Blank New York Transfer-on-Death Deed Form

Documents used along the form

The New York Transfer-on-Death Deed form allows individuals to designate beneficiaries for real property, enabling a smooth transfer of ownership upon the owner's death. Alongside this form, several other documents are commonly utilized to ensure proper estate planning and management. Below is a list of related forms that individuals may consider when creating a comprehensive estate plan.

- Last Will and Testament: This document outlines how a person's assets will be distributed after their death. It can name guardians for minor children and specify funeral arrangements.

- Durable Power of Attorney: This form grants someone the authority to make financial and legal decisions on behalf of another individual if they become incapacitated.

- Texas Motorcycle Bill of Sale: This form is essential for transferring ownership of a motorcycle in Texas. It safeguards both the buyer and seller during the transaction. Learn more by visiting https://pdftemplates.info/texas-motorcycle-bill-of-sale-form/.

- Health Care Proxy: This document allows an individual to appoint someone to make medical decisions on their behalf if they are unable to do so themselves.

- Living Will: A living will provides instructions regarding medical treatment preferences in situations where an individual cannot communicate their wishes.

- Beneficiary Designation Forms: These forms are used to designate beneficiaries for specific accounts, such as retirement accounts or life insurance policies, ensuring that these assets transfer directly to the named individuals upon death.

Utilizing these documents in conjunction with the New York Transfer-on-Death Deed can help streamline the estate management process and provide clarity regarding the distribution of assets. It is advisable to consult with a legal professional to ensure all forms are completed accurately and reflect the individual’s intentions.

Other Popular State-specific Transfer-on-Death Deed Templates

Ladybird Deed Texas Form - While a Transfer-on-Death Deed is a valuable tool, it is not a substitute for a complete estate plan or will.

How Much Does a Beneficiary Deed Cost - You remain responsible for property taxes and maintenance even after completing the Transfer-on-Death Deed.

When engaging in the purchase or sale of a vehicle in Washington, it is essential to utilize the Washington Motor Vehicle Bill of Sale form to ensure a smooth transaction. This form not only records the details of the sale but also protects both parties involved by clearly outlining the terms of the agreement. To make the process even more straightforward, you can find the form and additional resources at https://billofsaleforvehicles.com.

Right of Survivorship Deed Pennsylvania - The Transfer-on-Death Deed is an evolving tool, reflecting modern perspectives on estate planning.

Transfer on Death Deed Illinois - Property owners can ensure their assets go to the intended individuals without the usual legal hassles.

Similar forms

The New York Transfer-on-Death Deed (TODD) allows property owners to transfer their real estate to beneficiaries upon their death, without the need for probate. This document is similar to a Last Will and Testament, which also designates how a person's assets should be distributed after their passing. However, unlike a will, which goes through the probate process, a TODD allows for a more straightforward transfer, enabling beneficiaries to take ownership immediately upon the owner's death without additional court proceedings.

Another document akin to the TODD is the Revocable Living Trust. This trust allows individuals to manage their assets during their lifetime and specify how those assets should be distributed upon their death. Like the TODD, a revocable living trust avoids probate, providing a seamless transition of property to beneficiaries. However, a trust can also offer additional benefits, such as asset management during incapacity and privacy, as it does not become a matter of public record.

The Beneficiary Designation form is another important document that shares similarities with the TODD. This form is commonly used for financial accounts, such as life insurance policies or retirement accounts, allowing account holders to name beneficiaries who will receive the assets upon their death. Like the TODD, beneficiary designations bypass probate, ensuring that the intended recipients receive their inheritance quickly and efficiently.

A Joint Tenancy Agreement is also comparable to a Transfer-on-Death Deed. This agreement allows two or more individuals to own property together with rights of survivorship. When one owner passes away, their share automatically transfers to the surviving owner(s), much like how a TODD operates. Both documents provide a means of transferring property outside of probate, but a joint tenancy can complicate matters if one owner wishes to sell their share or if disputes arise among co-owners.

The Lady Bird Deed, or Enhanced Life Estate Deed, is another estate planning tool that resembles the TODD. This deed allows property owners to retain control over their property during their lifetime while designating beneficiaries to receive the property upon death. Similar to a TODD, a Lady Bird Deed avoids probate, but it also allows the original owner to sell or mortgage the property without the beneficiaries' consent, providing greater flexibility.

A Power of Attorney (POA) can be seen as related to the TODD in terms of managing property. A POA grants someone the authority to act on behalf of another person in financial matters, which can include transferring property. While the TODD specifically addresses the transfer of real estate upon death, a POA can be used to manage property during the owner’s lifetime, making it a vital tool for those who may become incapacitated.

The Affidavit of Heirship serves a different but related purpose. This document is used to establish the heirs of a deceased individual when there is no will. While it does not transfer property like a TODD, it can help clarify who inherits property and may be used in conjunction with a TODD if the property owner dies without a clear designation of beneficiaries in other documents.

In the realm of vehicle transactions, having the right documentation is crucial to ensure a smooth transfer of ownership, which is where the importance of Auto Bill of Sale Forms becomes evident. These forms not only capture the essential details of the sale but also safeguard both parties against potential disputes, making the buying and selling process more secure and transparent.

