Blank Ohio Quitclaim Deed Form

Documents used along the form

When transferring property ownership in Ohio, a Quitclaim Deed is often used, but it is not the only document that may be necessary. Understanding the additional forms that accompany a Quitclaim Deed can help ensure a smooth transaction. Here’s a list of other common documents that you might encounter during the process.

- Property Transfer Tax Affidavit: This form is required to report the transfer of property and calculate any applicable transfer taxes. It provides essential information about the property and the parties involved.

- Title Search Report: Conducting a title search ensures that the seller has clear ownership of the property. This report reveals any liens, encumbrances, or claims against the property.

- Purchase Agreement: This document outlines the terms of the sale, including the purchase price and any contingencies. It serves as a binding contract between the buyer and seller.

- Affidavit of Title: This sworn statement by the seller confirms their ownership of the property and discloses any known issues. It helps protect the buyer from future claims against the title.

- Florida RV Bill of Sale Form: For a smooth transaction process, it’s essential to have the comprehensive RV Bill of Sale requirements that protect both the buyer and seller in Florida.

- Power of Attorney: If a party cannot be present for the signing of the Quitclaim Deed, a Power of Attorney allows someone else to act on their behalf in the transaction.

- Closing Statement: This document summarizes the financial details of the transaction, including costs, fees, and the final amount due at closing. It ensures transparency for both parties.

- Warranty Deed: Although different from a Quitclaim Deed, a Warranty Deed may be used if the seller wants to provide a guarantee that they hold clear title to the property, offering more protection to the buyer.

- Deed of Trust: This document secures a loan by placing a lien on the property. It is often used in conjunction with a Quitclaim Deed if financing is involved.

- Notice of Intent to Transfer: This form notifies relevant parties, such as homeowners associations or local authorities, about the impending transfer of property ownership.

Having these documents ready and understanding their purposes can facilitate a smoother property transfer process. Each form plays a vital role in protecting the interests of both buyers and sellers, ensuring that the transaction is legally sound and transparent.

Other Popular State-specific Quitclaim Deed Templates

Florida Quit Claim Deed - A Quitclaim Deed is one way to manage shared ownership of real estate.

When engaging in the sale or purchase of an ATV in Connecticut, utilizing the proper documentation is essential. The Connecticut ATV Bill of Sale form not only validates the transaction but also safeguards both parties' interests. This form acts as a legal record and supports a smooth transfer of ownership. If you're in the market for these forms, you can visit Vehicle Bill of Sale Forms to ensure you're equipped with the correct paperwork.

Pennsylvania Quit Claim Deed Pdf - The Quitclaim Deed is a common tool in real estate transactions of personal nature.

Similar forms

A warranty deed is a legal document that transfers ownership of real property. Unlike a quitclaim deed, which offers no guarantees about the title, a warranty deed provides a warranty of title. This means the seller assures the buyer that they hold clear title to the property and have the right to sell it. If any issues arise regarding ownership, the seller is responsible for resolving them. This added layer of security makes warranty deeds more common in traditional real estate transactions.

Understanding the various types of deeds is crucial for anyone engaged in real estate transactions, particularly in North Carolina. For those looking to securely transfer ownership of trailers, utilizing an appropriate document is essential. A suitable resource for this purpose is the Auto Bill of Sale Forms, which can help ensure all necessary information is accurately recorded and verified during the sale process.

A special warranty deed is similar to a warranty deed but with a key difference. It only guarantees that the seller has not done anything to harm the title during their ownership. In other words, the seller makes no promises about the title's history before they acquired the property. This type of deed is often used in commercial real estate transactions where the seller wants to limit their liability for past issues.

A bargain and sale deed transfers property without any warranties. The seller conveys whatever interest they have in the property, but they do not guarantee that the title is clear. This type of deed is often used in foreclosure sales or by fiduciaries who may not have full knowledge of the property's history. Buyers should proceed with caution, as they assume the risk of any title defects.

A grant deed is a type of deed commonly used in some states, including California. It conveys property and includes two main warranties: that the seller has not sold the property to anyone else and that the property is free from any encumbrances created by the seller. While it offers more protection than a quitclaim deed, it does not provide as comprehensive a guarantee as a warranty deed.

A deed of trust is a security instrument used in real estate transactions, particularly in financing. It involves three parties: the borrower, the lender, and a trustee. The borrower conveys the property to the trustee, who holds it as security for the loan. If the borrower defaults, the trustee can sell the property to pay off the debt. This document differs from a quitclaim deed, which does not involve a loan or security interest.

An easement deed grants a specific right to use someone else's property for a particular purpose. Unlike a quitclaim deed, which transfers ownership, an easement deed allows the holder to access or use the property without owning it. Common examples include utility easements or access roads. The rights and limitations of the easement are typically detailed in the deed.

A lease agreement is a contract that allows one party to use another's property for a specified time in exchange for rent. While a quitclaim deed transfers ownership, a lease agreement does not. Instead, it creates a temporary right to use the property. Leases can include various terms and conditions, such as maintenance responsibilities and renewal options, making them distinct from deeds.

