA), shares some similarities with the LOI, particularly in the context of protecting sensitive information. When discussing potential lease terms, parties may wish to keep certain details private. An NDA ensures that any shared information remains confidential, allowing for open discussions without the fear of public disclosure.

The Letter of Intent also aligns with a Letter of Interest (LOI). While both documents express interest in a property, a Letter of Interest is often less formal and may not outline specific terms. It serves as a way to gauge interest from the landlord or property owner, similar to how an LOI signals intent to negotiate a lease agreement.

Another related document is the Lease Proposal. This document typically includes detailed terms that the prospective tenant is willing to accept. While the LOI outlines the initial terms and conditions, the Lease Proposal expands on these points, providing more specificity and clarity, which can help facilitate negotiations.

The Letter of Intent (LOI) to Lease Commercial Property shares similarities with a Purchase Agreement. A Purchase Agreement outlines the terms and conditions under which property is bought, establishing the price and necessary contingencies. Like the LOI, it serves as a negotiation tool, setting the framework for the transaction. Both documents facilitate discussions by articulating the essential points of agreement between the parties, ensuring that everyone is on the same page as negotiations progress toward finalizing a deal. For those looking to invest, the https://pdftemplates.info/investment-letter-of-intent-form/ provides a structured approach to outlining initial terms.

Lastly, a Commitment Letter can be compared to the LOI, particularly in financing scenarios. A Commitment Letter outlines the lender’s agreement to provide financing based on specified terms. Similar to an LOI, it serves as a preliminary agreement that sets expectations and guides the drafting of a more formal contract, ensuring that both parties understand their obligations moving forward.

Steps to Filling Out Letter of Intent to Lease Commercial Property

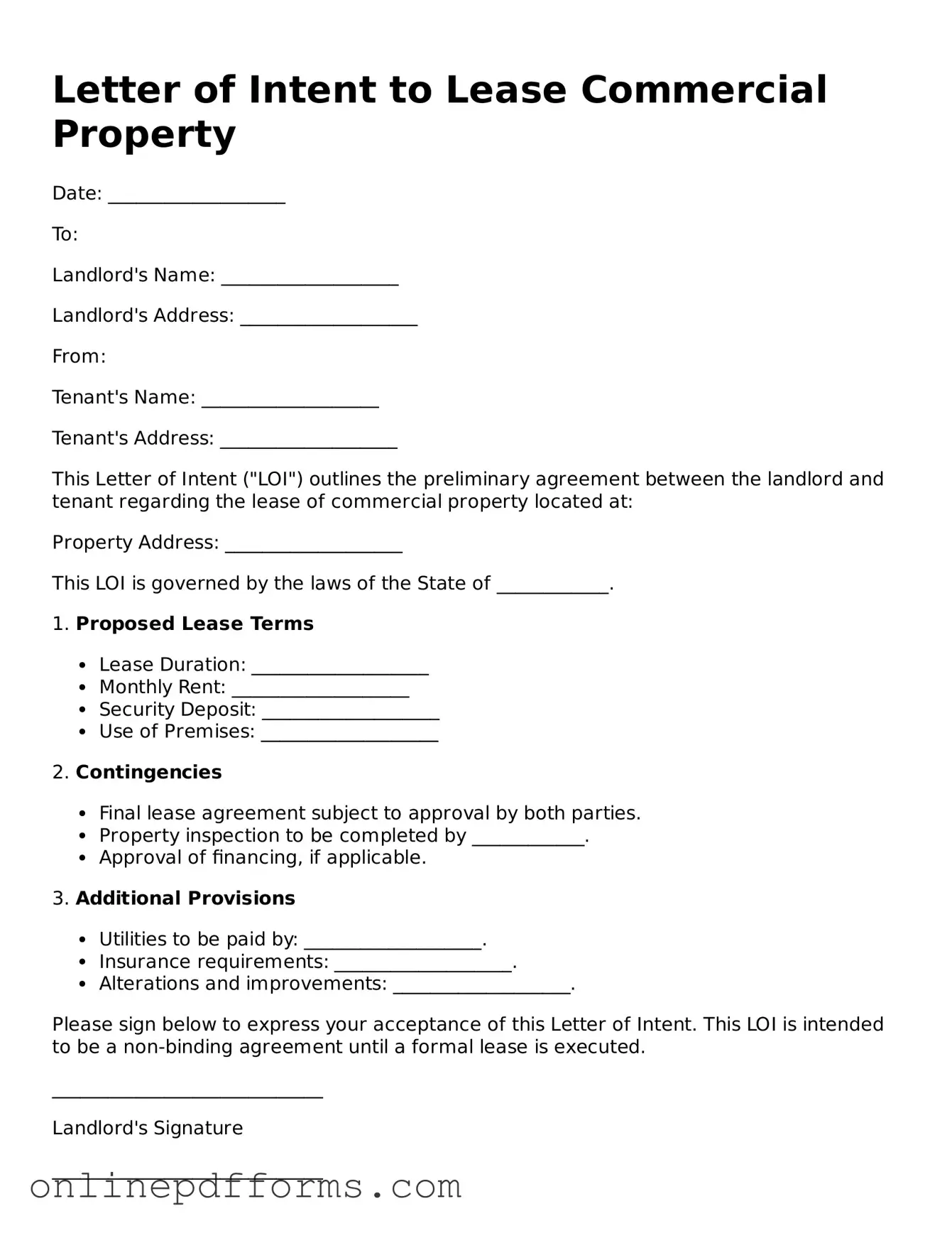

Once you have the Letter of Intent to Lease Commercial Property form in hand, you are ready to begin the process of filling it out. This form is essential for outlining the terms and conditions of a potential lease agreement between you and the property owner. Following the steps below will help ensure that you complete the form accurately and effectively.

- Begin by entering the date at the top of the form. This indicates when the letter is being submitted.

- Provide your name and contact information in the designated section. This should include your address, phone number, and email.

- Next, fill in the name and contact details of the property owner or landlord. Make sure to include their address and any relevant contact information.

- Specify the address of the commercial property you are interested in leasing. Include the complete street address and any suite or unit numbers.

- Outline the proposed lease term. Indicate how long you intend to lease the property, including the start and end dates.

- Detail the rental amount you are willing to pay. Be clear about the monthly rent and any additional costs or fees you anticipate.

- Include any specific conditions or contingencies you wish to propose. This could cover aspects like maintenance responsibilities or options for renewal.

- Sign and date the form at the bottom. This signifies your agreement to the terms outlined in the letter.

After completing the form, you will typically submit it to the property owner or their representative. They will review your proposal and may respond with further discussions or adjustments to the terms. This step is crucial in moving forward with the leasing process.