Blank Pennsylvania Deed Form

Documents used along the form

When transferring property in Pennsylvania, several forms and documents are often used alongside the Pennsylvania Deed form. Each of these documents serves a specific purpose in the real estate transaction process, ensuring that all legal requirements are met and that the transfer is properly recorded.

- Title Search Report: This document provides a history of the property’s ownership and any claims or liens against it. It ensures that the seller has the right to sell the property and that there are no unresolved issues that could affect the buyer's ownership.

- Articles of Incorporation Form: This essential document is required for setting up a corporation in Arizona and can be found at https://arizonaformspdf.com.

- Property Disclosure Statement: Sellers are required to disclose any known defects or issues with the property. This document helps buyers make informed decisions and protects sellers from future liability regarding undisclosed problems.

- Settlement Statement (HUD-1): This document outlines all costs associated with the sale, including closing costs, fees, and adjustments. It provides a clear financial picture for both the buyer and seller at the time of closing.

- Affidavit of Title: This sworn statement confirms the seller's ownership of the property and that there are no outstanding liens or claims. It provides assurance to the buyer that they are receiving clear title.

- Power of Attorney: In cases where the seller cannot be present for the transaction, a power of attorney allows another person to act on their behalf. This document must be executed properly to be valid.

- Deed of Trust or Mortgage: If the buyer is financing the purchase, these documents outline the loan terms and the lender's security interest in the property. They are essential for establishing the financial arrangement between the buyer and lender.

- IRS Form 1099-S: This form is used to report the sale of real estate to the IRS. It is typically filed by the settlement agent and ensures compliance with tax reporting requirements.

Understanding these documents is crucial for anyone involved in a property transaction in Pennsylvania. They work together to facilitate a smooth transfer of ownership and help protect the interests of all parties involved.

Other Popular State-specific Deed Templates

Contract for Deed Texas Template - A special warranty deed limits the grantor’s liability after the sale.

Quick Claim Deeds Georgia - Deeds can include restrictions or conditions on property use.

When engaging in a vehicle transaction, it is essential to complete the necessary paperwork to ensure a smooth sale, and the Oklahoma Motor Vehicle Bill of Sale form plays a vital role in this process. This important document not only confirms the transfer of ownership but also includes key information such as the vehicle's condition, price, and terms of sale. To facilitate this transaction, sellers can utilize resources like Auto Bill of Sale Forms, which streamline the document preparation and help verify proof of purchase, ultimately aiding in the vehicle registration process.

Grant Deed in California - A Deed may require disclosures about property conditions.

Similar forms

The Pennsylvania Deed form is similar to the Quitclaim Deed. Both documents are used to transfer property ownership. However, a Quitclaim Deed does not guarantee that the grantor has clear title to the property. It simply transfers whatever interest the grantor may have. This can be useful in situations where the parties know each other, such as family transactions, but it does not provide the same level of protection as a warranty deed.

Another document that shares similarities is the Warranty Deed. This form provides a guarantee from the seller that they hold clear title to the property and have the right to sell it. In contrast to the Pennsylvania Deed, which may not always include such assurances, a Warranty Deed offers more security to the buyer. This makes it a preferred choice in most real estate transactions.

For those venturing into real estate transactions, understanding the various forms is essential. The Texas Real Estate Purchase Agreement form plays a vital role in ensuring that both buyers and sellers are clear on their rights and responsibilities throughout the process. It's important to familiarize yourself with this document to avoid any ambiguities; you can access it here: https://pdftemplates.info/texas-real-estate-purchase-agreement-form.

The Bargain and Sale Deed also resembles the Pennsylvania Deed. It conveys property without warranties but implies that the seller has title to the property. This type of deed is often used in foreclosure sales or tax sales, where the seller may not be able to provide a full warranty. Buyers should be aware that while they receive the property, they assume the risk regarding any title issues.

The Special Purpose Deed is another document that can be compared to the Pennsylvania Deed. It is used for specific purposes, such as transferring property into a trust or for estate planning. Like the Pennsylvania Deed, it facilitates the transfer of ownership, but it serves a more specialized function. The language and requirements may differ based on the intended use.

In addition, the Executor’s Deed is similar in that it is used to transfer property from a deceased person's estate. This document is executed by the executor of the estate and conveys property to heirs or beneficiaries. While both the Executor’s Deed and Pennsylvania Deed accomplish the transfer of ownership, the Executor’s Deed is tied to the probate process.

The Personal Representative’s Deed is another related document. It serves a similar purpose to the Executor’s Deed but is used when a personal representative administers an estate. Like the Pennsylvania Deed, it transfers property ownership, but it is specifically associated with the duties of the personal representative in handling the estate.

The Deed of Trust is comparable as it involves property transfer, but it is primarily used in financing arrangements. This document creates a security interest in the property for a lender. Unlike the Pennsylvania Deed, which focuses solely on ownership transfer, a Deed of Trust includes the lender's rights and responsibilities in case of default.

The Grant Deed is also similar, as it transfers property ownership but includes implied warranties that the property is free from encumbrances. This document is commonly used in California and some other states. While both the Grant Deed and Pennsylvania Deed serve to transfer ownership, the Grant Deed provides additional assurances to the buyer.

The Tax Deed is another document that shares some characteristics with the Pennsylvania Deed. It is issued after a property has been sold at a tax sale due to unpaid taxes. This deed transfers ownership to the new buyer, but it may come with risks, as the previous owner may still have rights. The Pennsylvania Deed, in contrast, typically does not involve such complications.

