Blank New York Promissory Note Form

Documents used along the form

A New York Promissory Note is an important document for outlining a loan agreement between a borrower and a lender. However, several other forms and documents often accompany it to ensure clarity and protection for both parties involved. Below is a list of documents that are commonly used alongside a Promissory Note.

- Loan Agreement: This document details the terms of the loan, including the interest rate, repayment schedule, and any collateral involved. It provides a comprehensive overview of the agreement beyond the basic terms found in a Promissory Note.

- Security Agreement: If the loan is secured by collateral, this document outlines what the collateral is and the rights of the lender in case of default. It protects the lender's interests by specifying the assets involved.

- Personal Guarantee: This form is signed by an individual who agrees to be responsible for the loan if the primary borrower defaults. It adds an extra layer of security for the lender.

- Disclosure Statement: This document provides important information about the loan, including fees, interest rates, and terms. It ensures that the borrower understands the financial implications of the agreement.

- Repayment Schedule: A detailed schedule showing when payments are due, the amount of each payment, and how they will be applied. This helps both parties track the repayment process.

- Divorce Settlement Agreement: This document outlines the division of assets and other arrangements in a divorce. For more information, you can visit https://californiapdf.com.

- Amendment Agreement: If any terms of the original Promissory Note need to be changed, this document formalizes those changes. It ensures that both parties agree to the new terms.

- Default Notice: This is a notification sent to the borrower if they fail to meet the terms of the Promissory Note. It serves as a formal reminder of the borrower's obligations.

- Release of Liability: Once the loan is paid in full, this document releases the borrower from any further obligations under the Promissory Note. It provides closure for both parties.

- Loan Payment Receipt: This is a record provided to the borrower after each payment is made. It serves as proof of payment and helps maintain accurate records.

These documents work together with the New York Promissory Note to create a clear framework for the loan agreement. Understanding each of these forms can help both borrowers and lenders navigate their financial responsibilities effectively.

Other Popular State-specific Promissory Note Templates

Blank Promissory Note - Legal remedies for breach of a promissory note can include court judgments.

The proper completion of the Washington Bill of Sale form not only provides clarity regarding the transfer of ownership but also serves as a crucial proof of the transaction, including the identities of the buyer and seller, item descriptions, and sale price, ensuring all parties are protected. For more information on this important document, visit https://pdftemplates.info/washington-bill-of-sale-form.

Free Loan Agreement Template Texas - Disclosures regarding potential risks can also be included within a promissory note.

Similar forms

A loan agreement is a document that outlines the terms between a lender and a borrower regarding a loan. Like a promissory note, it specifies the amount borrowed, the interest rate, and the repayment schedule. However, a loan agreement is typically more comprehensive, often including clauses about collateral, default conditions, and other legal protections for both parties. While a promissory note focuses on the borrower's promise to repay, a loan agreement covers the broader relationship and obligations of both the lender and borrower.

A mortgage is another document that shares similarities with a promissory note. When a borrower takes out a mortgage to buy property, they sign a promissory note to repay the loan, but they also sign a mortgage document that secures the loan with the property itself. The promissory note serves as a promise to pay, while the mortgage provides the lender with the right to take possession of the property if the borrower defaults. This dual structure ensures that both the loan and the collateral are clearly defined.

When dealing with trailer sales, it is important to utilize the correct documentation to streamline the process and ensure compliance with state regulations. The Virginia Trailer Bill of Sale serves this purpose effectively, offering both parties clear evidence of the transaction. For individuals interested in the proper forms to facilitate vehicle transactions, resources such as Auto Bill of Sale Forms can be invaluable in obtaining the right paperwork.

A credit agreement is similar in that it establishes the terms under which a borrower can access credit. Like a promissory note, it details the amount of credit extended, the interest rate, and repayment terms. However, credit agreements often involve revolving credit lines, such as credit cards, where borrowers can draw on the credit as needed. While a promissory note typically represents a single loan transaction, a credit agreement can encompass multiple transactions over time.

An IOU, or informal acknowledgment of debt, is another document that bears resemblance to a promissory note. An IOU indicates that one party owes money to another, but it lacks the formal structure and legal enforceability of a promissory note. While both documents acknowledge a debt, an IOU is often less detailed and may not specify repayment terms or interest rates. This makes it a more casual option, suitable for personal loans among friends or family.

A personal guarantee is similar in that it involves a promise to repay a debt, but it typically involves a third party. When someone signs a personal guarantee, they agree to be responsible for another person’s debt if that person fails to repay it. Like a promissory note, it creates a legal obligation, but it is often used in business contexts where a lender requires additional assurance that the debt will be repaid. This document can provide extra security for lenders, similar to how a promissory note secures the borrower's commitment to repay.

