Blank New York Loan Agreement Form

Documents used along the form

When engaging in a loan agreement in New York, several other documents may accompany the main contract to ensure clarity and legality. These documents serve various purposes, from providing additional details about the loan to establishing the rights and responsibilities of the parties involved. Below is a list of commonly used forms and documents that often accompany a New York Loan Agreement.

- Promissory Note: This document outlines the borrower's promise to repay the loan. It specifies the loan amount, interest rate, repayment schedule, and any penalties for late payments.

- Security Agreement: If the loan is secured by collateral, this agreement details the collateral being used and the terms under which the lender can claim it in case of default.

- Loan Application: This form is completed by the borrower to provide the lender with necessary information about their financial situation, including income, debts, and credit history.

- Disclosure Statement: This document informs the borrower about the terms of the loan, including interest rates, fees, and the total cost of the loan over its lifetime.

- Personal Guarantee: In some cases, a personal guarantee may be required from the borrower or a third party, ensuring that the lender can seek repayment from the guarantor if the borrower defaults.

- Closing Statement: This document summarizes the final terms of the loan, including any closing costs and fees. It is typically reviewed and signed at the loan closing.

- Motorcycle Bill of Sale: Essential for transferring ownership in Texas, this document can be accessed by following this link: https://pdftemplates.info/texas-motorcycle-bill-of-sale-form. It ensures both parties have a clear record of the transaction, enhancing transparency and trust.

- Amortization Schedule: This schedule provides a detailed breakdown of each payment over the life of the loan, showing how much goes toward interest and how much goes toward the principal balance.

- Loan Modification Agreement: If changes to the original loan terms are necessary, this document outlines the new terms agreed upon by both parties.

Understanding these accompanying documents can help borrowers and lenders navigate the loan process more effectively. Each document plays a crucial role in ensuring that both parties are protected and that the terms of the loan are clear and enforceable.

Other Popular State-specific Loan Agreement Templates

Promissory Note Florida Pdf - It defines the interest rate applicable to the loan.

In addition to the important details outlined in the Washington Motor Vehicle Bill of Sale form, it is crucial for buyers and sellers to ensure they have all necessary documentation ready for the transaction. For further assistance and access to customizable templates, you can visit https://billofsaleforvehicles.com, which provides valuable resources to help streamline the process.

Promissory Note Template Georgia - The agreement supports accountability for borrowed funds allocation.

Similar forms

The New York Loan Agreement form shares similarities with the Promissory Note. Both documents outline the terms of a loan, including the amount borrowed, interest rates, and repayment schedules. While the Loan Agreement often details the relationship between the borrower and lender, the Promissory Note focuses primarily on the borrower's promise to repay the loan. This makes the Promissory Note a simpler, more direct document that can stand alone as evidence of the debt.

Another document akin to the Loan Agreement is the Mortgage Agreement. This document secures the loan with real property as collateral. Like the Loan Agreement, the Mortgage Agreement specifies the terms of the loan, including interest rates and payment schedules. However, the Mortgage Agreement also includes details about the property being used as security, which is not typically found in a standard Loan Agreement.

The Security Agreement is another document that resembles the Loan Agreement. It is often used in conjunction with a loan to specify collateral that secures the repayment of the loan. While the Loan Agreement outlines the loan terms, the Security Agreement details the specific assets pledged as collateral. This dual documentation provides additional protection for the lender in case of default.

The Credit Agreement is similar to the Loan Agreement in that it governs the terms under which a borrower can access credit. This document often includes a broader scope of terms, such as covenants and conditions that the borrower must adhere to, which may not be present in a standard Loan Agreement. Both documents aim to protect the lender’s interests while outlining the borrower's obligations.

When acquiring a vehicle, it is essential to have the proper documentation to ensure a smooth transfer of ownership, which can be facilitated by the use of Auto Bill of Sale Forms. This form not only confirms the agreement between the seller and buyer but also protects the rights of both parties during the transaction process.

Another related document is the Line of Credit Agreement. This agreement allows borrowers to access a predetermined amount of funds as needed, rather than receiving a lump sum upfront. Like the Loan Agreement, it specifies terms such as interest rates and repayment schedules, but it also includes provisions for how and when funds can be drawn, providing flexibility for the borrower.

The Installment Sale Agreement bears resemblance to the Loan Agreement as well. This document outlines the terms under which a buyer agrees to pay for an asset over time, similar to a loan. Both documents include payment terms, but the Installment Sale Agreement typically involves the transfer of ownership of the asset once all payments are made, while the Loan Agreement does not transfer ownership until the loan is repaid.

The Lease Agreement can also be compared to the Loan Agreement. While primarily used for rental arrangements, a Lease Agreement may include terms for financing the purchase of leased equipment or property. Similar to a Loan Agreement, it specifies payment terms and conditions, but it focuses more on the use of the asset rather than ownership.

The Debt Settlement Agreement is another document that aligns with the Loan Agreement. It outlines the terms under which a borrower and lender agree to settle a debt for less than the full amount owed. While the Loan Agreement establishes the original terms of the loan, the Debt Settlement Agreement modifies those terms to reflect a new understanding, often due to financial hardship on the part of the borrower.

Lastly, the Forbearance Agreement is similar to the Loan Agreement in that it addresses the terms of temporarily suspending loan payments. This document provides a framework for how and when payments will resume and may include adjusted payment terms. While the Loan Agreement sets the original payment schedule, the Forbearance Agreement serves as an amendment to those terms during periods of financial difficulty.

