Blank Ohio Last Will and Testament Form

Documents used along the form

A Last Will and Testament is an essential document for anyone looking to outline their wishes regarding the distribution of their assets after death. However, several other forms and documents often accompany a will to ensure a comprehensive estate plan. Below are some commonly used documents that complement the Ohio Last Will and Testament.

- Living Will: This document specifies an individual's preferences regarding medical treatment in situations where they may become incapacitated and unable to communicate their wishes. It guides healthcare providers and family members in making decisions about life-sustaining measures.

- Durable Power of Attorney: A Durable Power of Attorney allows an individual to designate someone else to make financial or legal decisions on their behalf if they become unable to do so. This document remains effective even if the person becomes incapacitated.

- Statement of Fact Texas: This official document certifies specific information, such as vehicle transaction details, ensuring compliance with Texas law. For assistance in filling out the form, view and download the document.

- Trusts: Trusts can be established to manage assets during a person's lifetime and after their death. They can help avoid probate, provide tax benefits, and ensure that assets are distributed according to the grantor's wishes.

- Beneficiary Designations: Certain assets, such as life insurance policies and retirement accounts, allow individuals to designate beneficiaries. These designations take precedence over a will, ensuring that specific assets are transferred directly to the named individuals upon death.

Incorporating these documents into an estate plan can provide clarity and direction for loved ones during difficult times. Each document serves a unique purpose and can help ensure that an individual's wishes are honored and upheld.

Other Popular State-specific Last Will and Testament Templates

Can I Do My Own Will - Provides clarity on the management of business interests after the testator’s death.

To ensure a smooth transaction when buying or selling a tractor in Missouri, it's essential to use a proper legal document. The Bill of Sale for Tractors serves as an official record of the sale, detailing vital information that protects both parties involved in the deal.

What Are the Requirements for a Will to Be Valid in Florida - A legally binding statement issued by a testator during their lifetime.

Similar forms

The Ohio Last Will and Testament form shares similarities with a Living Will, which outlines an individual's preferences regarding medical treatment in situations where they cannot communicate their wishes. Like a Last Will, a Living Will is a crucial document that reflects personal desires and intentions. Both documents serve to ensure that an individual's wishes are honored, whether in matters of estate distribution or medical care. While one deals with end-of-life decisions regarding health care, the other focuses on the distribution of assets after death.

Understanding the significance of a comprehensive General Power of Attorney form is vital for those looking to delegate authority in their personal and financial affairs. This document empowers an appointed individual to make critical decisions on behalf of another, ensuring that their interests are well protected.

Another document akin to the Last Will is a Durable Power of Attorney. This document allows a person to designate someone else to make financial or legal decisions on their behalf if they become incapacitated. Similar to a Last Will, it is essential for ensuring that an individual's preferences are respected when they can no longer advocate for themselves. Both documents are proactive measures that help individuals maintain control over their affairs, even in challenging circumstances.

A Trust Agreement is also comparable to the Last Will. This document allows individuals to manage their assets during their lifetime and specify how those assets should be distributed after their death. Trusts can offer advantages such as avoiding probate, which can simplify the process for heirs. Like a Last Will, a Trust Agreement ensures that an individual's wishes regarding asset distribution are clearly defined and legally binding.

The Health Care Proxy is another important document that parallels the Last Will. It allows individuals to appoint someone to make medical decisions on their behalf if they are unable to do so. This document serves a similar purpose to a Living Will, as it ensures that a person's health care preferences are respected. Both documents emphasize the importance of having a trusted person advocate for an individual’s wishes in critical situations.

A Codicil is a document that modifies an existing Last Will and Testament. It can add, change, or revoke provisions in the original will without the need to create an entirely new document. This similarity lies in their shared purpose of ensuring that an individual's final wishes are accurately reflected and updated as life circumstances change. Codicils provide a straightforward way to make adjustments while maintaining the integrity of the original will.

The Revocable Living Trust also bears resemblance to the Last Will. This document allows individuals to retain control over their assets while providing for their distribution upon death. Like a Last Will, it details the wishes of the individual regarding asset management and distribution. The key difference lies in the fact that a Revocable Living Trust can take effect during the individual's lifetime, providing added flexibility and control over assets.

Finally, the Joint Will is similar to the Last Will in that it is a single document executed by two individuals, typically spouses, outlining their mutual wishes regarding asset distribution. This document simplifies the process for couples who want to ensure that their shared intentions are clearly documented. Like a Last Will, a Joint Will serves to protect the interests of both parties and provides clarity in the event of one partner's passing.

