Blank Ohio Deed in Lieu of Foreclosure Form

Documents used along the form

When navigating the process of a deed in lieu of foreclosure in Ohio, several other forms and documents may be required to ensure a smooth transition. Each document plays a crucial role in the overall procedure, helping both the homeowner and the lender to clarify their rights and responsibilities. Below is a list of commonly used documents that may accompany the Ohio Deed in Lieu of Foreclosure form.

- Mortgage Release Form: This document formally releases the borrower from the mortgage obligation once the deed in lieu has been executed. It serves to clear the borrower's credit history regarding the specific mortgage.

- Property Condition Disclosure: This form provides information about the condition of the property. It is important for the lender to understand any potential issues that may affect the property's value.

- RV Bill of Sale Form: An Auto Bill of Sale Forms is crucial for completing the sale of a Recreational Vehicle, ensuring legal recognition of the ownership transfer.

- Settlement Statement: Often referred to as a HUD-1 form, this statement outlines the financial details of the transaction, including any costs or fees associated with the deed in lieu process.

- Affidavit of Title: This document confirms the ownership of the property and assures the lender that there are no undisclosed liens or encumbrances. It is essential for protecting the lender's interests.

- Release of Liability Agreement: This agreement releases the borrower from any further financial obligations related to the mortgage after the deed in lieu is completed, providing peace of mind for the homeowner.

Understanding these documents is vital for both homeowners and lenders involved in the deed in lieu of foreclosure process. Each plays a significant role in ensuring that all parties are informed and protected throughout the transaction.

Other Popular State-specific Deed in Lieu of Foreclosure Templates

Deed in Lieu of Mortgage - The process aims to allow borrowers to exit their mortgage responsibilities without further legal complications.

The Texas Real Estate Purchase Agreement form is essential for anyone involved in a real estate transaction in Texas, as it clarifies the obligations and rights of both buyers and sellers. By utilizing this form, parties can ensure a smooth process and avoid potential disputes. For more information and to access the form, visit pdftemplates.info/texas-real-estate-purchase-agreement-form/.

California Pre-foreclosure Property Transfer - A borrower considering this option should also weigh any potential impact on future home ownership opportunities.

Similar forms

A mortgage release, also known as a satisfaction of mortgage, is a document that signifies the borrower has fully paid off their mortgage. Once the mortgage is satisfied, the lender releases their claim on the property, allowing the owner to have clear title. Similar to a deed in lieu of foreclosure, a mortgage release removes the lender's interest in the property, but it occurs after the borrower has fulfilled their payment obligations rather than as a result of default. Both documents aim to provide clarity in ownership and eliminate any potential disputes over the property's title.

A short sale agreement allows a homeowner to sell their property for less than the amount owed on the mortgage, with the lender's approval. This process is often pursued when the homeowner is facing financial difficulties but wants to avoid foreclosure. Like a deed in lieu of foreclosure, a short sale involves the lender agreeing to accept less than the full amount owed. Both options aim to mitigate losses for the lender while providing the homeowner a way to move on from a challenging financial situation, albeit through different mechanisms.

The Arizona Motor Vehicle Bill of Sale form is essential for homeowners looking to make a smooth transition out of financial difficulties, similar to the processes involved in a Short Sale or Bankruptcy Filing. This form, which can be conveniently found at mypdfform.com/blank-arizona-motor-vehicle-bill-of-sale/, facilitates the transfer of vehicle ownership while ensuring that all necessary legal details are recorded properly.

A foreclosure notice is a legal document that informs a borrower of the lender's intent to take possession of the property due to missed payments. This notice marks the beginning of the foreclosure process. While a deed in lieu of foreclosure is a voluntary agreement to transfer property ownership to the lender, a foreclosure notice is an indication of a more adversarial process. Both documents relate to the borrower’s inability to meet mortgage obligations, but they represent different stages and approaches to resolving the situation.

A loan modification agreement is a document that alters the terms of an existing loan to make it more manageable for the borrower. This can include changing the interest rate, extending the loan term, or reducing the principal balance. Like a deed in lieu of foreclosure, a loan modification aims to help the borrower avoid foreclosure by making their mortgage payments more affordable. Both documents reflect efforts to address financial difficulties, but a loan modification keeps the borrower in their home, while a deed in lieu of foreclosure results in the transfer of ownership to the lender.

