Blank Ohio Transfer-on-Death Deed Form

Documents used along the form

When planning for the transfer of property in Ohio, the Transfer-on-Death Deed is a useful tool. However, it often works best in conjunction with other documents that help clarify intentions and ensure a smooth transition of assets. Below is a list of commonly used forms and documents that may accompany the Transfer-on-Death Deed.

- This document outlines how a person's assets should be distributed after their death. It can provide additional instructions that complement the Transfer-on-Death Deed.

- A legal entity that holds assets during a person's lifetime and specifies how they should be distributed after death. It can help avoid probate, making the transfer of property more efficient.

- This document can be used to establish the heirs of a deceased person, especially when there is no will. It helps clarify who is entitled to inherit property.

- Vehicle Purchase Agreement: For those involved in vehicle transactions, having a pdftemplates.info/texas-vehicle-purchase-agreement-form/ can safeguard both parties by clearly defining the terms of sale.

- This document allows someone to make financial decisions on behalf of another person if they become incapacitated. It can be crucial in managing property before the transfer occurs.

- This document proves ownership of a vehicle or property. It may need to be updated to reflect the transfer of ownership after the property owner passes away.

- Keeping these records up to date ensures that the property taxes are properly assessed and paid, which is essential for maintaining clear title to the property.

- This is a secured real estate transaction that involves three parties: the borrower, the lender, and the trustee. It can be relevant if the property is under a mortgage.

- A policy that can provide financial support to beneficiaries upon the policyholder's death. It can be used to cover estate taxes or other expenses related to property transfer.

- A detailed list of all assets owned by a person at the time of their death. This helps in understanding the overall estate and can assist in the distribution process.

Understanding these documents can significantly enhance the effectiveness of a Transfer-on-Death Deed. Each serves a unique purpose and can help ensure that property is transferred smoothly and according to the wishes of the deceased. It's wise to consider these forms in your estate planning to avoid complications down the road.

Other Popular State-specific Transfer-on-Death Deed Templates

Where Can I Get a Tod Form - The Transfer-on-Death Deed provides a clear legal framework for the transfer of property, reducing fears of disputes.

The Arizona Marital Separation Agreement form is a legally binding document that outlines the terms agreed upon by both parties in a marital separation. It covers areas such as asset division, debt allocation, and, if applicable, child custody arrangements. For those navigating the complexities of marital separation in Arizona, accurately completing this form is crucial. A helpful resource for obtaining this form can be found at arizonaformspdf.com, ensuring you have the necessary tools for a smooth process.

Transfer on Death Deed Georgia - The deed must be executed, recorded, and is effective only upon the owner's death.

Ladybird Deed Texas Form - This deed form acts as a clear directive to avoid ambiguity and potential family disputes in the inheritance process.

Similar forms

The Ohio Transfer-on-Death Deed (TODD) form shares similarities with the traditional will. Both documents allow individuals to dictate how their property will be distributed after their death. A will requires probate, which can be a lengthy and costly process. In contrast, the TODD allows for the direct transfer of property to beneficiaries without going through probate, simplifying the process and reducing potential delays and expenses for the heirs.

The South Carolina RV Bill of Sale form serves as a legal document representing the transaction of a recreational vehicle (RV) between two parties in the state of South Carolina. It not only proves the change of ownership but also outlines the specific details of the sale, including information on the buyer, seller, and the RV itself. This form is crucial for both the buyer and the seller as it provides a record that the sale has taken place, ensuring the transaction is recognized by law. For those looking for similar documents, Auto Bill of Sale Forms can be a valuable resource.

