Blank Ohio Prenuptial Agreement Form

Documents used along the form

When preparing a prenuptial agreement in Ohio, several other documents may be beneficial to ensure that all aspects of the agreement are thoroughly addressed. Each of these documents serves a specific purpose and can help clarify the intentions of both parties involved.

- Financial Disclosure Statement: This document provides a detailed account of each party's financial situation, including assets, liabilities, income, and expenses. Transparency in financial matters is crucial for a fair prenuptial agreement.

- Address Change Form: For those in California, updating your address with the relevant authorities is vital for maintaining accurate records. This can be done by submitting the Address Change California form, which is essential for licensed professionals. To learn more about this important process, visit californiapdf.com.

- Postnuptial Agreement: Similar to a prenuptial agreement, this document is created after the marriage takes place. It can address changes in circumstances or provide updates to the original prenuptial agreement.

- Property Settlement Agreement: This agreement outlines how property and debts will be divided in the event of a divorce. It can be used alongside a prenuptial agreement to clarify expectations regarding asset division.

- Will or Estate Plan: While not directly related to a prenuptial agreement, having a will or estate plan ensures that both parties' wishes regarding their assets are documented. This can prevent conflicts in the future and complement the terms set forth in the prenuptial agreement.

By considering these additional documents, individuals can create a more comprehensive legal framework that protects their interests and fosters a clear understanding between partners. It is always advisable to consult with a legal professional to ensure that all necessary documents are properly prepared and executed.

Other Popular State-specific Prenuptial Agreement Templates

California Prenup Agreement - A prenuptial agreement can cover how to handle financial windfalls.

To facilitate a smooth transaction, it is recommended to utilize Auto Bill of Sale Forms, which provide an essential framework for documenting the sale and ensuring that all necessary information is recorded accurately, protecting both the buyer and the seller in the process.

Illinois Prenup Agreement - An agreement that can provide peace of mind regarding individual financial security.

New York Prenup Agreement - This agreement demonstrates a commitment to transparent communication.

Georgia Prenup Agreement - Help prepare for life's uncertainties with a prenup.

Similar forms

A Cohabitation Agreement is similar to a prenuptial agreement in that it outlines the rights and responsibilities of partners who choose to live together without marrying. This document can address issues like property ownership, financial responsibilities, and how assets will be divided if the relationship ends. Like a prenuptial agreement, it is a proactive measure that helps clarify expectations and reduce conflict in the future.

A Postnuptial Agreement serves a similar purpose but is executed after marriage. Couples can use this document to modify or clarify financial arrangements and asset distribution. This agreement can be particularly useful if circumstances change during the marriage, such as a significant increase in income or the acquisition of new property. Both agreements aim to protect individual interests and ensure transparency.

A Separation Agreement is often used when a couple decides to live apart but is not yet divorced. This document outlines how assets and responsibilities will be handled during the separation period. Much like a prenuptial agreement, it can cover child support, property division, and other financial obligations, providing a clear framework to avoid disputes while living separately.

In addition to these agreements, it is important to consider documentation related to the sale of personal property, such as a trailer. A Trailer Bill of Sale is a vital legal document that records this transaction, detailing information about the trailer and the parties involved. To learn more about this form and how to properly complete it, you can visit pdftemplates.info/trailer-bill-of-sale-form.

A Divorce Settlement Agreement is reached during the divorce process. It details how the couple will divide their assets and responsibilities once the marriage is dissolved. Similar to a prenuptial agreement, this document aims to establish a fair arrangement, ensuring that both parties understand their rights and obligations post-divorce.

An Estate Plan, including a will and trusts, shares similarities with a prenuptial agreement in that both documents address the distribution of assets. While a prenuptial agreement focuses on asset division during a marriage or upon divorce, an estate plan outlines how those assets will be handled after death. Both documents are essential for ensuring that individual wishes are respected and legally upheld.

A Financial Power of Attorney grants someone the authority to make financial decisions on behalf of another person. This document can be seen as similar to a prenuptial agreement in that it involves the management of assets and financial responsibilities. Both documents help clarify who has control over financial matters, ensuring that decisions are made according to the individual's wishes.

A Business Partnership Agreement is relevant for couples who own a business together. This document outlines each partner's roles, contributions, and how profits and losses will be shared. Like a prenuptial agreement, it aims to prevent disputes by clearly defining each party's expectations and responsibilities, especially if the partnership dissolves.

A Child Custody Agreement is crucial for couples with children. While it primarily focuses on the welfare of the children, it can also touch on financial responsibilities related to child support. This agreement shares a common goal with a prenuptial agreement: to provide clarity and structure in potentially contentious situations, ensuring that all parties understand their roles and obligations.

An Asset Protection Trust is designed to safeguard assets from creditors or legal claims. This document is similar to a prenuptial agreement in that it aims to protect individual interests. Both instruments help individuals plan for their financial future and can be particularly relevant for those in high-risk professions or facing potential lawsuits.

A Living Trust allows individuals to manage their assets during their lifetime and dictate how those assets should be distributed after death. This document is akin to a prenuptial agreement as it involves planning for asset distribution and can help avoid probate, making the transfer of assets smoother. Both documents emphasize the importance of clear intentions regarding asset management.

