Blank New York Quitclaim Deed Form

Documents used along the form

A Quitclaim Deed is a legal document used to transfer ownership of real estate from one party to another without any warranties. When using this form in New York, several other documents may accompany it to ensure a smooth transaction. Below is a list of commonly used forms and documents related to the Quitclaim Deed.

- Property Transfer Tax Form: This form is required by the state to report the transfer of property and calculate any applicable taxes.

- Affidavit of Title: This document certifies that the seller has the legal right to transfer the property and that there are no undisclosed claims against it.

- Title Search Report: A report that provides information about the property's ownership history and any liens or encumbrances that may exist.

- Bill of Sale: Used when personal property is included in the transaction, this document outlines the sale of any tangible items associated with the real estate.

- Closing Statement: A detailed account of all financial transactions involved in the sale, including fees, taxes, and the final purchase price.

- Statement of Fact Texas Form: To certify specific vehicle transaction details in Texas, it is important to accurately complete the download an editable form to comply with state laws and avoid legal issues.

- Real Estate Purchase Agreement: This contract outlines the terms and conditions of the sale, including price, contingencies, and closing date.

- Power of Attorney: If the seller cannot be present at the closing, this document allows another person to act on their behalf during the transaction.

- Homeowner’s Association (HOA) Documents: If the property is part of an HOA, these documents provide information about rules, fees, and regulations that govern the community.

- Survey of the Property: A professional survey may be required to define the property boundaries and identify any encroachments or easements.

- Notice of Sale: This document may be filed to formally announce the sale of the property, especially if it is part of a foreclosure process.

Each of these documents plays a vital role in the property transfer process. Ensuring that all necessary forms are completed and filed correctly can help prevent future disputes and facilitate a successful transaction.

Other Popular State-specific Quitclaim Deed Templates

How Do I File a Quit Claim Deed - It serves as a method for one spouse to give up their rights to a jointly held property.

The completion of a sale in Missouri is made easier with the legal safeguards provided by the Missouri Tractor Bill of Sale form, which not only documents the transaction but also serves as essential proof of ownership transfer. To facilitate this process, you can find guidance and templates specifically tailored for this purpose; one such resource is the Bill of Sale for Tractors, which outlines the necessary details for completing your tractor sale.

Florida Quit Claim Deed - This deed is often recommended for personal property gifts.

Similar forms

The Warranty Deed is similar to the Quitclaim Deed in that both documents facilitate the transfer of property ownership. However, the key difference lies in the level of protection offered to the buyer. A Warranty Deed guarantees that the seller holds clear title to the property and has the right to sell it, protecting the buyer against any future claims. In contrast, a Quitclaim Deed does not provide any such guarantees, making it a riskier option for buyers who seek assurance regarding the title's validity.

The Bargain and Sale Deed also shares similarities with the Quitclaim Deed, as it is used to transfer property ownership. This type of deed implies that the seller has an interest in the property but does not guarantee a clear title. While the Quitclaim Deed transfers whatever interest the seller has without warranties, the Bargain and Sale Deed suggests that the seller may have some ownership rights, albeit without any assurances regarding the absence of liens or other encumbrances.

The Special Purpose Deed serves specific functions, such as transferring property in particular situations like foreclosure or tax sales. Like the Quitclaim Deed, it is often used when the seller does not want to provide any warranties about the property. Both documents can facilitate quick transfers, but the Special Purpose Deed may be more limited in its application, as it is designed for specific legal scenarios.

The Grant Deed is another document that shares similarities with the Quitclaim Deed. A Grant Deed conveys property ownership and includes implied warranties that the seller has not transferred the property to anyone else and that the property is free from undisclosed encumbrances. While the Quitclaim Deed provides no such warranties, both documents are commonly used in real estate transactions and can be executed without extensive legal formalities.

The Virginia Trailer Bill of Sale form serves an important role in property transactions involving trailers, providing a clear record of ownership transfer, similar to how various deeds safeguard real estate interests. For those looking to formalize the sale of a trailer, utilizing resources such as Auto Bill of Sale Forms can facilitate this process and ensure that all necessary legal requirements are met, thus minimizing potential disputes between parties involved.

The Deed of Trust is related to property transactions, but it serves a different purpose. This document is used to secure a loan by placing the property as collateral. Although it is not a deed of ownership transfer like the Quitclaim Deed, it involves the same property and can be part of a larger transaction. Both documents require careful attention to detail and must be recorded with the appropriate authorities to be effective.

Lastly, the Affidavit of Title can be seen as similar to the Quitclaim Deed in that it addresses property ownership. This document is used to affirm the status of the title and can be used in conjunction with a Quitclaim Deed to provide some level of assurance to the buyer. However, unlike the Quitclaim Deed, which transfers ownership, the Affidavit of Title merely serves as a declaration about the title's condition and may help clarify any potential issues before a transfer occurs.

