Blank Ohio Promissory Note Form

Documents used along the form

In addition to the Ohio Promissory Note form, several other documents are commonly used in financial transactions. Each of these forms serves a specific purpose and helps clarify the terms of the agreement between the parties involved. Understanding these documents can aid in ensuring that all legal obligations are met.

- Loan Agreement: This document outlines the terms of the loan, including the amount borrowed, interest rate, repayment schedule, and any collateral involved. It provides a comprehensive overview of the obligations of both the lender and borrower.

- Real Estate Purchase Agreement: This essential document sets forth the terms and conditions for property sales, crucial for providing clarity in real estate transactions. For more details, visit https://pdftemplates.info/texas-real-estate-purchase-agreement-form/.

- Security Agreement: Used when a loan is secured by collateral, this document specifies the assets that back the loan. It protects the lender's interests in case of default.

- Personal Guarantee: This is a promise made by an individual to repay a loan if the borrowing entity defaults. It adds an extra layer of security for lenders.

- Disclosure Statement: This document provides important information about the loan terms, including fees, interest rates, and potential risks. It ensures that borrowers are fully informed before entering into an agreement.

- Amortization Schedule: This schedule breaks down each payment into principal and interest components over the life of the loan. It helps borrowers understand how their payments will affect the outstanding balance.

- Loan Application: This form collects information about the borrower’s financial status, credit history, and purpose of the loan. Lenders use it to assess the risk of lending.

- Default Notice: If a borrower fails to make payments, this document notifies them of their default status. It often serves as a precursor to further legal action.

- Release of Liability: This document is used when a loan is paid off. It releases the borrower from any further obligations under the promissory note, providing peace of mind.

Each of these documents plays a vital role in the lending process. They help define the relationship between the parties and protect their interests. Familiarity with these forms can lead to better decision-making and more successful financial transactions.

Other Popular State-specific Promissory Note Templates

Promissory Note Florida Pdf - Poorly drafted promissory notes may lead to misunderstandings, so clarity in terms is vital.

For those involved in a vehicle transaction, it is essential to utilize the correct documentation, such as the Oklahoma Motor Vehicle Bill of Sale form, which is a crucial document used in the transaction of a vehicle between a seller and a buyer. It serves as a legal record that verifies the transfer of ownership and details regarding the vehicle's condition, price, and terms of sale. This form not only provides proof of purchase but also plays a significant role in the registration process of the vehicle, making the use of proper Auto Bill of Sale Forms important for ensuring compliance with state regulations.

Free Loan Agreement Template Texas - Failure to comply with the terms of a promissory note can lead to legal action by the lender.

New York Promissory Note Requirements - Promissory notes can be easily customized to fit different loan scenarios and needs.

Similar forms

The Ohio Promissory Note is closely related to a Loan Agreement. Both documents serve as formal agreements between a borrower and a lender, outlining the terms of a loan. A Loan Agreement typically includes details such as the amount borrowed, interest rates, repayment schedules, and consequences of default. While a promissory note is a simpler document, the Loan Agreement provides a more comprehensive framework, often addressing additional aspects like collateral and governing law. Both documents aim to protect the interests of the lender while ensuring the borrower understands their obligations.

Another similar document is the IOU, or "I Owe You." An IOU is a less formal acknowledgment of a debt, typically lacking the detailed terms found in a promissory note. While an IOU can serve as a simple reminder of a debt, a promissory note is a legally enforceable contract that specifies repayment terms. The clarity and structure of a promissory note make it a more reliable document for lenders seeking to secure their interests.

A Credit Agreement also shares similarities with the Ohio Promissory Note. This document is commonly used in business transactions and outlines the terms under which credit is extended to a borrower. Like a promissory note, a Credit Agreement details the amount borrowed and repayment terms. However, it often includes additional provisions such as covenants and representations, which may not be present in a standard promissory note. Both documents aim to establish clear expectations between the parties involved.

The Mortgage is another related document, particularly when the promissory note is secured by real property. A Mortgage establishes a lien on the property, providing the lender with a claim if the borrower defaults on the loan. While the promissory note represents the borrower’s promise to repay the loan, the Mortgage serves as collateral, offering additional security for the lender. Together, these documents create a comprehensive legal framework for real estate transactions.

A Security Agreement is also akin to the Ohio Promissory Note in that it outlines the terms under which collateral is provided to secure a loan. While a promissory note focuses on the borrower's promise to repay, a Security Agreement specifies the assets that will be used as collateral. This agreement protects the lender's interests by providing a legal claim to the specified assets in case of default, complementing the promissory note's terms.

For individuals engaging in mobile home transactions, the importance of a detailed comprehensive Mobile Home Bill of Sale cannot be overstated. This form provides essential documentation for legal ownership transfer, encompassing the specific details of the buyer, seller, and property involved, ensuring clarity and safeguarding all parties' rights.

Additionally, a Demand Note is similar to a promissory note but with a key distinction: it allows the lender to request repayment at any time. This flexibility can be advantageous for lenders, as they retain the right to demand payment without adhering to a fixed schedule. In contrast, a standard promissory note typically establishes a set repayment timeline. Both documents serve to formalize a borrower’s obligation, but the Demand Note offers more fluidity for the lender.

The Installment Note is another document that shares characteristics with the Ohio Promissory Note. An Installment Note specifies that the borrower will repay the loan in regular, scheduled payments over time. This structure can make it easier for borrowers to manage their finances, as they know exactly what to expect. While a promissory note may also include installment provisions, the Installment Note emphasizes the repayment schedule more explicitly, often detailing the amount and frequency of each payment.

