Blank Ohio Employment Verification Form

Documents used along the form

The Ohio Employment Verification form is an essential document used to confirm an individual's employment status. It is often accompanied by several other forms and documents that provide additional context or information. Below is a list of related documents that may be required or helpful in conjunction with the Employment Verification form.

- W-2 Form: This form reports an employee's annual wages and the taxes withheld from their paycheck. It is often used to verify income for loans or benefits.

- Pay Stubs: Recent pay stubs provide a detailed breakdown of an employee's earnings, deductions, and hours worked. They serve as proof of current income.

- Offer Letter: This document outlines the terms of employment, including position, salary, and benefits. It can help clarify the nature of the employment relationship.

- Employment Contract: A formal agreement between the employer and employee detailing job responsibilities, compensation, and duration of employment. It provides legal backing for the employment terms.

- Tax Returns: Personal tax returns can serve as proof of income over a longer period. They are often requested for financial assessments or loan applications.

- Background Check Authorization: This form allows an employer to conduct a background check on an employee. It is often required by companies during the hiring process.

- Social Security Card: A copy of the employee's Social Security card may be required for identity verification and tax purposes.

- Driver's License or ID: A government-issued identification helps confirm the identity of the individual and may be needed for various applications.

- Automobile Bill of Sale: This document serves as a critical record for buyers and sellers in the vehicle market, ensuring legal transfer of ownership and is often required for vehicle registration. For more details, check the Automobile Bill of Sale.

- Reference Letters: Letters from previous employers or colleagues can provide insight into the employee's work ethic and capabilities, supporting the employment verification process.

Gathering these documents along with the Ohio Employment Verification form can streamline the verification process and ensure that all necessary information is available. It is important to keep these documents organized and accessible for any future needs.

Other Popular State-specific Employment Verification Templates

Snap Income Verification - The form can help in confirming eligibility for government assistance programs.

Texas Work Verification Letter - It may require notarization in some industries to ensure authenticity.

Understanding the implications of a Texas Power of Attorney form is essential for making informed decisions regarding one's health and financial well-being. This form empowers an individual to designate someone they trust to act on their behalf, providing peace of mind for both the principal and the agent. For those interested in the nuances of this important document and its potential benefits, read more about the process and considerations involved.

Uscis Form I-9 - Employees should request this form from their employer directly.

Similar forms

The I-9 form is a crucial document for employment verification in the United States. It requires employers to verify the identity and employment eligibility of their employees. Like the Ohio Employment Verification form, the I-9 is filled out by both the employee and employer. It collects information such as the employee's name, address, and Social Security number, while also requiring proof of identity through various forms of identification. This form is essential for compliance with federal immigration laws.

In situations where marital separation is being considered, knowing how to navigate legal documentation can be essential. The Arizona Marital Separation Agreement form provides a structured way for couples to define their terms during separation, addressing key aspects such as asset distribution and child custody arrangements. For more information on this important document, visit arizonaformspdf.com, which can guide you through the necessary steps to complete your form accurately.

The W-4 form is another important document that shares similarities with the Ohio Employment Verification form, though its primary focus is on tax withholding. Employees fill out the W-4 to inform their employers of their tax situation. Both forms require personal information such as name and address, and both are used by employers to ensure compliance with regulations—one for tax purposes and the other for employment eligibility.

The 1099 form is used for reporting income received by independent contractors and freelancers. While it serves a different purpose than the Ohio Employment Verification form, it still requires detailed information about the individual’s identity, including their name and taxpayer identification number. Both forms are essential for ensuring that the correct information is reported to the government, though the 1099 is primarily focused on income rather than employment status.

The state-specific employment verification forms, such as those used in California or New York, are similar to Ohio's form in that they are designed to confirm an employee's eligibility for work. These forms often require similar information, such as personal details and employment history. However, each state may have its own specific requirements and processes, reflecting local laws and regulations.

The Social Security Administration (SSA) verification process is another document that parallels the Ohio Employment Verification form. Employers often need to verify an employee's Social Security number to ensure they are legally authorized to work. Both processes involve confirming identity and eligibility, but the SSA verification focuses specifically on the accuracy of Social Security numbers, which is crucial for tax reporting and benefits eligibility.

The Employee Eligibility Verification (EEV) is a form that some employers use to confirm an employee's eligibility to work in the United States. Similar to the Ohio Employment Verification form, the EEV collects personal information and requires the employer to verify the employee's identity and work authorization. This form is particularly important for industries that require strict compliance with immigration laws.

The background check authorization form is another document that shares similarities with the Ohio Employment Verification form. While its primary purpose is to allow employers to conduct background checks on potential employees, it also requires the individual to provide personal information. Both forms aim to ensure that the employer is making informed hiring decisions while adhering to legal standards.

The state unemployment insurance (UI) application is a document that employees may need to fill out when seeking unemployment benefits. Like the Ohio Employment Verification form, it requires personal information and employment history. Both forms are essential for ensuring that individuals receive the benefits they are entitled to, although the UI application is focused on providing financial assistance rather than verifying employment status.