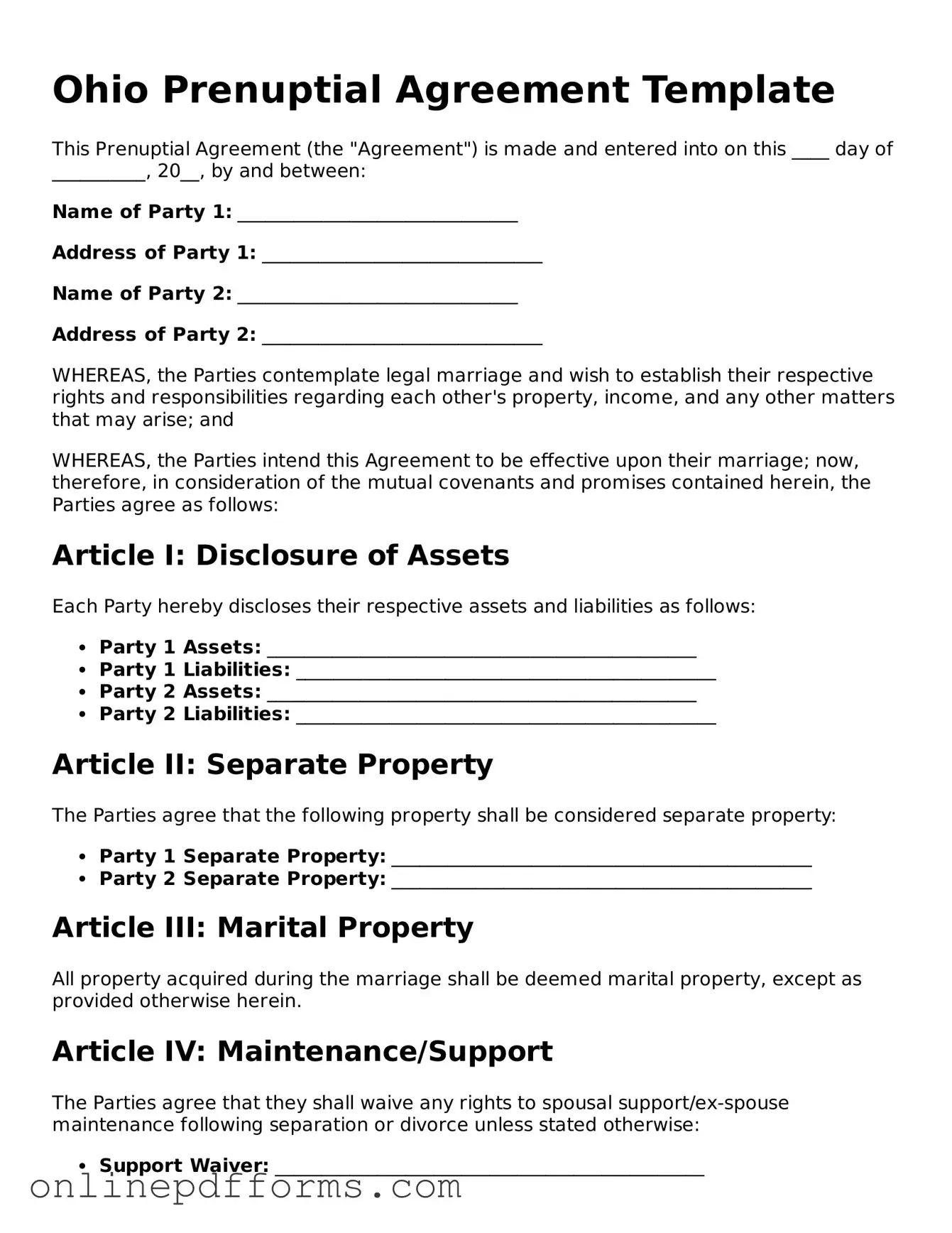

Steps to Filling Out Ohio Prenuptial Agreement

Filling out the Ohio Prenuptial Agreement form requires careful attention to detail. This document is essential for couples planning to marry who wish to outline their financial rights and responsibilities. Following these steps will help ensure that the form is completed accurately.

- Begin by obtaining the Ohio Prenuptial Agreement form from a reliable source, such as a legal website or a family law attorney.

- Read through the entire form to understand the sections and requirements before filling it out.

- Enter the full names of both parties at the top of the form. Ensure the names are spelled correctly.

- Provide the date of the marriage in the designated section.

- List all assets and liabilities for each party. Be thorough and include bank accounts, real estate, debts, and any other financial interests.

- Clearly state how the couple wishes to handle property acquired during the marriage. Specify if it will be considered joint or separate property.

- Include any provisions regarding spousal support or alimony, if applicable. Detail the terms clearly.

- Both parties must sign and date the agreement. Ensure that the signatures are witnessed, if required.

- Consider having the agreement notarized to enhance its legal standing.

Once the form is completed, it is advisable to keep copies for both parties. Consulting with a legal professional can provide additional assurance that the agreement meets all necessary legal standards and adequately protects both parties' interests.