Blank Pennsylvania Articles of Incorporation Form

Documents used along the form

When forming a corporation in Pennsylvania, several additional forms and documents may be required alongside the Articles of Incorporation. Each of these documents serves a specific purpose in the incorporation process.

- Bylaws: These are the internal rules governing the management of the corporation. Bylaws outline the roles of directors and officers, meeting procedures, and voting rights.

- Florida Rental Application Form: To assess potential tenants, utilize the necessary Florida rental application resources that aid landlords in collecting comprehensive information about applicants.

- Initial Report: This document provides the state with basic information about the corporation, such as its address and the names of its officers and directors. It is typically filed shortly after incorporation.

- Employer Identification Number (EIN): Obtained from the IRS, this number is necessary for tax purposes. It allows the corporation to hire employees, open bank accounts, and file tax returns.

- Business License: Depending on the type of business and its location, a corporation may need to apply for various local, state, or federal licenses to operate legally.

- Statement of Election: If the corporation chooses to be treated as an S Corporation for tax purposes, this form must be filed with the IRS to make the election official.

These documents play a crucial role in ensuring that a corporation operates within the legal framework established by the state and federal laws. Properly completing and filing these forms helps facilitate smooth business operations and compliance.

Other Popular State-specific Articles of Incorporation Templates

How Do I Get a Copy of My Articles of Incorporation in Georgia - The Articles of Incorporation can help establish a company's strategic direction.

State of Florida Division of Corporations - The Articles create a framework within which the corporation can operate legally and effectively.

When engaging in a vehicle transaction, it is crucial to utilize the Arizona Motor Vehicle Bill of Sale form, which can be found at mypdfform.com/blank-arizona-motor-vehicle-bill-of-sale/. This form serves as a comprehensive legal document that records the transfer of ownership and includes essential details such as the buyer's and seller's information, a description of the vehicle, and the purchase price. By completing this form, parties involved can ensure a seamless transaction while providing necessary proof of the ownership change.

Llc Illinois - It typically includes the corporation's name, purpose, and duration.

New York State Division of Corporations - In the event of dissolution, the Articles outline how assets will be handled.

Similar forms

The Pennsylvania Articles of Incorporation form is similar to the Certificate of Incorporation found in many states. Both documents serve the purpose of officially creating a corporation and provide essential information such as the corporation's name, registered agent, and business purpose. The Certificate of Incorporation is typically filed with the Secretary of State or a similar agency, and it marks the legal recognition of the corporation, allowing it to operate within the state’s jurisdiction.

Another similar document is the Articles of Organization, which is used for limited liability companies (LLCs). Like the Articles of Incorporation, the Articles of Organization outlines basic details about the business, including its name and address. This document is crucial for establishing the legal existence of an LLC and provides a framework for its governance. Both documents facilitate the formation of a business entity and protect the owners from personal liability.

The Bylaws of a corporation bear resemblance to the Articles of Incorporation as well. While the Articles establish the corporation's existence, the Bylaws govern its internal operations. They outline the rules for managing the corporation, including the roles of officers, the process for holding meetings, and voting procedures. Together, these documents ensure that the corporation operates smoothly and in accordance with its stated purpose.

The Partnership Agreement is another document that shares similarities with the Articles of Incorporation. While the Articles are specific to corporations, the Partnership Agreement establishes the terms and conditions under which a partnership operates. It details the responsibilities and rights of each partner, the distribution of profits, and the procedures for resolving disputes. Both documents serve to formalize the relationship between business owners and provide clarity on operational matters.

The Operating Agreement for LLCs is akin to the Articles of Incorporation in that it outlines the structure and management of the LLC. This document specifies the roles of members, management procedures, and profit distribution. Just as the Articles of Incorporation lay the groundwork for a corporation, the Operating Agreement establishes the foundational rules for the LLC, ensuring all members are on the same page regarding their rights and responsibilities.

The Certificate of Formation is another document that parallels the Articles of Incorporation, particularly in states that use this terminology. This certificate is filed to formally create a corporation or LLC and includes similar information such as the business name, registered agent, and purpose. It serves as a legal declaration that a business entity has been established and is recognized by the state.

The Trailer Bill of Sale form is essential not only for facilitating the transfer of ownership of trailers in Maryland but also for protecting the interests of both sellers and buyers. Proper documentation ensures that all parties are clear about the terms of the sale, minimizing potential disputes in the future. For those looking for additional resources on similar transactions, Auto Bill of Sale Forms can provide guidance and templates that streamline the process.

The Assumed Name Registration, often referred to as a "Doing Business As" (DBA) registration, is related to the Articles of Incorporation in that it allows a business to operate under a name different from its legal name. While the Articles of Incorporation establish the corporation's official name, the Assumed Name Registration provides flexibility for branding and marketing. Both documents are essential for compliance and transparency in business operations.

Finally, the Statement of Information, which some states require, is similar to the Articles of Incorporation in that it provides ongoing information about a corporation. This document typically includes updates on the corporation’s address, officers, and registered agent. While the Articles of Incorporation are filed at the time of formation, the Statement of Information is submitted periodically to keep the state informed about the corporation's status.

