Blank New York Articles of Incorporation Form

Documents used along the form

When forming a corporation in New York, the Articles of Incorporation is just the starting point. Several other documents and forms are often needed to ensure compliance with state regulations and to establish your business properly. Here’s a list of important documents that may accompany your Articles of Incorporation:

- Bylaws: These are the rules that govern the internal management of the corporation. Bylaws outline the duties of officers, the process for holding meetings, and how decisions are made.

- Initial Report: Some states require an initial report shortly after incorporation. This document provides basic information about the corporation, including its address and the names of its officers.

- Employer Identification Number (EIN): This is a unique number assigned by the IRS to identify your business for tax purposes. It’s essential for hiring employees and filing taxes.

- Certificate of Publication: New York law requires newly formed corporations to publish a notice of incorporation in two newspapers. A Certificate of Publication proves that this requirement has been met.

- Organizational Meeting Minutes: After incorporation, the first meeting of the board of directors should be documented. This record includes decisions made, such as appointing officers and adopting bylaws.

- Form SS-4: This form is used to apply for an EIN. It can be submitted online or via mail, and it’s a crucial step for businesses that will have employees.

- State Tax Registration: Depending on the nature of your business, you may need to register for state taxes. This could include sales tax, employer taxes, or other business-related taxes.

- Share Certificates: If your corporation issues shares, share certificates serve as proof of ownership for shareholders. These documents should be prepared and distributed as needed.

Completing these documents accurately is vital to ensuring your corporation is established correctly and operates smoothly. Always consider consulting with a professional to navigate the requirements effectively.

Other Popular State-specific Articles of Incorporation Templates

Llc Illinois - The Articles can designate specific powers of the board of directors.

File Llc Ohio - Filing the articles can set the stage for business growth.

How Do I Get a Copy of My Articles of Incorporation in Georgia - Incorporating can enhance a business’s credibility and legitimacy.

Similar forms

The New York Articles of Incorporation form is similar to the Certificate of Incorporation, which is often used interchangeably. Both documents serve the purpose of officially establishing a corporation in New York. They outline essential details such as the corporation's name, purpose, and the registered agent. While the Articles of Incorporation may be more commonly referenced in some states, the Certificate of Incorporation is the term used in New York to formalize the creation of a corporation.

Another document akin to the Articles of Incorporation is the Bylaws. Bylaws set the internal rules for managing the corporation. They detail how the corporation will operate, including the roles of officers, the process for holding meetings, and voting procedures. While Articles of Incorporation focus on the external registration of the corporation, Bylaws govern its internal affairs.

The Operating Agreement is also similar, particularly for LLCs (Limited Liability Companies). Like the Articles of Incorporation, the Operating Agreement outlines the structure and management of the business. It specifies the rights and responsibilities of members and managers, providing a framework for how the LLC will function. This document is crucial for LLCs but does not apply to corporations directly.

The Statement of Information is another document related to corporate formation. This form provides updated information about the corporation, including its address, officers, and registered agent. While the Articles of Incorporation are filed at the formation stage, the Statement of Information is typically required annually or biennially to keep the state informed about the corporation's status.

The Business License is similar in that it is necessary for legal operation. While the Articles of Incorporation establish the corporation, a business license is required to conduct business legally within a specific jurisdiction. This document ensures compliance with local laws and regulations, allowing the corporation to operate without legal hindrances.

The Federal Employer Identification Number (EIN) application is another essential document. While the Articles of Incorporation create the corporation at the state level, the EIN is required for tax purposes at the federal level. This number is crucial for opening bank accounts, hiring employees, and filing taxes. It connects the corporation to the IRS and is necessary for legal business operations.

The Certificate of Good Standing is similar in that it verifies the corporation's compliance with state regulations. After filing the Articles of Incorporation, a corporation may need this certificate to prove it is active and in good standing with the state. This document is often required when applying for loans or entering contracts.

Lastly, the Annual Report is a document that shares ongoing information about the corporation. Similar to the Statement of Information, the Annual Report provides updates on the corporation's activities and financial status. It is a way to keep the state informed and is often required to maintain good standing after the initial formation through the Articles of Incorporation.

