Blank Ohio Deed Form

Documents used along the form

When engaging in real estate transactions in Ohio, several forms and documents accompany the Ohio Deed form. Each of these documents serves a specific purpose, ensuring that the transfer of property rights is conducted smoothly and legally. Below is a list of commonly used forms that you may encounter alongside the Ohio Deed.

- Property Transfer Tax Affidavit: This document is required to report the sale of real estate to the county auditor. It helps determine the applicable transfer tax based on the sale price of the property.

- Title Insurance Policy: A title insurance policy protects the buyer and lender against any issues that may arise with the property's title. This could include disputes over ownership or claims against the property.

- Settlement Statement (HUD-1): This form provides a detailed account of all the costs associated with the transaction. It outlines the financial aspects of the sale, including fees, taxes, and the distribution of funds.

- Affidavit of Title: This document is a sworn statement by the seller affirming their ownership of the property and disclosing any liens or encumbrances. It assures the buyer of the seller's legal right to transfer the property.

- Texas Vehicle Purchase Agreement: This form is essential for vehicle sales, ensuring all terms, such as purchase price and vehicle details, are clearly stated. For more information, visit https://pdftemplates.info/texas-vehicle-purchase-agreement-form/.

- Power of Attorney: In some cases, a seller may not be able to attend the closing. A power of attorney allows another person to act on their behalf, facilitating the signing of documents necessary for the transaction.

- Purchase Agreement: This is the initial contract between the buyer and seller that outlines the terms of the sale, including the purchase price, contingencies, and closing date. It sets the stage for the entire transaction.

- Disclosure Statements: Ohio law requires sellers to provide specific disclosures regarding the condition of the property. These statements inform buyers of any known issues, such as lead paint, mold, or structural problems.

- Deed of Trust: This document secures the loan used to purchase the property. It gives the lender a claim against the property if the borrower defaults on their mortgage obligations.

Understanding these documents is crucial for anyone involved in real estate transactions in Ohio. Each form plays a vital role in ensuring that the transfer of property is executed properly and that all parties are protected throughout the process.

Other Popular State-specific Deed Templates

How Long Does It Take to Record a Deed in Florida - Investors frequently encounter deeds as part of property acquisitions in real estate portfolios.

Contract for Deed Texas Template - In most cases, a notary public must witness the signing of a deed.

The process of filing a separation can be daunting, but having a comprehensive understanding of the necessary documentation is essential for a smooth transition. One key element in this process is utilizing the Arizona Marital Separation Agreement form, which can be accessed at arizonaformspdf.com/. This form helps ensure that all terms are clearly articulated and agreed upon, thereby minimizing conflicts between the parties involved.

Grant Deed in California - A Deed outlines the roles and rights of both parties involved.

How Do I Get My Deed to My House - Deeds usually include essential information like names, dates, and signatures.

Similar forms

The Ohio Deed form is similar to a Quitclaim Deed. Both documents serve the purpose of transferring property ownership from one party to another. However, a Quitclaim Deed does not guarantee that the grantor has clear title to the property. Instead, it simply conveys whatever interest the grantor may have in the property at the time of the transfer. This makes it a popular choice for transferring property between family members or in situations where the parties trust each other, as it avoids the need for extensive title searches or warranties.

When purchasing an RV, it is essential to use proper documentation to ensure a smooth transaction, and the Auto Bill of Sale Forms play a crucial role in this process by providing legal proof of the sale while outlining the necessary details of the agreement between the buyer and seller.

An additional document that shares similarities with the Ohio Deed form is the Warranty Deed. Like the Ohio Deed, a Warranty Deed also facilitates the transfer of property ownership. However, it offers a higher level of protection for the grantee. The grantor guarantees that they hold clear title to the property and will defend against any claims that may arise. This assurance provides peace of mind for the buyer, making the Warranty Deed a preferred choice in most real estate transactions.

Lastly, the Bargain and Sale Deed is another document that resembles the Ohio Deed form. This type of deed conveys property without any warranties regarding the title. While it implies that the grantor has the right to sell the property, it does not guarantee that the title is free from encumbrances. This makes it a useful option in certain transactions, particularly when the buyer is willing to accept the risks associated with potential title issues. The Bargain and Sale Deed can streamline the transfer process, especially in situations where a thorough title search may not be feasible.

