Blank Ohio Durable Power of Attorney Form

Documents used along the form

When creating a Durable Power of Attorney (DPOA) in Ohio, it's important to consider other documents that can complement or enhance the effectiveness of your planning. These forms can provide additional clarity and support for your wishes regarding financial and healthcare decisions. Below is a list of six common documents often used alongside a Durable Power of Attorney.

- Living Will: This document outlines your preferences for medical treatment in situations where you may be unable to communicate your wishes. It specifies what life-sustaining treatments you do or do not want, ensuring that your healthcare providers and loved ones understand your desires.

- Healthcare Power of Attorney: Similar to a DPOA, this document designates someone to make healthcare decisions on your behalf if you are incapacitated. It focuses specifically on medical decisions, providing clarity on your treatment preferences.

- Will: A will is a legal document that outlines how your assets will be distributed upon your death. It can also appoint guardians for minor children, ensuring that your wishes are respected after you pass away.

- Trust: A trust is a legal arrangement that allows you to transfer assets to a trustee, who will manage those assets for the benefit of your beneficiaries. Trusts can help avoid probate and provide greater control over how and when your assets are distributed.

- Financial Power of Attorney: This document grants someone the authority to manage your financial affairs. While a DPOA can cover both financial and healthcare decisions, a separate financial power of attorney can provide more specific guidance for financial matters.

- Trailer Bill of Sale: It's important to document the sale of your trailer with a proper form, such as the Bill of Sale for Trailers, to ensure a smooth transfer of ownership and comply with registration requirements.

- Beneficiary Designations: These are forms used to specify who will receive your assets upon your death, such as life insurance policies and retirement accounts. Keeping these designations updated is crucial for ensuring that your assets go to the intended recipients.

Each of these documents plays a vital role in comprehensive planning. By considering them alongside your Durable Power of Attorney, you can create a more robust framework that addresses your financial, healthcare, and estate planning needs. This proactive approach helps ensure that your wishes are honored and that your loved ones are supported during difficult times.

Other Popular State-specific Durable Power of Attorney Templates

General Power of Attorney Form Pennsylvania - Having a Durable Power of Attorney in place signifies responsible planning for potential future incapacity.

Poa Form Texas - Its validity typically depends on your mental competence at the time you create it.

Obtaining a California Do Not Resuscitate Order form is essential for anyone who wishes to communicate their end-of-life preferences clearly, allowing them to ensure that their wishes are honored in emergency medical situations; for more information, you can visit https://californiapdf.com/.

Does Durable Power of Attorney Cover Medical - In cases of joint accounts, discuss the extent of decisions your agent may make.

Durable Power of Attorney Florida Pdf - You can specify limitations on the authority granted to your agent.

Similar forms

The Ohio Durable Power of Attorney form is similar to a General Power of Attorney. Both documents grant authority to an agent to make decisions on behalf of the principal. However, a General Power of Attorney typically becomes invalid if the principal becomes incapacitated, while the Durable Power of Attorney remains effective even in such situations. This distinction is crucial for individuals who want their agent to continue managing their affairs if they can no longer do so themselves.

Another document that shares similarities is the Healthcare Power of Attorney. This form specifically allows an individual to designate someone to make medical decisions on their behalf. Like the Durable Power of Attorney, it remains effective if the principal becomes incapacitated. The key difference lies in the focus; the Healthcare Power of Attorney is limited to health-related decisions, while the Durable Power of Attorney can cover a broader range of financial and legal matters.

A Living Will is another document that is often compared to the Durable Power of Attorney. While a Living Will outlines an individual's wishes regarding medical treatment in end-of-life situations, it does not appoint someone to make decisions on their behalf. In contrast, the Durable Power of Attorney allows for a designated agent to make various decisions, including those related to healthcare, but it can be more comprehensive in scope.

The Revocable Trust shares some characteristics with the Durable Power of Attorney. Both documents allow individuals to plan for their future and manage their assets. A Revocable Trust can help avoid probate and allows the grantor to retain control over their assets during their lifetime. However, unlike the Durable Power of Attorney, which grants decision-making authority to an agent, a Revocable Trust places assets in a trust for management by a trustee.

For those navigating the complexities of legal documents, understanding the nuances of various forms like the Statement of Fact Texas is essential. This formal document, utilized for certifying pertinent details such as vehicle transactions in Texas, mandates accurate information submission to prevent serious legal repercussions. By carefully completing the form, individuals can ensure compliance with state regulations and avoid penalties for misinformation. To assist in this process, you can read more about the document to facilitate proper understanding and completion.

The Financial Power of Attorney is closely related to the Durable Power of Attorney, as both documents enable an agent to handle financial matters. The Financial Power of Attorney may be limited to specific financial transactions, while the Durable Power of Attorney can encompass a wider range of powers. This allows for more flexibility in managing the principal's affairs, especially if the principal becomes incapacitated.

Lastly, the Guardian Appointment document is another form that can be compared to the Durable Power of Attorney. This document is used to appoint a guardian for an individual who is unable to care for themselves. While the Durable Power of Attorney allows someone to manage financial and legal decisions, the Guardian Appointment focuses on personal care and welfare. Both documents aim to protect the interests of individuals, but they serve different purposes in the realm of decision-making.

