Fill in Your P 45 It Template

Documents used along the form

The P45 form is an essential document for employees leaving a job in the UK, providing crucial information about their earnings and tax deductions. Alongside the P45, several other forms and documents may be required to ensure a smooth transition for both the employee and the employer. Below is a list of related forms that are often used in conjunction with the P45.

- P60: This document summarizes an employee's total pay and deductions for the tax year. It is issued by the employer and serves as proof of income for tax purposes.

- P50: Used to claim a tax refund when an employee stops working. This form can be requested from HMRC to recover any overpaid taxes.

- P85: This form is necessary for individuals leaving the UK for work or residence abroad. It helps determine tax liabilities and potential refunds while living outside the UK.

- P11D: Employers use this form to report benefits and expenses provided to employees. It is important for tax calculations and ensuring compliance with tax regulations.

- Tax Return: This annual form is required for individuals to report their income and calculate their tax obligations. Employees may need to reference their P45 information when completing it.

- Medical Power of Attorney: For ensuring your healthcare wishes are respected, consult the detailed Medical Power of Attorney form guidelines to assist in making informed decisions during critical situations.

- Jobseeker's Allowance Claim Form: If an employee is applying for Jobseeker's Allowance after leaving their job, this form is required. It helps assess eligibility for financial support while seeking new employment.

- Employment Support Allowance (ESA) Claim Form: Similar to the Jobseeker's Allowance, this form is used by individuals who are unable to work due to illness or disability and need financial assistance.

Understanding these forms and their purposes can greatly assist employees during their transition out of a job. Each document plays a vital role in ensuring that all tax obligations are met and that employees can access any benefits or refunds they may be entitled to.

More PDF Templates

Time Sheet Printable - Enhances employee accountability regarding work schedules.

Profits or Loss From Business - Schedule C can also be a tool for evaluating the overall success of your business.

The Texas Motorcycle Bill of Sale form is crucial for anyone engaging in the sale or purchase of a motorcycle in Texas, as it captures vital details about both the buyer and seller, along with the motorcycle itself. To ensure a smooth and legally recognized transaction, it is important to have the correct documentation; to achieve this, you can see the document that facilitates the process.

Odometer Reading Form - Providing an accurate odometer reading assists in determining the vehicle's market value.

Similar forms

The P60 form is similar to the P45 in that it summarizes an employee's total pay and tax deductions for the tax year. Employees receive a P60 at the end of the tax year, while the P45 is issued when they leave a job. Both documents provide important information for tax purposes. Employees need to keep their P60 as it may be required for tax returns or when applying for loans or mortgages.

The P11D form is another document that shares similarities with the P45. It is used to report benefits and expenses provided to employees by their employers. While the P45 focuses on pay and tax deductions upon leaving a job, the P11D provides a broader overview of an employee's compensation package. Both forms are crucial for ensuring that employees and HMRC have accurate records for tax calculations.

For those navigating the intricacies of vehicle registration, understanding forms can be just as vital as in the realm of employment documentation. In Texas, for instance, motor vehicle owners may rely on the Short-Term Auto Registration, which allows them to legally drive on public roads while they await permanent registration. This temporary measure is crucial, much like the tax forms employees utilize when transitioning between jobs, ensuring compliance and proper reporting in both scenarios.

The P46 form is also related to the P45. This form is used when an employee starts a new job but does not have a P45 from their previous employer. It helps employers determine the correct tax code for the new employee. Like the P45, the P46 ensures that tax deductions are calculated accurately from the beginning of employment.

The P60U form is a variation of the P60, specifically for employees who have been paid through the PAYE system but have left their employment before the end of the tax year. This form provides a summary of pay and tax deductions similar to the P60 but is tailored for those who did not complete a full tax year with an employer. Both forms serve to keep records clear for tax purposes.

The P85 form is used when an employee leaves the UK to live or work abroad. It helps individuals claim any tax refund they may be entitled to after leaving their job. While the P45 is focused on the transition out of employment, the P85 addresses the next steps for individuals moving out of the country. Both documents are important for ensuring proper tax handling during transitions.

The P50 form is similar to the P45 in that it is used to claim a tax refund after stopping work. This form is specifically for those who have paid too much tax and want to reclaim it. While the P45 provides details about employment and tax paid, the P50 is the means by which individuals can request their money back. Both forms are essential for managing tax obligations effectively.

The P14 form, which has been replaced by the P60, was previously used to report an employee's pay and tax deductions at the end of the tax year. It shares similarities with the P45 in that it contains information about earnings and tax, but it was specifically for reporting purposes rather than for employees leaving a job. Both forms were important for ensuring accurate tax records.

The P2 form is a notice of coding sent to employees by HMRC, which informs them of their tax code for the year. While the P45 provides details about an employee's tax situation upon leaving a job, the P2 helps employees understand how their tax will be calculated in the future. Both documents play a role in keeping employees informed about their tax responsibilities.

