Fill in Your Mortgage Statement Template

Documents used along the form

The Mortgage Statement form is a crucial document for homeowners, providing a detailed overview of their mortgage account. However, it is often accompanied by several other forms and documents that serve various purposes throughout the mortgage process. Below is a list of commonly used documents that may be encountered alongside the Mortgage Statement.

- Loan Estimate: This document outlines the estimated costs associated with a mortgage loan, including interest rates, monthly payments, and closing costs. It is provided to borrowers within three days of applying for a mortgage.

- Closing Disclosure: This form provides final details about the mortgage loan, including the loan terms, monthly payments, and closing costs. Borrowers receive it at least three days before closing on the loan.

- Payment Coupon: Often included with the Mortgage Statement, this coupon allows borrowers to send payments easily. It typically includes the account number and the amount due.

- Escrow Account Statement: This document details the funds held in escrow for property taxes and insurance. It provides an overview of how much is collected and disbursed throughout the year.

- Notice of Default: This formal notification is sent to borrowers who have missed payments. It warns them of potential foreclosure proceedings if the account remains delinquent.

- Forbearance Agreement: If a borrower is experiencing financial hardship, this document outlines the terms under which the lender agrees to temporarily reduce or suspend payments.

- Loan Modification Agreement: This document is used when a borrower and lender agree to change the terms of the mortgage, such as adjusting the interest rate or extending the loan term.

- Articles of Incorporation: This essential document is needed to officially establish a corporation in Wisconsin. For more details, refer to the https://pdftemplates.info/wisconsin-articles-of-incorporation-form.

- Property Tax Statement: This statement provides information on the property taxes owed on the home. It is essential for understanding the overall financial obligations associated with homeownership.

- Insurance Declaration Page: This document summarizes the coverage provided by the homeowner's insurance policy. It is often required by lenders to ensure adequate protection of the property.

Understanding these documents can empower homeowners to manage their mortgage effectively. Each serves a distinct purpose, contributing to the overall clarity and transparency of the mortgage process. Familiarity with these forms can help borrowers navigate their financial responsibilities with confidence.

More PDF Templates

U.S. Corporation Income Tax Return - Corporations can report the gains and losses from the sale of assets on this form.

To facilitate a smooth transaction when buying or selling a vehicle in Connecticut, it is essential to utilize the proper documentation. The Connecticut Motor Vehicle Bill of Sale form serves as an official record of the sale, ensuring both parties are protected. For those interested, you can find the necessary documents and templates, including the Vehicle Bill of Sale Forms, to streamline the process.

Cancel Melaleuca Membership - Clear completion helps avoid delays in processing your form.

Similar forms

The Mortgage Statement form shares similarities with the Billing Statement. Both documents provide a summary of account activity and outstanding balances. A Billing Statement typically includes details about the amount due, payment due dates, and a breakdown of charges. Like the Mortgage Statement, it often highlights any late fees that may apply if payments are not made on time. The primary purpose of both documents is to inform the recipient of their financial obligations and account status, ensuring clarity and transparency in billing practices.

Another similar document is the Loan Statement. This document outlines the terms of a loan, including the outstanding principal and interest rates, much like the Mortgage Statement. The Loan Statement provides a detailed account of the payment history, including any fees incurred and the total amount due. Both statements serve to keep borrowers informed about their loan obligations and help them manage their payments effectively.

The Payment Reminder Notice is also comparable to the Mortgage Statement. This document serves as a notification to the borrower regarding upcoming payment due dates and the amount owed. It may include information about late fees and the consequences of missed payments, similar to the Mortgage Statement's delinquency notice. Both documents aim to prompt timely payments and maintain open communication between the borrower and the lender.

The Account Summary is another document that resembles the Mortgage Statement. An Account Summary provides an overview of the financial status of an account, including balances, recent transactions, and any pending fees. Like the Mortgage Statement, it helps the account holder understand their financial standing and make informed decisions regarding their payments. Both documents are essential for tracking financial responsibilities.

For those navigating the complexities of loan agreements, it's crucial to have access to comprehensive resources that clarify any uncertainties. One such resource is the California Loan Agreement form, which provides vital details about the lending process. It serves to protect both parties by delineating the terms clearly, ensuring that borrowers understand their obligations. For additional insights and editable versions of this essential document, you can visit https://californiapdf.com.

The Escrow Statement is also similar, as it details the funds held in escrow for property taxes and insurance. The Mortgage Statement includes an escrow breakdown, making it clear how much of the monthly payment goes toward these expenses. Both documents ensure that borrowers are aware of their escrow obligations and any changes that may occur, such as increases in property taxes or insurance premiums.

Lastly, the Delinquency Notice bears resemblance to the Mortgage Statement, particularly in its focus on overdue payments. This notice explicitly states the consequences of late payments, including potential fees and foreclosure risks. The Mortgage Statement includes similar warnings, emphasizing the importance of maintaining timely payments. Both documents serve to alert borrowers to their financial responsibilities and the urgency of addressing any overdue amounts.

