Fill in Your Netspend Dispute Template

Documents used along the form

When filing a dispute using the Netspend Dispute form, several other forms and documents may be necessary to support your claim. These documents help clarify the situation and provide essential details to the review process. Below is a list of commonly used forms and documents that can aid in your dispute.

- Police Report: If your card was lost or stolen, a police report is crucial. It serves as official documentation of the incident and may help in proving your case.

- Transaction Receipts: Collect any receipts related to the disputed transactions. These documents provide proof of the purchase and can support your claim.

- Email Correspondence: If you have communicated with the merchant, include any relevant emails. They can show attempts to resolve the issue directly with the merchant.

- Shipping or Tracking Information: For disputes related to online purchases, shipping or tracking details can help establish the timeline of events and confirm delivery status.

- Rental Application Form: To streamline your tenant screening process, refer to the comprehensive Rental Application document which outlines essential information for potential landlords.

- Cancellation Confirmation: If you canceled a transaction, include any confirmation received. This document can demonstrate that you took action to prevent the charge.

- Account Statements: Recent account statements can provide an overview of your transactions. They may help identify unauthorized charges and verify your claims.

- Identity Verification Documents: In some cases, you may need to provide proof of identity, such as a driver's license or utility bill, to confirm your identity.

- Affidavit of Loss: This document can be used to formally declare that your card is lost or stolen. It adds another layer of support to your dispute.

- Additional Dispute Forms: Depending on the nature of the dispute, other specific forms may be required. Always check with Netspend for any additional requirements.

Gathering these documents will strengthen your case and may expedite the resolution process. Ensure that you submit everything in a timely manner to avoid delays in your dispute resolution.

More PDF Templates

Fedex Signature Required - Track your shipment online at fedex.com for updates after completing the form.

The Arizona Motorcycle Bill of Sale form is a crucial document used to transfer ownership of a motorcycle from one party to another. This form not only provides proof of the transaction but also protects both the buyer and the seller by outlining the terms of the sale. For additional information and to access a template, visit mypdfform.com/blank-arizona-motorcycle-bill-of-sale. Understanding this form is essential for anyone looking to buy or sell a motorcycle in Arizona.

Family Law Financial Affidavit Short Form Florida - The affidavit helps judges assess each party's financial situation effectively.

Similar forms

The Netspend Dispute form is similar to a Credit Card Dispute Form, which allows cardholders to contest unauthorized charges on their credit card statements. Like the Netspend form, it requires the cardholder to provide details about the disputed transactions, including transaction dates, amounts, and merchant names. Both forms emphasize the importance of submitting the dispute within a specific timeframe, typically within 60 days of the transaction date, to ensure timely processing. Additionally, both forms may require supporting documentation to substantiate the claim, such as receipts or correspondence with the merchant.

Another document that shares similarities is the Bank Statement Dispute Form. This form is used by bank customers to dispute transactions listed on their bank statements. Similar to the Netspend Dispute form, it requires detailed information about the transaction in question, including the date and amount. Both forms highlight the need for prompt submission of the dispute to facilitate a quick resolution. Furthermore, both may ask for additional documentation to support the claim, reinforcing the importance of evidence in the dispute process.

The PayPal Dispute Resolution Form is also comparable to the Netspend Dispute form. This document allows users to report unauthorized transactions or issues with purchases made through PayPal. Like the Netspend form, it requires users to provide transaction details and may include a section for additional explanations. Both forms stress the importance of acting quickly, as disputes typically need to be filed within a specific period after the transaction. Additionally, both forms encourage users to gather any relevant evidence to strengthen their case.

Similarly, the Venmo Dispute Form serves a comparable purpose for users of the Venmo payment platform. This form enables users to report unauthorized transactions or billing errors. Like the Netspend Dispute form, it requires detailed information about the transaction, including amounts and dates. Both forms emphasize the need for timely submission and may request supporting documents to aid in the resolution process. Users are encouraged to provide a thorough explanation of the situation to facilitate a comprehensive review.

The Zelle Dispute Form is another document that shares characteristics with the Netspend Dispute form. Zelle users can use this form to report unauthorized transactions or other issues related to their payments. Both forms require users to provide specific transaction details and highlight the importance of submitting the dispute promptly. Additionally, both forms may ask for documentation to support the claim, ensuring that users provide adequate evidence for their disputes.

In the realm of e-commerce, the Amazon Dispute Resolution Form is similar to the Netspend Dispute form. This document allows customers to report issues with unauthorized charges or unsatisfactory purchases. Like the Netspend form, it requires transaction details and encourages users to submit their claims quickly. Both forms may also require supporting documentation, such as order confirmations or correspondence with sellers, to strengthen the user's case in the dispute process.

The eBay Dispute Resolution Form also shares similarities with the Netspend Dispute form. eBay users can use this form to report unauthorized transactions or problems with purchases made on the platform. Both forms require detailed transaction information and emphasize the need for prompt action. Supporting documentation is also encouraged to assist in the resolution of the dispute, making both forms reliant on the provision of evidence to support the claims made.

In the realm of vehicle transactions, having the right documentation is essential, and one such vital form is the Vehicle Bill of Sale Forms, which provides a legal record of the sale agreement between a seller and a buyer, ensuring both parties are protected throughout the process.

The Western Union Dispute Form is another document that mirrors the Netspend Dispute form. This form allows customers to report unauthorized transactions or issues with money transfers. Like the Netspend form, it requires specific details about the transaction and stresses the importance of timely submission. Both forms may request supporting documentation, such as transaction receipts or correspondence, to help resolve the dispute effectively.

