Legal Owner Financing Contract Form

Documents used along the form

When engaging in an owner financing arrangement, several other documents may accompany the Owner Financing Contract. Each of these documents plays a crucial role in ensuring clarity and protection for both the buyer and the seller. Below is a list of commonly used forms that you may encounter in this process.

- Promissory Note: This document outlines the borrower's promise to repay the loan amount. It includes details such as the loan amount, interest rate, payment schedule, and consequences for defaulting on payments.

- Real Estate Purchase Agreement: This essential document lays out the terms and conditions for buying and selling real estate in Texas, providing clarity and protection for both parties in the transaction. For more information, visit pdftemplates.info/texas-real-estate-purchase-agreement-form.

- Deed of Trust: This legal document secures the loan by giving the lender a claim against the property if the borrower fails to repay. It effectively acts as collateral for the loan.

- Disclosure Statement: This statement provides important information about the financing terms and conditions. It ensures that the buyer understands their obligations and the risks involved in the transaction.

- Sales Agreement: This document outlines the terms of the property sale, including purchase price, contingencies, and any repairs or improvements that may be required before closing.

- Title Insurance Policy: This policy protects the buyer and lender against potential issues with the property's title. It ensures that the buyer receives clear ownership and that there are no undisclosed liens or claims against the property.

Understanding these documents is essential for anyone involved in an owner financing arrangement. They help clarify the terms of the agreement and protect the interests of both parties. Always consider consulting a professional to ensure you are fully informed and prepared for the transaction.

Consider More Types of Owner Financing Contract Forms

Terminate Real Estate Agent Contract Letter - It can also be used if problems arise with the property title.

Completing the transaction smoothly requires a comprehensive understanding of the California Real Estate Purchase Agreement form, and for those looking to simplify this process, California PDF Forms are an essential resource that can help facilitate accurate and efficient documentation.

Purchase Agreement Addendum - A method for recording changes in responsibilities regarding repairs.

Similar forms

The Owner Financing Contract form shares similarities with a Purchase Agreement. Both documents outline the terms of a property sale, including the purchase price and conditions of the sale. A Purchase Agreement typically details the buyer's obligations, such as securing financing and conducting inspections. In contrast, the Owner Financing Contract emphasizes the seller's role in providing financing directly to the buyer, thus altering the traditional financing landscape.

For anyone navigating real estate transactions, understanding the nuances of a comprehensive Real Estate Purchase Agreement process is crucial. This document solidifies the relationship between a buyer and seller, ensuring clear terms and minimizing potential disputes during the transaction. To enhance your knowledge, you can explore the essentials of a Real Estate Purchase Agreement that outline what you need to consider when drafting this important contract.

Another document akin to the Owner Financing Contract is the Lease Purchase Agreement. This agreement combines elements of leasing and purchasing. A Lease Purchase Agreement allows a tenant to rent a property with the option to buy it later. Like the Owner Financing Contract, it provides a pathway for buyers who may not qualify for traditional loans. However, the Lease Purchase Agreement usually involves an initial rental period, which is not a feature of standard owner financing.

The Seller Financing Addendum also resembles the Owner Financing Contract. This addendum is often attached to a standard Purchase Agreement to outline specific financing terms provided by the seller. Both documents specify interest rates, repayment schedules, and default consequences. The key difference lies in the fact that the Seller Financing Addendum supplements an existing contract, while the Owner Financing Contract serves as a standalone agreement.

Similar to the Owner Financing Contract is the Land Contract, also known as a Contract for Deed. In this arrangement, the buyer makes payments directly to the seller while occupying the property. Ownership is transferred only after the buyer fulfills the payment terms. This document emphasizes the seller's security interest in the property until full payment is made, mirroring the owner financing structure where the seller retains a financial stake.

The Promissory Note is another document that aligns with the Owner Financing Contract. A Promissory Note is a written promise to pay a specified amount of money at a certain time. In owner financing, this note serves as a formal acknowledgment of the buyer's obligation to repay the seller. While the Owner Financing Contract outlines the broader terms of the sale, the Promissory Note focuses specifically on the repayment details.

The Mortgage Agreement is also similar, although it typically involves a third-party lender. In a Mortgage Agreement, the borrower secures a loan to purchase a property, using the property as collateral. Like the Owner Financing Contract, it includes terms regarding payment schedules and interest rates. However, unlike owner financing, a Mortgage Agreement involves a financial institution, which may introduce additional complexities such as credit checks and underwriting processes.

Lastly, the Real Estate Option Agreement bears resemblance to the Owner Financing Contract. This document grants a buyer the right, but not the obligation, to purchase a property within a specified timeframe. It often requires the buyer to pay an option fee. While the Owner Financing Contract obligates the buyer to purchase and finance the property, the Real Estate Option Agreement allows for more flexibility, giving buyers a chance to evaluate the property before committing to a purchase.

