Fill in Your Payroll Check Template

Documents used along the form

In the realm of payroll processing, various forms and documents complement the Payroll Check form. Each of these documents plays a vital role in ensuring that employees are compensated accurately and in compliance with legal requirements. Below is a list of commonly used forms and documents in conjunction with the Payroll Check form.

- W-4 Form: This form is filled out by employees to indicate their tax withholding preferences. It provides employers with the necessary information to withhold the correct amount of federal income tax from each paycheck.

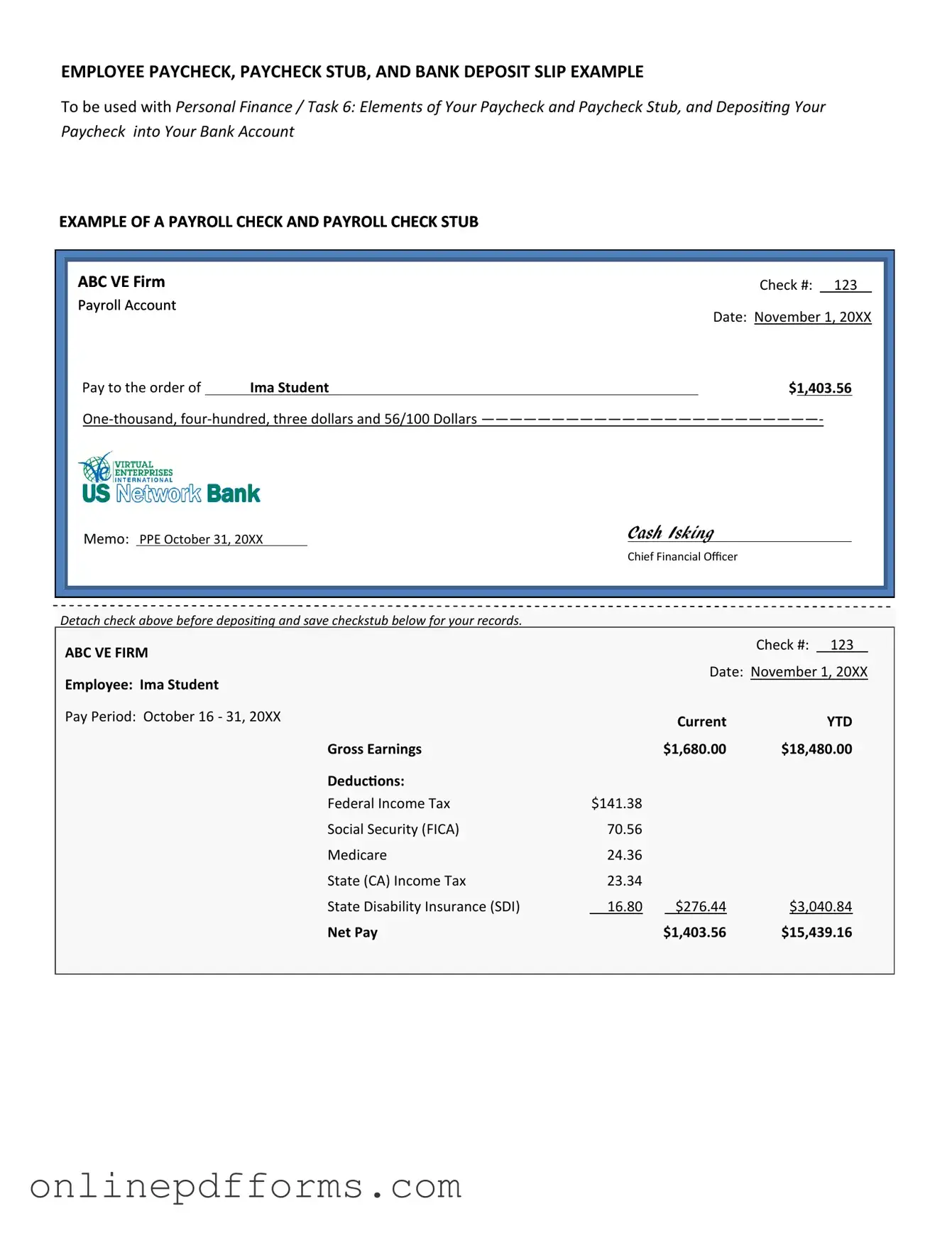

- Pay Stub: A pay stub accompanies the Payroll Check and details an employee's earnings for a specific pay period. It typically includes information on gross pay, deductions, and net pay, allowing employees to understand their compensation breakdown.

- Vehicle Bill of Sale: This document is essential when transferring ownership of an all-terrain vehicle (ATV), as it acts as a legal proof of the transaction. For those in Connecticut, using the Vehicle Bill of Sale Forms can ensure the process is conducted properly and is recognized legally.

- Direct Deposit Authorization Form: This document allows employees to authorize their employer to deposit their paychecks directly into their bank accounts. It streamlines the payment process and reduces the need for physical checks.

- Time Sheet: A time sheet records the hours worked by an employee during a pay period. This document is essential for calculating wages, especially for hourly employees, and ensures accurate payroll processing.

- State Tax Withholding Form: Similar to the W-4, this form is specific to state income tax withholding. Employees complete it to inform their employer of the state tax deductions to be applied to their paychecks.