A transfer on death deed allows an individual to transfer real property to a beneficiary upon their death without going through probate. This type of deed is revocable during the owner's lifetime and does not affect ownership until death occurs. While a quitclaim deed transfers ownership immediately, a transfer on death deed provides a way to ensure that property passes directly to heirs without legal complications.

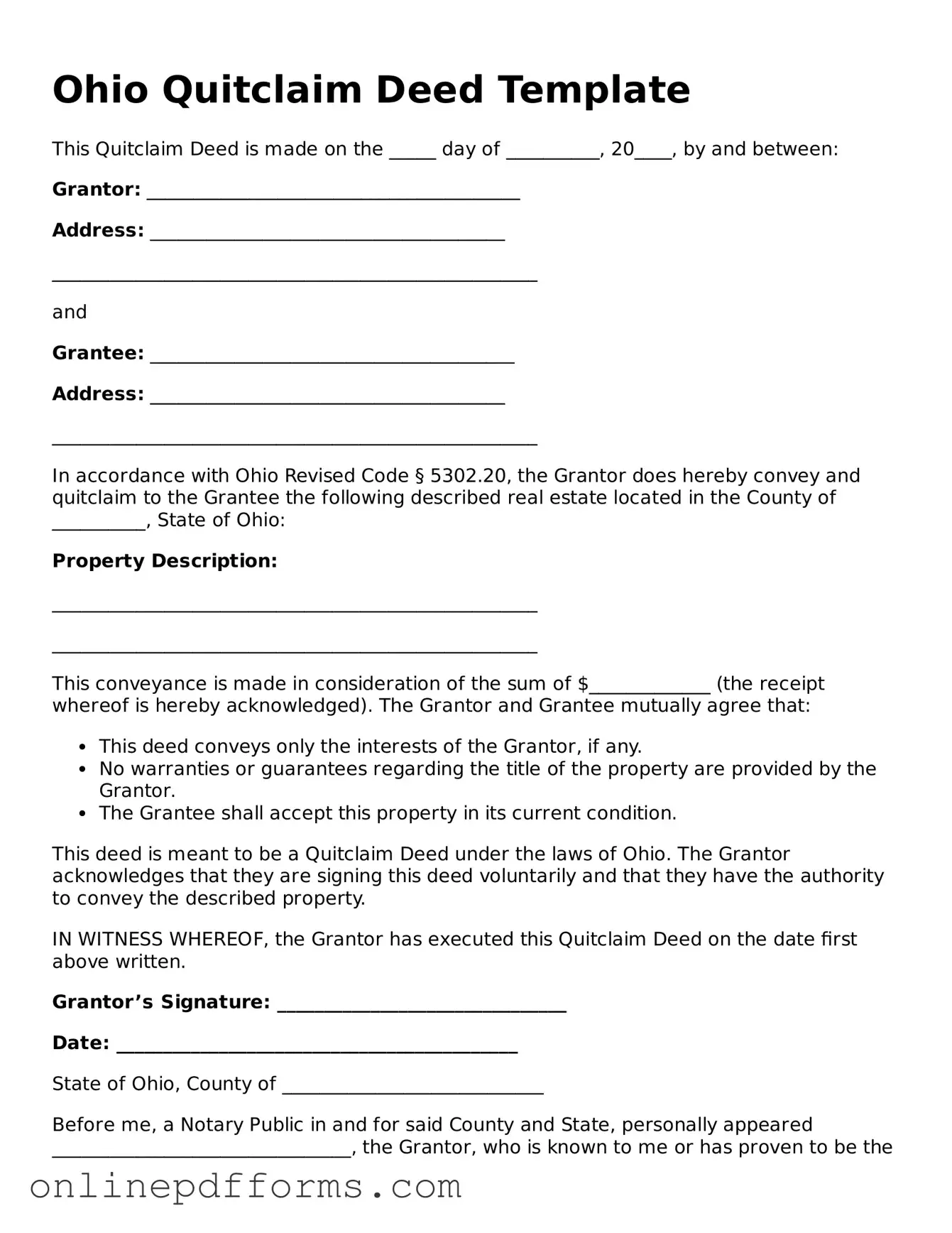

Steps to Filling Out Ohio Quitclaim Deed

After obtaining the Ohio Quitclaim Deed form, it is essential to fill it out accurately to ensure a smooth transfer of property ownership. Once completed, the form must be signed, notarized, and filed with the appropriate county recorder's office.

- Begin by entering the date at the top of the form.

- Fill in the names of the Grantor(s) (the person(s) transferring the property) in the designated space.

- Provide the names of the Grantee(s) (the person(s) receiving the property) next.

- Clearly describe the property being transferred. Include the address and any relevant legal descriptions.

- Indicate the consideration (the amount paid for the property) in the appropriate section.

- Sign the form in front of a notary public. Ensure all Grantors sign the document.

- Have the notary public complete their section, including their signature and seal.

- Make copies of the completed and notarized deed for your records.

- File the original Quitclaim Deed with the county recorder's office in the county where the property is located.