Fill in Your Louisiana act of donation Template

Documents used along the form

When engaging in the process of property donation in Louisiana, several forms and documents may be necessary to ensure compliance with legal requirements. These documents help clarify the intentions of the parties involved and provide a clear record of the transaction.

- Donation Agreement: This document outlines the terms and conditions of the donation, including the description of the property and any obligations of the donor and recipient.

- Auto Bill of Sale Forms: Essential for documenting the transfer of vehicle ownership, these forms ensure that all necessary information, such as purchase price and buyer/seller details, is recorded accurately, serving protections for both parties involved. For more information on this, visit Auto Bill of Sale Forms.

- Affidavit of Identity: This sworn statement verifies the identity of the donor, which can help prevent fraud and ensure that the donor has the legal right to make the donation.

- Property Description Form: A detailed description of the property being donated, including its location and any relevant characteristics, is essential for clarity and legal purposes.

- Title Transfer Document: This form facilitates the official transfer of property title from the donor to the recipient, ensuring that ownership is legally recognized.

- Gift Tax Return (Form 709): Depending on the value of the donation, the donor may need to file a federal gift tax return to report the transaction to the IRS.

- Notarized Statement: A notarized statement may be required to confirm that the donation was made voluntarily and without coercion, adding an extra layer of protection for both parties.

- Beneficiary Designation Form: If the donation involves financial assets or accounts, this form specifies the beneficiary who will receive those assets upon the donor's passing.

- Real Estate Transfer Declaration: This document provides information about the property transfer to local tax authorities, ensuring proper assessment and taxation.

- Consent Form: If the property being donated is co-owned, a consent form from all co-owners may be required to confirm that they agree to the donation.

Understanding these documents can help facilitate a smooth donation process. Properly completing and filing each form can protect all parties involved and ensure compliance with Louisiana law.

More PDF Templates

Ds-82 Passport Form - Using a passport card instead of a passport book is an option for some applicants.

Doctors Notes - This form reflects the vital intersection of health and professional responsibilities.

In addition to providing essential details about the transaction, the Arizona Motor Vehicle Bill of Sale form can be easily accessed and downloaded from mypdfform.com/blank-arizona-motor-vehicle-bill-of-sale, ensuring that both buyers and sellers have the necessary documentation to facilitate the transfer of ownership effectively.

Roof Certification Form Florida - Indicate if emergency repairs were necessary and provide details on those repairs.

Similar forms

The Louisiana act of donation form shares similarities with a will. Both documents serve to convey an individual's wishes regarding the distribution of their property upon death. A will outlines how a person's assets should be divided among beneficiaries, while the act of donation allows a person to give away property during their lifetime. In both cases, the intent of the donor or testator is crucial. Legal requirements, such as signatures and witnesses, ensure that the documents reflect the true intentions of the individual, providing a clear framework for asset distribution.

Understanding various property transfer documents is crucial, especially when dealing with family and friends. For instance, a quitclaim deed can serve as an effective tool for transferring property ownership without warranties on the title's quality. This is similar to the Louisiana act of donation form; both allow for uncomplicated transfers without monetary compensation. To learn more about the specifics of a quitclaim deed in Texas, you can visit pdftemplates.info/texas-quitclaim-deed-form/.

Another document that parallels the Louisiana act of donation form is a gift deed. A gift deed is a legal instrument used to transfer ownership of real property from one person to another without any exchange of money. Like the act of donation, a gift deed requires the donor's intent to make a gift and the acceptance of that gift by the recipient. Both documents must be executed with specific formalities to be legally binding, ensuring that the transfer of property is clear and enforceable.

Lastly, the trust agreement can be compared to the Louisiana act of donation form. A trust allows an individual to place assets into a trust for the benefit of another person or entity. Like the act of donation, the establishment of a trust requires the intent to transfer property. Both documents provide mechanisms for managing and distributing assets, often with specific conditions attached. Trusts can offer more flexibility and control over how assets are used, while the act of donation typically represents a straightforward transfer of ownership.

