Blank Ohio Articles of Incorporation Form

Documents used along the form

When forming a corporation in Ohio, several additional forms and documents may be required alongside the Articles of Incorporation. Each of these documents serves a specific purpose in the incorporation process and ensures compliance with state regulations.

- Bylaws: These are the internal rules governing the management of the corporation. Bylaws outline the roles of directors and officers, meeting procedures, and shareholder rights.

- Initial Report: In some cases, corporations must file an initial report shortly after incorporation. This document provides updated information about the business, including its address and key personnel.

- Employer Identification Number (EIN): This is a unique number assigned by the IRS for tax purposes. It is necessary for opening a business bank account and filing taxes.

- Operating Agreement: Although typically associated with LLCs, some corporations may choose to create an operating agreement to outline the management structure and operational procedures.

- Affidavit of Residency: To verify your residence in Texas, consult the Texas affidavit of residency form requirements crucial for various legal applications.

- Business Licenses: Depending on the nature of the business, various local, state, or federal licenses may be required. These licenses ensure that the business complies with relevant regulations.

- Shareholder Agreement: This document outlines the rights and responsibilities of shareholders. It can address issues like share transfers, voting rights, and dispute resolution.

- Statement of Information: Similar to the initial report, this document provides ongoing information about the corporation to the state, often required annually or biennially.

Incorporating a business involves several steps, and understanding these additional forms can help ensure a smooth process. Each document plays a crucial role in establishing a legally compliant and well-structured corporation in Ohio.

Other Popular State-specific Articles of Incorporation Templates

How Do I Get a Copy of My Articles of Incorporation in Georgia - Many states have specific requirements for the language used in this document.

Having the appropriate documentation is vital in any RV transaction, and that's where the Vehicle Bill of Sale Forms come into play. This ensures both the buyer and seller have a clear understanding of the agreement, safeguarding their interests and complying with state regulations.

How Much Is Llc in Texas - Can outline limitations on director liability.

Similar forms

The Articles of Incorporation in Ohio serves a specific purpose in establishing a corporation, but several other documents share similar functions in different contexts. One such document is the Certificate of Formation, commonly used in limited liability companies (LLCs). Like the Articles of Incorporation, the Certificate of Formation outlines essential information about the business entity, including its name, purpose, and registered agent. Both documents are filed with the state to legally create the entity and provide a framework for its governance.

Another comparable document is the Bylaws of a corporation. While the Articles of Incorporation serve to formally establish the corporation, the Bylaws govern its internal operations. They outline the roles of directors and officers, the process for holding meetings, and how decisions are made. Essentially, while the Articles provide the legal foundation, the Bylaws detail the rules for managing the corporation.

The Operating Agreement is similar to the Bylaws but is specific to LLCs. This document outlines the management structure and operational procedures of the LLC, including member responsibilities and profit distribution. Like the Articles of Incorporation, the Operating Agreement is essential for defining how the business will function and is often required for compliance with state laws.

The Partnership Agreement is another relevant document, used in partnerships to outline the terms of the partnership relationship. It specifies each partner's contributions, profit-sharing arrangements, and responsibilities. Similar to the Articles of Incorporation, it serves to formalize the business arrangement and can help prevent disputes among partners.

In the realm of nonprofit organizations, the Articles of Incorporation for Nonprofits is a closely related document. This form establishes a nonprofit entity and details its purpose, governance structure, and how it will operate. Like the for-profit Articles of Incorporation, it must be filed with the state to gain legal recognition and tax-exempt status.

The Certificate of Good Standing is another document that, while different in function, relates to the Articles of Incorporation. This certificate verifies that a corporation is legally registered and compliant with state regulations. It can be required for various business activities, such as obtaining loans or entering contracts, ensuring that the corporation remains in good standing after its initial formation.

The Assumed Name Certificate, also known as a DBA (Doing Business As), allows a business to operate under a name different from its legal name. This document is similar to the Articles of Incorporation in that it must be filed with the state, providing transparency about the business's identity and ensuring that consumers can identify the entity behind a business name.

The Business License is another important document that complements the Articles of Incorporation. While the Articles establish the legal entity, a business license grants permission to operate in a specific jurisdiction. This license often requires compliance with local regulations, ensuring that the business meets safety and zoning standards.

The Aaa International Driving Permit Application form is a crucial document for travelers looking to drive in foreign countries. This permit allows individuals to legally operate a vehicle outside the United States, translating their driver's license into multiple languages. Understanding how to fill out this application correctly ensures a smooth process for travelers planning their adventures. For more information, you can visit https://fillable-forms.com/blank-aaa-international-driving-permit-application.

Finally, the Tax Identification Number (TIN) application is akin to the Articles of Incorporation in that it is essential for a corporation's operations. The TIN, issued by the IRS, is used for tax reporting purposes and is necessary for opening bank accounts and hiring employees. While the Articles create the entity, the TIN is crucial for its financial operations.

