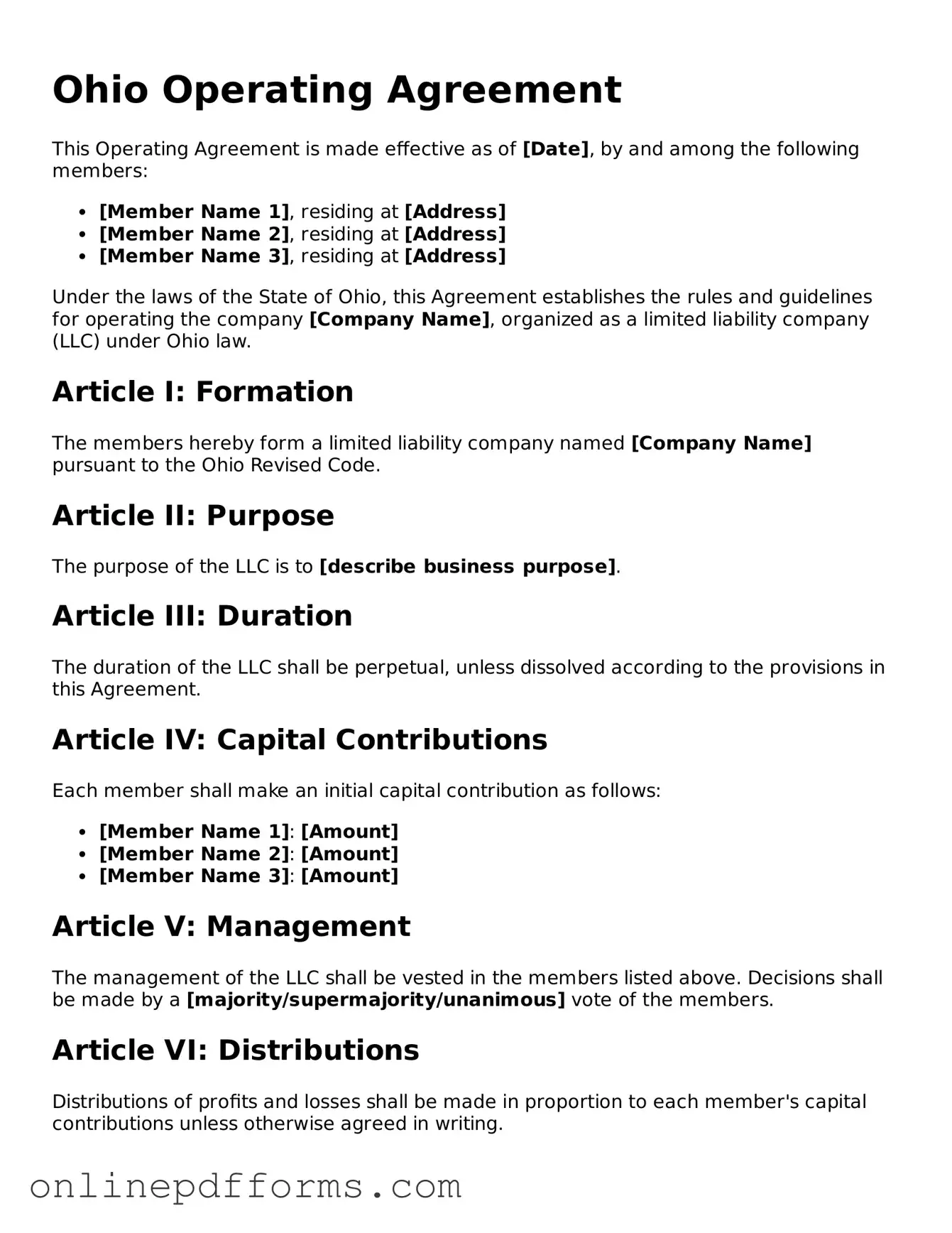

Blank Ohio Operating Agreement Form

Documents used along the form

When forming a limited liability company (LLC) in Ohio, the Operating Agreement is a crucial document that outlines the management structure and operational procedures of the business. However, several other forms and documents are often used in conjunction with the Operating Agreement to ensure compliance with state laws and to facilitate smooth business operations. Below is a list of these important documents.

- Articles of Organization: This is the foundational document required to officially create an LLC in Ohio. It includes essential information such as the company name, address, and the names of the members or managers.

- Member Consent: This document serves to record the agreement among members regarding specific decisions or actions, particularly when a formal meeting is not held. It ensures that all members are on the same page.