Finally, the Small Estate Affidavit is relevant for those dealing with estates that fall below a certain value threshold. This document allows heirs to claim assets without going through probate. Similar to a TODD, it simplifies the transfer process and can expedite the distribution of assets. However, it is limited to smaller estates, making the TODD a more versatile option for transferring real property regardless of its value.

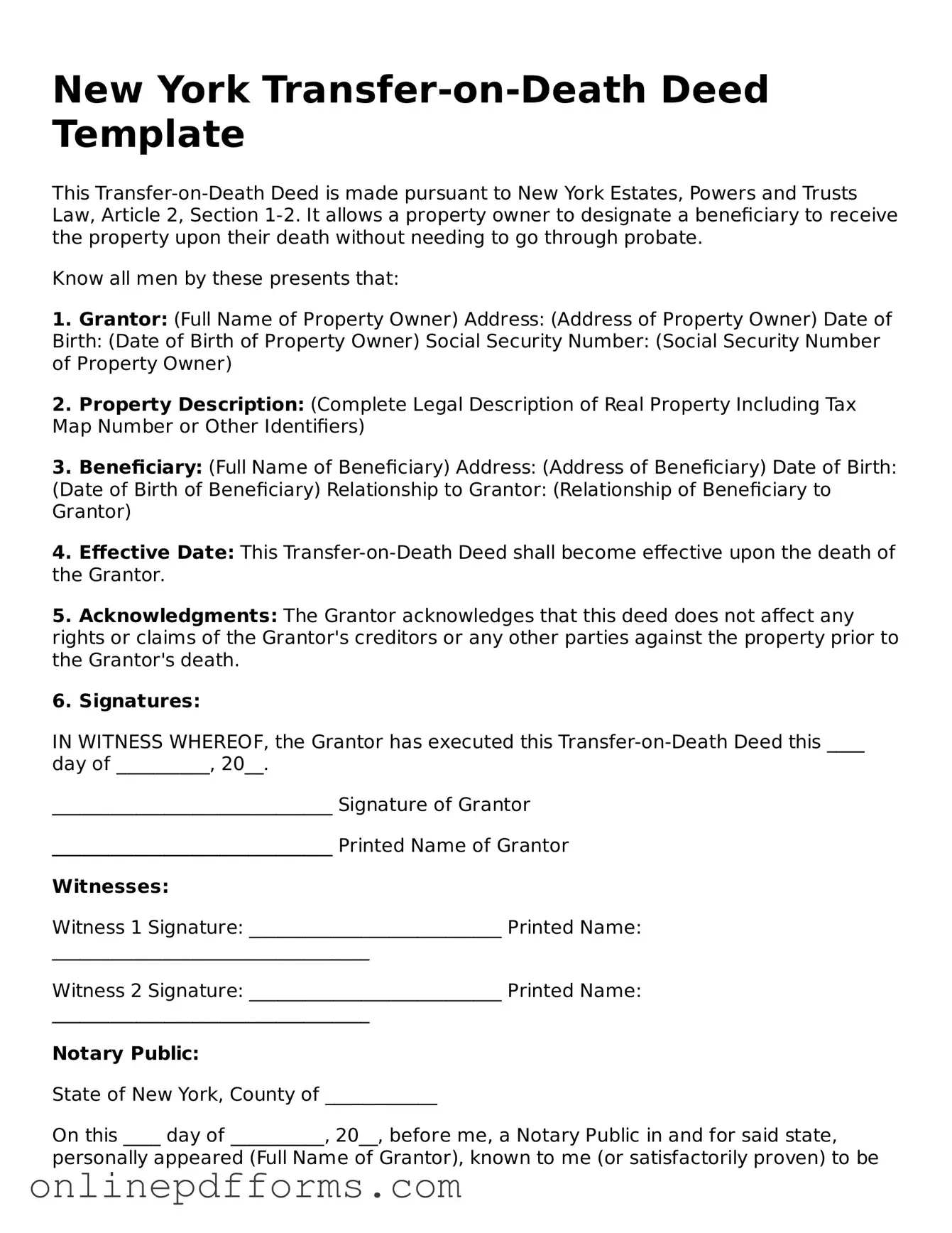

Steps to Filling Out New York Transfer-on-Death Deed

Filling out the New York Transfer-on-Death Deed form is an important step for property owners who wish to transfer their property upon their passing. After completing the form, you will need to ensure it is properly executed and recorded to make it effective. Below are the steps to guide you through the process of filling out the form.

- Obtain the Transfer-on-Death Deed form. You can find this form online or at your local county clerk's office.

- Fill in your name as the owner of the property. Make sure to include your full legal name.

- Provide the address of the property you wish to transfer. This should include the street number, street name, city, and zip code.

- List the name of the beneficiary who will receive the property. This person should be someone you trust.

- Include the beneficiary's address. This should be their full legal address.

- Sign the form in the presence of a notary public. Your signature must be notarized for the deed to be valid.

- Make copies of the completed and notarized form for your records.

- File the original form with the county clerk’s office where the property is located. There may be a filing fee, so be prepared to pay that when you submit the form.