Blank New York Durable Power of Attorney Form

Documents used along the form

A Durable Power of Attorney (DPOA) is an important legal document that allows an individual, known as the principal, to appoint someone else, known as the agent, to make decisions on their behalf. This document remains effective even if the principal becomes incapacitated. However, there are several other forms and documents that often accompany a DPOA to ensure comprehensive planning and protection of an individual's interests. Below are five commonly used documents.

- Health Care Proxy: This document allows an individual to designate someone to make medical decisions on their behalf if they are unable to do so. It focuses specifically on health care choices and can provide guidance on the principal’s wishes regarding treatment.

- Living Will: A living will outlines an individual’s preferences regarding medical treatment in situations where they may be unable to communicate their wishes, particularly at the end of life. It serves as a guide for health care providers and loved ones.

- Last Will and Testament: This document specifies how a person's assets should be distributed upon their death. It can also appoint guardians for minor children and can help avoid disputes among family members regarding the estate.

- Revocable Living Trust: A revocable living trust allows an individual to place their assets into a trust during their lifetime, which can then be managed by a trustee. This document can help avoid probate and ensure that assets are distributed according to the individual's wishes after death.

- Beneficiary Designations: Certain assets, such as life insurance policies and retirement accounts, allow individuals to name beneficiaries directly. Keeping these designations updated is crucial, as they can override the instructions in a will or trust.

Each of these documents plays a unique role in estate planning and decision-making. Together, they create a comprehensive framework that helps individuals prepare for the future and protect their interests, ensuring that their wishes are respected and followed.

Other Popular State-specific Durable Power of Attorney Templates

Printable Financial Power of Attorney - It provides a clear guideline on how you want your affairs to be handled, minimizing confusion during emergencies.

Durable Power of Attorney Florida Pdf - Review the document regularly to reflect any changes in your wishes.

Similar forms

The New York Durable Power of Attorney form shares similarities with the General Power of Attorney. Both documents allow an individual, known as the principal, to appoint someone else, the agent, to make decisions on their behalf. The key difference lies in the durability aspect; while a General Power of Attorney may become invalid if the principal becomes incapacitated, a Durable Power of Attorney remains effective even in such situations. This feature makes it particularly useful for long-term planning and ensuring that financial matters are managed continuously.

Another document similar to the Durable Power of Attorney is the Healthcare Proxy. This form allows individuals to designate someone to make medical decisions on their behalf if they become unable to do so. Like the Durable Power of Attorney, the Healthcare Proxy empowers a trusted person to act in the principal’s best interest. However, the focus here is specifically on health-related decisions, whereas the Durable Power of Attorney typically covers financial and legal matters.

The Living Will is another related document. This legal instrument outlines an individual’s wishes regarding medical treatment in the event of terminal illness or incapacitation. While the Durable Power of Attorney allows an agent to make decisions, a Living Will provides specific instructions that guide those decisions. Both documents work together to ensure that a person's preferences are respected during critical times.

The Revocable Trust is similar in that it allows for the management of assets during the grantor's lifetime and after their death. Like the Durable Power of Attorney, a Revocable Trust can help avoid probate and ensure that the individual’s wishes are followed. However, a trust typically involves a broader range of assets and can provide more comprehensive estate planning benefits than a Durable Power of Attorney.

The Assignment of Benefits form also resembles the Durable Power of Attorney in that it allows an individual to designate someone to receive benefits or payments on their behalf. This document is often used in insurance and healthcare situations. While the Durable Power of Attorney provides broader powers, the Assignment of Benefits is specific to financial transactions involving benefits, making it more limited in scope.

Similarly, the Financial Power of Attorney is closely aligned with the Durable Power of Attorney. Both documents grant authority to an agent to manage financial matters. The distinction often lies in the specific powers granted; a Financial Power of Attorney may focus solely on financial transactions, while a Durable Power of Attorney can encompass a wider range of responsibilities, including legal and property matters.

The Guardianship document is another relevant comparison. This legal arrangement appoints someone to make decisions for another person who is unable to do so due to incapacity. While a Durable Power of Attorney is created by the principal to designate an agent, guardianship is typically established through a court process. Both aim to protect the interests of individuals who cannot manage their affairs, but they differ in terms of authority and the method of appointment.

Lastly, the Will is similar in that it outlines an individual’s wishes regarding the distribution of their assets after death. Both the Will and Durable Power of Attorney are essential components of comprehensive estate planning. However, a Will only takes effect after death, whereas a Durable Power of Attorney is active during the principal’s lifetime, especially if they become incapacitated. Together, they create a complete plan for both life and afterlife decisions.

