Blank Pennsylvania Deed in Lieu of Foreclosure Form

Documents used along the form

When navigating the process of a deed in lieu of foreclosure in Pennsylvania, several other forms and documents may be necessary to ensure a smooth transaction. Each of these documents serves a specific purpose and can help clarify the responsibilities and rights of all parties involved. Below is a list of commonly used forms that complement the Deed in Lieu of Foreclosure.

- Mortgage Satisfaction Document: This document is used to confirm that the mortgage has been paid off and releases the lien on the property. It is essential for clearing the title after the deed transfer.

- RV Bill of Sale: To ensure a smooth transfer of ownership for recreational vehicles, utilizing the Auto Bill of Sale Forms is essential for documenting the sale and protecting both buyer and seller interests.

- Notice of Default: This formal notice informs the borrower that they are in default on their mortgage payments. It is often a prerequisite to initiating foreclosure proceedings.

- Property Condition Disclosure Statement: This statement outlines the condition of the property being transferred. It provides potential buyers or lenders with important information about any issues that may affect the property’s value.

- Affidavit of Title: This sworn statement confirms the ownership of the property and discloses any liens or encumbrances. It assures the buyer or lender of the seller’s legal right to transfer the property.

- Release of Liability: This document releases the borrower from any further obligations related to the mortgage once the deed in lieu of foreclosure is executed. It protects the borrower from future claims by the lender.

- Closing Statement: This financial document details all costs and fees associated with the transaction. It provides transparency for both parties regarding the financial aspects of the deed transfer.

- Loan Modification Agreement: If applicable, this agreement outlines any changes to the original loan terms. It may be relevant if the borrower and lender negotiate new terms before proceeding with the deed in lieu.

- Deed of Trust: In some cases, a deed of trust may be used instead of a traditional mortgage. This document details the agreement between the borrower and lender regarding the property and its use as collateral.

Understanding these documents can facilitate a smoother transition during the deed in lieu of foreclosure process. Each form plays a vital role in protecting the interests of all parties involved and ensuring that the transaction adheres to legal requirements.

Other Popular State-specific Deed in Lieu of Foreclosure Templates

California Pre-foreclosure Property Transfer - The lender must agree to accept the deed in lieu and may require a thorough review of the borrower's financial situation.

In addition to providing proof of ownership, the Alabama Motorcycle Bill of Sale form also ensures that both the buyer and seller are clear about the details of the transaction. This is essential for a smooth transfer of ownership, and for those looking for an efficient way to handle this process, templates such as Vehicle Bill of Sale Forms can be incredibly helpful.

A Deed in Lieu of Foreclosure - Consulting with a housing counselor may provide valuable insights into the Deed in Lieu process.

Similar forms

The Pennsylvania Deed in Lieu of Foreclosure form shares similarities with a traditional mortgage release. In both situations, the borrower relinquishes their interest in the property to the lender. The mortgage release, however, typically occurs after the borrower has paid off the loan, while the deed in lieu allows for a transfer of ownership to the lender when the borrower is unable to meet their mortgage obligations. This process can help avoid the lengthy and costly foreclosure process, providing a more amicable resolution for both parties.

Another document that resembles the Deed in Lieu of Foreclosure is the short sale agreement. A short sale occurs when a homeowner sells their property for less than the amount owed on the mortgage, with the lender's approval. Like a deed in lieu, a short sale aims to mitigate losses for the lender and provide a way for the homeowner to exit their mortgage obligations. However, in a short sale, the homeowner still retains some control over the sale process, unlike in a deed in lieu, where ownership is directly transferred to the lender.

The loan modification agreement is also comparable to the Deed in Lieu of Foreclosure. In a loan modification, the terms of the original mortgage are altered to make the payments more manageable for the borrower. This can involve lowering the interest rate, extending the loan term, or even reducing the principal balance. While a deed in lieu results in the transfer of property ownership, a loan modification allows the borrower to keep their home by making it more affordable to continue making payments.

Another related document is the forbearance agreement. This is a temporary arrangement between the borrower and lender that allows the borrower to pause or reduce their mortgage payments for a specified period. Similar to a deed in lieu, the goal is to help the borrower avoid foreclosure. However, unlike a deed in lieu, the borrower retains ownership of the property during the forbearance period, with the expectation that they will resume regular payments once their financial situation improves.

The bankruptcy filing is also relevant when discussing alternatives to foreclosure. When a homeowner files for bankruptcy, it can halt foreclosure proceedings and provide the borrower with an opportunity to reorganize their debts. While a deed in lieu results in the homeowner losing their property, bankruptcy may allow the homeowner to keep their home while negotiating new payment terms. Both options aim to provide relief, but they do so in different ways and with different implications for property ownership.

A quitclaim deed is another document that bears similarities to the Deed in Lieu of Foreclosure. A quitclaim deed allows a property owner to transfer their interest in a property to another party without any guarantees regarding the title. This can be used in various situations, including transferring property to a family member or in divorce settlements. While a quitclaim deed does not specifically address mortgage obligations, it can facilitate the transfer of property ownership, much like a deed in lieu, although without the involvement of a lender.

The property settlement agreement, often used in divorce cases, also shares some characteristics with the Deed in Lieu of Foreclosure. In a property settlement agreement, spouses agree on how to divide their assets, including real estate. If one spouse is unable to keep the home, they may agree to transfer their interest to the other spouse or sell the property. Like a deed in lieu, this agreement can help resolve ownership issues, but it does not involve a lender's approval or address mortgage obligations directly.

The release of lien document is another similar form. This document is used to remove a lien from a property, typically after a debt has been paid off. In a deed in lieu situation, the lender may agree to release the borrower from the mortgage lien in exchange for the property. While the release of lien focuses on clearing the title, the deed in lieu involves the actual transfer of property ownership, making it a more comprehensive solution for addressing mortgage defaults.