- Employee Information Form: This document collects essential details about the employee, such as name, address, and Social Security number. It is crucial for maintaining accurate payroll records and ensuring compliance with tax regulations.

- Payroll Register: A payroll register is a comprehensive report that summarizes all payroll transactions for a specific period. It includes details like employee names, wages, deductions, and net pay, serving as a valuable record for both employers and auditors.

Understanding these forms and documents is essential for both employers and employees. Each plays a significant role in the payroll process, ensuring that compensation is handled correctly and transparently. By familiarizing oneself with these documents, individuals can navigate the complexities of payroll with greater ease.

More PDF Templates

Texas Hub - Record for keeping track of issued and surrendered certificates.

For those planning their estate, the importance of a well-structured Last Will and Testament cannot be overstated. It is advisable to consult resources that provide insightful guidance on the nuances of creating your will, such as this informative link: thorough Last Will and Testament form insights.

Health Guarantee for Puppies Template - If the Buyer keeps a puppy after discovering a defect, they lose the right to a replacement.

Similar forms

The Payroll Check form is similar to the Direct Deposit Authorization form in that both documents facilitate the payment process for employees. While the Payroll Check form is used to issue physical checks, the Direct Deposit Authorization form allows employees to receive their wages directly into their bank accounts. This modern approach to payroll eliminates the need for paper checks and provides employees with quicker access to their earnings, streamlining the payment process for both employers and employees.

Another document that shares similarities with the Payroll Check form is the Pay Stub. A pay stub accompanies the paycheck, whether it is a physical check or a direct deposit. It details the employee's earnings, deductions, and net pay for a specific pay period. Both documents serve the purpose of informing employees about their compensation, ensuring transparency in the payroll process.

The W-2 form is also akin to the Payroll Check form, as both are crucial for employee compensation reporting. The W-2 form summarizes an employee's annual earnings and the taxes withheld by the employer. While the Payroll Check form reflects individual payments made during the year, the W-2 provides a comprehensive overview of total earnings and tax contributions, which employees need for filing their income tax returns.

The Time Sheet is another document that parallels the Payroll Check form. Time sheets record the hours worked by employees, serving as the basis for calculating wages. Employers use the information from time sheets to determine the amount to be paid, whether through a Payroll Check or direct deposit. Both documents are essential for accurate payroll processing and ensuring employees are compensated fairly for their work.

Similarly, the Payroll Register is a document that resembles the Payroll Check form in its function. The Payroll Register is a summary of all payroll transactions for a specific period, including employee names, hours worked, and total pay. This document helps employers track payroll expenses and ensures that each employee receives the correct amount, reinforcing the accuracy of the Payroll Check or direct deposit issued.

The Employment Agreement is another related document, as it outlines the terms of employment, including salary and payment frequency. This agreement sets the expectations for both the employer and the employee regarding compensation. While the Payroll Check form is used to execute payments, the Employment Agreement provides the foundational details that determine how much and how often those payments occur.

In addition to the crucial documents mentioned, those involved in the buying or selling of trailers in Washington should also consider utilizing Auto Bill of Sale Forms, which serve to formalize the transaction and protect both parties during the sale process.

The 1099 form is similar to the Payroll Check form in that it is used to report income, but it is specifically for independent contractors rather than employees. When a contractor receives payments, the issuing company must report those payments on a 1099 form. Like the Payroll Check, the 1099 is a crucial document for tax purposes, ensuring that all income is accurately reported to the IRS.

The Expense Reimbursement Form also shares similarities with the Payroll Check form. This document is used by employees to request reimbursement for business-related expenses incurred during their work. Once approved, the employer processes the reimbursement, which may be issued through a Payroll Check or direct deposit. Both forms serve to compensate employees, though they pertain to different types of payments.

The Benefits Enrollment Form is another document that connects to the Payroll Check form. While the Payroll Check form deals with salary payments, the Benefits Enrollment Form is used to select and enroll in various employee benefits, such as health insurance or retirement plans. The choices made on this form can affect an employee's net pay, as certain benefits may involve payroll deductions, ultimately influencing the amount reflected on the Payroll Check.

Finally, the Garnishment Order is a legal document that can impact the Payroll Check form. When an employee has a debt that requires repayment through wage garnishment, this order mandates that a portion of their paycheck be withheld and sent to the creditor. The Payroll Check must then reflect this deduction, ensuring compliance with the court order while also keeping the employee informed about their adjusted pay.

Steps to Filling Out Payroll Check

Completing the Payroll Check form is an essential task that ensures employees receive their due compensation. Once you have gathered all necessary information, you can proceed to fill out the form accurately. Follow these steps carefully to ensure everything is completed correctly.

- Begin by entering the employee's name in the designated space at the top of the form.

- Next, provide the employee's identification number or social security number.

- Fill in the pay period dates, indicating the start and end dates for the payment period.

- Specify the payment date, which is the date the check will be issued.

- In the hours worked section, enter the total number of hours the employee has worked during the pay period.

- Calculate the hourly rate and input this figure in the appropriate box.

- Multiply the hours worked by the hourly rate to determine the gross pay, and write this amount in the designated area.

- If applicable, list any deductions such as taxes or benefits, and write the total in the deductions section.

- Finally, subtract the deductions from the gross pay to calculate the net pay, and record this amount.