Legal Partial Release of Lien Form

Documents used along the form

When dealing with a Partial Release of Lien, there are several other forms and documents that may be necessary to ensure a smooth transaction. Each of these documents serves a specific purpose and helps clarify the rights and responsibilities of all parties involved.

- Full Release of Lien: This document formally removes a lien in its entirety, indicating that the debt has been fully satisfied. It provides assurance to the property owner that no further claims will be made against their property.

- Notice of Lien: This is a formal declaration that a lien has been placed on a property. It serves to inform interested parties, such as potential buyers or lenders, about the existing claim against the property.

- Construction Contract: This agreement outlines the terms between the contractor and the property owner. It specifies the scope of work, payment terms, and other essential details that govern the project.

- Invoice: A document detailing the services provided and the amount owed. It is often used to support the lien and demonstrate that payment is due for work completed.

- Release of Liability: This form provides assurance that any claims related to the work performed are relinquished once payment is completed. It protects the property owner from future liability concerning that particular job. To use this form, click to download.

- Mechanic's Lien: This type of lien is filed by contractors or suppliers to secure payment for work performed on a property. It serves as a legal claim against the property until the debt is paid.

- Affidavit of Debt: This sworn statement confirms the amount owed by the property owner. It can be used in conjunction with a lien to validate the claim for payment.

- Subordination Agreement: This document allows a new lien to take priority over an existing one. It is often used when refinancing a property or taking out a new loan.

Understanding these documents can help clarify the process surrounding a Partial Release of Lien. Each plays a vital role in protecting the interests of all parties involved and ensuring that transactions are handled legally and efficiently.

Consider More Types of Partial Release of Lien Forms

How to Create a Waiver - A form that communicates terms of participation and waives liabilities for injuries.

When considering participation in marketing efforts, it is essential to understand the implications of the Employee Photo Release form, which allows employers to utilize images of their staff. This form is designed to protect the rights of both employees and employers, ensuring that everyone is on the same page regarding image use. For those who are prepared to grant permission for their likeness to be used, please refer to the Employee Image Consent to complete the necessary steps.

Personal Training Liability Waivers - It reinforces the principle that fitness is a personal commitment.

Similar forms

The Partial Release of Lien form is similar to a Satisfaction of Mortgage document. Both serve to confirm that a debt has been settled, either partially or fully. A Satisfaction of Mortgage is issued when a borrower pays off a mortgage, releasing the lender's claim on the property. Similarly, a Partial Release of Lien indicates that a portion of the debt secured by a lien has been paid, releasing the lien on that specific part of the property. Both documents help clarify ownership and financial obligations in real estate transactions.

In cases of property disputes, it's essential to have a clear understanding of all relevant documents involved in the process. One such document is the Vehicle Accident Damage Release form, which plays a critical role in ensuring that all parties involved in a vehicle accident come to a settlement without lingering claims. For further details about managing such forms, you can visit https://onlinelawdocs.com.

An Affidavit of Release is another document that shares similarities with the Partial Release of Lien. This affidavit is a sworn statement that confirms the release of a claim against a property. It can be used to affirm that a lien has been satisfied or released, much like the Partial Release of Lien. The main difference lies in the formality of the affidavit, which requires notarization. Both documents aim to provide clarity and assurance regarding the status of financial claims on a property.

The Release of Lien form is closely related to the Partial Release of Lien as well. While a Release of Lien indicates that a lien has been completely removed from a property, the Partial Release of Lien only pertains to a portion of the lien. Both documents aim to update public records regarding the status of liens and provide assurance to property owners that their obligations have been met, either fully or partially.

The Assignment of Lien is another document that can be compared to the Partial Release of Lien. An Assignment of Lien transfers the rights of a lien from one party to another. This process can occur when a lienholder decides to sell their interest in a lien. In contrast, a Partial Release of Lien indicates that part of the lien has been satisfied while retaining the remaining balance. Both documents play a significant role in managing the rights associated with property claims.

Lastly, the Notice of Default is a document that is often associated with the Partial Release of Lien. A Notice of Default informs a borrower that they have failed to meet their mortgage obligations, which could lead to foreclosure. While the Partial Release of Lien indicates that a portion of the debt has been paid, the Notice of Default signals that the borrower is at risk of losing their property. Both documents are essential in the context of property ownership and financial responsibility, highlighting different stages of the borrowing process.

