Blank New York Deed in Lieu of Foreclosure Form

Documents used along the form

A Deed in Lieu of Foreclosure can streamline the process of transferring property ownership when a borrower is unable to meet mortgage obligations. However, it is often accompanied by other important documents that facilitate the transaction and protect the interests of both parties involved. Below are five commonly used forms and documents that complement the Deed in Lieu of Foreclosure in New York.

- Mortgage Release: This document formally releases the borrower from the mortgage obligation. It ensures that the lender relinquishes any claim against the property once the deed is executed.

- Affidavit of Title: The borrower provides this sworn statement to confirm their ownership of the property and disclose any existing liens or encumbrances. It assures the lender that the title is clear.

- Agreement for Deed in Lieu: This is a written agreement between the borrower and lender outlining the terms of the deed transfer. It specifies conditions such as the timeline and any potential liabilities that may remain.

- Motorcycle Bill of Sale Form: For those completing motorcycle transactions, the comprehensive Motorcycle Bill of Sale form guide is essential for proper documentation and legal compliance.

- Property Condition Disclosure: The borrower may need to disclose the condition of the property. This document informs the lender about any existing issues or repairs needed, helping them assess the property's value.

- Release of Liability: This document protects the borrower from future claims related to the mortgage. It ensures that once the deed is transferred, the lender cannot pursue the borrower for any remaining debt.

Understanding these accompanying documents is crucial for anyone navigating the Deed in Lieu of Foreclosure process. Each plays a vital role in ensuring a smooth transaction and safeguarding the rights of all parties involved.

Other Popular State-specific Deed in Lieu of Foreclosure Templates

Deed in Lieu of Foreclosure Pa - This process can be a more amicable solution for both homeowners and lenders when addressing distressed properties.

Georgia Foreclosure - The lender may agree to forgive any remaining balances after the property transfer, depending on the agreement.

Deed in Lieu Vs Foreclosure - Homeowners might also be able to negotiate terms that allow them to remain in the property for a short time after signing the deed.

When engaging in an RV transaction, it is essential to utilize proper documentation such as the South Carolina RV Bill of Sale form, which serves as a vital legal tool for confirming ownership transfer. For those interested in ensuring their transaction adheres to state regulations, resources like Auto Bill of Sale Forms can provide necessary templates and guidance.

California Pre-foreclosure Property Transfer - The borrower should review any remaining liens on the property that could complicate the transfer.

Similar forms

A Deed in Lieu of Foreclosure is often compared to a Short Sale. In a Short Sale, a homeowner sells their property for less than the amount owed on the mortgage, with the lender's approval. This process can help the homeowner avoid foreclosure and mitigate damage to their credit. However, unlike a Deed in Lieu of Foreclosure, which transfers ownership directly to the lender, a Short Sale involves selling the home to a third party, making it a more complex transaction that can take longer to complete.

Another document similar to the Deed in Lieu of Foreclosure is the Mortgage Modification Agreement. This agreement allows borrowers to modify the terms of their existing mortgage to make payments more manageable. While both options aim to prevent foreclosure, a Mortgage Modification keeps the borrower in their home by adjusting the loan terms, whereas a Deed in Lieu results in the borrower relinquishing ownership of the property.

Additionally, a Forebearance Agreement shares similarities with the Deed in Lieu of Foreclosure. This agreement allows borrowers to temporarily pause or reduce their mortgage payments during financial hardship. While both options provide relief to struggling homeowners, a Forebearance Agreement keeps the homeowner in possession of the property, while a Deed in Lieu transfers ownership to the lender.

The Bankruptcy Filing is another document that often comes up in discussions about foreclosure alternatives. Filing for bankruptcy can provide immediate relief from creditors and halt foreclosure proceedings. However, unlike a Deed in Lieu of Foreclosure, which is a voluntary transfer of property, bankruptcy is a legal process that can have long-term implications on a borrower’s credit and financial future.

Understanding various legal documents, such as the Texas Vehicle Purchase Agreement, can enhance your ability to navigate complex transactions effectively. This form serves a similar purpose to agreements outlined in other financial contexts, ensuring that both parties involved in a sale are protected. For further details on this specific agreement, you can visit pdftemplates.info/texas-vehicle-purchase-agreement-form, where you will find comprehensive information to assist in accurately completing the necessary documentation.

A Loan Assumption Agreement is also comparable to a Deed in Lieu of Foreclosure. In this agreement, a buyer takes over the seller's existing mortgage, assuming responsibility for the remaining debt. While both options involve the transfer of property rights, a Loan Assumption allows the borrower to sell the property without losing it to the lender, whereas a Deed in Lieu involves the borrower giving up the property entirely to avoid foreclosure.

The Quitclaim Deed is another document that may come to mind. This legal instrument allows a property owner to transfer their interest in the property to another party without making any guarantees about the title. While a Quitclaim Deed can be used in various situations, including family transfers, it lacks the formalities and protections of a Deed in Lieu of Foreclosure, which is specifically designed to address mortgage default situations.

The Release of Mortgage is also relevant when discussing foreclosure alternatives. This document formally releases the borrower from their mortgage obligations after the loan is paid off. While both a Release of Mortgage and a Deed in Lieu of Foreclosure signify the end of the borrower's obligations, the former occurs after full payment, while the latter happens when the borrower voluntarily surrenders the property to the lender to avoid foreclosure.