When navigating the complexities of buying or selling any vehicle, including recreational vehicles in Texas, it's crucial to have the proper documentation in place to protect both parties involved in the transaction. One essential document that should not be overlooked is the https://pdftemplates.info/texas-rv-bill-of-sale-form/, which serves to formally record the details of the sale and ensure that ownership is transferred legally and effectively.

Lastly, the foreclosure notice is a document that is often the precursor to a deed in lieu. When a borrower falls behind on mortgage payments, the lender may issue a foreclosure notice, indicating the intent to begin foreclosure proceedings. This notice serves as a warning to the borrower and can prompt them to seek alternatives, such as a deed in lieu. Both documents address the issue of mortgage default, but while a foreclosure notice signifies the start of a legal process, a deed in lieu represents a voluntary resolution between the borrower and lender.

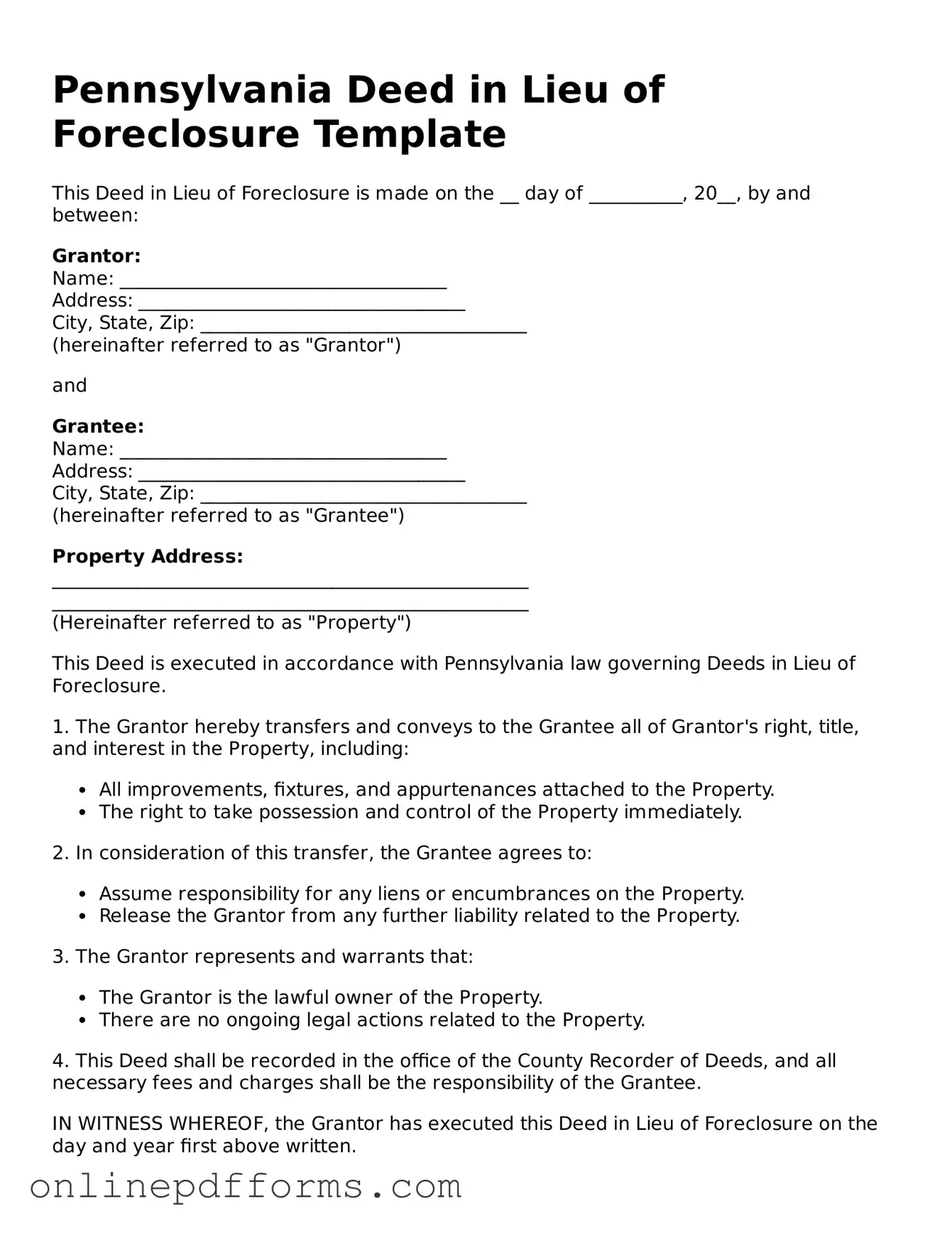

Steps to Filling Out Pennsylvania Deed in Lieu of Foreclosure

After completing the Pennsylvania Deed in Lieu of Foreclosure form, the next step involves submitting the document to the appropriate parties. This may include the lender and any relevant county offices. Ensure that all required signatures are obtained and that the document is filed according to local regulations.

- Obtain the Pennsylvania Deed in Lieu of Foreclosure form from a reliable source.

- Fill in the date at the top of the form.

- Enter the name of the grantor (the person giving the property) in the designated space.

- Provide the name of the grantee (the entity receiving the property) accurately.

- Include the property address, ensuring all details are correct.

- List the legal description of the property as required.

- Indicate whether the grantor is an individual or an entity, and provide any necessary identification numbers.

- Sign the form in the appropriate section, ensuring that the signature matches the name of the grantor.

- Have the signature notarized by a licensed notary public.

- Make copies of the completed form for your records.

- Submit the original form to the lender and file it with the county recorder’s office, if required.