Finally, the Fair Credit Reporting Act (FCRA) disclosure form is similar in that it involves the collection of personal information for the purpose of conducting background checks. Employers must provide this disclosure to candidates before obtaining a credit report. Both the FCRA disclosure and the Ohio Employment Verification form aim to protect individuals’ rights while ensuring that employers have the necessary information to make informed decisions.

Steps to Filling Out Ohio Employment Verification

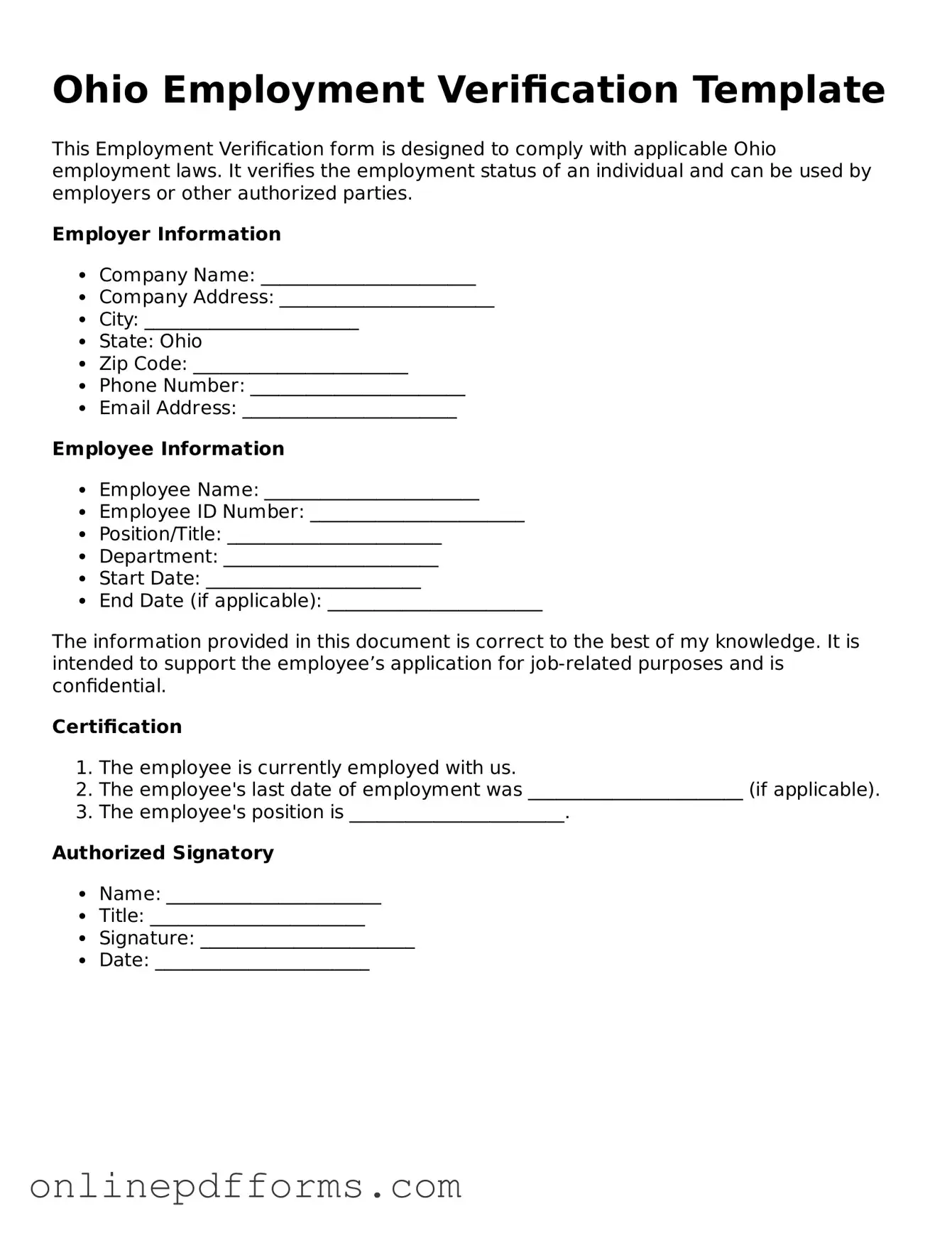

After receiving the Ohio Employment Verification form, it's essential to fill it out accurately to ensure a smooth verification process. Follow these steps carefully to complete the form correctly.

- Begin by entering your personal information. Include your full name, address, and contact details.

- Provide your Social Security number. Make sure this is accurate to avoid any delays.

- Fill in your employment details. This includes your job title, the name of your employer, and the dates of your employment.

- Indicate your current employment status. Specify whether you are still employed, have left, or are on leave.

- Sign and date the form. Your signature confirms that the information you provided is correct.

- Submit the form according to the instructions provided. Ensure you send it to the correct address or email as specified.

Once you have completed these steps, the next phase involves your employer or the designated verifier reviewing the information. They will use this to confirm your employment status as needed.