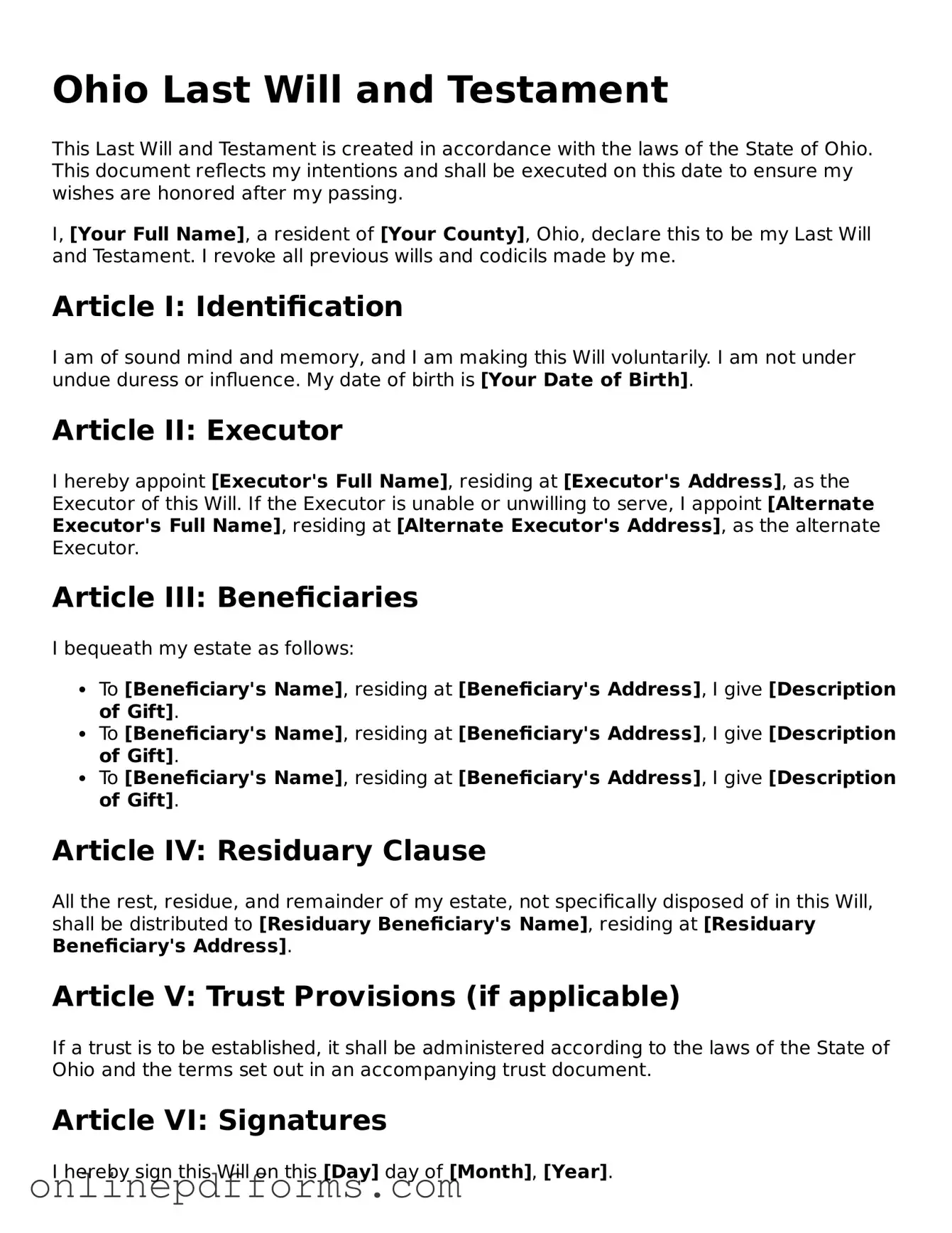

Steps to Filling Out Ohio Last Will and Testament

After obtaining the Ohio Last Will and Testament form, it is essential to complete it accurately to ensure that your wishes regarding the distribution of your assets are clearly articulated. The following steps will guide you through the process of filling out the form.

- Begin by entering your full legal name at the top of the form.

- Next, provide your address, including the city, state, and zip code.

- Clearly state that you are of sound mind and not under any undue influence.

- Designate an executor by naming the individual who will be responsible for carrying out your wishes. Include their full name and contact information.

- List your beneficiaries, specifying their names and the relationship to you. Indicate what each beneficiary will receive.

- If applicable, include any specific bequests or gifts you wish to make to individuals or organizations.

- Indicate how you want your remaining assets to be distributed after specific bequests have been made.

- Include any provisions for the care of minor children, if necessary, naming guardians and outlining any specific instructions.

- Sign the document in the presence of two witnesses. Ensure that they also sign the form, confirming they witnessed your signature.

- Consider having the document notarized to add an additional layer of authenticity, though it is not required in Ohio.

Once completed, store the form in a safe place and inform your executor and loved ones of its location. Regularly review and update the will as necessary to reflect any changes in your life circumstances.