Lastly, a Property Settlement Agreement can be similar in certain contexts, especially during divorce proceedings. This agreement outlines the division of property and debts between spouses. While it does not directly address foreclosure, it can lead to a situation where one spouse agrees to transfer property ownership, similar to a Deed in Lieu of Foreclosure. Both documents involve the transfer of property rights, but a Property Settlement Agreement is typically part of a broader legal negotiation rather than a foreclosure avoidance strategy.

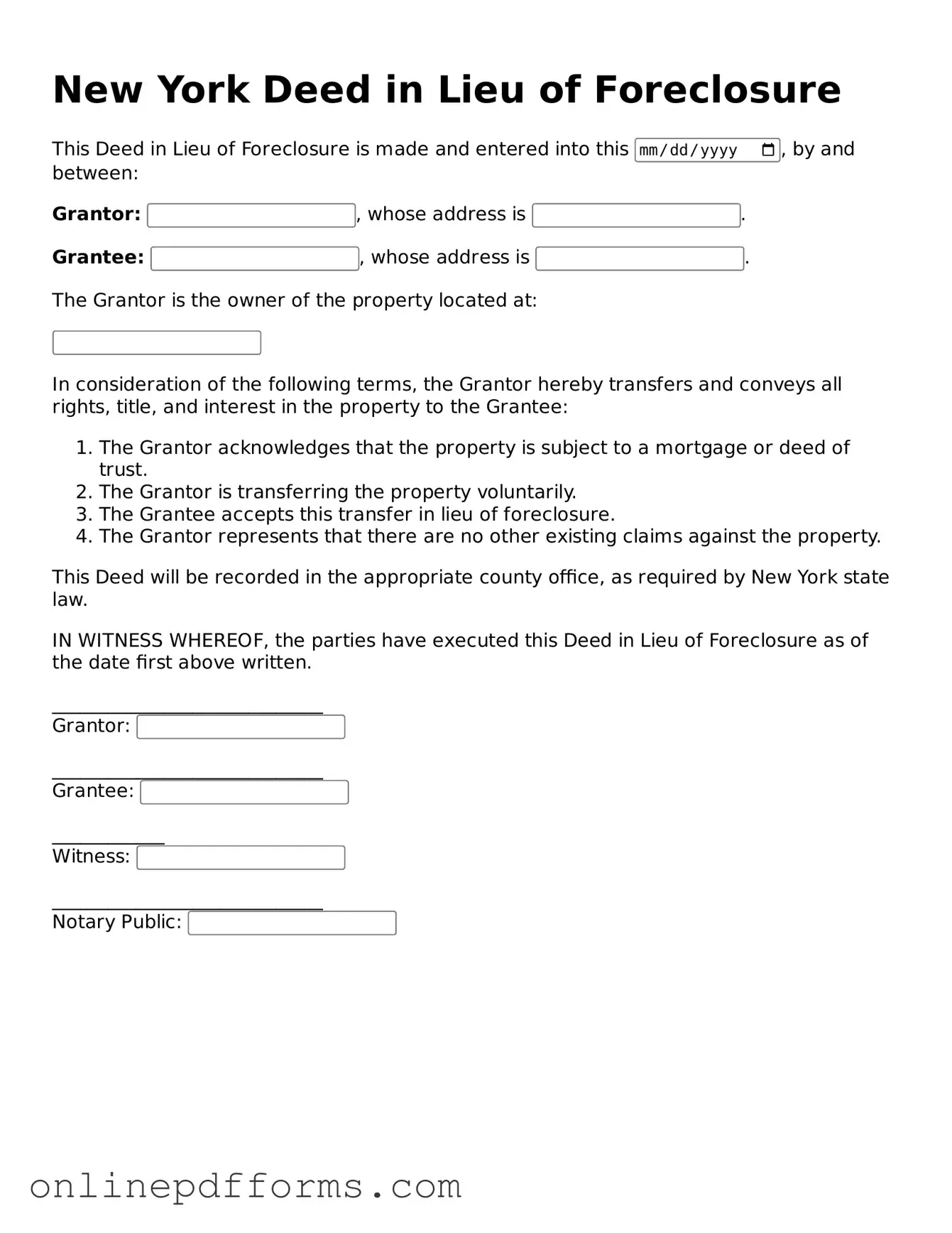

Steps to Filling Out New York Deed in Lieu of Foreclosure

Once you have gathered the necessary information and documentation, you can proceed with filling out the New York Deed in Lieu of Foreclosure form. This process involves several key steps to ensure that all required details are accurately provided. After completing the form, it will need to be signed and notarized before being submitted to the appropriate parties.

- Begin by downloading the New York Deed in Lieu of Foreclosure form from a reliable source.

- At the top of the form, enter the name of the borrower (the property owner) as it appears on the mortgage documents.

- Next, provide the address of the property that is subject to the deed in lieu of foreclosure.

- Include the legal description of the property. This can usually be found in your mortgage documents or on your property deed.

- In the section for the lender's information, write the name of the lender or mortgage company that holds the mortgage on the property.

- Fill in the lender's address, ensuring it is accurate and up to date.

- Indicate the date on which the deed is being executed.

- Both the borrower and an authorized representative of the lender must sign the form. Ensure that signatures are provided in the appropriate spaces.

- Have the signatures notarized. This step is crucial for the validity of the deed.

- Once notarized, make copies of the completed form for your records and for the lender.

- Finally, submit the original deed to the lender and follow any additional instructions they provide regarding the next steps.