Legal Loan Agreement Form

Documents used along the form

When entering into a loan agreement, several other forms and documents may be necessary to ensure clarity and legal protection for all parties involved. Below is a list of common documents that often accompany a Loan Agreement.

- Promissory Note: This document outlines the borrower's promise to repay the loan, detailing the amount borrowed, interest rate, and repayment schedule.

- Loan Application: A form completed by the borrower, providing personal and financial information to help the lender assess the borrower's creditworthiness.

- Credit Report: A detailed report of the borrower's credit history, used by lenders to evaluate risk and make informed lending decisions.

- Collateral Agreement: If the loan is secured, this document specifies the assets pledged as collateral to protect the lender in case of default.

- Personal Guarantee: A document where a third party agrees to be responsible for the loan if the borrower fails to make payments.

- Disclosure Statement: This document provides important information about the loan terms, including fees, interest rates, and any potential penalties.

- Amortization Schedule: A table that outlines each payment over the life of the loan, showing how much goes toward principal and interest.

- Loan Closing Statement: A summary of the final terms of the loan, including the total amount financed, fees, and any adjustments made at closing.

These documents work together to provide a comprehensive framework for the loan transaction, ensuring that both the lender and borrower understand their rights and obligations. Proper documentation helps prevent misunderstandings and protects everyone involved.

Other Templates:

Letter of Intent Homeschool Ny - A brief statement indicating the intent to homeschool for the school year.

Hold Harmless Clause Insurance - A Hold Harmless Agreement can provide peace of mind when entering into potentially risky activities.

Create Gift Card Online Free - Provides a structured way to detail any conditions or terms related to the gift.

Loan Agreement Document Categories

Similar forms

A promissory note is a written promise to pay a specified amount of money at a certain time. Like a loan agreement, it outlines the terms of the loan, including the interest rate and repayment schedule. However, a promissory note is typically simpler and may not include all the detailed conditions that a loan agreement might have. It serves as a straightforward acknowledgment of the debt between the borrower and the lender.

A mortgage agreement is a specific type of loan agreement used when borrowing money to purchase real estate. This document secures the loan with the property itself, meaning if the borrower fails to repay, the lender can take possession of the property. It includes details about the property, loan amount, interest rate, and repayment terms, similar to a standard loan agreement but with additional provisions related to the property.

A credit agreement governs the terms of borrowing under a line of credit. It outlines the maximum amount the borrower can draw, interest rates, and repayment terms. Like a loan agreement, it sets forth the obligations of both parties. However, a credit agreement is typically more flexible, allowing the borrower to withdraw funds as needed, rather than receiving a lump sum upfront.

A lease agreement is similar in that it outlines the terms under which one party can use another party's property, typically real estate. It details the rental payments, duration, and responsibilities of both the landlord and tenant. While a lease focuses on property use rather than a financial loan, both documents serve to formalize an agreement between parties and protect their rights.

A partnership agreement is essential for business partnerships. It outlines the roles, responsibilities, and financial contributions of each partner. Similar to a loan agreement, it establishes the terms of the relationship and can include provisions for profit sharing and dispute resolution. Both documents aim to clarify expectations and prevent misunderstandings between parties.

An installment sale agreement allows a buyer to purchase an item by making regular payments over time. It details the purchase price, payment schedule, and consequences of default. Like a loan agreement, it provides a framework for repayment but is often used for tangible goods rather than cash loans, making it a unique variant of borrowing agreements.

A forbearance agreement is a temporary arrangement between a lender and borrower that allows the borrower to pause or reduce payments. This document outlines the terms of the forbearance, including how long it lasts and what happens after. While it serves as a relief option for borrowers, it shares similarities with a loan agreement in that it formalizes the terms of repayment adjustments.

An equity sharing agreement involves two parties sharing the financial benefits of a property investment. One party provides the funds, while the other manages the property. This agreement details how profits and losses will be divided. Similar to a loan agreement, it establishes clear expectations and responsibilities for both parties, focusing on financial contributions and returns.

A personal guarantee is a document where an individual agrees to be responsible for another person's debt. It often accompanies loan agreements to provide additional security for the lender. This document outlines the guarantor's obligations and can be crucial for borrowers who may not qualify for a loan on their own. Both documents aim to protect the lender's interests while facilitating borrowing.

