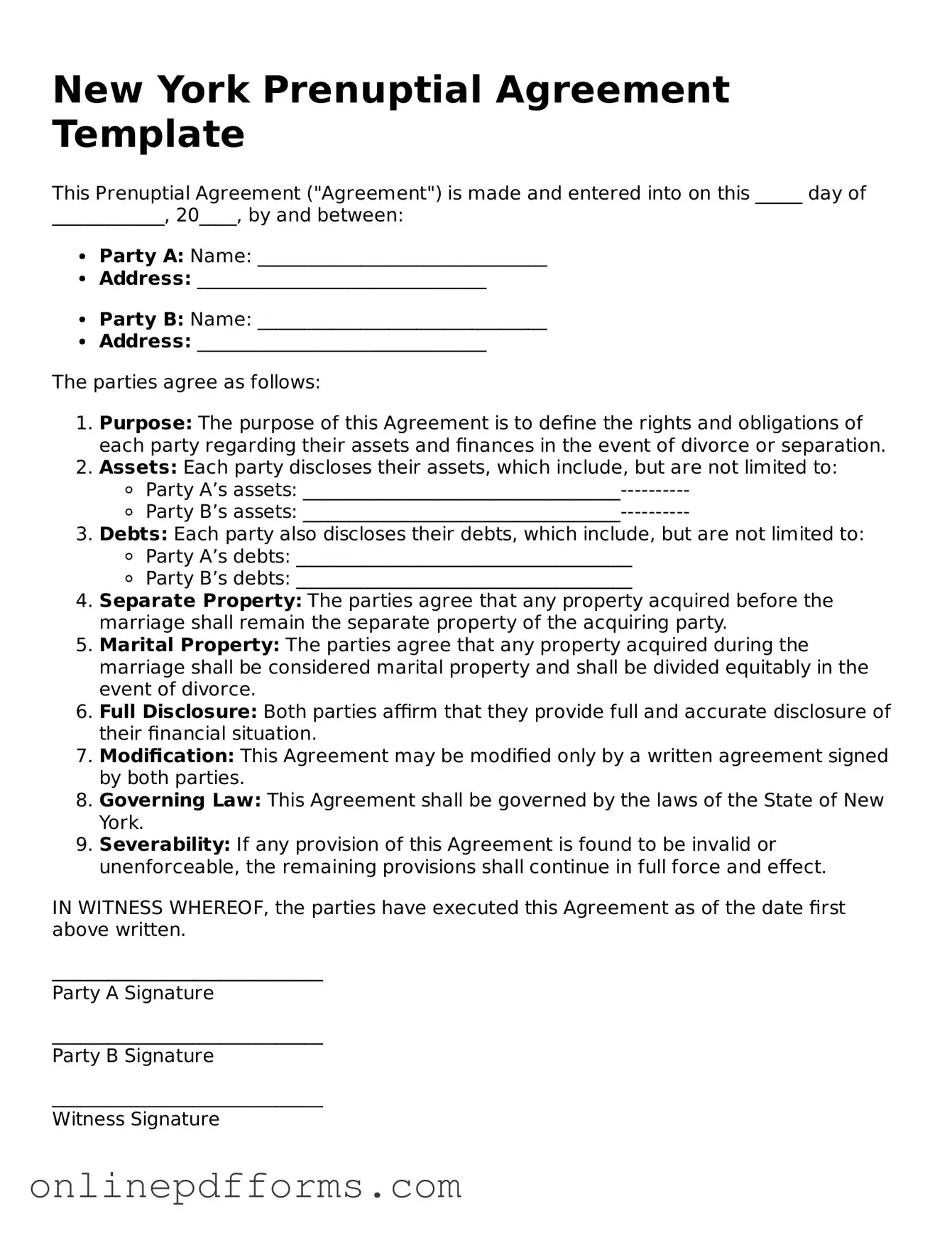

Blank New York Prenuptial Agreement Form

Documents used along the form

When preparing for a marriage, a prenuptial agreement is often a crucial document. However, there are several other forms and documents that may be necessary to ensure a comprehensive understanding of both parties' rights and responsibilities. Below is a list of documents that are commonly used alongside a New York Prenuptial Agreement.

- Postnuptial Agreement: Similar to a prenuptial agreement, this document is created after marriage. It outlines how assets and debts will be handled in the event of divorce or separation.

- Financial Disclosure Statement: This form requires both parties to disclose their financial situation, including assets, debts, and income. Transparency is key to a valid prenuptial agreement.

- Separation Agreement: In the event of a separation, this document outlines the terms of the separation, including asset division and support obligations.

- Divorce Agreement: If a marriage ends, this document details the terms of the divorce, including asset division, child custody, and support arrangements.

- Will: A will specifies how a person's assets will be distributed after their death. It can complement a prenuptial agreement by ensuring that wishes regarding property are clear.

- RV Bill of Sale: This form is essential for documenting the sale of a recreational vehicle in Texas. To get started, click here to get the form.

- Trust Document: This document establishes a trust to manage assets for the benefit of one or more beneficiaries. It can be used to protect assets from creditors or during a divorce.