Steps to Filling Out Ohio Deed

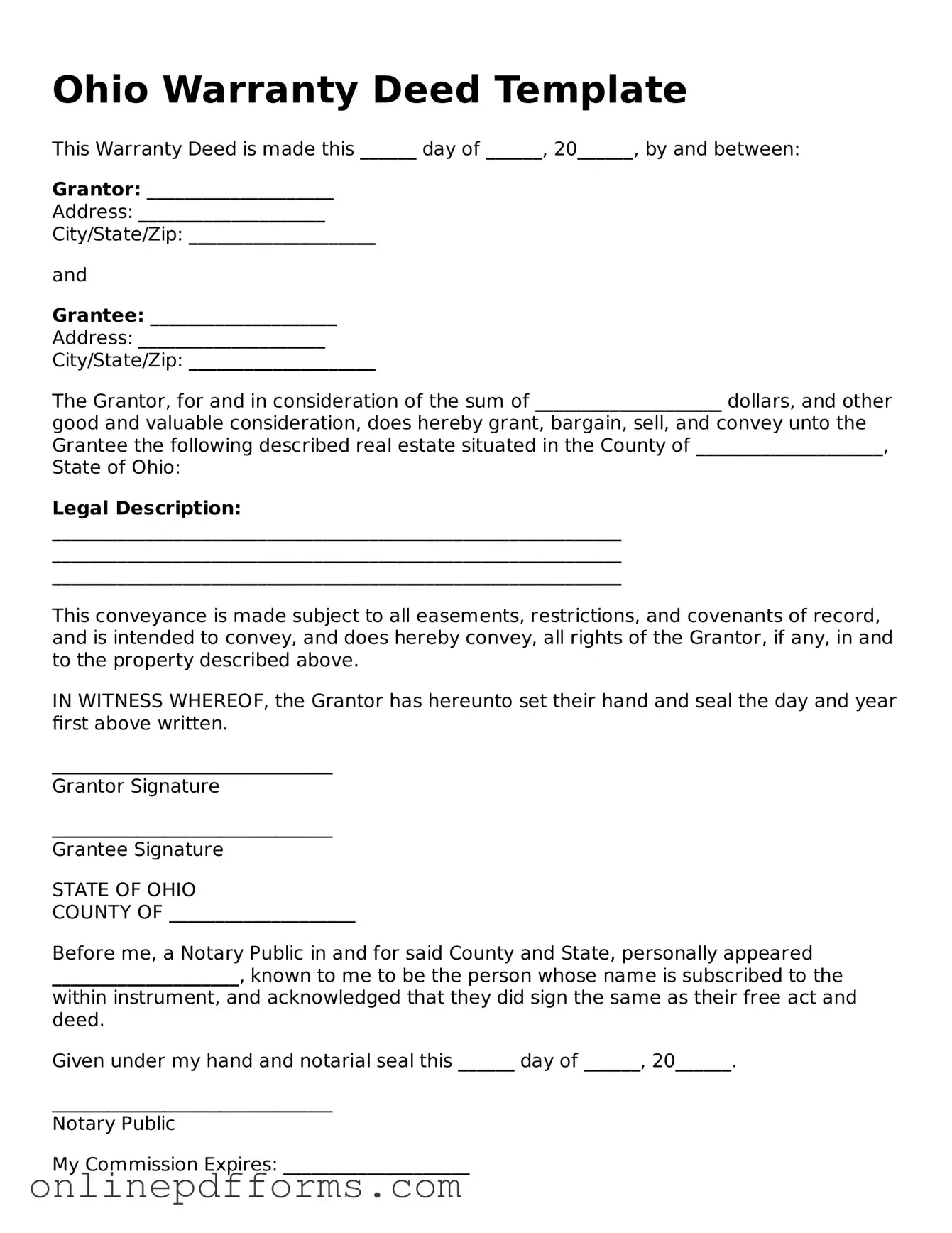

Once you have the Ohio Deed form ready, you will need to fill it out carefully. Each section requires specific information, and accuracy is important to ensure the deed is valid. Follow these steps to complete the form correctly.

- Start with the title of the document. Write “Deed” at the top of the form.

- Provide the date the deed is being executed. This is typically the date you are signing the document.

- Identify the grantor (the person transferring the property). Include the full name and address.

- Next, identify the grantee (the person receiving the property). Again, include their full name and address.

- Describe the property being transferred. Include the legal description, which may be found in previous deeds or property records.

- Indicate the consideration (the amount paid for the property). This can be a dollar amount or a statement indicating that the transfer is a gift.

- Sign the deed in the designated area. The grantor must sign the document for it to be valid.

- Have the deed notarized. This step is crucial as it verifies the identities of the signers.

- Finally, file the completed deed with the county recorder’s office where the property is located. This step officially records the transfer.