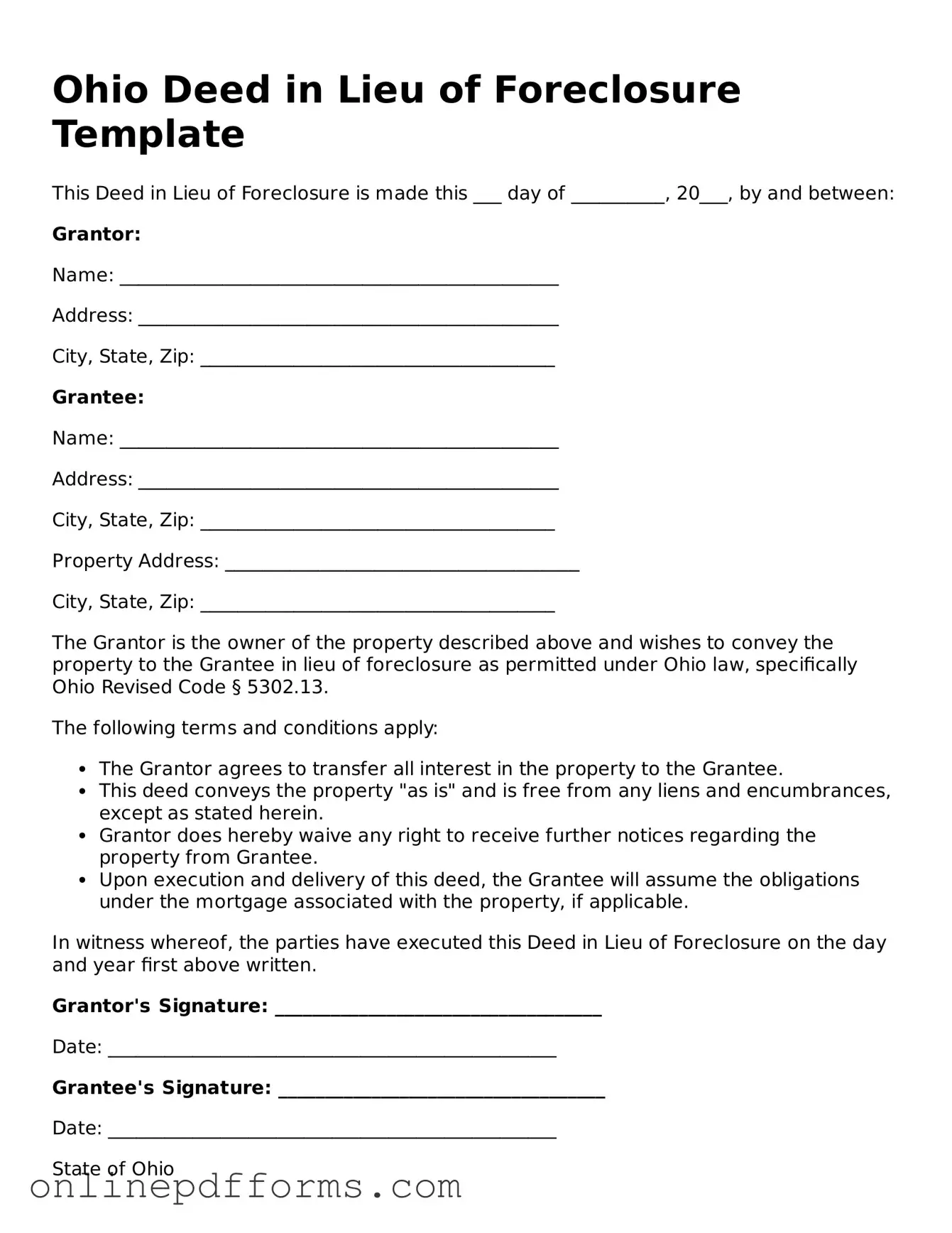

Steps to Filling Out Ohio Deed in Lieu of Foreclosure

Once you have decided to proceed with a Deed in Lieu of Foreclosure, it’s important to fill out the form accurately. This document will help facilitate the transfer of property ownership back to the lender, allowing you to avoid the lengthy foreclosure process. Follow these steps carefully to ensure everything is completed correctly.

- Begin by downloading the Ohio Deed in Lieu of Foreclosure form from a reputable source or obtain a hard copy from your lender.

- At the top of the form, fill in the name of the borrower(s). This should be the individual(s) who hold the mortgage on the property.

- Next, provide the address of the property being transferred. Make sure to include the street address, city, state, and zip code.

- In the designated section, enter the name of the lender or financial institution that will receive the property.

- Indicate the date on which the deed is being executed. This is typically the date you are signing the document.

- Carefully read the terms outlined in the form. If you agree with all the terms, sign and date the document where indicated. If there are multiple borrowers, ensure that all parties sign.

- Have the document notarized. This step is crucial as it adds a layer of authenticity to the form.

- Once notarized, make copies of the signed document for your records.

- Finally, submit the original deed to the lender. Confirm with them whether they require any additional documents or information.

After submitting the form, you will await confirmation from your lender regarding the acceptance of the deed. This process may take some time, so it’s important to stay in communication with your lender for updates. Remember, this step is essential in moving forward and alleviating the stress of foreclosure.