Blank New York Deed Form

Documents used along the form

When dealing with property transactions in New York, several important documents accompany the Deed form. Each of these documents serves a unique purpose in ensuring a smooth transfer of ownership. Here’s a brief overview of some commonly used forms.

- Title Search Report: This document outlines the history of ownership of the property. It confirms whether the seller has the legal right to transfer ownership and identifies any liens or claims against the property.

- Property Survey: A property survey provides a detailed map of the property boundaries. It helps to clarify the exact dimensions and location of the property, which is crucial for both buyers and sellers.

- Affidavit of Title: This sworn statement from the seller confirms their ownership of the property and asserts that there are no outstanding claims or liens. It provides additional assurance to the buyer.

- Closing Statement: Also known as a HUD-1 form, this document summarizes all financial aspects of the transaction. It details the costs involved in the sale, including fees, taxes, and any adjustments.

- Transfer Tax Form: This form is required to report the transfer of property and calculate any applicable transfer taxes. It ensures compliance with local tax regulations.

- Motorcycle Bill of Sale: To ensure a valid transaction, it's recommended to use the official Florida motorcycle bill of sale form template that documents all essential details of the sale.

- Bill of Sale: Although not always necessary, this document may be used to transfer personal property associated with the real estate, such as appliances or fixtures.

Each of these documents plays a crucial role in the property transaction process. Understanding them can help ensure that everything goes smoothly and that all parties are protected during the transfer of ownership.

Other Popular State-specific Deed Templates

Contract for Deed Texas Template - A quitclaim deed offers the least protection for the buyer.

When participating in a vehicle sale, it's essential to have a clear understanding of the Texas Vehicle Purchase Agreement form, as it serves as a safeguard for both the buyer and seller. This document details important aspects like the purchase price, vehicle description, and any relevant warranties. For more information on how to properly fill out this form, you can visit https://pdftemplates.info/texas-vehicle-purchase-agreement-form/.

What Does a House Deed Look Like in Pa - Helps establish legal rights to real property for the grantee.

Similar forms

The New York Deed form shares similarities with the Quitclaim Deed. Both documents are used to transfer property ownership, but they differ in the guarantees provided. A Quitclaim Deed conveys whatever interest the grantor has in the property without any warranties. This means that if the grantor has no legal claim to the property, the grantee receives nothing. In contrast, the New York Deed may include warranties that protect the grantee against claims on the property, offering a greater level of security.

Another document similar to the New York Deed is the Warranty Deed. Like the New York Deed, a Warranty Deed provides a guarantee that the grantor holds clear title to the property and has the right to sell it. This type of deed protects the buyer from future claims against the property. Both documents serve to establish ownership, but the Warranty Deed typically offers more extensive protections than the New York Deed.

The Bargain and Sale Deed also resembles the New York Deed. This type of deed transfers ownership without any warranties against encumbrances. While the New York Deed may include certain assurances, the Bargain and Sale Deed does not guarantee that the property is free from liens or other claims. This makes the Bargain and Sale Deed a riskier option for buyers who seek assurance regarding the property's title.

Additionally, the Special Warranty Deed is comparable to the New York Deed. This document guarantees that the grantor has not caused any title issues during their ownership of the property. While the New York Deed may provide broader assurances, the Special Warranty Deed limits its guarantees to the time the grantor owned the property. Buyers must consider this distinction when evaluating their level of protection.

When navigating the specifics of buying or selling an RV in South Carolina, it is essential to utilize the proper documentation to ensure a smooth transaction. The Auto Bill of Sale Forms provide a structured format for detailing the purchase agreement, protecting both parties involved. Understanding these forms can significantly ease the transfer process and facilitate proper legal compliance, offering peace of mind to buyers and sellers alike.

The Trustee's Deed is another document that bears resemblance to the New York Deed. This deed is used when a property is transferred by a trustee, often in the context of a trust or estate. While the New York Deed is typically used for standard property transfers, the Trustee's Deed may involve unique legal considerations related to the trust's terms. Both documents facilitate the transfer of ownership but may differ in their legal implications and contexts.

Finally, the Life Estate Deed is similar in that it involves the transfer of property rights. This deed allows an individual to retain a life interest in the property while transferring the remainder interest to another party. While the New York Deed focuses on the outright transfer of ownership, the Life Estate Deed creates a more complex arrangement that defines the rights of multiple parties. Understanding these distinctions is crucial for anyone involved in property transactions.