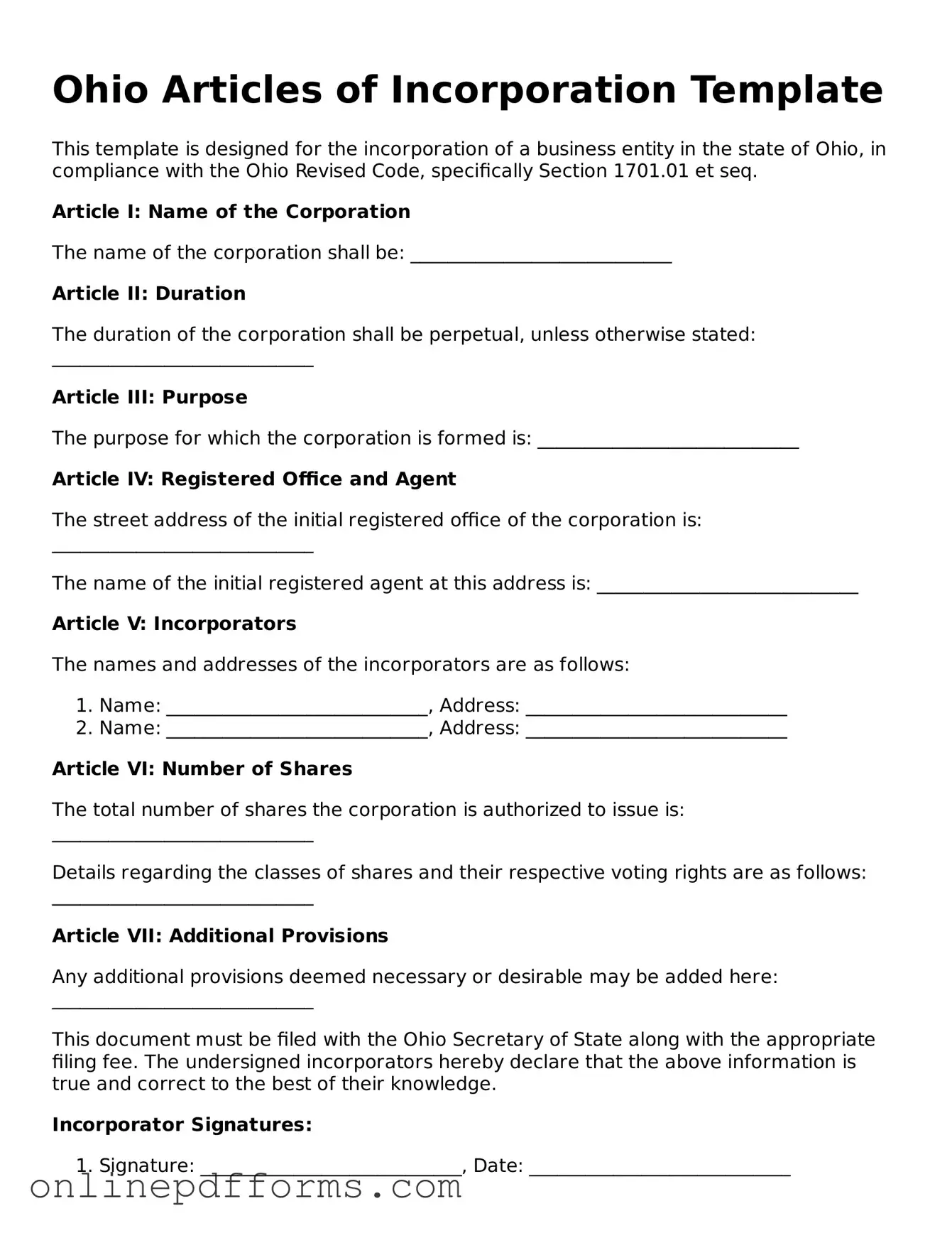

Steps to Filling Out Ohio Articles of Incorporation

After completing the Ohio Articles of Incorporation form, you will need to submit it to the Ohio Secretary of State's office along with the required filing fee. Ensure that all information is accurate and complete to avoid delays in processing.

- Obtain the Ohio Articles of Incorporation form from the Ohio Secretary of State's website or office.

- Fill in the name of the corporation. Ensure it complies with Ohio naming requirements.

- Provide the purpose of the corporation. Be clear and concise about the business activities.

- Enter the duration of the corporation. Most corporations are set up to exist perpetually unless specified otherwise.

- List the address of the principal office. This should be a physical address, not a P.O. Box.

- Designate a registered agent. This can be an individual or a business entity authorized to do business in Ohio.

- Include the name and address of the incorporator(s). This is the person or persons who are filing the Articles.

- Indicate whether the corporation will have members. This is relevant for certain types of corporations.

- Sign and date the form. The incorporator(s) must sign to validate the document.

- Prepare the filing fee. Check the current fee amount on the Ohio Secretary of State’s website.

- Submit the completed form and fee to the Ohio Secretary of State’s office, either online or by mail.