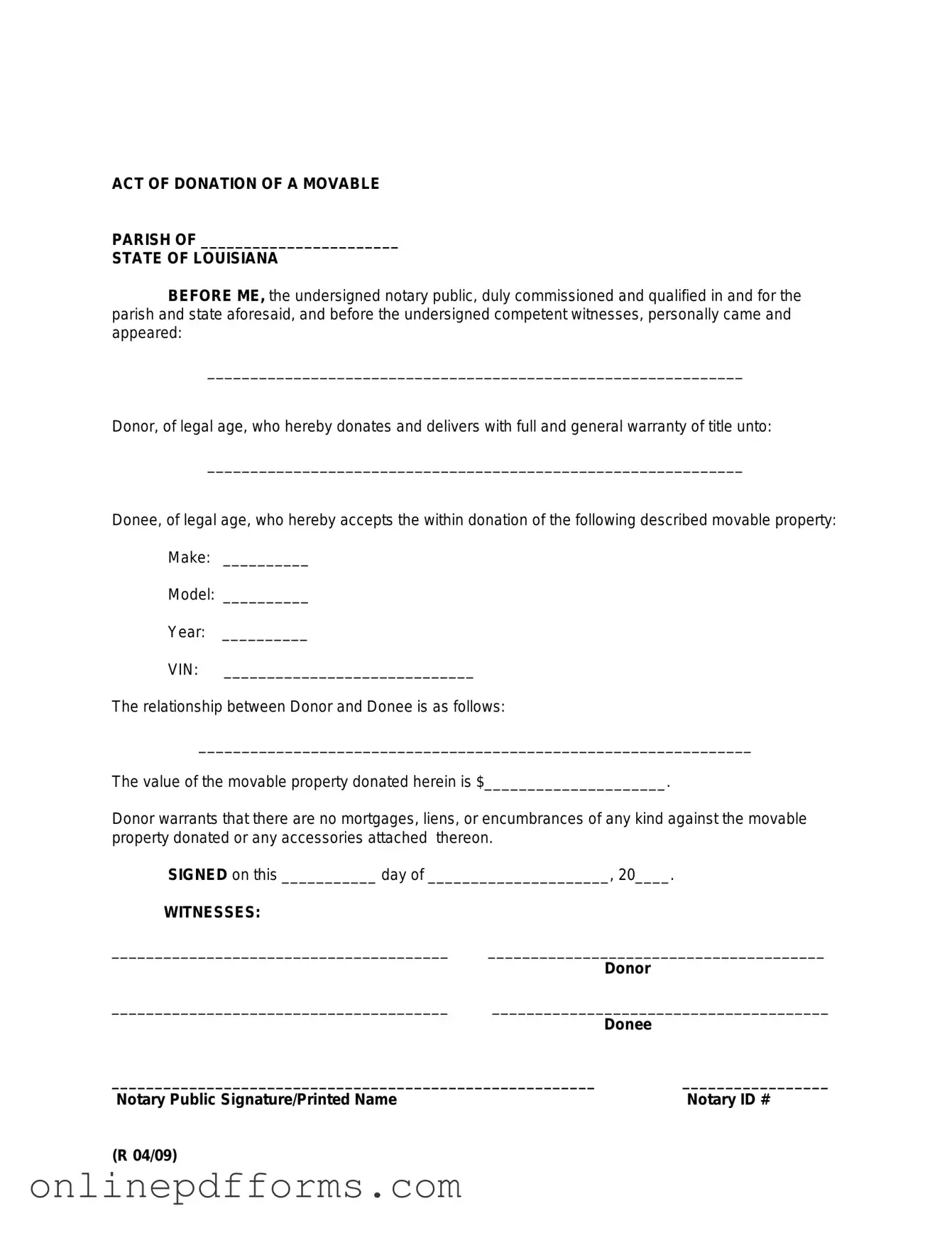

Steps to Filling Out Louisiana act of donation

Completing the Louisiana Act of Donation form is an important step in the process of transferring property. After filling out the form, it will need to be signed and notarized before it can be filed with the appropriate authorities. Follow these steps to ensure that you complete the form correctly.

- Begin by entering the full name of the donor at the top of the form.

- Provide the donor's address, including the city, state, and zip code.

- Next, fill in the full name of the recipient of the donation.

- Include the recipient's address, ensuring accuracy in the city, state, and zip code.

- Describe the property being donated. Be specific about the type and location of the property.

- State the value of the property being donated. This may require an appraisal or other valuation method.

- Include any conditions or restrictions related to the donation, if applicable.

- Sign the form in the designated area, confirming your intent to donate the property.

- Have the signature notarized by a licensed notary public.

- Make copies of the completed form for your records and for the recipient.

Once the form is filled out and notarized, it should be filed with the appropriate local government office to finalize the donation process. This will ensure that the transfer is legally recognized.