Steps to Filling Out New York Loan Agreement

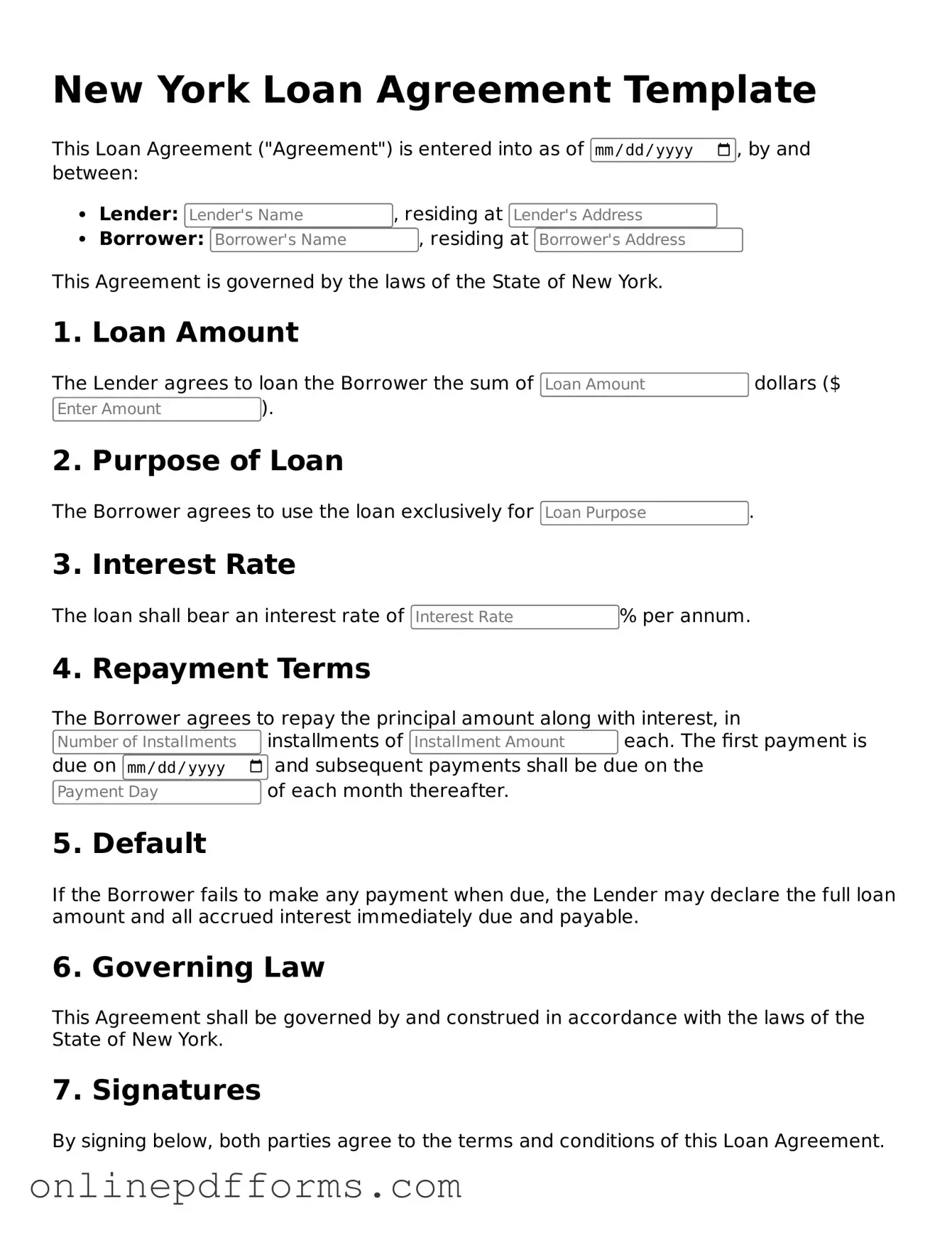

Completing the New York Loan Agreement form is an important step in securing a loan. This document outlines the terms and conditions of the loan, ensuring that both the lender and borrower have a clear understanding of their responsibilities. Follow these steps carefully to ensure the form is filled out correctly.

- Begin by entering the date at the top of the form. This is important for record-keeping purposes.

- Fill in the name and address of the borrower. Ensure that all information is accurate and up-to-date.

- Next, provide the lender's name and address. Double-check for any spelling errors.

- Specify the loan amount in the designated field. Be precise, as this is a critical part of the agreement.

- Indicate the interest rate. Clearly state whether it is fixed or variable.

- Detail the repayment terms, including the duration of the loan and the payment schedule. This section should be clear to avoid any misunderstandings.

- Include any collateral information if applicable. This secures the loan and provides assurance to the lender.

- Review any additional terms or conditions that may be required. Make sure these are clearly stated and agreed upon by both parties.

- Sign and date the form at the bottom. Both the borrower and lender must provide their signatures for the agreement to be valid.

- Make copies of the completed form for both parties' records. This ensures that both the lender and borrower have access to the signed agreement.

After filling out the form, both parties should review it thoroughly. This ensures that all information is correct and that both parties understand the terms of the loan agreement before proceeding. Proper documentation is essential for a smooth transaction.