Finally, the MoneyGram Dispute Form is similar to the Netspend Dispute form in that it enables customers to contest unauthorized transactions or report issues with their money transfers. Both forms require detailed transaction information and highlight the necessity of prompt action. Additionally, both documents may ask for supporting evidence to assist in the dispute resolution process, reinforcing the importance of documentation in substantiating claims.

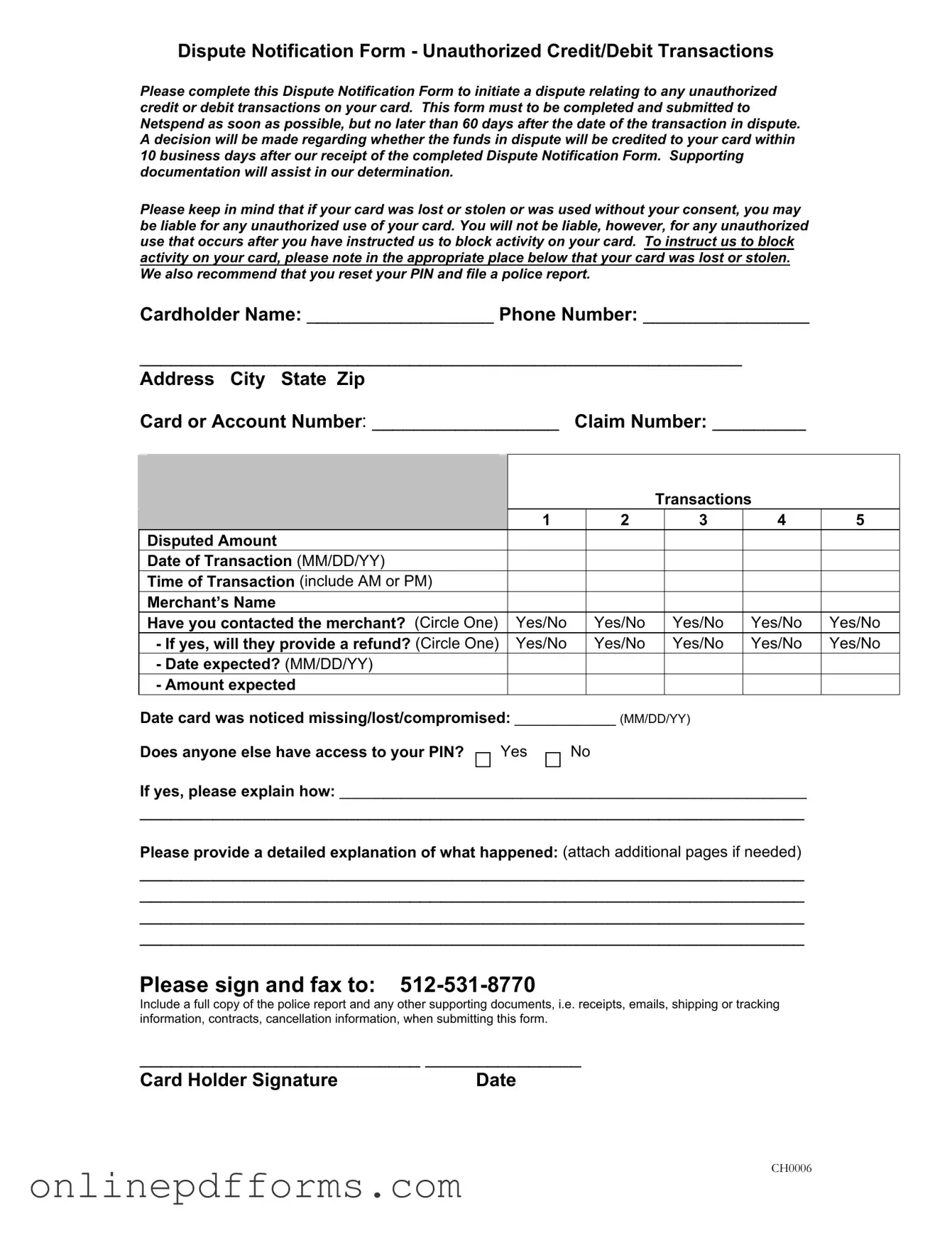

Steps to Filling Out Netspend Dispute

After completing the Netspend Dispute Notification Form, you will submit it along with any supporting documents to initiate your dispute. This process is crucial for addressing unauthorized transactions on your card. Ensure that you act promptly, as the form must be submitted within 60 days of the disputed transaction.

- Begin by entering your Cardholder Name at the top of the form.

- Provide your Phone Number for contact purposes.

- Fill in your Address, including City, State, and Zip Code.

- Write your Card or Account Number in the designated space.

- Input your Claim Number if you have one.

- List the Disputed Amount for each transaction you are disputing (up to 5 transactions).

- Record the Date of Transaction in MM/DD/YY format.

- Indicate the Time of Transaction and specify AM or PM.

- Provide the Merchant’s Name associated with the transaction.

- Circle Yes or No to indicate if you have contacted the merchant.

- If you contacted the merchant, circle Yes or No to indicate if they will provide a refund.

- If applicable, enter the Date expected for the refund in MM/DD/YY format.

- Note the Date card was noticed missing/lost/compromised in MM/DD/YY format.

- Answer whether anyone else has access to your PIN by circling Yes or No.

- If you circled Yes, provide an explanation of how someone else has access to your PIN.

- Write a detailed explanation of what happened regarding the unauthorized transaction(s). Attach additional pages if necessary.

- Sign the form and write the Date next to your signature.

- Fax the completed form to 512-531-8770.

- Include a full copy of the police report and any other supporting documents, such as receipts or emails.