Finally, a Guaranty Agreement can be related to a promissory note when a third party agrees to be responsible for the borrower’s debt. While the promissory note establishes the terms between the borrower and lender, the Guaranty Agreement adds an extra layer of security for the lender. It ensures that if the borrower defaults, the guarantor is legally obligated to fulfill the repayment terms. This relationship can provide additional reassurance to lenders, particularly in higher-risk transactions.

Steps to Filling Out Ohio Promissory Note

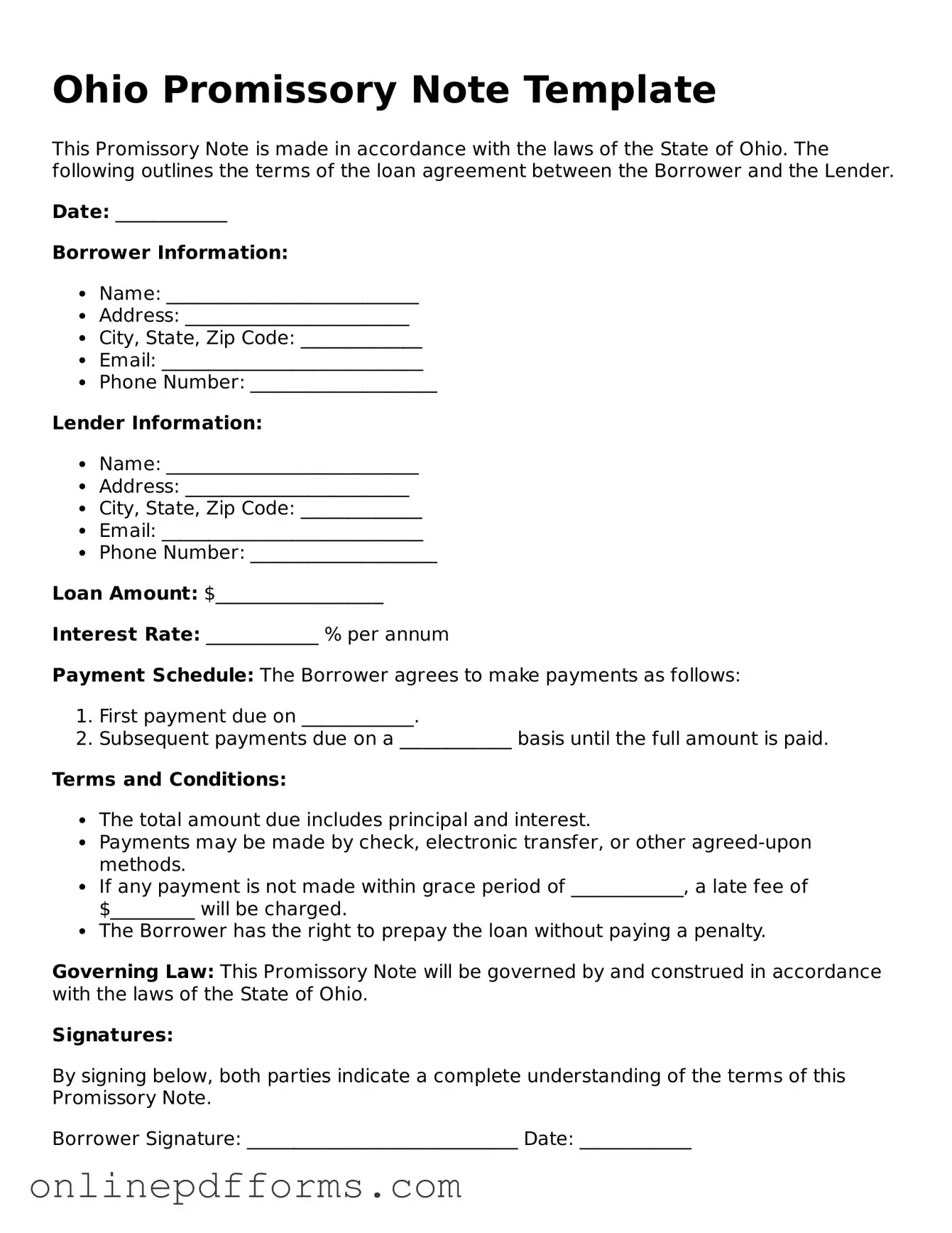

Filling out the Ohio Promissory Note form is a straightforward process that requires attention to detail. Once completed, this document will serve as a written promise to repay a specific amount of money under agreed-upon terms. Here’s how to fill it out correctly.

- Obtain the form: Find the Ohio Promissory Note form online or at a local legal supply store.

- Fill in the date: Write the date on which the note is being executed at the top of the form.

- Identify the borrower: Enter the full name and address of the person or entity borrowing the money.

- Identify the lender: Enter the full name and address of the person or entity lending the money.

- Specify the loan amount: Clearly state the total amount of money being borrowed.

- Outline the repayment terms: Include details such as the interest rate, payment schedule, and the final due date for repayment.

- Include any late fees: If applicable, specify any penalties for late payments.

- Sign the document: Both the borrower and lender must sign the form to make it legally binding.

- Notarization (if required): Consider having the document notarized for added legal protection, though this may not be necessary in all cases.

After completing the form, ensure that both parties retain a copy for their records. This will help in maintaining clarity regarding the terms of the loan and the obligations of both parties.