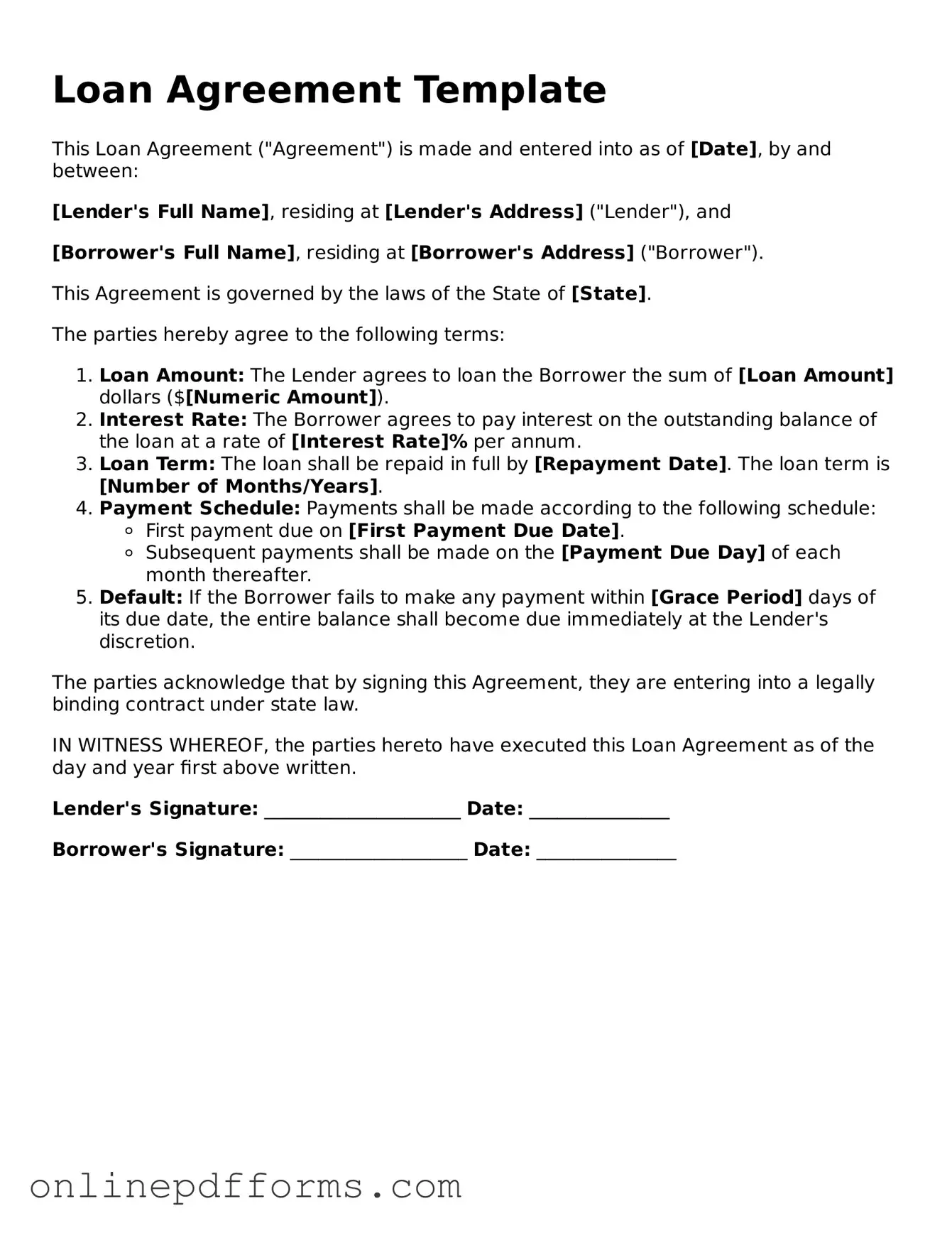

Steps to Filling Out Loan Agreement

Filling out the Loan Agreement form is an important step in securing the financing you need. It is essential to provide accurate information to ensure a smooth process. After completing the form, you will typically submit it to the lender for review, and they will guide you through the next steps.

- Start by entering your full name in the designated field at the top of the form.

- Provide your current address, including city, state, and zip code.

- Input your Social Security number, ensuring that it is accurate and free of errors.

- Fill in your date of birth, using the format specified on the form.

- Next, indicate your employment status by checking the appropriate box or providing details as required.

- Enter your annual income, making sure to include all sources of income.

- In the section for loan amount, specify the total amount you wish to borrow.

- Review the terms and conditions of the loan carefully, then sign and date the form where indicated.

- Finally, ensure that all required documents are attached before submitting the form to the lender.