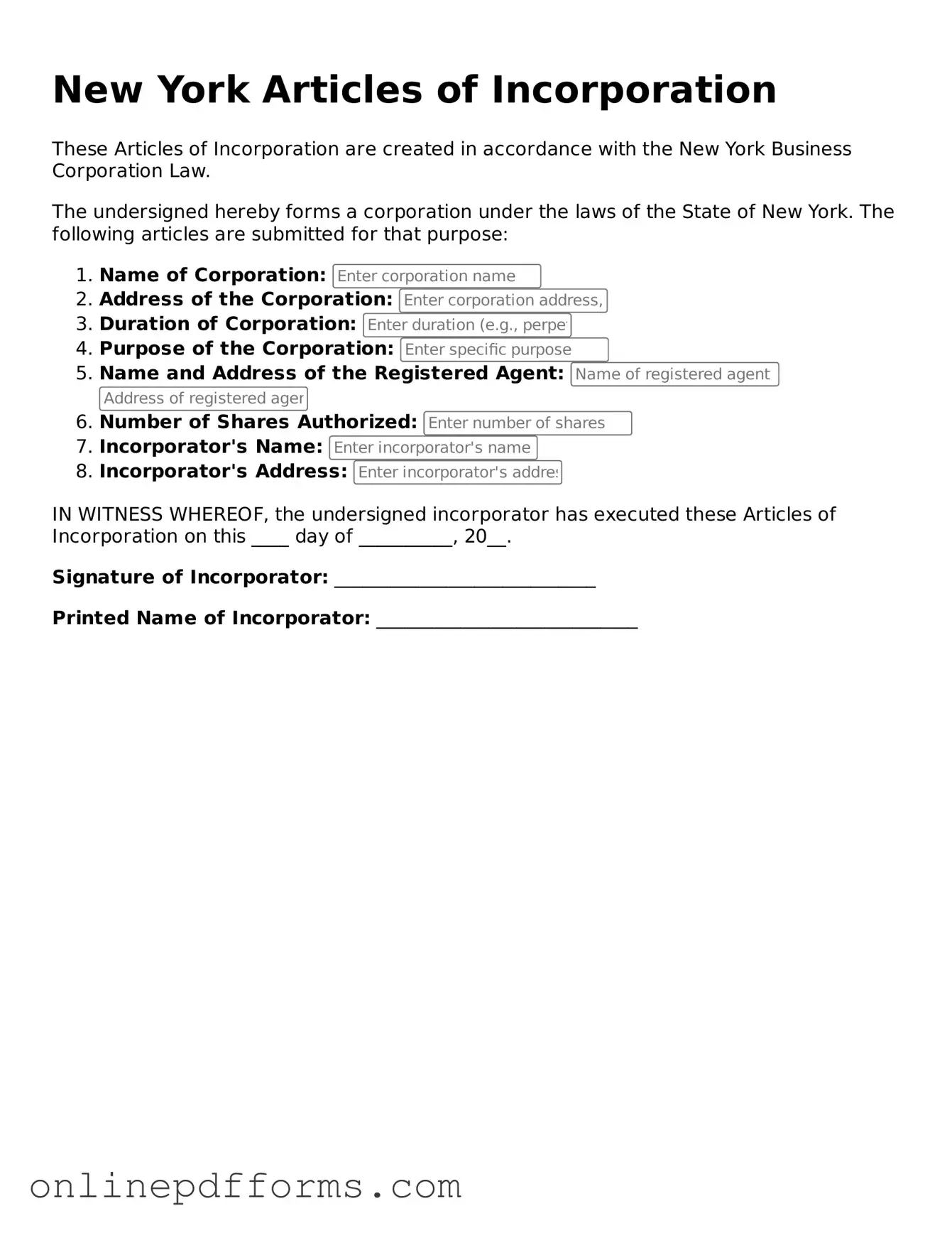

Steps to Filling Out New York Articles of Incorporation

Once you have the New York Articles of Incorporation form in hand, it’s time to fill it out. This document is essential for establishing your business entity in the state of New York. Completing it accurately is crucial for a smooth incorporation process.

- Begin by entering the name of your corporation. Ensure the name is unique and complies with New York naming requirements.

- Provide the purpose of your corporation. Be specific about what your business will do.

- List the county in New York where your corporation will be located. This is important for jurisdictional purposes.

- Fill in the address of the corporation's principal office. This must be a physical address, not a P.O. Box.

- Include the name and address of the registered agent. This person or entity will receive legal documents on behalf of the corporation.

- State the number of shares your corporation is authorized to issue. Specify the classes of shares if applicable.

- Provide the names and addresses of the incorporators. These are the individuals responsible for filing the Articles of Incorporation.

- Sign and date the form. Ensure that all incorporators have signed where required.

- Review the completed form for accuracy. Double-check all information to avoid any delays.

- Submit the form to the New York Department of State along with the required filing fee.

After submitting your Articles of Incorporation, you will receive confirmation from the state. Keep this document safe, as it is an important part of your business records. You may also need to take additional steps, such as obtaining an Employer Identification Number (EIN) and registering for state taxes.