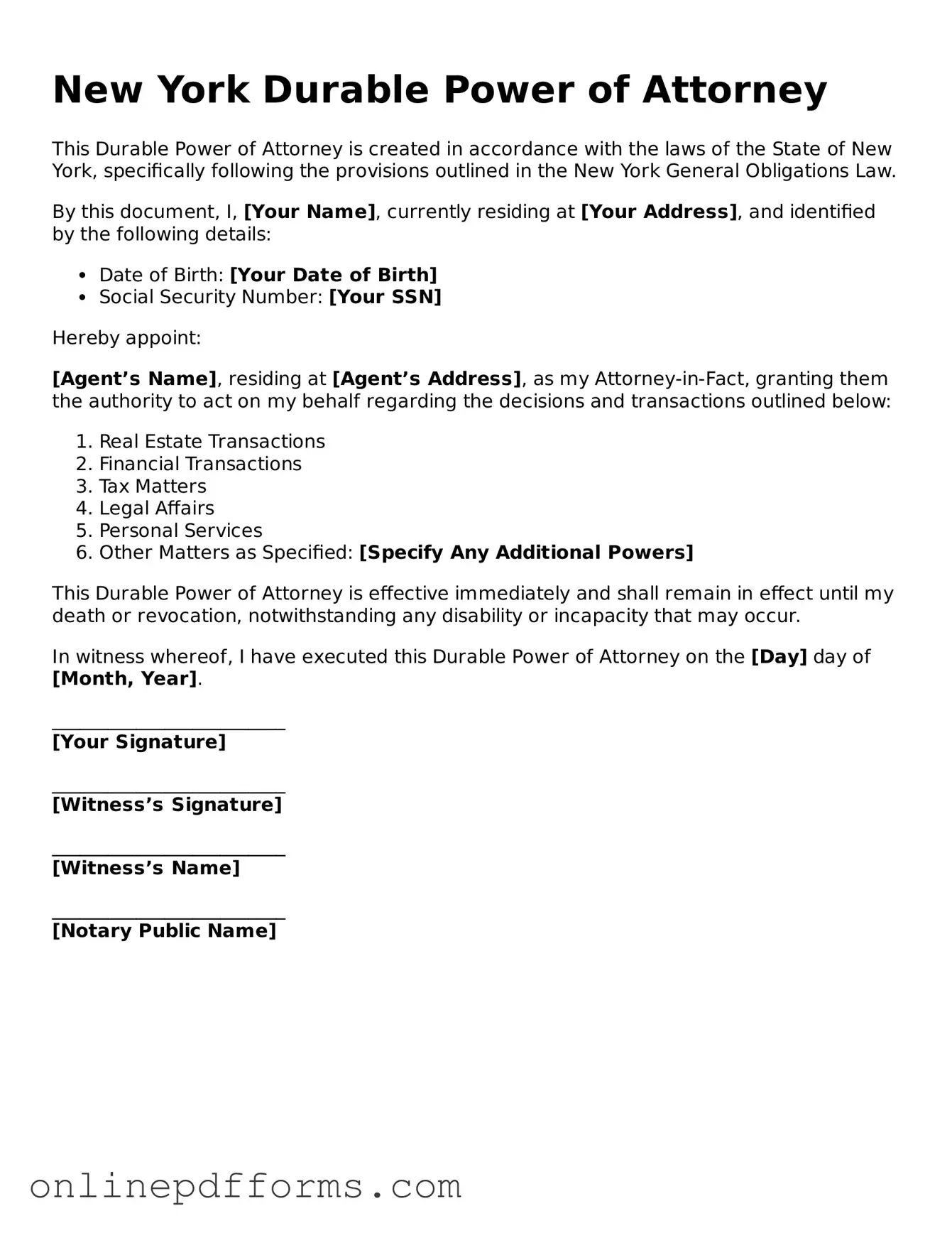

Steps to Filling Out New York Durable Power of Attorney

Once you have the New York Durable Power of Attorney form ready, it’s important to fill it out accurately to ensure it meets your needs. Follow these steps carefully to complete the form.

- Start by entering your name and address at the top of the form. This identifies you as the principal.

- Next, provide the name and address of the person you are appointing as your agent. This person will have the authority to act on your behalf.

- Specify the powers you wish to grant your agent. You can check the boxes next to each power you want to include.

- If there are any limitations to the powers you are granting, clearly state them in the designated section.

- Include the date on which the form is being signed. This is crucial for the validity of the document.

- Sign the form in the presence of a notary public. This adds a layer of legal authenticity.

- Ask the notary to sign and stamp the document. This completes the notarization process.

After filling out the form, keep a copy for your records and provide copies to your agent and any relevant parties. This ensures that everyone involved is aware of the arrangement.