Steps to Filling Out New York Deed

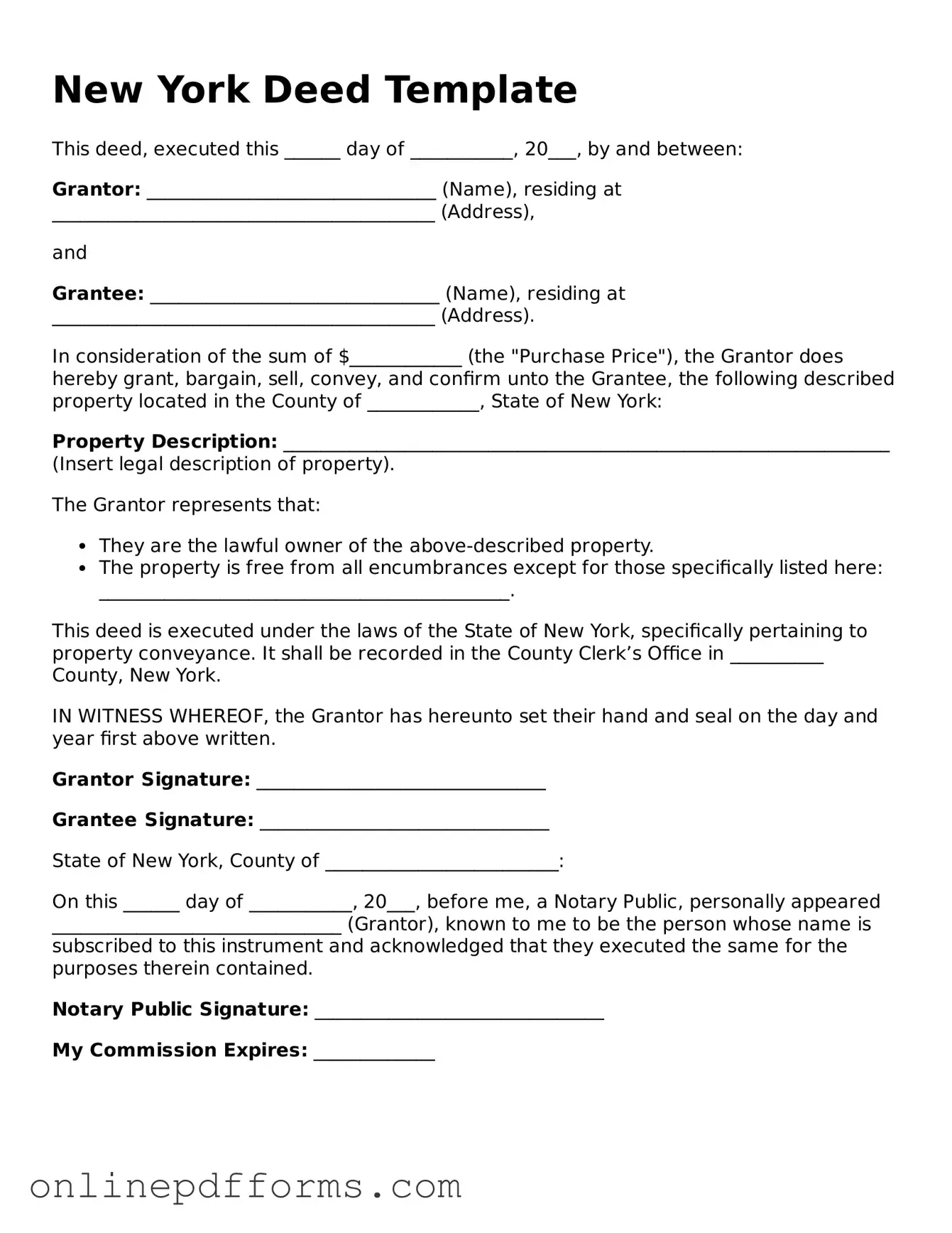

Once you have obtained the New York Deed form, you are ready to begin the process of filling it out. This form is essential for transferring property ownership and must be completed accurately to ensure a smooth transaction. Follow these steps carefully to ensure that all necessary information is included and correct.

- Begin by entering the date at the top of the form. This should be the date on which the deed is being executed.

- Next, provide the grantor's name. This is the person or entity transferring the property. Include their full legal name as it appears on official documents.

- Following the grantor's name, list the grantee's name. This is the individual or entity receiving the property. Again, use the full legal name.

- In the next section, describe the property being transferred. Include the address and any relevant details, such as the lot number or tax identification number.

- Indicate the consideration amount. This is the price paid for the property. If the transfer is a gift, you can note that as well.

- Next, provide the signature of the grantor. The grantor must sign the document to validate the transfer.

- Have the signature witnessed if required. New York law may necessitate a witness, depending on the circumstances.

- Finally, ensure that the deed is notarized. A notary public must acknowledge the signatures to complete the process.

After completing these steps, the deed must be filed with the appropriate county clerk's office to finalize the property transfer. Ensure that you keep copies of the completed deed for your records and any future reference.