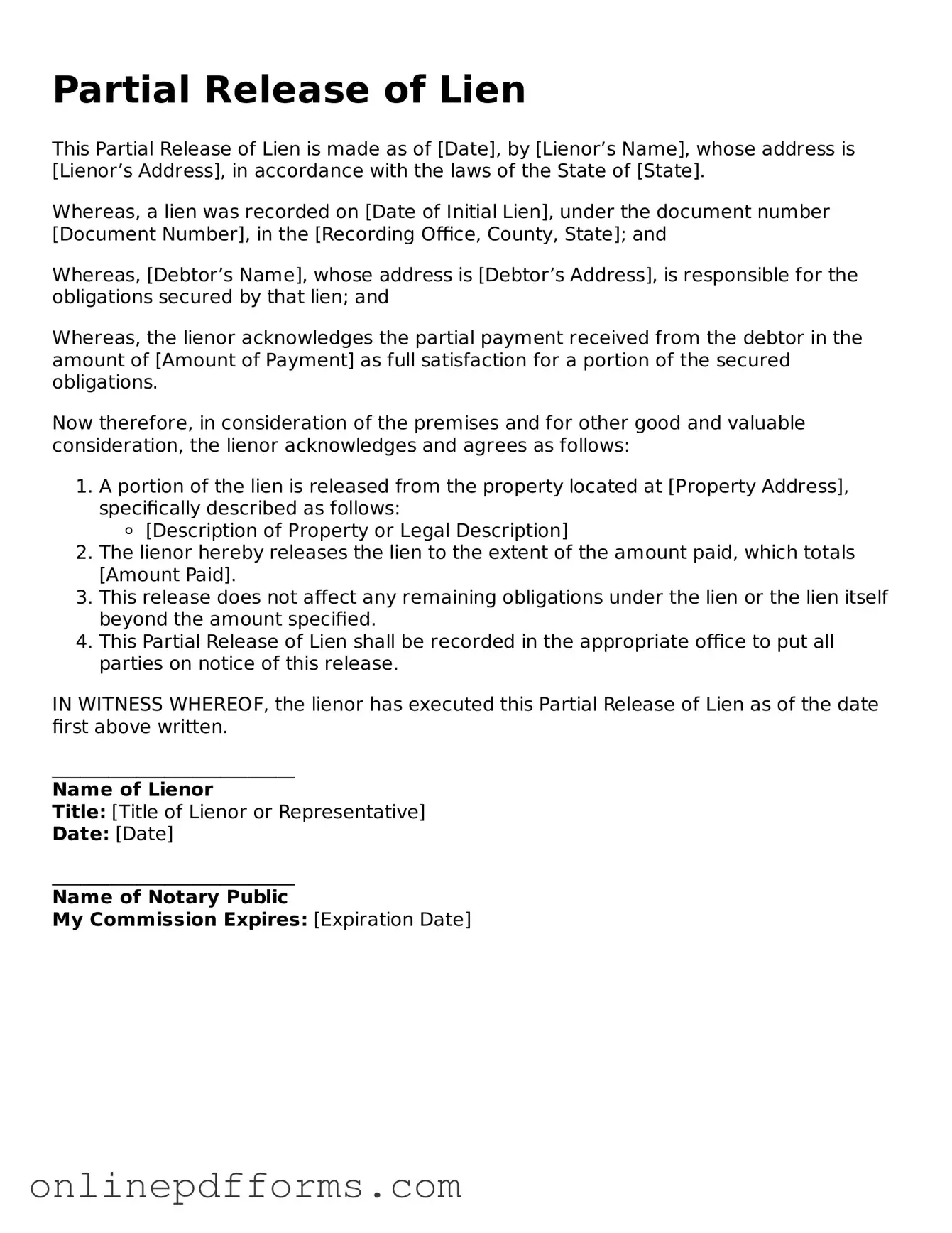

Steps to Filling Out Partial Release of Lien

After completing the Partial Release of Lien form, the next step involves submitting it to the appropriate parties. This may include the property owner, the contractor, or the local government office, depending on the specifics of the project and the requirements of the jurisdiction.

- Begin by entering the date at the top of the form.

- Identify the property involved by filling in the property address, including the city, state, and zip code.

- Provide the name and address of the lien claimant, which is the person or entity that filed the original lien.

- List the name and address of the property owner.

- Specify the amount of the lien being released. This should reflect the partial amount being released.

- Include a description of the work performed or materials supplied that correspond to the amount being released.

- Sign the form. The lien claimant or an authorized representative must sign it.

- Print the name of the signer below the signature.

- Provide the date of the signature.

- If required, have the signature notarized by a licensed notary public.