Steps to Filling Out P 45 It

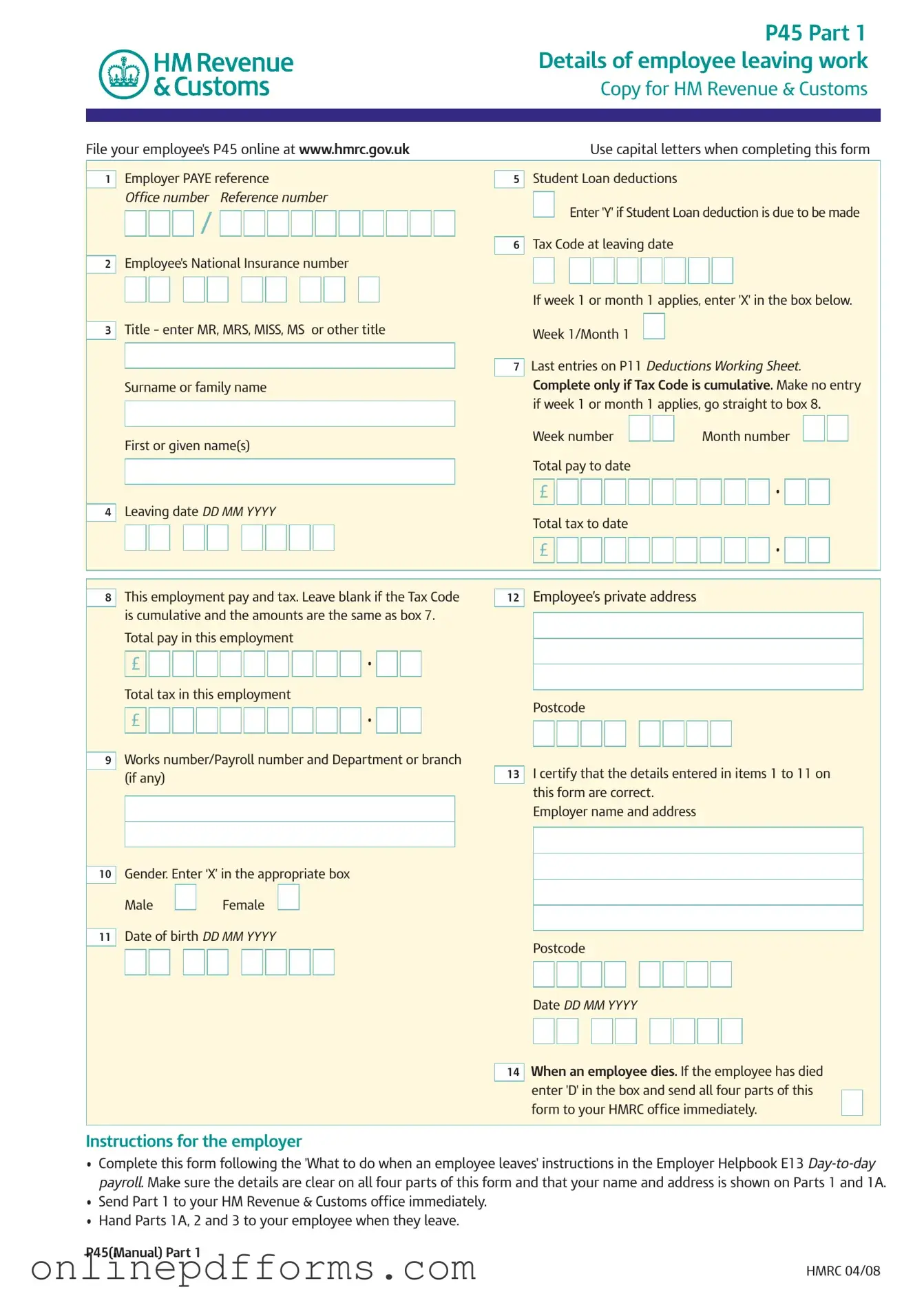

Filling out the P45 It form requires careful attention to detail. Once completed, this form serves several important functions in the employment transition process. Follow these steps to ensure accuracy and compliance.

- Begin with the Details of Employee Leaving Work section. Fill in the employer's PAYE reference and office number in the designated boxes.

- Enter the employee's National Insurance number accurately.

- Indicate the title of the employee (MR, MRS, MISS, MS, or other) and fill in their surname and first name(s).

- Specify the leaving date in the format DD MM YYYY.

- Complete the sections for student loan deductions and tax code at the leaving date, marking 'X' if week 1 or month 1 applies.

- Provide the total pay to date and total tax to date in the appropriate boxes.

- Fill in the employee's private address, including postcode.

- For cumulative tax codes, complete the total pay and total tax in this employment section; otherwise, leave it blank.

- Mark the employee's gender by placing an 'X' in the appropriate box.

- Enter the employee's date of birth in the format DD MM YYYY.

- Finally, certify that the details entered are correct by signing and dating the form.

After filling out the P45 It form, ensure that all parts are distributed appropriately. Part 1 should be sent to HM Revenue & Customs immediately, while Parts 1A, 2, and 3 should be handed to the employee. This will help streamline their transition to a new job or other employment-related processes.