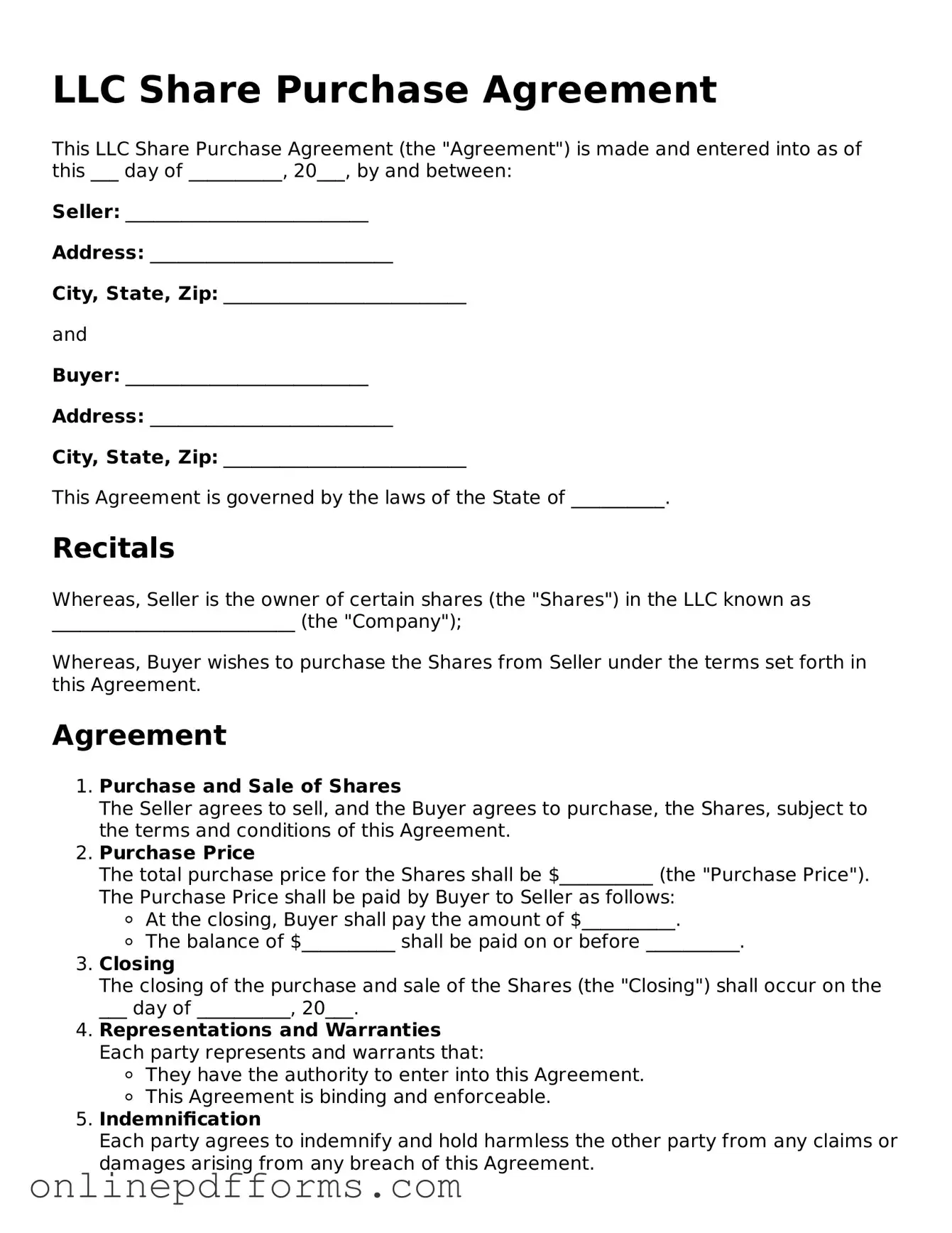

Legal LLC Share Purchase Agreement Form

Documents used along the form

When engaging in a transaction involving an LLC Share Purchase Agreement, several other forms and documents may be necessary to ensure a smooth process. Each of these documents serves a specific purpose and can help clarify the terms and conditions of the transaction.

- Operating Agreement: This document outlines the management structure and operating procedures of the LLC. It details the rights and responsibilities of members and managers.

- Membership Interest Purchase Agreement: Similar to the share purchase agreement, this document is used when purchasing membership interests in an LLC rather than shares.

- Confidentiality Agreement: This agreement protects sensitive information shared during the negotiation process. It ensures that all parties maintain confidentiality regarding proprietary information.

- Investment Letter of Intent: This form serves as a preliminary agreement outlining essential terms and conditions for impending investments, facilitating a clear path towards a more formal agreement. For more details, visit https://documentonline.org/blank-investment-letter-of-intent.

- Due Diligence Checklist: A list of items to review before completing the purchase. This may include financial statements, tax returns, and legal documents related to the LLC.

- Bill of Sale: This document formally transfers ownership of the shares or membership interests from the seller to the buyer, providing legal proof of the transaction.

- Tax Forms: Various tax documents may be required to report the sale or transfer of ownership, including IRS forms for capital gains and other tax implications.