Steps to Filling Out Owner Financing Contract

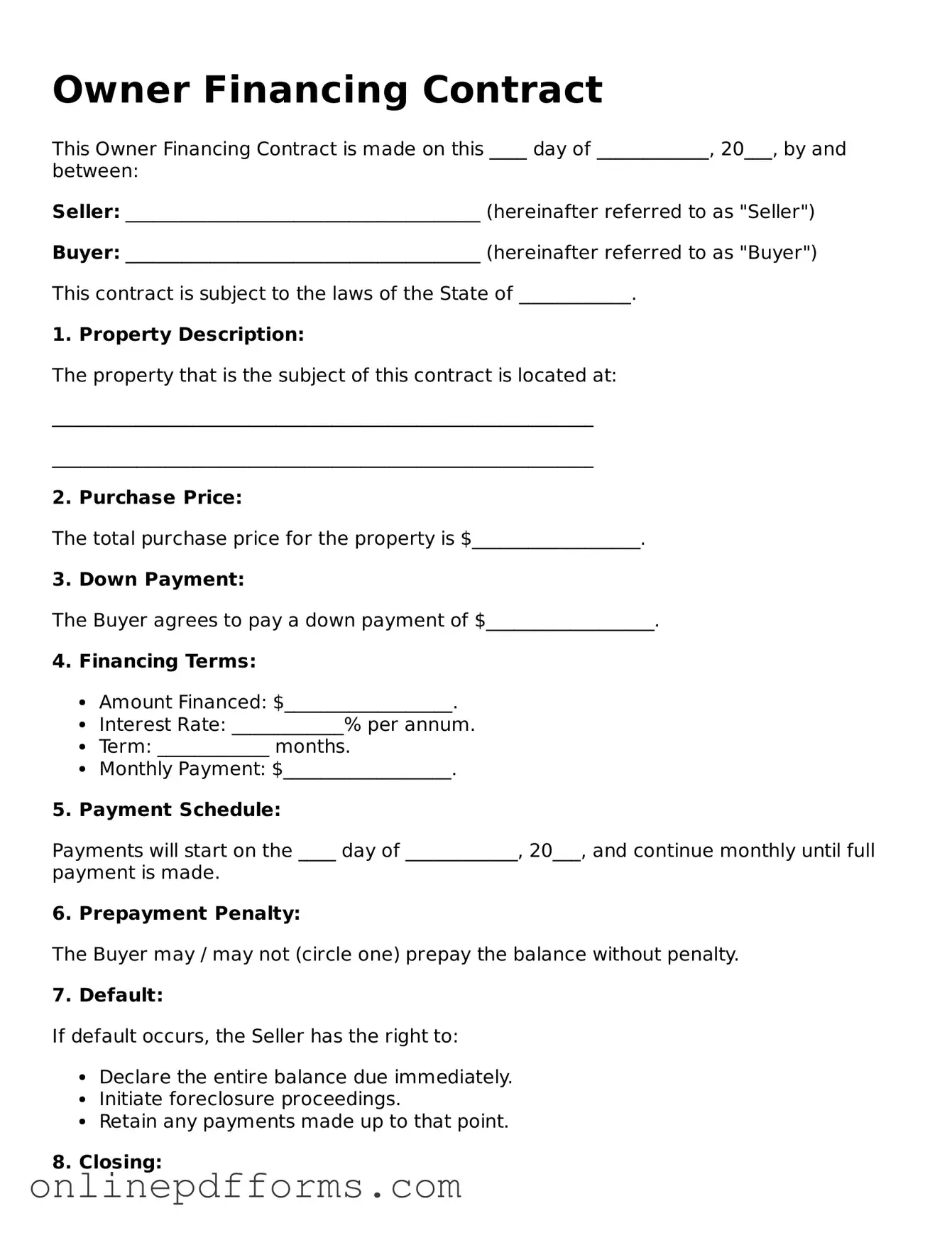

Completing the Owner Financing Contract form is an important step in facilitating a smooth transaction between the buyer and seller. It is essential to provide accurate information to ensure clarity and legal compliance. Follow the steps below to fill out the form correctly.

- Begin by entering the date at the top of the form. This establishes when the agreement is being made.

- Identify the parties involved. Clearly write the full names of the seller and the buyer in the designated sections.

- Provide the property address. This should include the street address, city, state, and zip code to avoid any confusion.

- Detail the purchase price. State the total amount agreed upon for the property in the specified area.

- Specify the down payment. Indicate the amount the buyer will pay upfront as part of the financing arrangement.

- Outline the financing terms. Include the interest rate, loan term, and any additional details regarding payment schedules.

- Include any contingencies. Note any conditions that must be met for the contract to be valid.

- Sign and date the form. Both parties should sign and date the document to indicate their agreement to the terms.

Once you have completed the form, ensure that both parties retain a copy for their records. It is advisable to review the document carefully before finalizing the agreement.