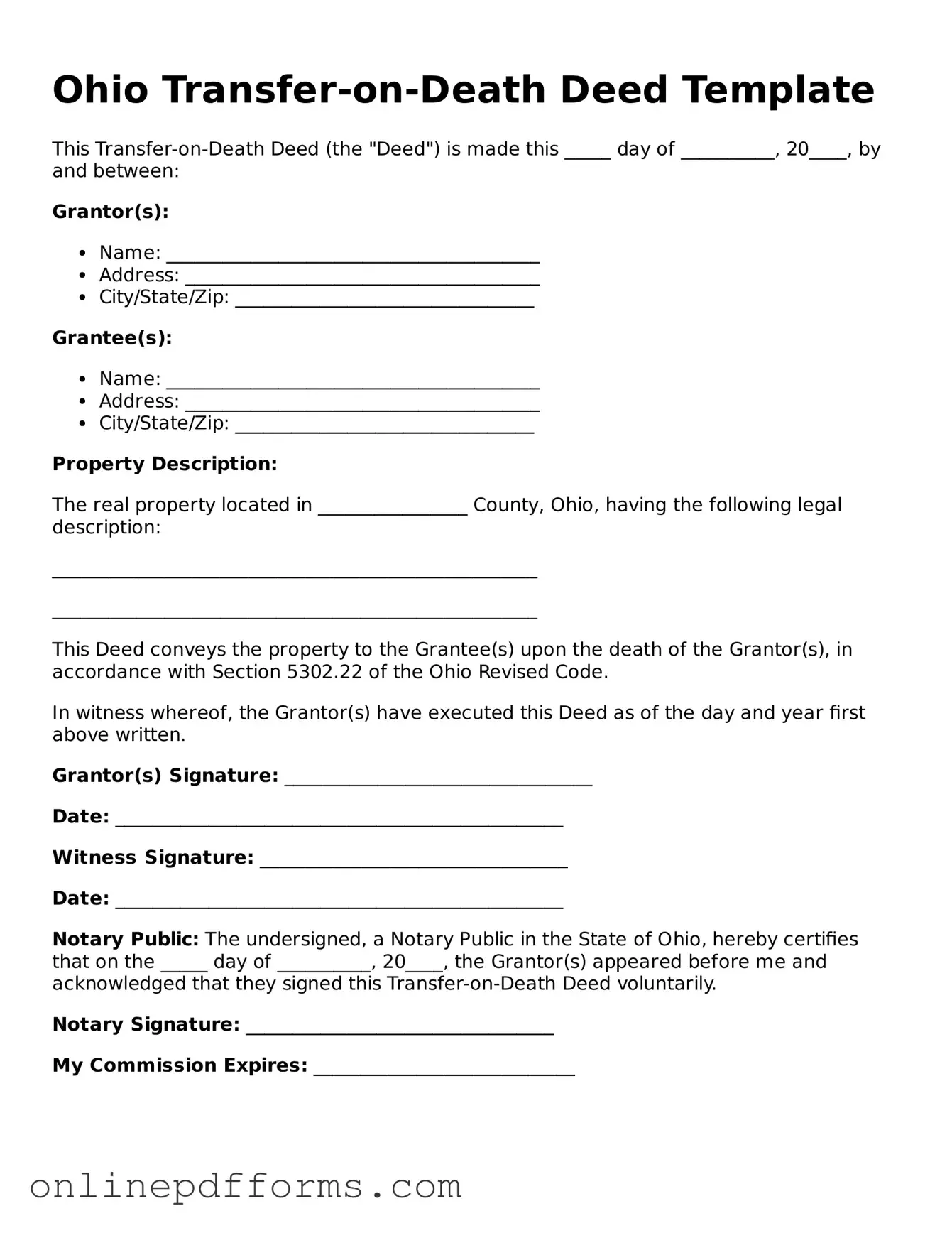

Steps to Filling Out Ohio Transfer-on-Death Deed

Filling out the Ohio Transfer-on-Death Deed form is a straightforward process. After completing the form, it will need to be signed and notarized before being recorded with the county recorder’s office. This ensures that your wishes regarding the transfer of property upon your death are legally documented.

- Obtain the Ohio Transfer-on-Death Deed form from a reliable source, such as the Ohio Secretary of State's website or your local county recorder's office.

- Enter the full name and address of the property owner (the grantor) at the top of the form.

- Provide the legal description of the property being transferred. This can often be found on the property deed or tax records.

- List the name(s) of the beneficiary or beneficiaries who will receive the property upon the owner's death.

- Include the address of each beneficiary to ensure proper identification.

- Indicate whether the transfer is to be made to multiple beneficiaries and specify how the property will be divided, if applicable.

- Sign the form in the presence of a notary public. The notary will verify your identity and witness your signature.

- Make a copy of the completed and notarized form for your records.

- Submit the original form to the county recorder’s office in the county where the property is located for recording.