- Operating Procedures: While the Operating Agreement covers the broad strokes of management, Operating Procedures detail the day-to-day operations and responsibilities of members or managers, providing clarity on how the business will function.

- Tax Forms: Depending on the structure and activities of the LLC, various tax forms may be necessary. These could include forms for federal, state, and local tax obligations, ensuring compliance with tax regulations.

- I-864 Form: Also known as the Affidavit of Support, this form is crucial for sponsors of immigrants, demonstrating financial stability and support. For guidance on completing this form, visit pdftemplates.info/uscis-i-864-form.

- Bylaws: Although not always required, bylaws can complement the Operating Agreement by outlining the internal rules and regulations governing the LLC's operations, including voting procedures and member rights.

Each of these documents plays a vital role in establishing a well-organized and legally compliant LLC in Ohio. Together with the Operating Agreement, they help ensure that all members understand their rights and responsibilities, contributing to the overall success of the business.

Other Popular State-specific Operating Agreement Templates

Operating Agreement Llc California Template - This document protects the personal assets of members from business debts.

For those seeking a reliable way to document their transaction, the official Florida Tractor Bill of Sale form provides essential protection for both buyers and sellers, ensuring all pertinent details are captured for a successful transfer of ownership.

Operating Agreement Llc Florida Sample - The document details the handling of financial records and reporting.

Similar forms

The Ohio Operating Agreement is similar to a Partnership Agreement. Both documents outline the structure and operational procedures of a business entity. In a Partnership Agreement, partners define their roles, responsibilities, and profit-sharing arrangements. This ensures that all parties are on the same page, much like an Operating Agreement does for members of a limited liability company (LLC). The primary goal of both documents is to provide clarity and prevent disputes among stakeholders.

Another document that parallels the Ohio Operating Agreement is the Corporate Bylaws. While Corporate Bylaws govern the internal management of a corporation, they share similarities with an Operating Agreement in terms of outlining the rules and procedures for the organization. Both documents address issues such as decision-making processes, voting rights, and the roles of key individuals within the entity. They serve to formalize the governance structure and help maintain order within the organization.

The Shareholders Agreement is also akin to the Ohio Operating Agreement. This document is used primarily in corporations and outlines the rights and obligations of shareholders. Like an Operating Agreement, it addresses how decisions are made, how shares are transferred, and how disputes are resolved. Both agreements aim to protect the interests of the parties involved and ensure that the business operates smoothly.

The Texas Trailer Bill of Sale form is a crucial document that facilitates the process of buying or selling a trailer in the state of Texas. It serves as a formal record of the transaction, detailing the exchange between buyer and seller. This form not only confirms the sale but also transfers ownership of the trailer, making it an essential part of the sales process. For those interested in understanding similar documents, you can also explore Auto Bill of Sale Forms.

Similarly, a Joint Venture Agreement shares characteristics with the Ohio Operating Agreement. This document is created when two or more parties collaborate on a specific project or business activity. Like an Operating Agreement, it outlines each party's contributions, responsibilities, and profit-sharing arrangements. The intent is to provide a clear framework for cooperation, reducing the risk of misunderstandings or conflicts.

Lastly, the Non-Disclosure Agreement (NDA) can be seen as a related document. While its primary purpose is to protect confidential information, it often accompanies other agreements, including Operating Agreements. Both documents emphasize the importance of trust and confidentiality in business relationships. An NDA ensures that sensitive information shared among members or partners remains protected, complementing the operational guidelines set forth in an Operating Agreement.

Steps to Filling Out Ohio Operating Agreement

Once you have gathered the necessary information, you can proceed to fill out the Ohio Operating Agreement form. This document will outline the structure and operating procedures of your business. Follow these steps to complete the form accurately.

- Begin by entering the name of your LLC at the top of the form.

- Provide the principal address of the LLC. This should be a physical address, not a P.O. Box.

- List the names and addresses of all members involved in the LLC. Ensure that each member's information is complete and accurate.

- Specify the purpose of the LLC. Describe the business activities the LLC will engage in.

- Indicate the management structure. Decide whether the LLC will be member-managed or manager-managed and fill in the relevant details.

- Outline the capital contributions from each member. Clearly state the amount each member is contributing to the LLC.

- Detail the distribution of profits and losses among the members. Specify how profits will be shared and how losses will be handled.

- Include any additional provisions that may be relevant to your LLC. This can include buy-sell agreements, voting rights, or other operational rules.

- Review the form for any errors or omissions. Ensure that all information is accurate and complete.

- Finally, have all members sign and date the form. This step is crucial for the agreement to be valid.