- Power of Attorney: This form allows one person to make legal and financial decisions on behalf of another, which can be important in situations where one spouse is incapacitated.

- Healthcare Proxy: This document designates someone to make medical decisions on behalf of another person if they are unable to do so themselves, ensuring that healthcare wishes are respected.

- Child Custody Agreement: If children are involved, this document outlines custody arrangements and parenting plans, ensuring that both parents are on the same page.

Understanding these documents can significantly enhance the clarity and security of your financial and personal arrangements. It is advisable to consult with a legal professional to ensure that all necessary documents are correctly prepared and executed.

Other Popular State-specific Prenuptial Agreement Templates

Georgia Prenup Agreement - Define spousal support expectations with a prenuptial agreement.

When buying or selling a trailer in Louisiana, it is essential to complete the necessary documentation to ensure a smooth transaction. One important resource for this process is the Auto Bill of Sale Forms, which provides templates and guidance to help you create a valid Louisiana Trailer Bill of Sale form. This ensures that all relevant details are captured, thereby protecting the interests of both the seller and the buyer.

Florida Prenup Agreement - A prenuptial agreement can help protect a spouse from unfair debts incurred by the other.

Similar forms

The New York Prenuptial Agreement form shares similarities with the Cohabitation Agreement. Both documents serve to establish the rights and responsibilities of individuals entering into a relationship. A Cohabitation Agreement is particularly relevant for couples who choose to live together without marrying. Like a prenuptial agreement, it can outline property division, financial responsibilities, and other important matters, ensuring that both parties have a clear understanding of their arrangement before entering into a shared living situation.

Another document akin to the Prenuptial Agreement is the Postnuptial Agreement. This type of agreement is entered into after marriage and addresses similar issues as a prenuptial agreement, such as asset division and spousal support. Couples may choose to create a postnuptial agreement to clarify their financial arrangements or to reflect changes in their circumstances, making it a flexible option for married couples who want to formalize their financial expectations.

The Separation Agreement is also comparable, as it outlines the terms of a couple’s separation. This document can detail issues such as child custody, visitation rights, and the division of property. While a prenuptial agreement is established before marriage, a separation agreement comes into play when a couple decides to part ways, addressing the legal and financial implications of their separation.

Similarly, the Marital Settlement Agreement is used during divorce proceedings. This document outlines the terms of the divorce, including asset division, alimony, and child support. While a prenuptial agreement aims to prevent disputes before they arise, a marital settlement agreement resolves those disputes once they have emerged, making both documents essential in managing marital finances.

The Estate Plan also bears resemblance to a prenuptial agreement in that it addresses the distribution of assets. Both documents aim to clarify the intentions of individuals regarding their property. An estate plan outlines how a person's assets will be distributed upon their death, while a prenuptial agreement specifies how assets will be managed during marriage and in the event of divorce.

Power of Attorney documents share a connection with prenuptial agreements in that they grant authority to one person to make decisions on behalf of another. In the context of marriage, a prenuptial agreement can influence financial decisions and responsibilities, while a power of attorney allows a designated individual to manage financial or medical decisions if one partner becomes incapacitated.

The Arizona Tractor Bill of Sale form is crucial for documenting the sale and transfer of a tractor in Arizona, ensuring both buyer and seller have a clear record of the transaction. This form not only proves ownership transfer but also records essential details about the sale. For those looking to safely complete their transaction, further information can be found at https://arizonaformspdf.com.

The Living Will is another document that, while primarily focused on healthcare decisions, can be related to prenuptial agreements through its emphasis on personal choice and autonomy. Both documents allow individuals to express their wishes regarding significant life events. A living will specifies medical preferences, while a prenuptial agreement clarifies financial and property preferences within a marriage.

The Trust Agreement is comparable in its focus on asset management and distribution. A trust can be established to manage assets for beneficiaries, similar to how a prenuptial agreement can dictate how assets are handled during marriage and in the event of a divorce. Both documents aim to protect the interests of the individuals involved and ensure that their wishes are honored.

Finally, the Business Partnership Agreement has parallels with prenuptial agreements, particularly when one or both partners in a marriage own a business. This document outlines the roles, responsibilities, and financial arrangements between business partners. Just as a prenuptial agreement can protect individual assets, a business partnership agreement can safeguard business interests, ensuring that both personal and professional assets are clearly defined and protected.

Steps to Filling Out New York Prenuptial Agreement

When preparing to fill out the New York Prenuptial Agreement form, it's important to gather all necessary information and documents beforehand. This will help ensure a smooth process. Below are the steps to complete the form accurately.

- Begin by clearly writing the full names of both parties at the top of the form.

- Provide the current addresses for both individuals. Make sure this information is up-to-date.

- State the date of the intended marriage. This is crucial for the context of the agreement.

- List all assets and liabilities for each party. Be thorough and honest in this section.

- Include any specific terms or conditions that both parties agree upon. This can cover financial arrangements, property rights, and other relevant matters.

- Review the completed form for accuracy. Double-check all names, dates, and figures.

- Once confirmed, both parties should sign the document in the presence of a notary public to ensure its validity.

After completing the form, it may be wise to keep multiple copies for personal records. Consulting with a legal professional can also provide additional guidance tailored to your specific situation.