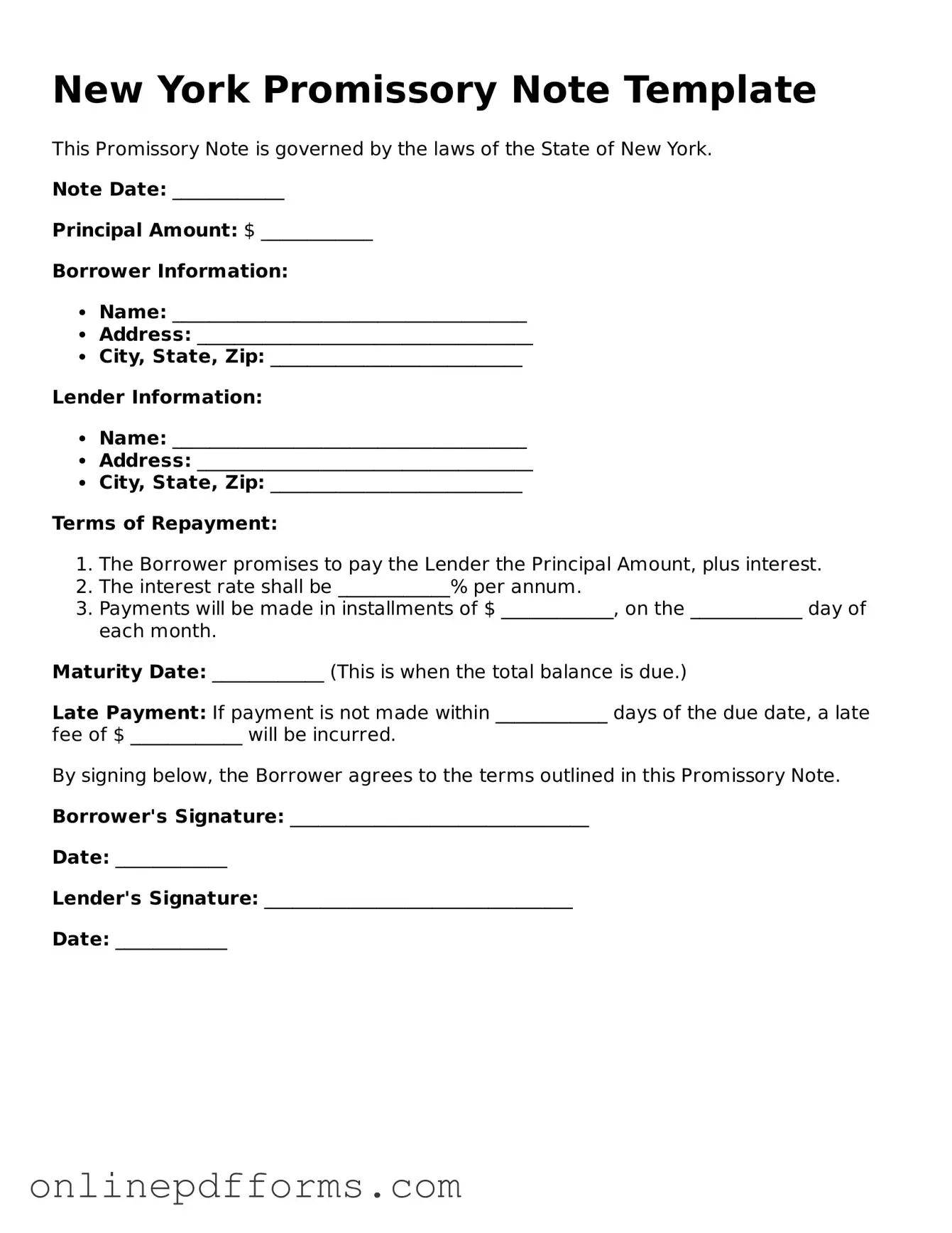

Steps to Filling Out New York Promissory Note

Once you have the New York Promissory Note form in front of you, it is essential to fill it out accurately to ensure clarity and enforceability. After completing the form, you will need to have it signed by both parties and possibly notarized, depending on your specific needs. This step is crucial for the document's validity.

- Begin by entering the date at the top of the form. This date should reflect when the note is being created.

- Next, identify the borrower. Write the full legal name of the individual or entity receiving the loan. Include their address for clarity.

- Then, specify the lender’s information. Provide the full legal name and address of the individual or entity providing the loan.

- Clearly state the principal amount of the loan. This is the total amount being borrowed and should be written in both numerical and written form for accuracy.

- Outline the interest rate, if applicable. Indicate whether the interest is fixed or variable and provide the percentage rate.

- Define the repayment terms. Specify the schedule for payments, including the frequency (e.g., monthly, quarterly) and the duration of the loan.

- Include any late fees or penalties for missed payments. Clearly state the conditions under which these fees will apply.

- Detail any collateral, if applicable. If the loan is secured by an asset, describe the asset and its value.

- Finally, ensure both parties sign the document. Include spaces for the signatures and printed names of the borrower and lender.

After completing these steps, review the form for any errors or omissions. A well-prepared promissory note can help prevent misunderstandings and ensure a smooth lending process.