Steps to Filling Out New York Quitclaim Deed

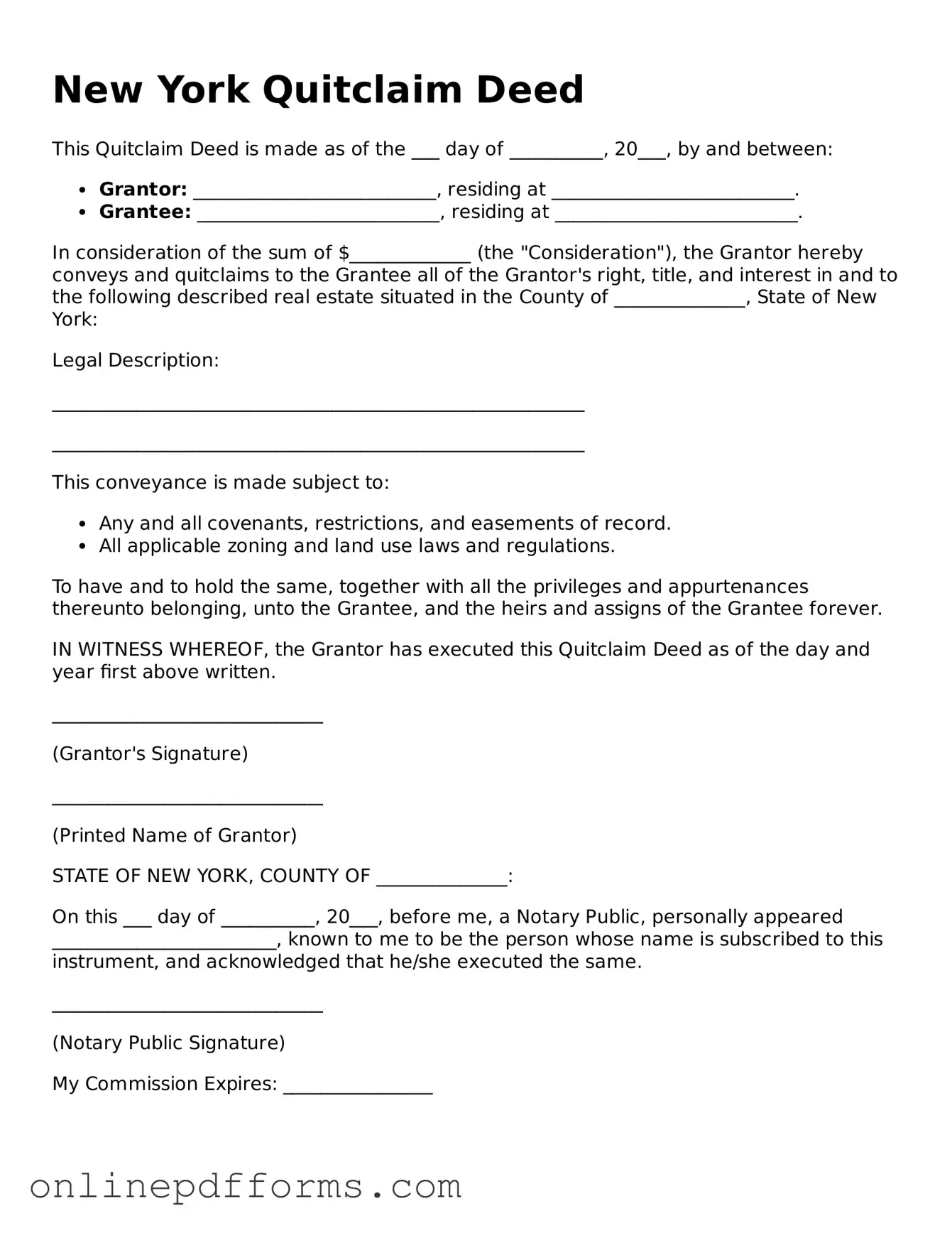

After obtaining the New York Quitclaim Deed form, you will need to provide specific information to complete it accurately. This process involves gathering details about the property and the parties involved in the transaction. Follow the steps below to ensure the form is filled out correctly.

- Begin by entering the name of the grantor (the person transferring the property) at the top of the form.

- Next, include the address of the grantor. This should be the complete mailing address.

- Identify the grantee (the person receiving the property) by writing their full name below the grantor’s information.

- Provide the address of the grantee, ensuring it is accurate and complete.

- In the section for property description, include the full legal description of the property. This may involve referencing the property’s lot number, block number, or any other identifying information.

- Fill in the county where the property is located. This is important for proper filing.

- Sign and date the form where indicated. The grantor must sign the document in the presence of a notary public.

- After the signature, have the notary public complete their section by providing their signature and seal.

Once the form is completed and notarized, it will need to be filed with the appropriate county clerk's office. Be sure to keep a copy for your records after filing.