Steps to Filling Out Pennsylvania Articles of Incorporation

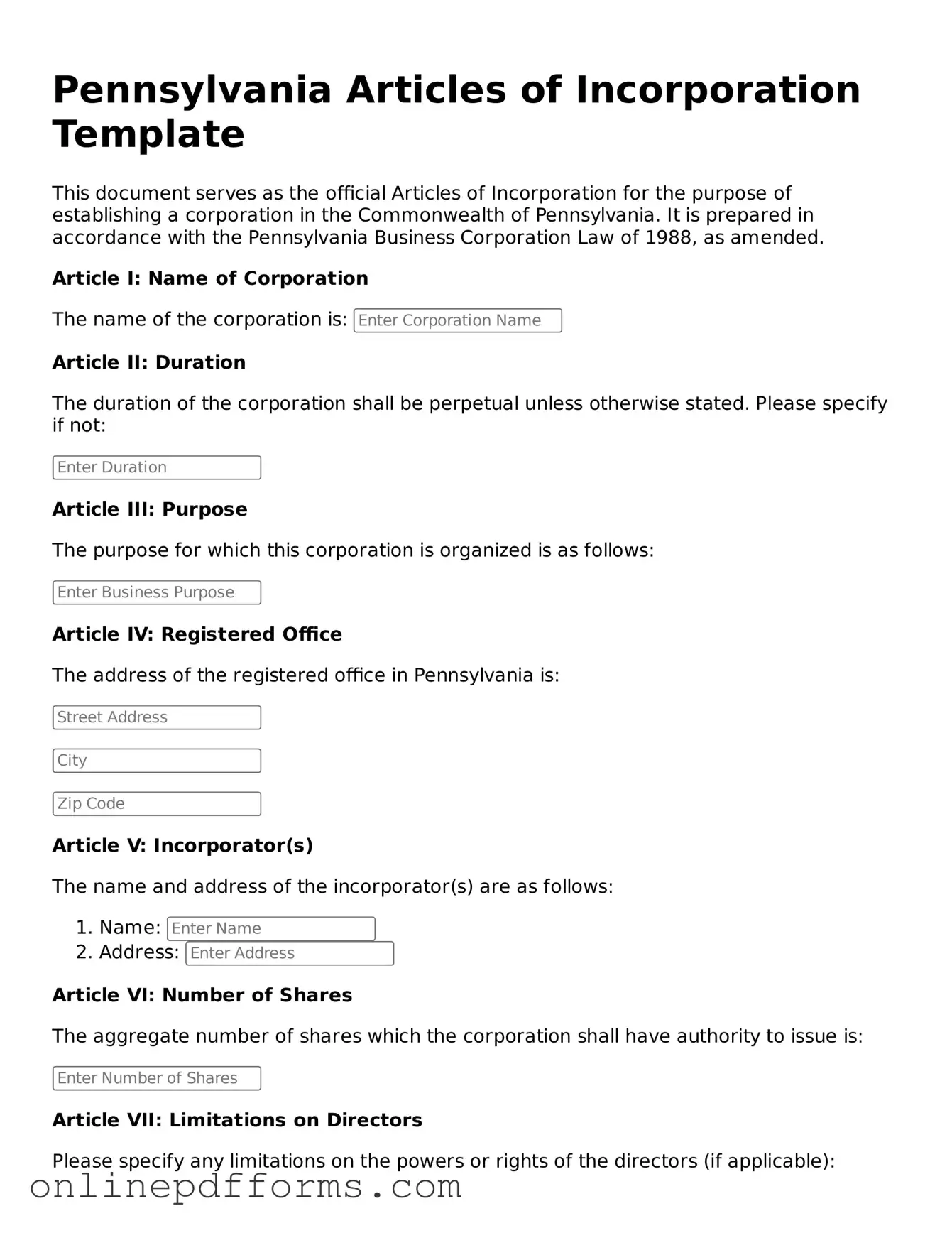

After you gather the necessary information and materials, you can proceed to fill out the Pennsylvania Articles of Incorporation form. This document is essential for establishing your business as a legal entity in the state. Follow these steps carefully to ensure accuracy and completeness.

- Download the Pennsylvania Articles of Incorporation form from the Pennsylvania Department of State website.

- Begin with the name of your corporation. Ensure it complies with Pennsylvania naming requirements.

- Provide the purpose of your corporation. Be specific about what your business will do.

- List the registered office address. This must be a physical address in Pennsylvania.

- Include the name and address of the incorporators. These are the individuals responsible for filing the form.

- Indicate the number of shares the corporation is authorized to issue. Specify the classes of shares if applicable.

- Sign and date the form. Ensure that the signatures are from the incorporators listed.

- Prepare the filing fee. Check the current fee schedule on the Pennsylvania Department of State website.

- Submit the completed form and payment to the appropriate office, either online or by mail.

Once you submit the Articles of Incorporation, the state will process your application. You will receive confirmation once your corporation is officially established.