Steps to Filling Out Ohio Durable Power of Attorney

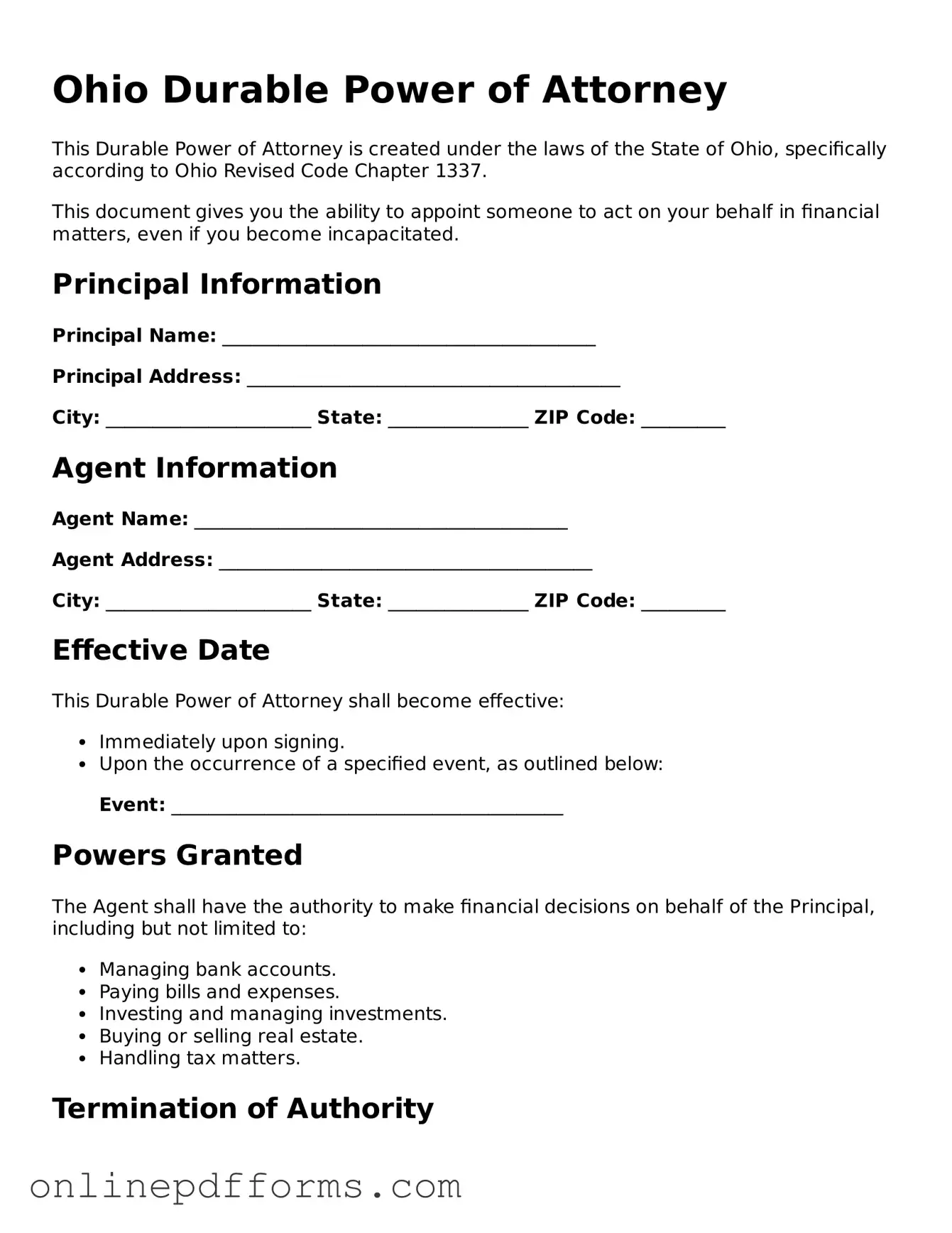

Filling out the Ohio Durable Power of Attorney form requires careful attention to detail. This document will allow you to appoint someone to make decisions on your behalf in case you become unable to do so. Follow these steps to ensure that the form is completed correctly.

- Obtain the Ohio Durable Power of Attorney form. You can find it online or at legal stationery stores.

- Begin by filling in your name and address at the top of the form. This identifies you as the principal.

- Next, provide the name and address of the person you are appointing as your attorney-in-fact. This person will have the authority to act on your behalf.

- Specify the powers you wish to grant. You can choose general powers or limit them to specific tasks, such as managing your finances or making healthcare decisions.

- Include any additional instructions or limitations regarding the powers granted, if necessary. This can help clarify your intentions.

- Sign and date the form in the presence of a notary public. This step is crucial as it verifies your identity and ensures the document is legally binding.

- Have the notary public complete their section of the form. They will confirm your signature and provide their seal.

- Make copies of the completed form. Keep the original in a safe place and provide copies to your attorney-in-fact and any relevant parties.

Once you have completed these steps, your Durable Power of Attorney form is ready for use. Ensure that your appointed attorney-in-fact understands your wishes and is prepared to act in your best interest.