Steps to Filling Out Mortgage Statement

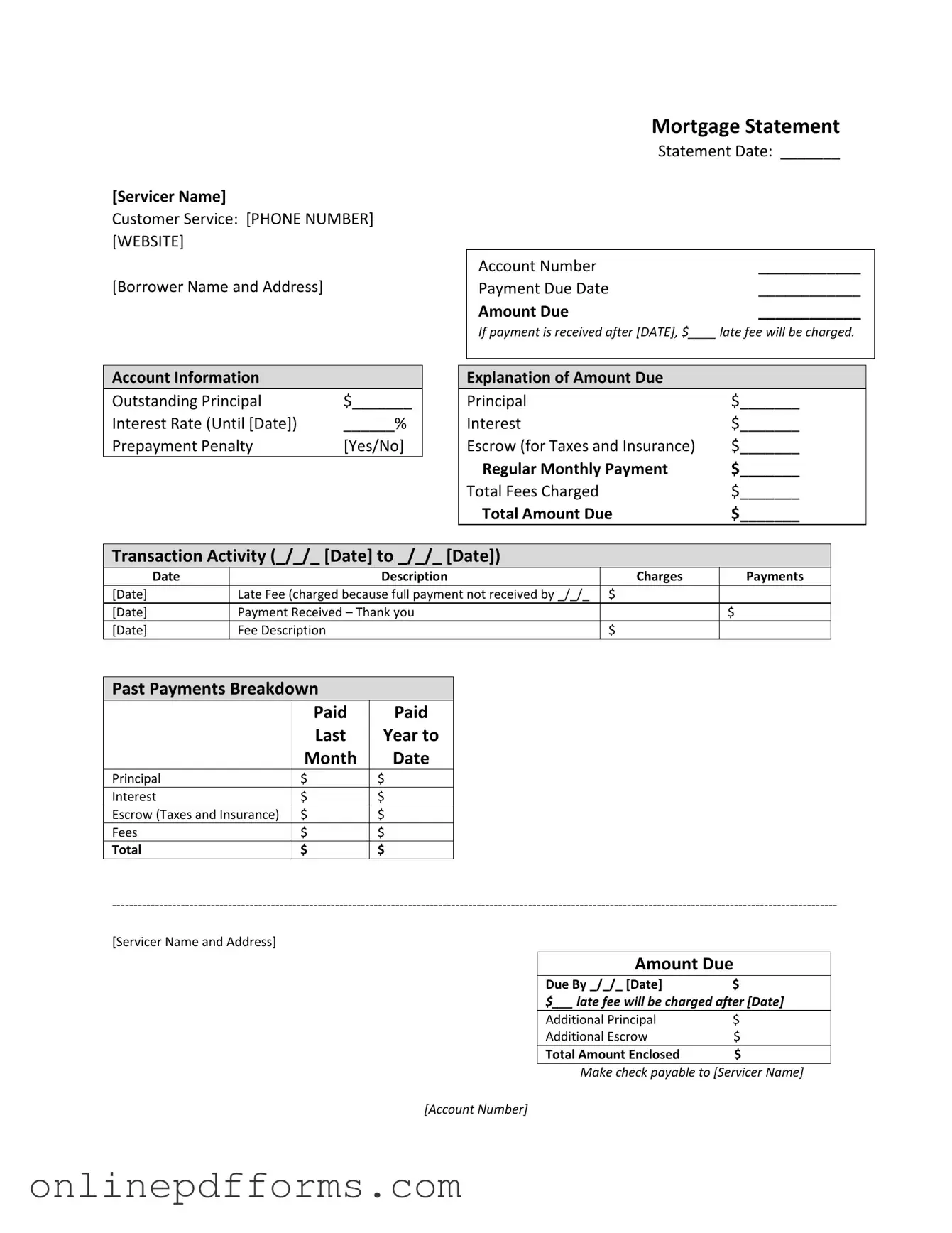

Completing the Mortgage Statement form accurately is essential for maintaining clear communication with your mortgage servicer. This process involves gathering relevant information and filling out the necessary fields to ensure that your account details are correct. Follow these steps to complete the form effectively.

- Locate the Servicer Name and Customer Service section at the top of the form. Enter the name of your mortgage servicer and their contact information, including phone number and website.

- In the Borrower Name and Address section, fill in your name and current address as it appears on your mortgage documents.

- Record the Statement Date, Account Number, and Payment Due Date in the designated fields.

- Input the Amount Due for the current payment period.

- Note the date after which a late fee will be charged and enter the amount of the late fee.

- In the Account Information section, provide the Outstanding Principal and Interest Rate until the specified date.

- Indicate whether there is a Prepayment Penalty by selecting yes or no.

- Break down the Amount Due into its components: Principal, Interest, Escrow (for taxes and insurance), Regular Monthly Payment, Total Fees Charged, and Total Amount Due.

- Review the Transaction Activity section. Fill in the dates and descriptions of any charges and payments made during the specified period.

- In the Past Payments Breakdown section, list the amounts paid last year by category: Principal, Interest, Escrow, and Fees.

- Complete the Amount Due section, noting the due date and any late fees that may apply after that date.

- Calculate and enter the Total Amount Enclosed if you are sending a payment. Make the check payable to the servicer and include your account number.

- Finally, review the Important Messages section for any additional information regarding partial payments or delinquency notices.