- Resolution of Members: A formal document that records the decision of the LLC members to approve the sale of shares or membership interests, ensuring compliance with internal governance.

- Escrow Agreement: This document outlines the terms under which a third party holds funds or documents until certain conditions are met, providing security for both buyer and seller.

- Indemnification Agreement: This agreement protects one party from potential losses or liabilities that may arise from the transaction, ensuring that they are compensated if issues occur post-sale.

Each of these documents plays a crucial role in the overall transaction process. Proper preparation and understanding of these forms can help facilitate a successful and legally compliant transfer of ownership in an LLC.

Other Templates:

T47 Form - It helps facilitate smooth real estate transactions by validating ownership.

When engaging in the sale of a trailer, it is essential to utilize the appropriate documentation, such as the Louisiana Trailer Bill of Sale form, to ensure a smooth ownership transfer. This form not only captures vital details about the trailer but also outlines the terms agreed upon by both the buyer and seller. For those looking to create or understand these documents in more detail, resources like Auto Bill of Sale Forms can provide valuable guidance for a hassle-free transaction.

Terminate Real Estate Agent Contract Letter - All involved parties must understand the implications of the termination.

Purchase Agreement Addendum - A type of notice that highlights important updates to a purchase contract.

Similar forms

The LLC Share Purchase Agreement is similar to a Stock Purchase Agreement. Both documents facilitate the transfer of ownership interests in a company. In a Stock Purchase Agreement, shares of stock are sold, while in an LLC Share Purchase Agreement, membership interests in an LLC are sold. Each agreement outlines the terms of the sale, including the purchase price, representations, warranties, and conditions that must be met for the transaction to proceed.

Another document that resembles the LLC Share Purchase Agreement is the Membership Interest Purchase Agreement. This document specifically addresses the sale of membership interests in an LLC. It serves a similar purpose, detailing the rights and obligations of both the buyer and seller. Like the LLC Share Purchase Agreement, it includes provisions for payment, closing procedures, and any contingencies that may affect the transaction.

To facilitate the smooth transfer of ownership during various transactions, including the purchase of personal property, it is essential to utilize a General Bill of Sale. This document not only verifies the transfer but also serves to safeguard the interests of both parties involved. For those looking to draft such a form, you can find the necessary template at https://pdftemplates.info/general-bill-of-sale-form.

The Asset Purchase Agreement also shares similarities with the LLC Share Purchase Agreement. While the former focuses on the sale of specific assets rather than ownership interests, both documents outline the terms of a transfer. They specify what is being sold, the price, and any representations or warranties made by the parties. Both agreements ensure that the transaction is legally binding and that the rights of the parties are protected.

A Joint Venture Agreement can be compared to the LLC Share Purchase Agreement as well. While a Joint Venture Agreement establishes a partnership for a specific project or purpose, it often involves the exchange of ownership interests. Both documents require clear terms regarding contributions, profit sharing, and the responsibilities of each party. They aim to create a mutual understanding between the involved parties about their roles and expectations.

The Partnership Agreement is another document that has similarities to the LLC Share Purchase Agreement. This agreement governs the relationship between partners in a business venture. Like the LLC Share Purchase Agreement, it outlines the rights and responsibilities of each partner, including how ownership interests can be transferred. Both agreements are essential for defining the structure and management of the business.

A Confidentiality Agreement, or Non-Disclosure Agreement, also shares a connection with the LLC Share Purchase Agreement. While the primary focus of a Confidentiality Agreement is to protect sensitive information, it often accompanies the negotiation of a share purchase. Both documents help establish trust between the parties and ensure that proprietary information remains secure during the transaction process.

The Buy-Sell Agreement is another document that is similar to the LLC Share Purchase Agreement. This agreement outlines the process for buying out a partner's interest in a business under specific circumstances, such as death or retirement. Both agreements provide a framework for ownership transfer and help prevent disputes among partners regarding the valuation and sale of interests.

Lastly, a Letter of Intent (LOI) can be seen as related to the LLC Share Purchase Agreement. An LOI outlines the preliminary terms and conditions of a potential transaction before the final agreement is drafted. While it is not legally binding, it sets the stage for negotiations and helps ensure that both parties are aligned on key points before moving forward with the more detailed LLC Share Purchase Agreement.

Steps to Filling Out LLC Share Purchase Agreement

After gathering all necessary information, you are ready to fill out the LLC Share Purchase Agreement form. This process will ensure that all parties involved are clear about the terms and conditions of the share purchase.

- Read the Form Carefully: Familiarize yourself with all sections of the agreement.

- Enter the Date: Write the date when the agreement is being signed at the top of the form.

- Provide Buyer Information: Fill in the buyer's full name, address, and contact information.

- Provide Seller Information: Enter the seller's full name, address, and contact information.

- Describe the Shares: Specify the type and number of shares being purchased.

- State the Purchase Price: Clearly indicate the total price for the shares.

- Include Payment Terms: Outline how and when the payment will be made.

- Signatures: Ensure both the buyer and seller sign and date the form at the designated areas.

- Review the Completed Form: Check for any errors or missing information before finalizing.