Lastly, the Leasehold Deed is similar in that it involves property rights, but it conveys a leasehold interest rather than full ownership. This document outlines the terms of leasing property for a specified period. While both documents facilitate property interests, the Leasehold Deed does not transfer outright ownership, unlike the Pennsylvania Deed.

Steps to Filling Out Pennsylvania Deed

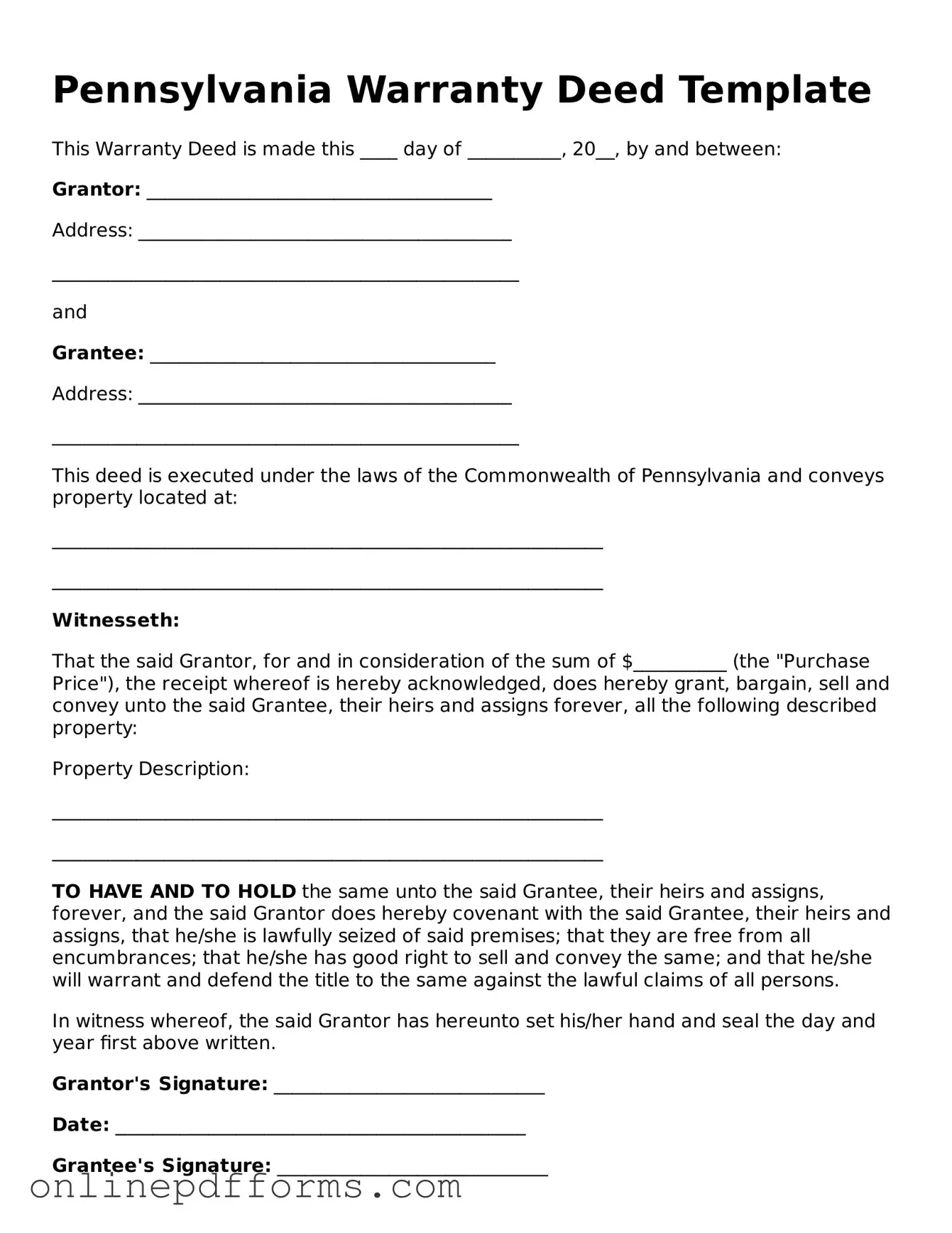

Once you have the Pennsylvania Deed form ready, it’s important to fill it out accurately. This ensures that the transfer of property is recognized legally. Follow these steps to complete the form properly.

- Obtain the Form: Download the Pennsylvania Deed form from a reliable source or acquire a physical copy from your local courthouse.

- Identify the Grantor: Fill in the name and address of the current property owner (the grantor) in the designated section.

- Identify the Grantee: Enter the name and address of the person or entity receiving the property (the grantee).

- Describe the Property: Provide a clear description of the property being transferred. Include the address, parcel number, and any legal description required.

- Include Consideration: State the amount of money or value being exchanged for the property. This is often referred to as "consideration."

- Sign the Document: The grantor must sign the deed in the presence of a notary public. Ensure that all signatures are legible.

- Notarization: Have the deed notarized. The notary will verify the identity of the signer and affix their seal.

- Record the Deed: Submit the completed and notarized deed to the county recorder’s office where the property is located. Pay any applicable recording fees.

After completing these steps, the deed will be recorded officially. This process finalizes the transfer of property ownership and provides a public record of the transaction.